Stock Market Peak Investing Strategies

Stock market peak investing sets the stage for navigating the tricky waters of a potentially volatile market. This in-depth exploration will cover identifying market peaks, understanding various investment strategies, and evaluating opportunities. We’ll also discuss risk management, long-term planning, and real-world examples, providing a comprehensive guide to navigating this critical market phase.

The article delves into the intricacies of investing during a market peak, offering practical insights and strategies for maximizing returns while minimizing risks. We’ll explore different investment approaches, considering factors like diversification, risk mitigation, and long-term planning.

Identifying Market Peaks

Spotting a stock market peak is notoriously difficult, a challenge even seasoned investors grapple with. While no foolproof method exists, understanding the common indicators and historical patterns can significantly enhance the likelihood of recognizing potential turning points. This analysis delves into the key factors that often signal a market peak, examining historical examples, and exploring methodologies for recognizing such shifts.Identifying a market peak isn’t about predicting the future with certainty, but rather about recognizing subtle shifts in market dynamics that might foreshadow a downturn.

These shifts are often revealed through a combination of factors, including investor sentiment, economic indicators, and technical analysis. Recognizing these patterns allows investors to adjust their strategies proactively, potentially mitigating potential losses and capitalizing on emerging opportunities.

Common Indicators Preceding Peaks

Understanding the telltale signs that precede a market peak can be instrumental in anticipating potential shifts. These indicators often point towards a confluence of factors suggesting that the market’s upward momentum is waning.

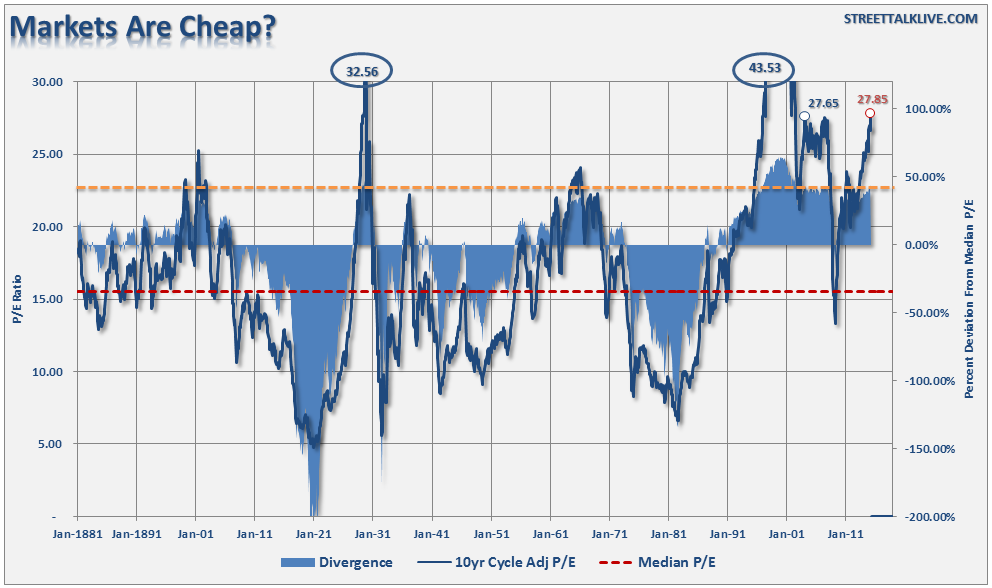

- High valuations: When stock prices become detached from fundamental values, the risk of a correction increases. This detachment can manifest in metrics like high price-to-earnings (P/E) ratios or market capitalization relative to GDP. Historical examples show that inflated valuations often precede market downturns. For instance, the dot-com bubble saw a dramatic increase in valuations, ultimately followed by a sharp decline.

Peak stock market investing often involves calculated risk, but the recent flurry of activity surrounding FTC AI deals, like the Microsoft-OpenAI partnership ( ftc ai deals microsoft openai ), could potentially shift the landscape. While the specifics of these agreements are still unfolding, they might introduce new complexities and opportunities that savvy investors need to consider. Ultimately, though, understanding market trends and maintaining a long-term strategy remain crucial for success in peak investing.

- Excessive optimism and speculative activity: Unprecedented enthusiasm often precedes market peaks. Investors may become overly optimistic, leading to excessive speculation and a surge in trading volume. This exuberant sentiment can obscure underlying risks and contribute to unsustainable valuations.

- Reduced economic growth: While not always a direct indicator, slower economic growth can create uncertainty and apprehension in the market. Reduced corporate earnings and decreased consumer spending can trigger investor caution, paving the way for a peak.

- Rising interest rates: A rising interest rate environment can impact investment returns and reduce the attractiveness of equities. Investors may shift their capital towards fixed-income securities, impacting the demand for stocks.

Historical Examples of Market Peaks, Stock market peak investing

Examining past market peaks provides valuable insights into the characteristics and patterns associated with these turning points. Understanding how these peaks unfolded can aid in recognizing similar patterns in the current market.

- The dot-com bubble (late 1990s): Characterized by excessive speculation in internet-related companies, the dot-com bubble saw a dramatic rise in valuations that ultimately collapsed. The bubble burst, highlighting the dangers of unchecked optimism and speculative activity.

- The 2000-2002 bear market: Following the dot-com bubble, the market experienced a significant downturn. The decline was marked by a confluence of factors, including high valuations, excessive speculation, and the bursting of the internet bubble.

- The 2008 financial crisis: This crisis was triggered by a combination of factors, including subprime mortgage lending, excessive risk-taking, and a housing market bubble. The crisis exposed vulnerabilities in the financial system and led to a sharp market decline.

Methods for Recognizing Potential Turning Points

Various methods can help identify potential turning points in the market. These techniques combine technical analysis, fundamental analysis, and an understanding of market sentiment.

- Technical indicators: Moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are common technical indicators that can help identify trends and potential reversals. By tracking these indicators, investors can potentially anticipate shifts in market momentum.

- Fundamental analysis: Assessing the financial health of companies and the overall economic climate provides insights into the sustainability of current valuations. A thorough analysis of earnings reports, balance sheets, and industry trends can provide valuable insights into potential turning points.

- Sentiment analysis: Monitoring investor sentiment, through surveys or social media data, can reveal shifts in market psychology. An abrupt shift from bullishness to bearishness can signal an impending market peak.

Comparing and Contrasting Market Indicators

The following table highlights the strengths and weaknesses of different market indicators, providing a comprehensive comparison.

| Indicator | Strengths | Weaknesses |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | Helpful in assessing valuation levels. | Can be influenced by accounting practices. |

| Moving Averages | Identify trends and potential reversals. | Lagging indicators, may not predict immediate changes. |

| RSI (Relative Strength Index) | Identify overbought and oversold conditions. | Can be susceptible to noise and short-term fluctuations. |

Understanding Peak Investing Strategies

Navigating a market peak requires a nuanced approach that considers the inherent volatility and potential for decline. This phase necessitates careful evaluation of investment strategies, recognizing the delicate balance between maximizing returns and mitigating risk. A successful peak investing strategy requires anticipating market shifts and adjusting positions accordingly.Investment approaches during a market peak often fall into two broad categories: defensive and aggressive strategies.

Understanding the distinctions between these approaches is crucial for adapting to the specific characteristics of the market cycle. Both strategies have their place, and the optimal approach depends on individual risk tolerance and investment goals.

Defensive Strategies for Peak Investing

Defensive strategies prioritize preserving capital during a potential market downturn. These strategies focus on minimizing risk by avoiding highly speculative investments and concentrating on established, lower-volatility assets. The primary goal is to maintain capital while potentially seeking modest returns.

- Cash and Cash Equivalents: Holding significant portions of the portfolio in readily accessible cash allows for swift reactions to market shifts. This strategy is particularly effective when market conditions become uncertain.

- High-Quality Bonds: Bonds, especially those with a high credit rating, provide a stable income stream and lower risk during market peaks. The fixed income provided can be a valuable hedge against potential declines.

- Dividend-Paying Stocks: Companies with a strong track record of dividend payments often maintain their value even during market corrections. The dividend income can provide a buffer against market volatility.

Aggressive Strategies for Peak Investing

Aggressive strategies, while potentially yielding higher returns, carry a greater degree of risk during market peaks. Investors adopting this approach aim to capitalize on the remaining upward momentum while acknowledging the potential for significant losses.

- Selective Stock Picking: Identifying undervalued companies with strong fundamentals can be a source of potential gains during a peak. This approach demands thorough research and a deep understanding of company performance.

- Options Trading: Using options can allow for leveraged exposure to specific stocks or market indices. However, this approach is extremely risky and necessitates a high level of expertise.

- Growth Stocks: Companies with strong growth prospects might still present opportunities for profit during a peak. However, the potential for decline is proportionally higher compared to established companies.

Risks and Potential Rewards of Each Strategy

Defensive strategies offer lower potential rewards but significantly reduce risk. Aggressive strategies, conversely, carry higher potential rewards but expose investors to greater risk.

Diversification During a Market Peak

Diversification remains paramount during market peaks. Spreading investments across various asset classes and industries can help mitigate potential losses from a single sector or market segment. A diversified portfolio can be more resilient to market fluctuations.

Investment Vehicles Suitable for Peak Investing

| Investment Vehicle | Description | Suitability for Peak Investing |

|---|---|---|

| Cash | Liquid assets | High (Defensive) |

| High-Grade Bonds | Fixed-income securities | Medium (Defensive) |

| Dividend-Paying Stocks | Stocks with consistent dividends | Medium (Defensive) |

| Selective Stock Picking | Identifying undervalued stocks | High (Aggressive) |

| Options | Contracts to buy or sell assets | High (Aggressive) |

| Growth Stocks | Stocks with high growth potential | Medium to High (Aggressive) |

Evaluating Investment Opportunities

Navigating a market peak requires a discerning eye, moving beyond the prevailing euphoria. Simply following the crowd can be perilous. Investors need a critical lens to assess opportunities, recognizing potential pitfalls and hidden risks. This involves more than just looking at the headline numbers; it’s about digging deeper, understanding the underlying fundamentals, and anticipating potential shifts in the market.Identifying companies with strong fundamentals during a market peak is crucial for long-term success.

A thorough evaluation of the company’s financial health, competitive position, and management quality provides critical insight into its resilience during periods of market volatility. Assessing valuation becomes even more important, as inflated valuations can mask underlying weaknesses. Understanding these factors is key to avoiding the common pitfalls of peak investing.

Factors to Consider When Evaluating Investment Opportunities

Evaluating investment opportunities during a market peak requires careful consideration of several key factors. Companies that appear attractive on the surface may hide significant vulnerabilities. Price-to-earnings ratios and other metrics can be misleading if not examined in the context of the broader market and the company’s specific circumstances.

- Company Fundamentals: Assessing a company’s financial statements, revenue streams, and competitive advantages is crucial. This includes analyzing profitability, debt levels, and cash flow to identify potential weaknesses.

- Market Trends: Understanding the current and future trends within the industry is vital. Are the growth drivers sustainable, or are they based on temporary factors? What are the emerging competitive threats?

- Management Quality: The experience and competence of management play a critical role in navigating market fluctuations. Strong leadership can help navigate uncertainty and capitalize on opportunities.

- Valuation Metrics: Analyzing price-to-earnings ratios, price-to-book ratios, and other valuation metrics is crucial. Comparing these metrics to historical data and industry averages provides valuable context.

Examples of Companies that Thrived or Faltered

Past market peaks have offered both success stories and cautionary tales. Identifying companies that thrived during previous peaks, and those that faltered, provides valuable insights for current investors. Consider Enron, a company that flourished in the late 1990s but eventually collapsed due to accounting irregularities.

- Thriving during a Peak: Companies like Apple in the late 2000s demonstrated remarkable resilience and growth. Their strong brand recognition and innovative products allowed them to continue to thrive even amidst a market slowdown.

- Faltering during a Peak: Enron’s rapid growth and inflated stock price, based on questionable accounting practices, ultimately led to its collapse during a market peak. This highlights the importance of scrutinizing a company’s financial health, not just its market capitalization.

Importance of Fundamental Analysis

Fundamental analysis is paramount during peak investing. It provides a framework for evaluating a company’s intrinsic value, independent of market sentiment. By focusing on factors like earnings, revenue, and assets, investors can gain a deeper understanding of the company’s long-term prospects, regardless of the market’s short-term fluctuations.

Fundamental analysis provides a critical framework for evaluating a company’s intrinsic value, helping investors identify potential value mismatches.

Techniques for Assessing Company Valuation

Several techniques can help assess company valuation at market peaks. These methods allow investors to identify companies that might be overvalued and those that may be undervalued, relative to their intrinsic value.

- Discounted Cash Flow (DCF) Analysis: DCF analysis estimates the present value of future cash flows, offering an objective measure of a company’s intrinsic worth.

- Comparable Company Analysis: Comparing a company’s valuation metrics to those of similar companies in the same industry can identify potential mispricing.

- Ratio Analysis: Using financial ratios like price-to-earnings, price-to-book, and debt-to-equity ratios can highlight potential financial vulnerabilities.

Sector Performance Comparison

Analyzing sector performance during past market peaks can help investors understand which sectors tend to perform well or poorly.

| Sector | Performance during Peak X (Year) | Performance during Peak Y (Year) |

|---|---|---|

| Technology | Strong Growth | Moderate Growth |

| Energy | Significant Gains | Steady Performance |

| Financials | Mixed Performance | Outperformance |

Note: Peak X and Peak Y refer to specific market peaks in the past. Data in the table represents a generalized trend. Specific companies and sectors will experience unique outcomes.

Peak stock market investing can be tricky, you know? It’s all about timing, and sometimes, the best opportunities are hidden in plain sight. For example, the extravagant displays of couture, like at the Didier Ludot 50th anniversary Paris show couture didier ludot 50th anniversary paris , might offer a glimpse into broader societal shifts. Perhaps the same kind of calculated risk-taking that fuels high-end fashion also finds a place in the stock market, suggesting an underlying confidence in the economy.

So, when you’re trying to gauge the market’s peak, maybe consider looking beyond the obvious; the seemingly unrelated might just hold the key.

Managing Risk During Peak Investing: Stock Market Peak Investing

Navigating a market peak requires a nuanced approach to risk management. Simply identifying a potential peak is insufficient; investors must proactively strategize to mitigate potential losses. A robust risk management framework is crucial for capital preservation and maximizing returns during these volatile times. Ignoring risk during a peak can lead to significant financial setbacks.Peak investing, while potentially rewarding, presents unique challenges.

Investors need to be particularly vigilant in assessing risk and employing appropriate strategies to protect their capital. Market peaks are often characterized by inflated valuations and reduced investor sentiment, making it difficult to accurately predict the timing of market corrections. A disciplined risk management approach is the key to capital preservation and potentially profiting during a market downturn.

Strategies for Mitigating Risk

Effective risk mitigation during a market peak involves a multifaceted approach. Diversification of investments across various asset classes, including stocks, bonds, and alternative investments, can help to reduce exposure to any single market sector. This strategy reduces the impact of a single sector’s downturn on the overall portfolio. Thorough due diligence on individual investments is equally vital, ensuring that investments align with personal financial goals and risk tolerance.

Examples of Past Investor Risk Management

Past investors who successfully navigated market peaks often utilized stop-loss orders and position sizing strategies. For example, during the dot-com bubble, investors who employed stop-loss orders were able to limit losses when the market corrected. Careful position sizing, limiting the percentage of the portfolio allocated to a single investment, allowed for a smoother transition through market downturns. A significant portion of their success was predicated on not being overly exposed to any one particular stock or sector.

Importance of Stop-Loss Orders

Stop-loss orders are a critical risk management tool. These orders automatically sell a security when its price reaches a predetermined level. This helps limit potential losses by preventing the investor from holding onto a losing position for an extended period. For instance, if an investor buys a stock at $100 and sets a stop-loss order at $90, the order will automatically sell the stock if the price drops to $90, mitigating potential losses.

Properly used, stop-loss orders can be a significant tool in risk mitigation.

Significance of Position Sizing

Position sizing is the process of determining the appropriate amount of capital to allocate to a specific investment. During market peaks, it is especially crucial to avoid overexposure to any single security. A well-defined position sizing strategy limits the impact of potential losses and prevents significant portfolio drawdown. For instance, an investor might allocate only 5% of their portfolio to a single high-growth stock, safeguarding against large losses if the stock price declines.

A crucial aspect is understanding that an over-allocation to a single investment can disproportionately impact the overall portfolio.

Risk Management Tools

| Risk Management Tool | Application |

|---|---|

| Stop-loss orders | Automatically sell a security when its price reaches a predetermined level, limiting potential losses. |

| Diversification | Distributing investments across various asset classes to reduce exposure to a single market sector. |

| Position sizing | Determining the appropriate amount of capital to allocate to a specific investment, limiting the impact of potential losses. |

| Hedging | Using financial instruments to offset potential losses from an investment. |

| Monitoring market trends | Staying informed about market trends to adjust investment strategies accordingly. |

Long-Term Investment Planning

Peak investing, while potentially lucrative in the short term, demands a meticulous long-term perspective. A successful strategy considers not only the immediate market conditions but also the potential trajectory of the economy and individual financial goals. This necessitates a deep understanding of the long-term implications of peak investing decisions, the development of strategies that mitigate risk, and the crucial role of a diversified portfolio.Understanding the long-term implications of peak investing decisions is paramount.

Investors who prioritize short-term gains during a market peak may find themselves significantly disadvantaged if the subsequent market downturn is severe or prolonged. The decision to invest heavily during a peak must be carefully weighed against the potential for significant losses if the market subsequently corrects.

Successful Long-Term Investment Strategies During Market Peaks

A key aspect of peak investing is the selection of assets that have strong fundamentals and a history of consistent performance. Diversification across asset classes, including stocks, bonds, real estate, and alternative investments, is critical. This approach helps mitigate risk during potential market downturns.

Considering Future Economic Trends

Future economic trends are critical when assessing investment opportunities during a market peak. Factors such as inflation, interest rates, and geopolitical events can significantly impact market performance. Projections based on historical data and expert analysis can help investors make informed decisions. Recognizing that economic forecasts are never precise is crucial.

Peak stock market investing can be a risky game, often leading to devastating losses. It’s easy to get caught up in the hype, but sometimes, the best investments are the ones that don’t involve financial markets at all. For instance, the tragic story of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium, here , highlights the fleeting nature of life and the importance of appreciating the present moment.

Still, the lessons learned from history can’t replace sound financial strategies for navigating the unpredictable stock market.

Maintaining a Balanced Portfolio During Market Peaks

Maintaining a balanced portfolio is vital during market peaks. This involves adjusting the portfolio’s allocation to reflect the current market conditions while adhering to a long-term financial plan. Consider strategies like dollar-cost averaging, which involves investing a fixed amount at regular intervals regardless of market fluctuations.

Evolution of Market Peaks Over Time

A historical overview of market peaks can provide valuable insights. Analyzing past peaks allows investors to understand the typical market cycles and the potential for subsequent corrections.

| Peak Year | Leading Economic Indicators | Subsequent Market Correction | Lessons Learned |

|---|---|---|---|

| 1999 | High tech boom, low interest rates | Dot-com bubble burst | Overvalued sectors can be vulnerable to sharp corrections. |

| 2007 | Housing market bubble, low interest rates | Global financial crisis | Asset bubbles can lead to significant market downturns. |

| 2021 | Low interest rates, rapid economic recovery | Inflationary pressures, rising interest rates | Rapid growth can be accompanied by volatility. |

Illustrative Examples of Peak Investing

Navigating market peaks requires a nuanced understanding of market dynamics and historical patterns. Successful peak investing hinges on identifying the precise moment of a market’s zenith and making calculated adjustments to one’s portfolio. It’s a delicate dance between recognizing potential for further growth and mitigating the risk of imminent decline.

Real-World Scenarios of Peak Investing

Market peaks are not singular events; they are periods characterized by heightened investor optimism and increasing asset valuations. Understanding these scenarios allows for more informed decision-making. For instance, the dot-com bubble of the late 1990s saw a rapid rise in internet-related stocks, followed by a dramatic crash. Investors who bought into this exuberant market during its peak faced significant losses.

Conversely, savvy investors who recognized the bubble and took profits or adjusted their portfolios by diversifying into more stable sectors saw their portfolios less affected.

Case Studies: Successful and Unsuccessful Peak Investing

A significant example of a successful peak investing strategy is Warren Buffett’s approach during the tech bubble. He avoided high-growth tech stocks, focusing instead on more established companies with strong fundamentals. This cautious approach preserved his capital during the market’s downturn. Contrastingly, the 2008 financial crisis showcased how investors who heavily invested in mortgage-backed securities, a prominent asset class during the housing market peak, faced substantial losses.

The subsequent market crash exposed the vulnerability of such concentrated holdings. These case studies demonstrate the importance of diversification and thorough research.

Peak stock market investing can be tricky, especially when you’re seeing record-high prices like those driving up the value of 2 million dollar homes california. 2 million dollar homes california are a prime example of how inflated real estate markets can be, a reminder that the stock market isn’t immune to bubbles. This should make any peak investing strategy a bit more cautious.

Historical Context in Peak Investing Decisions

Evaluating peak investing decisions requires a deep understanding of the historical context. Analyzing past market cycles, considering economic indicators, and recognizing recurring patterns can help predict potential market reactions. For instance, the 1929 stock market crash followed a period of rapid growth and speculation. Understanding the underlying factors that led to that crash provides invaluable lessons for investors today.

Impact on Different Asset Classes

Market peaks affect different asset classes in varying ways. During periods of heightened optimism, stocks often lead the ascent, while bonds and other fixed-income instruments might lag. However, this dynamic can change rapidly. Real estate, for instance, can exhibit strong growth at market peaks, but the subsequent decline can be equally sharp. Commodities, too, can experience price fluctuations correlated with broader economic conditions.

Portfolio Adjustments During Market Peaks

Portfolio adjustments are critical during market peaks. They involve shifting allocation among different asset classes to mitigate potential losses. A well-structured portfolio should adapt to the changing market conditions.

| Scenario | Portfolio Adjustment | Rationale |

|---|---|---|

| High-growth stocks experiencing a peak | Reduce allocation to high-growth stocks, increase allocation to more stable sectors (e.g., utilities, consumer staples). | Mitigating risk associated with potential declines in high-growth sectors. |

| Rising bond yields | Rebalance bond holdings, potentially shifting towards shorter-term bonds. | Capturing potential yield increases while managing interest rate risk. |

| Real estate market at peak | Review real estate holdings, consider diversification into other asset classes. | Managing risk associated with potential real estate market corrections. |

Factors Influencing Peak Investing Decisions

Navigating market peaks requires a deep understanding of the forces driving the market’s trajectory. A multitude of factors, both internal and external, influence investor decisions at these critical junctures. Understanding these factors is paramount for successful peak investing strategies, as it allows investors to anticipate potential shifts and adjust their portfolios accordingly.Peak investing strategies hinge on recognizing and analyzing various influences.

By comprehending the complex interplay of economic forces, investor sentiment, and geopolitical events, investors can refine their decision-making processes and potentially capitalize on opportunities presented during market highs.

External Factors Influencing Peak Investing Decisions

External factors significantly impact market peaks, influencing investor behavior and ultimately shaping investment strategies. These factors often operate independently but frequently interact, creating a complex web of influences. Recognizing these interactions is critical for peak investors.

Macroeconomic Factors Affecting Market Peaks

Macroeconomic factors are fundamental drivers of market trends. Changes in interest rates, inflation, and economic growth directly affect the valuation of assets. For example, rising interest rates can decrease the attractiveness of stocks, while robust economic growth can support higher valuations. The interplay of these factors can trigger periods of market volatility, both positive and negative, impacting investor confidence and influencing peak investing decisions.

Peak stock market investing can be tricky, but understanding the nuances of market cycles is key. Choosing the right time to invest is crucial, and sometimes, even the most seasoned investors find themselves caught in the rush of market highs. For instance, are you considering the future implications of naming a baby? Navigating the complexities of apellido bebe madre padre decisions can be similar to navigating the ups and downs of a volatile market.

Ultimately, careful research and a solid understanding of the market remain paramount when approaching peak investing opportunities.

- Interest Rates: Changes in interest rates affect borrowing costs and investment returns. Higher rates often cool down the market, while lower rates can stimulate investment.

- Inflation: Inflation erodes purchasing power and impacts asset values. High inflation often leads to decreased investment demand.

- Economic Growth: Strong economic growth typically supports higher asset prices, creating an environment favorable for peak investing strategies. Conversely, economic downturns often lead to market corrections.

- Unemployment Rates: Low unemployment rates can indicate a strong economy, while high unemployment often signals a weakening economy.

- Currency Exchange Rates: Fluctuations in exchange rates can impact the profitability of international investments and influence global market trends.

Impact of Investor Psychology on Market Peaks

Investor psychology plays a crucial role in market peaks. FOMO (Fear Of Missing Out) and herd mentality can lead to overvaluation and subsequent corrections. Understanding the psychology of investors during market peaks is vital for successful peak investing. Conversely, periods of caution and pessimism can signal opportunities for astute investors.

How Geopolitical Events Influence Peak Investing Decisions

Geopolitical events, such as wars, trade disputes, or political instability, can significantly impact market sentiment and valuations. These events can create uncertainty and volatility, prompting investors to reassess their portfolios and adjust their investment strategies. For instance, international trade disputes can lead to currency fluctuations and reduced investor confidence, impacting market peaks.

Categorization of Factors Influencing Peak Investing

| Category | Factor | Impact on Peak Investing |

|---|---|---|

| Macroeconomic | Interest Rates | Higher rates often cool down the market, lower rates stimulate investment. |

| Macroeconomic | Inflation | High inflation erodes purchasing power and impacts asset values, decreasing investment demand. |

| Macroeconomic | Economic Growth | Strong growth supports higher asset prices, while downturns lead to corrections. |

| Investor Psychology | Fear of Missing Out (FOMO) | Can lead to overvaluation and subsequent corrections. |

| Geopolitical | Trade Disputes | Can lead to currency fluctuations and reduced investor confidence. |

Epilogue

In conclusion, stock market peak investing requires careful consideration of market indicators, diverse investment strategies, and thorough risk assessment. Understanding the potential rewards and pitfalls of various approaches, coupled with a well-defined long-term plan, is crucial for success. This guide equips you with the knowledge and tools to navigate this challenging yet potentially rewarding market phase.

Q&A

What are some common indicators of a stock market peak?

Common indicators include high valuations, inflated asset prices, reduced trading volume, and investor exuberance. These often precede a market downturn.

How can I diversify my portfolio during a market peak?

Diversification involves spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors. This reduces the impact of a single investment’s poor performance.

What are the key differences between defensive and aggressive peak investing strategies?

Defensive strategies prioritize preserving capital during a potential market downturn, while aggressive strategies aim for higher returns, though with higher risk. Defensive strategies might involve bonds or cash, while aggressive strategies could involve high-growth stocks.

What are the risks of investing in a market peak?

The primary risk is the potential for a sharp market correction or downturn. Also, inflated valuations can lead to lower future returns. The risk of missing out on potentially lucrative future returns if the market doesn’t correct as quickly as expected, is also important.