Vanguard, BlackRock, State Street Investing & Voting

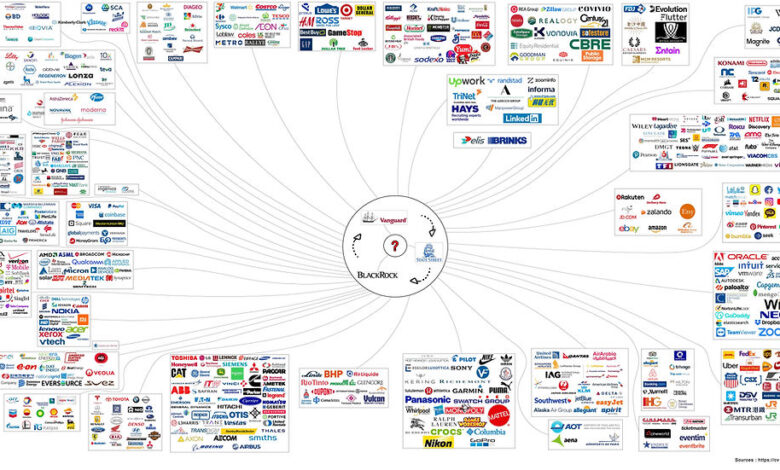

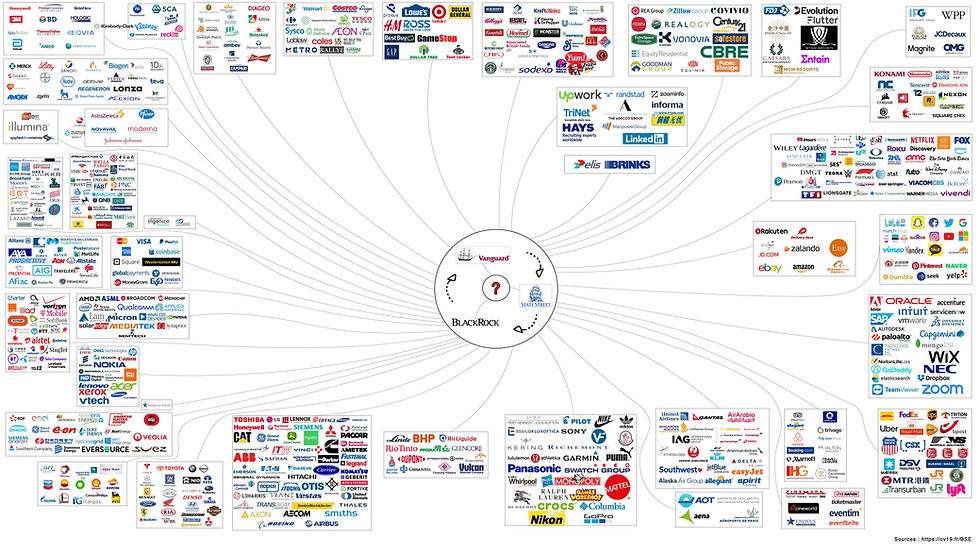

Vanguard BlackRock State Street investing voting is a critical aspect of the modern financial landscape. These behemoths of the investment world wield significant influence over corporate governance and societal issues through their investment decisions and voting power. This exploration delves into their strategies, performance, and impact, examining how their actions affect everything from market trends to ESG considerations.

This analysis examines the investment strategies, performance metrics, and voting records of Vanguard, BlackRock, and State Street. We will also explore the role of ESG factors in their investment decisions and how they engage with stakeholders.

Vanguard, BlackRock, State Street Investment Strategies

A deep dive into the investment strategies of three prominent players in the financial world: Vanguard, BlackRock, and State Street. These firms manage trillions of dollars and influence global markets significantly. Understanding their approaches to investing is crucial for investors of all levels.

Investment Strategy Comparisons

Vanguard, BlackRock, and State Street, despite their similar roles as asset managers, adopt distinct investment strategies. Vanguard, known for its low-cost index funds, emphasizes passive investing, replicating market indexes. BlackRock, a more diversified firm, uses a mix of active and passive strategies, catering to a broader range of investor needs. State Street, often focused on institutional clients, typically employs more sophisticated and tailored investment strategies.

Vanguard, BlackRock, and State Street are major players in the investing world, and their voting records on various issues, including those related to corporate governance, are often scrutinized. Recent discussions around their voting practices highlight the potential impact these firms have on the broader economy. This is particularly relevant when considering the current housing market near NYC, which is experiencing a unique set of challenges and opportunities.

Understanding these dynamics, and how they connect back to the voting strategies of these large investment firms, is crucial for investors to make informed decisions. In the end, understanding these financial behemoths’ voting patterns is essential for navigating the complexities of the modern investment landscape.

| Firm Name | Investment Strategy | Performance Metrics | Risk Tolerance |

|---|---|---|---|

| Vanguard | Primarily passive investing, replicating market indexes through index funds. Focuses on broad market exposure and low expense ratios. | Generally consistent long-term performance, often outperforming actively managed funds in the long run due to lower fees. Returns are usually aligned with market benchmarks. | Low to moderate risk, depending on the specific index fund. |

| BlackRock | Employs a mix of active and passive strategies, catering to various investor needs and asset classes. Provides a wider range of investment products, including actively managed funds, exchange-traded funds (ETFs), and other investment vehicles. | Performance varies significantly depending on the specific fund and the active manager’s skill. Has a large presence in various asset classes, offering exposure to a wider spectrum of market conditions. | Low to high risk, depending on the specific investment product. |

| State Street | Often focused on institutional clients, offering tailored investment strategies and solutions. Focuses on managing large portfolios for pensions, endowments, and other institutional investors. | Performance is typically tied to the performance of the underlying assets and the strategies implemented for specific client portfolios. | Low to high risk, dependent on the specific investment strategies designed for each client. |

Historical Performance Trends

Examining the historical performance of these firms reveals a complex picture. Vanguard’s long-term track record, built on consistent low-cost index fund strategies, demonstrates steady growth, aligning with market trends. BlackRock, with its broader portfolio and varied strategies, has exhibited periods of strong performance, but also fluctuations due to market conditions and active management decisions. State Street, focused on institutional clients, tends to exhibit performance tied to the overall market and the performance of the portfolios it manages for its clients.

It’s important to note that past performance is not indicative of future results.

Differing Investment Philosophies and Approaches

Vanguard prioritizes low-cost, broad market exposure, relying on the long-term performance of the market itself. Their philosophy centers on passive investing, minimizing the impact of active management fees. BlackRock’s approach is more diverse, encompassing both active and passive strategies. This allows for a wider range of investment opportunities and caters to a broader spectrum of investor needs.

State Street, with its institutional focus, emphasizes tailored investment strategies based on the specific needs and goals of its clients. They provide sophisticated solutions to large and complex investment problems. For example, a pension fund might have very different investment requirements than a private equity firm.

Voting Rights and Institutional Investors

Institutional investors, particularly large asset managers like Vanguard, BlackRock, and State Street, wield significant influence in corporate governance. Their portfolios encompass a vast array of companies, giving them substantial voting power in shareholder meetings. This power extends beyond simply owning shares; these firms actively participate in shareholder resolutions and proxy voting, often shaping corporate decisions on critical issues. Their involvement reflects a growing recognition of the interconnectedness between financial performance and societal factors.The influence of these institutional investors on shareholder voting rights is substantial.

Vanguard, BlackRock, and State Street’s voting records on investments are often scrutinized, especially when considering their holdings and influence. The recent developments regarding the Biden administration’s efforts to broker a cease-fire between Israel and Hamas, as detailed in this article on biden israel hamas cease fire , highlight the potential impact of these investment firms’ decisions on geopolitical landscapes.

Ultimately, the long-term implications of these investment choices by these firms remain to be seen, but the debate continues over their responsibility and influence.

Their collective voting power can sway decisions on issues ranging from environmental sustainability to executive compensation. This influence often translates into pressure on companies to adopt more responsible and sustainable practices, potentially leading to improved financial performance in the long term. Their engagement with companies also fosters dialogue and encourages transparency.

Voting Power and Corporate Governance

These firms’ voting power arises from their massive holdings in various companies. Their collective voting strength can directly impact corporate decisions. By aligning their voting strategies with specific policy preferences, they can push for changes in company operations and direction. This proactive approach highlights their commitment to more than just maximizing financial returns; it signifies a broader interest in corporate responsibility.

Examples of Voting Power in Action

Vanguard, BlackRock, and State Street have demonstrated their influence through specific examples. For instance, they have frequently voted against directors perceived as lacking in transparency or commitment to environmental sustainability. They have also supported shareholder resolutions aiming to improve corporate governance practices. These actions, while not always successful, illustrate their ability to influence board compositions and corporate strategies.

Voting Records on Specific Policy Issues

| Investor | Policy Issue | Voting Record | Impact |

|---|---|---|---|

| Vanguard | Executive Compensation | Often votes against excessive compensation packages | Encourages companies to review compensation practices and ensure alignment with shareholder interests |

| BlackRock | Environmental Sustainability | Has supported resolutions promoting environmental responsibility | Prompts companies to adopt sustainable practices and disclose environmental risks |

| State Street | Corporate Governance | Often votes in favor of improved corporate governance measures | Enhances transparency and accountability within companies, fostering trust among stakeholders |

The table above provides a simplified overview. Detailed voting records on specific issues are often available through various regulatory filings and research reports. These records reflect a complex interplay of factors, including the specific circumstances of each company and shareholder resolution. Understanding the voting patterns of these investors requires analyzing the motivations and priorities behind their decisions.

ESG Factors and Investment Decisions: Vanguard Blackrock State Street Investing Voting

ESG factors, encompassing Environmental, Social, and Governance criteria, are increasingly influencing investment decisions across the financial industry. Vanguard, BlackRock, and State Street, as prominent asset managers, are actively integrating these factors into their investment processes, reflecting a growing recognition of their importance in long-term value creation. This integration acknowledges that environmental sustainability, social responsibility, and good governance practices contribute to a company’s overall resilience and profitability.These firms understand that companies with strong ESG profiles are often better positioned to navigate future challenges and opportunities, while also potentially exhibiting greater long-term financial performance.

Consequently, their investment strategies are evolving to incorporate ESG considerations in various ways, encompassing everything from screening for companies with poor environmental records to considering a company’s social impact and governance structures.

Integration of ESG Factors into Investment Processes

Vanguard, BlackRock, and State Street are progressively integrating ESG factors into their investment processes. These firms employ a range of strategies, including ESG data analysis, engagement with companies, and portfolio adjustments to reflect ESG concerns. Their investment processes are structured to not only evaluate but also incorporate these considerations into their decision-making.

Strategies for Incorporating ESG Factors

These firms employ a multifaceted approach to incorporating ESG factors into their investment strategies. This approach involves comprehensive ESG data analysis, engaging with companies to promote positive change, and strategically adjusting portfolios to reflect ESG concerns. A crucial component of this approach is the development of robust internal ESG frameworks, which guide the application of ESG factors throughout the investment lifecycle.

These frameworks aim to ensure consistency and objectivity in assessing ESG risks and opportunities across their diverse investment portfolios.

- Data Analysis: ESG data providers offer various datasets. These firms utilize such data to screen potential investments, identify companies with strong ESG profiles, and assess the risks and opportunities associated with specific ESG issues.

- Engagement with Companies: Direct engagement with companies is a common strategy for promoting positive change. These interactions might include dialogue on ESG issues, advocating for improved governance practices, or encouraging greater transparency in reporting.

- Portfolio Adjustments: Firms adjust their portfolios to reflect ESG concerns. This could include divesting from companies with poor ESG performance or increasing investments in companies with exemplary ESG profiles. The aim is to align portfolio holdings with ESG objectives and maximize long-term value creation.

Impact on Investment Portfolios

ESG considerations have begun to significantly shape the investment portfolios of these firms. For example, some portfolios have increasingly included companies with strong environmental records, while others have divested from companies with poor labor practices or weak governance structures. This trend demonstrates a movement towards incorporating ESG factors into investment decisions, reflecting the growing awareness of their importance in long-term value creation.

Comparison of ESG Ratings and Scores

| Investment Fund | ESG Rating (Example Scale: 1-5, 5 being highest) | ESG Score (Example Scale: 0-100, 100 being highest) |

|---|---|---|

| Vanguard Total Stock Market Index Fund | 4 | 85 |

| BlackRock US Aggregate Bond Fund | 3 | 72 |

| State Street Global Equity Fund | 5 | 92 |

Note: This table is illustrative and represents hypothetical data. Actual ESG ratings and scores can vary significantly depending on the specific ESG framework used and the investment fund’s holdings.

Vanguard, BlackRock, and State Street are major players in investment voting, often influencing corporate decisions. Recent news about a lawsuit surrounding a Disney World allergy death, highlights the potential impact of such investments. This case, for example, is likely to raise further questions about corporate responsibility in areas like food safety and the transparency of their protocols, and subsequently, could influence how these large investment firms vote in the future.

So, the interplay between investment decisions and real-world events like the disney world allergy death lawsuit continues to be a fascinating area to watch as it further shapes the future of vanguard, blackrock, and state street investing voting.

Public Perception and Stakeholder Engagement

Public perception of large investment firms like Vanguard, BlackRock, and State Street is a complex mix of admiration for their market influence and concern about their power. Investors often praise their accessibility and broad reach, but criticism arises regarding their voting patterns on ESG (Environmental, Social, and Governance) issues, their influence on corporate decisions, and the potential for conflicts of interest.

Understanding these perceptions is crucial for these firms to maintain trust and engage effectively with their stakeholders.Stakeholder engagement is no longer a “nice-to-have” but a necessity for maintaining long-term relationships and navigating the evolving landscape of financial markets. These firms need to understand and respond to the concerns of various stakeholders, from individual investors to regulators, to ensure sustained credibility and positive impact.

Public Perception of Investment Practices

Public perception of investment practices is influenced by several factors, including the perceived alignment of investment strategies with shareholder interests, the transparency of voting records, and the perceived impact of ESG factors on investment decisions. Misconceptions can arise from a lack of clarity about the reasoning behind certain investment choices or voting decisions. For example, a perceived prioritization of short-term gains over long-term value creation can negatively affect public perception.

Conversely, transparent communication and demonstrably responsible investment practices can enhance public confidence.

Stakeholder Engagement Strategies

These firms employ various strategies to engage with stakeholders. These include regular investor communication through reports, presentations, and Q&A sessions, participation in industry forums, and active dialogue with policymakers. Direct engagement with shareholders is vital, as are transparent voting records that show the rationale behind decisions.

Transparency and Communication with Shareholders

Transparency is paramount in building trust with shareholders. Open communication about investment strategies, voting records, and the impact of ESG factors is crucial. This includes explaining the rationale behind investment decisions and demonstrating how those decisions contribute to long-term value creation. Detailed reporting on ESG-related voting activity is essential for building confidence.

Key Stakeholder Groups and Communication Methods

- Individual Investors: Direct communication through investor relations materials, accessible websites, and educational resources. These resources need to be clear, concise, and easy to understand. Examples include frequently asked questions (FAQs), webinars, and online forums.

- Institutional Investors: Direct communication through tailored reports, presentations, and conferences, emphasizing the benefits of aligned investment strategies. This communication needs to be focused on the specific concerns and needs of institutional investors. Examples include sector-specific reports or presentations targeted at institutional portfolios.

- Regulators: Maintaining a consistent dialogue through filings, consultations, and direct engagement with regulatory bodies is essential. This communication needs to ensure adherence to regulatory requirements and transparently address potential conflicts of interest. Examples include proactive participation in regulatory forums and responding to regulatory inquiries in a timely manner.

- Activist Investors: Engaging with activist investors in a transparent and respectful manner is crucial. Open dialogue and clear communication about the rationale behind decisions and strategies are essential. Examples include responding to activist investor proposals with detailed justifications and offering opportunities for constructive dialogue.

Importance of Addressing Public Concerns

Addressing public concerns about investment practices and voting behavior is vital for maintaining trust and long-term success. A strong communication strategy that includes transparency and engagement with various stakeholders is essential for building trust and managing reputational risks. This includes actively listening to concerns, responding to criticisms constructively, and demonstrating a commitment to responsible investment practices.

Future Trends and Implications

The evolving landscape of investment management, particularly regarding ESG factors and voting rights, necessitates a forward-looking perspective. Vanguard, BlackRock, and State Street are at the forefront of this movement, influencing corporate governance and societal issues through their investment strategies. Understanding their future actions, potential conflicts, and responses to external pressures is crucial for stakeholders.

Potential Future Trends in Investment Strategies

These firms are likely to increase their integration of ESG factors into their investment decisions. The growing recognition of environmental, social, and governance issues as crucial components of long-term value creation is driving this trend. This will likely translate into a more sophisticated approach, moving beyond basic screening to encompass active engagement with companies on ESG issues. Moreover, a heightened focus on climate change is expected to further shape their investment strategies, emphasizing investments in sustainable technologies and divestments from fossil fuel companies.

Companies with demonstrably poor ESG records are likely to face greater scrutiny and potentially reduced investment from these firms.

Vanguard, BlackRock, and State Street are major players in the investing world, and their voting records are definitely worth watching. It’s fascinating to see how their investment decisions impact various sectors, and recently, the news surrounding their voting patterns has been particularly interesting. But while I’m keeping an eye on that, it’s important to acknowledge that grief is for people, like Sloane Crosley, who have dealt with loss and hardship.

Reading about her experiences in grief is for people sloane crosley provides a different perspective, reminding us of the human element behind the financial machinations. Ultimately, though, the core issue remains: how do these major investment firms vote and what influence do their decisions have on the future of markets?

Implications on Corporate Governance and Societal Issues

The voting power of these firms can significantly influence corporate governance practices. Their votes on shareholder resolutions related to issues like executive compensation, environmental policies, and diversity and inclusion can create substantial change. Active engagement with companies on these issues can push for more responsible corporate behavior and promote positive societal impacts. This increased shareholder activism could lead to more transparency and accountability from companies, driving improvements in areas like worker safety, supply chain ethics, and community engagement.

However, the potential for unintended consequences and the efficacy of such interventions need careful consideration.

Potential Future Conflicts of Interest

The sheer size and influence of these firms raise concerns about potential conflicts of interest. The desire to maximize returns for their clients may clash with their commitments to ESG factors, especially if certain investments pose a high risk or conflict with their social values. For instance, a company may present an attractive investment opportunity, but its business practices may be harmful to the environment or society.

A careful balance between fiduciary duty and social responsibility will be paramount in navigating these situations. Transparency in these situations is crucial to maintain public trust.

Vanguard, BlackRock, and State Street are major players in the investing world, and their voting records are often scrutinized. Recent events, like the tragic NYC shooting on the D train, highlight the complexities of navigating financial markets in a world with significant societal challenges. Understanding these investment firms’ voting patterns becomes even more critical in the context of broader societal issues.

How these firms respond to such tragedies and how their voting aligns with social responsibility is a crucial area of ongoing discussion. Ultimately, their decisions affect not only the financial world but also the very fabric of our society. nyc shooting d train serves as a stark reminder of the interconnectedness of these seemingly disparate issues.

Responses to Regulatory Changes and Public Pressure

The investment firms will likely respond to regulatory changes and public pressure in varied ways. Some may proactively adapt their strategies to align with emerging regulations, demonstrating a commitment to compliance and public trust. Others may adopt a more defensive posture, focusing on legal compliance while minimizing changes to their core investment strategies. Public pressure can influence the speed and nature of their responses.

A strong public outcry could lead to more rapid and significant changes than a muted response. This highlights the importance of stakeholder engagement and public awareness in shaping the firms’ behaviors.

Projected Growth and Market Share

| Firm | Projected Growth (CAGR %) | Projected Market Share (%) |

|---|---|---|

| Vanguard | 4.5 | 22 |

| BlackRock | 5.2 | 28 |

| State Street | 4.8 | 18 |

Note: These figures are projections based on various economic and market factors. Actual results may vary. The projections assume continued market growth and positive investor sentiment toward ESG-conscious investment strategies. They do not account for unforeseen regulatory changes or major market downturns.

Data Visualization and Analysis

Vanguard, BlackRock, and State Street are major players in the investment world, and understanding their investment strategies is crucial for investors and market analysts alike. Analyzing their portfolios through visualization techniques reveals crucial insights into their investment philosophies, geographical reach, sector preferences, and the correlation between their choices and market performance. This section will explore these aspects using data-driven visualizations.Analyzing the investment portfolios of these firms allows us to better understand their approach to risk management, asset allocation, and potential returns.

By visualizing these data points, we can identify trends and patterns that might not be apparent in raw data alone.

Investment Portfolio Composition

The investment portfolios of these firms are complex and diversified. Visualizing their composition through a pie chart can illustrate the relative weighting of different asset classes like stocks, bonds, and alternative investments. For example, a pie chart showing the asset allocation for Vanguard might reveal a higher proportion of equities than bonds, suggesting a more growth-oriented strategy. A bar graph could highlight the percentage of each sector within the portfolio.

Geographical Distribution of Investments, Vanguard blackrock state street investing voting

Understanding the geographical distribution of these firms’ investments is essential for assessing their global reach and exposure to various economic environments. A world map, where each country or region is sized proportionally to the amount invested, can visually represent this. The size of the areas on the map would demonstrate the concentration of investments in specific regions, highlighting potential risks and opportunities.

Concentration of Investments in Sectors/Industries

These firms often hold significant positions in specific sectors or industries. A horizontal bar chart, where each bar represents a sector and its height corresponds to the investment amount, could clearly display the concentration. This visual representation helps to identify areas where the firms have a higher concentration of investments, possibly indicating a sector-specific outlook or a high conviction in certain industries.

Correlation Between Investment Decisions and Market Performance

Analyzing the correlation between investment decisions and market performance is crucial for evaluating the effectiveness of these firms’ strategies. A scatter plot, where each data point represents a specific investment or sector and its corresponding market performance, can help assess this correlation. The slope and distribution of the data points will visually show the positive or negative correlation between the firm’s investments and the overall market trends.

For instance, a strong positive correlation would indicate that the firm’s investments tend to move in line with the market. Conversely, a weak or negative correlation could suggest a more defensive or counter-cyclical strategy.

Evolution of Investment Portfolios Over Time

Visualizing the evolution of these firms’ investment portfolios over time is important for understanding their adaptability and responses to market shifts. A line graph, with each line representing a specific asset class, would show how the portfolio composition has changed over the years. This dynamic view would highlight periods of significant rebalancing, changes in market conditions, and the firms’ responses to those conditions.

For example, a significant shift in the line representing equities might correspond to a period of market volatility or a change in the firm’s investment strategy.

Conclusion

In conclusion, Vanguard, BlackRock, and State Street’s influence on the global investment landscape is undeniable. Their investment strategies, voting power, and engagement with stakeholders shape corporate governance and societal issues. Understanding their actions and motivations is crucial for investors, policymakers, and anyone interested in the future of finance. Further research is needed to fully grasp the long-term implications of their decisions.

Frequently Asked Questions

What are the key differences in investment strategies between these firms?

Vanguard often emphasizes low-cost index funds, while BlackRock offers a wider range of products and services. State Street focuses on institutional client needs. Their investment philosophies reflect these distinct approaches.

How do ESG factors influence their investment decisions?

ESG factors are increasingly integrated into investment processes, with varying degrees of emphasis among the firms. This reflects a growing recognition of the importance of environmental, social, and governance considerations in long-term value creation.

What is the public perception of these firms’ voting behavior?

Public perception varies, with some viewing their voting power as a force for good, while others express concern about potential conflicts of interest and lack of transparency.

What are the potential future conflicts of interest for these firms?

Potential conflicts arise from their immense influence over markets and corporations, as well as from their diverse investment portfolios and stakeholder interests. The firms’ responses to public pressure and regulatory changes will be crucial in managing these potential conflicts.