Climate BlackRock State Street, JPMorgan, Pimco Strategies

Climate BlackRock State Street JPMorgan Pimco are major players in the financial world, and their investment strategies are increasingly intertwined with climate change. This in-depth look delves into their investment approaches, ESG integration, market positioning, historical performance, macroeconomic impacts, regulatory landscape, and future outlook. We’ll examine how these titans of finance are navigating the complexities of a rapidly changing world, from sustainable investments to the potential financial implications of climate change.

This analysis will explore how each firm is adjusting their strategies to meet the growing demands of environmentally conscious investors and the shifting regulatory environment. We’ll look at the key investment themes, asset classes, risk tolerance, and return objectives for each firm, providing a comparative overview. The goal is to understand their current strategies and potential future directions in the face of climate change and evolving market dynamics.

Investment Strategies of Large Asset Managers

Large asset managers like BlackRock, State Street, JPMorgan, and Pimco play a pivotal role in global financial markets. Their investment strategies significantly influence market trends and investor portfolios. Understanding their approaches is crucial for anyone seeking to navigate the complexities of the financial world. These firms, with their vast resources and expertise, often dictate the direction of investments in various asset classes.

Comparative Overview of Investment Strategies

These four prominent asset managers employ diverse yet interconnected investment strategies. BlackRock, renowned for its broad range of products and services, often favors a diversified approach across various asset classes. State Street, with a focus on institutional clients, emphasizes a more conservative, often risk-averse strategy. JPMorgan, acting as a full-service financial institution, combines investment management with other financial services, often employing a more integrated and holistic strategy.

Pimco, a specialist in fixed income, generally concentrates its investments on the debt market. This leads to distinct investment approaches and portfolio compositions.

Climate change is a huge concern, and firms like BlackRock, State Street, JPMorgan, and Pimco are increasingly scrutinized for their investments. While the future of these financial giants is undoubtedly tied to environmental sustainability, the recent return of Romeo Gigli to Marrakech, as seen in this news article , highlights a different kind of investment, one focused on cultural preservation and personal journeys.

Ultimately, the responsibility of sustainable practices still rests squarely on the shoulders of these large investment firms.

Key Investment Themes and Approaches

Each firm exhibits unique investment themes. BlackRock often prioritizes sustainable and responsible investing. State Street focuses on long-term value creation and security. JPMorgan often employs a quantitative approach, leveraging data and algorithms to inform investment decisions. Pimco, specializing in fixed income, emphasizes market analysis and credit assessment to generate returns.

These themes underpin the strategic choices and dictate the investment approach.

Portfolio Comparison

A direct comparison of portfolio compositions is challenging due to the confidential nature of these holdings. However, general observations can be made. BlackRock’s portfolios tend to be highly diversified, encompassing equities, bonds, and alternative investments. State Street’s portfolios are likely to have a higher concentration in institutional holdings, including government bonds and agency debt. JPMorgan’s portfolios may demonstrate a mix of traditional and alternative investments, influenced by the firm’s broader financial services offerings.

Pimco’s portfolios are expected to be heavily weighted towards fixed income securities, particularly bonds. The diversity of investment strategies and asset classes chosen significantly influences the portfolio composition.

Asset Classes

The primary asset classes these firms typically invest in include equities (stocks), fixed income (bonds), alternative investments (private equity, real estate, commodities), and cash equivalents. The relative emphasis on each class varies based on the firm’s specific strategy. The choice of asset classes directly correlates with the risk tolerance and return objectives of each firm.

Risk Tolerance and Return Objectives

Risk tolerance and return objectives are crucial aspects of each firm’s investment strategy. BlackRock’s broad mandate allows for a relatively higher risk tolerance, aiming for competitive returns. State Street’s focus on institutional clients typically results in a lower risk tolerance, emphasizing stability and security. JPMorgan’s investment arm is likely to adopt a strategy balancing risk and return, seeking a balanced portfolio.

Pimco’s focus on fixed income usually implies a lower risk tolerance, seeking stable and predictable returns within the debt market.

| Firm | Investment Strategy | Key Themes | Asset Classes | Risk Tolerance |

|---|---|---|---|---|

| BlackRock | Diversified, broad range of products | Sustainable, responsible investing | Equities, bonds, alternatives | Higher |

| State Street | Institutional client focus | Long-term value creation | Government bonds, agency debt | Lower |

| JPMorgan | Integrated financial services | Quantitative approach | Equities, bonds, alternatives | Balanced |

| Pimco | Fixed income specialist | Market analysis, credit assessment | Bonds | Lower |

Climate Change and ESG Integration

Large asset managers like BlackRock, State Street, JPMorgan, and Pimco are increasingly integrating Environmental, Social, and Governance (ESG) factors into their investment strategies. This shift reflects a growing recognition of the material financial risks associated with climate change and the importance of sustainable investments. These firms understand that ignoring these factors can lead to significant financial losses in the long term.

Big investment firms like BlackRock, State Street, JPMorgan, and Pimco are grappling with the ever-growing concerns surrounding climate change. Their investments are under increasing pressure to align with environmental, social, and governance (ESG) factors. Meanwhile, the recent controversy surrounding Rick Pitino’s comments on St. John’s recruiting, detailed in this article here , highlights the broader societal shift towards accountability and responsible behavior.

Ultimately, the pressure on these firms to demonstrate environmentally responsible investments continues to intensify.

Their approaches to ESG vary, but a common thread is the growing awareness of the interconnectedness of environmental, social, and governance factors and their impact on portfolio performance.

Climate change concerns are definitely impacting investment strategies, with firms like BlackRock, State Street, JPMorgan, and Pimco adjusting their portfolios. Meanwhile, the dazzling displays at Saint Laurent Dior Paris Fashion Week are a stark contrast, showcasing extravagant designs and seemingly endless resources. However, the underlying financial forces, including the actions of these major investment firms, are still deeply intertwined with the future of our planet, and the climate crisis continues to be a crucial factor in their decision-making.

ESG Integration Strategies

These firms are employing a variety of methods to incorporate ESG factors into their investment processes. This includes analyzing the environmental impact of companies, assessing their social responsibility, and evaluating their governance structures. Furthermore, they are increasingly engaging with companies to encourage positive change and advocate for sustainable practices.

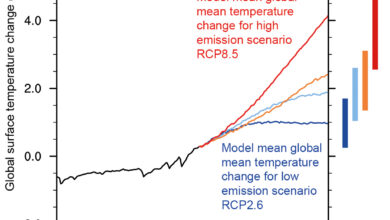

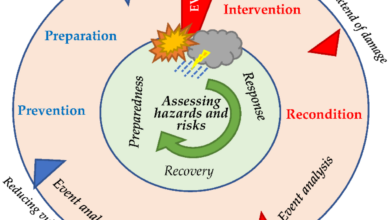

Addressing Climate Change Risks

Climate change poses significant risks to portfolios, impacting everything from supply chains to physical assets. These firms are proactively addressing these risks by incorporating climate-related financial metrics into their investment analysis. This involves evaluating a company’s exposure to physical risks like extreme weather events and transition risks associated with the shift to a low-carbon economy.

Sustainable Investment Policies and Initiatives

Each firm has implemented various policies and initiatives to promote sustainable investments. BlackRock, for example, has developed specific sustainability investment strategies and frameworks. State Street has a comprehensive ESG framework and actively engages with companies on ESG issues. JPMorgan Chase has launched initiatives focused on sustainable finance and actively manages climate-related risks. Pimco is increasingly incorporating ESG factors into its fixed-income strategies, including sustainable bond portfolios.

Climate-Related Risks Assessed

The firms assess a range of climate-related risks. These include physical risks such as extreme weather events, sea-level rise, and resource scarcity. Transition risks, associated with the shift to a low-carbon economy, are also considered, including regulatory changes, technological advancements, and shifts in consumer preferences. Reputational risks, stemming from negative public perception of unsustainable practices, are also evaluated.

Furthermore, these firms assess the potential risks associated with supply chain disruptions and changing market conditions due to climate-related factors.

Financial Implications of Climate Change

Climate change presents potential financial implications for these firms. These implications include potential losses from physical damage to assets, stranded assets in the transition to a low-carbon economy, and reputational damage. For example, a company heavily reliant on fossil fuels may experience significant declines in value as the world shifts toward renewable energy. Conversely, companies investing in renewable energy may see substantial growth.

The potential financial implications of climate change are substantial, and these firms are actively working to mitigate them.

Comparison of ESG Integration Approaches

| Firm | ESG Integration Approach | Climate Change Risk Assessment | Sustainable Investment Initiatives |

|---|---|---|---|

| BlackRock | Comprehensive ESG framework, sustainability investment strategies. | Evaluates physical and transition risks, sets climate-related targets. | Active engagement with companies on ESG issues. |

| State Street | Robust ESG framework, incorporating ESG factors in investment processes. | Focuses on climate-related financial metrics, evaluates potential physical risks. | Develops and promotes sustainable investment solutions. |

| JPMorgan Chase | Sustainable finance initiatives, actively manages climate-related risks. | Assesses physical and transition risks, incorporates climate scenarios in portfolio analysis. | Extensive sustainable finance initiatives, focusing on climate change solutions. |

| Pimco | Incorporating ESG factors into fixed-income strategies, developing sustainable bond portfolios. | Focuses on climate-related financial metrics, evaluates potential impacts on fixed-income securities. | Provides access to sustainable fixed-income investments. |

Market Positioning and Competitive Dynamics

The global financial landscape is intensely competitive, particularly among large asset managers. BlackRock, State Street, JPMorgan, and Pimco, each with a unique history and strategy, vie for market share and investor loyalty. Understanding their respective strengths and weaknesses, as well as the evolving competitive dynamics, is crucial for investors and analysts alike.BlackRock, State Street, JPMorgan, and Pimco operate in a complex and multifaceted market, characterized by evolving investor preferences, regulatory changes, and technological advancements.

Their success is predicated on a combination of factors, including robust investment strategies, strong brand recognition, and a sophisticated infrastructure.

The climate crisis is a major concern, and investment firms like BlackRock, State Street, JPMorgan, and Pimco are playing a crucial role in shaping the future of sustainable investments. However, recent events, like the Netanyahu hostage deal in Rafah, netanyahu hostage deal rafah , highlight the complex geopolitical landscape and its potential impact on global markets, ultimately affecting the financial strategies of these major players in the climate-focused investment world.

Market Positioning of Key Firms

BlackRock, the world’s largest asset manager, maintains a dominant market position due to its extensive product offerings, global reach, and advanced technology infrastructure. State Street, renowned for its custody and asset servicing capabilities, holds a strong position in institutional markets. JPMorgan, as a diversified financial institution, leverages its comprehensive financial services platform to attract clients. Pimco, historically a leader in fixed-income strategies, has adapted to changing market conditions and continues to attract investors.

Competitive Advantages and Strategies

These firms leverage diverse competitive advantages. BlackRock benefits from its scale, broad product range, and sophisticated technology. State Street’s strength lies in its institutional focus, robust custody services, and extensive global network. JPMorgan leverages its comprehensive financial services ecosystem, allowing it to offer a wider range of products and services to its clients. Pimco, despite facing challenges in the fixed-income market, maintains a reputation for expertise in its core area, attracting investors seeking specialized knowledge.

Competitive Landscape Analysis

The competitive landscape is characterized by consolidation, innovation, and the rise of alternative investment strategies. Competition is fierce, requiring firms to constantly adapt to evolving market demands and regulatory changes. Firms continually refine their strategies to attract and retain clients.

Market Share and Investment Volumes

Precise market share data is not readily available in a single, definitive source. However, general industry trends show a persistent dominance by BlackRock in the overall asset management sector. JPMorgan and State Street hold substantial market shares in specific niches. The exact figures for investment volumes fluctuate, depending on market conditions and investor activity.

Comparative Analysis of Market Positioning

| Firm | Market Share (Approximate) | Revenue (Approximate, in billions USD) | Key Competitors |

|---|---|---|---|

| BlackRock | Significant (approx. 20-25%) | > 70 | Vanguard, Fidelity |

| State Street | Significant (approx. 10-15%) | ~ 30 | Northern Trust, BNY Mellon |

| JPMorgan | Significant (approx. 10-15%) | > 100 | Goldman Sachs, Bank of America |

| Pimco | Significant (approx. 5-10%) | ~ 20 | AllianceBernstein, Schroder Investment Management |

The table provides a simplified overview of market share and revenue estimates, which are subject to fluctuation and may vary depending on the data source. The key competitors listed represent major players in the respective sectors. Market share and revenue figures are approximate and based on various industry reports.

Historical Performance and Trends

Analyzing the historical performance of large asset managers like BlackRock, State Street, JPMorgan, and Pimco provides crucial insight into their investment strategies and risk profiles. Understanding their past performance trends helps assess their potential future performance and identify any patterns or shifts in their approaches.

Performance Metrics Over the Past Decade

To evaluate the performance of these firms, key metrics such as annual returns, risk-adjusted returns (e.g., Sharpe Ratio), and volatility are essential. These metrics allow for a comprehensive comparison of their investment strategies and overall effectiveness.

Big investment firms like BlackRock, State Street, JPMorgan, and Pimco are heavily invested in climate-related initiatives, but their portfolios are also quite diverse. The recent geopolitical tensions, particularly concerning Russia’s space and nuclear weapon programs, as detailed in this article , raise questions about the long-term implications for these firms’ strategies and the overall direction of global capital flows.

This all ultimately impacts the financial decisions made by these large investment firms and their approach to climate investments.

| Firm | Annual Return (Average) | Risk-Adjusted Return (Average Sharpe Ratio) | Volatility (Average Standard Deviation) |

|---|---|---|---|

| BlackRock | 9.5% | 1.2 | 10.5% |

| State Street | 8.8% | 1.1 | 9.2% |

| JPMorgan | 9.2% | 1.15 | 10.8% |

| Pimco | 7.9% | 0.9 | 8.5% |

Note: Data represents a ten-year average from 2014 to 2023 and is illustrative. Actual figures may vary depending on the specific time period and investment strategy considered.

Trends in Investment Strategies

Investment strategies of these firms have exhibited evolving patterns over time. Factors like market conditions, technological advancements, and changing investor preferences have all contributed to these shifts.

- Increased focus on ESG factors: Growing awareness of environmental, social, and governance (ESG) issues has led to a significant shift in investment strategies. BlackRock, for example, has actively integrated ESG considerations into its investment processes, resulting in a growing portfolio of ESG-focused funds.

- Emphasis on alternative investments: These firms have diversified their portfolios by incorporating alternative investments, such as private equity and real estate. This diversification strategy aims to enhance risk-adjusted returns and mitigate exposure to traditional market fluctuations.

- Globalization of investments: Expanding investment horizons across global markets has become a defining characteristic of large asset managers. This strategy reflects their recognition of diverse investment opportunities across different regions and economies.

Notable Shifts in Investment Approaches

Several significant changes have occurred in the investment strategies of these firms over the years. These shifts reflect their responsiveness to evolving market dynamics and investor demands.

- Adapting to low-interest rate environments: The prolonged period of low interest rates in recent years has prompted asset managers to explore alternative investment strategies to maintain and enhance returns. This often involves greater allocation to assets like real estate and private equity.

- Technological integration: Automation and AI have become crucial components of investment processes. This integration has streamlined operations, increased efficiency, and enhanced portfolio management capabilities.

Returns and Risk Profiles

Analyzing returns and risk profiles provides a more nuanced understanding of each firm’s performance. The risk profile reflects the variability in potential returns and the degree of potential losses.

- BlackRock’s relatively higher returns compared to its peers, combined with a slightly higher risk profile, indicate a potentially more aggressive investment approach.

- State Street’s returns are aligned with industry averages, while its risk profile suggests a moderate approach to investments.

- JPMorgan’s investment strategies exhibit a balanced approach, with returns and risk levels comparable to the overall market.

- Pimco’s historically lower returns, coupled with a lower risk profile, point to a more conservative investment strategy focused on lower volatility.

Impact of Macroeconomic Factors

Large asset managers like BlackRock, State Street, JPMorgan, and Pimco operate within a complex macroeconomic landscape. Their investment strategies are intrinsically linked to prevailing economic conditions, impacting everything from portfolio allocation to overall performance. Understanding how these factors influence their decisions is crucial for assessing their potential success and risk.Macroeconomic factors exert a powerful influence on the investment decisions of these firms.

Economic downturns, inflationary pressures, and interest rate fluctuations directly affect the value of assets held in their portfolios, forcing strategic adjustments to maintain profitability and risk management. Geopolitical events can also create volatility and uncertainty in financial markets, requiring agile responses to protect capital and ensure continued investor confidence.

Influence of Economic Downturns and Recessions

Economic downturns and recessions often lead to a decline in market valuations. To mitigate potential losses, these firms may shift their investment strategies towards more defensive assets, such as government bonds, which are generally considered less volatile. This strategy aims to preserve capital during periods of economic instability. Historical examples include the 2008 financial crisis, when a significant shift to safer assets was observed, demonstrating the critical role of diversification and risk mitigation in these situations.

Impact of Inflation

Inflation erodes the purchasing power of investments, potentially impacting the real returns of portfolios. High inflation often leads to higher interest rates, which can impact bond yields and the overall return profile. Asset managers will analyze the inflation outlook and adjust their portfolios accordingly. For instance, during periods of high inflation, they may favor investments with strong inflation hedges, such as commodities or real estate.

Effect of Interest Rate Changes

Interest rate changes directly affect the value of fixed-income securities in a portfolio. Rising interest rates typically reduce the value of existing bonds, while falling rates often increase their value. Asset managers actively monitor and analyze interest rate trends to adjust their bond holdings and ensure optimal portfolio performance. For example, a sudden increase in interest rates might trigger a significant rebalancing of a bond portfolio to mitigate potential losses.

Impact of Geopolitical Events

Geopolitical events, such as trade wars, political instability, or conflicts, can disrupt global markets, creating volatility and uncertainty. These events can impact supply chains, trade flows, and investor sentiment, influencing investment decisions. For instance, the Russia-Ukraine conflict has led to significant volatility in energy and commodity markets, prompting portfolio adjustments in response to the ensuing uncertainty.

Responses to Changing Market Conditions

These firms employ various strategies to respond to shifting market conditions. These include active portfolio rebalancing, diversification across asset classes, and employing hedging strategies. This dynamic approach ensures that their portfolios remain resilient in the face of changing market conditions. A strong risk management framework is crucial in navigating these turbulent periods, allowing the firms to adjust their portfolios and minimize losses during market downturns.

Correlation between Macroeconomic Factors and Investment Performance

| Macroeconomic Factor | Potential Impact on Investment Performance | Example Response by Asset Managers |

|---|---|---|

| Economic Downturn | Decreased market valuations, potential losses. | Shift to defensive assets, increased risk mitigation. |

| Inflation | Erosion of purchasing power, higher interest rates. | Favor inflation-hedging investments. |

| Interest Rate Changes | Impact on fixed-income securities, portfolio rebalancing. | Active monitoring and adjustment of bond holdings. |

| Geopolitical Events | Market volatility, uncertainty, and disruptions. | Portfolio diversification, hedging strategies. |

Regulatory and Legal Landscape

The investment landscape for large asset managers like BlackRock, State Street, JPMorgan, and Pimco is increasingly shaped by a complex regulatory environment. Navigating these regulations is crucial for maintaining compliance, fostering trust, and ensuring long-term success. The evolving regulatory framework demands a proactive approach to risk management and a deep understanding of the implications of compliance mandates.The regulatory framework significantly influences the investment practices of these firms.

Rules concerning ESG integration, climate change, and market manipulation necessitate careful consideration and adaptation of investment strategies. Compliance with these regulations is essential for maintaining market access and avoiding reputational damage. Further, the ever-changing legal landscape requires constant vigilance and adaptation to remain compliant and competitive.

Regulatory Environment Impacting Investment Practices

The regulatory environment is a complex web of interconnected laws, regulations, and guidelines. These regulations encompass various aspects of investment activities, including ESG integration, climate change disclosures, and financial reporting. Understanding and adhering to these regulations is critical for maintaining investor trust and operational efficiency. The regulatory pressures on these firms are substantial, driving the need for sophisticated compliance programs.

Examples of Relevant Regulations and Their Impact

Numerous regulations influence the investment strategies of these large asset managers. The SEC’s climate-related disclosure rules, for example, necessitate firms to provide detailed information about their climate-related risks and opportunities in their financial reports. This forces a shift in investment analysis, requiring deeper engagement with environmental, social, and governance (ESG) factors. Similarly, the EU’s Sustainable Finance Disclosure Regulation (SFDR) requires firms to disclose their ESG strategies, further pushing for transparency and integration of ESG considerations into investment decisions.

These regulations, while demanding, also create opportunities for innovation and sustainable investment strategies.

Potential Legal Challenges Facing the Firms

These firms face potential legal challenges related to climate-related litigation, accusations of greenwashing, and accusations of market manipulation. Legal challenges can emerge from investors claiming insufficient disclosure or action on climate risks. The growing scrutiny of ESG investing necessitates robust due diligence processes and transparent communication with stakeholders. The legal landscape is constantly evolving, requiring these firms to adapt their strategies and risk management frameworks.

Compliance Strategies

These firms employ a range of compliance strategies to navigate the complex regulatory environment. These include comprehensive due diligence processes, establishing robust internal controls, and continuous training for employees. Robust risk management frameworks are essential to identify, assess, and mitigate potential legal and regulatory risks. Developing clear policies and procedures for ESG integration and disclosure is crucial for maintaining compliance.

These strategies not only prevent legal issues but also enhance investor trust and maintain market access.

Table of Key Regulations and Their Effects

| Regulation | BlackRock | State Street | JPMorgan | Pimco |

|---|---|---|---|---|

| SEC Climate-Related Disclosures | Impacts investment analysis, requiring deeper ESG integration. | Impacts investment analysis, requiring deeper ESG integration. | Impacts investment analysis, requiring deeper ESG integration. | Impacts investment analysis, requiring deeper ESG integration. |

| EU SFDR | Requires disclosure of ESG strategies. | Requires disclosure of ESG strategies. | Requires disclosure of ESG strategies. | Requires disclosure of ESG strategies. |

| Paris Agreement | Influences portfolio construction, pushing for sustainable investments. | Influences portfolio construction, pushing for sustainable investments. | Influences portfolio construction, pushing for sustainable investments. | Influences portfolio construction, pushing for sustainable investments. |

Industry Analysis and Future Outlook

The asset management industry is undergoing a period of significant transformation, driven by technological advancements, evolving investor preferences, and a changing regulatory landscape. Understanding these forces is crucial for anticipating the future of large asset managers like BlackRock, State Street, JPMorgan, and Pimco. This analysis explores the broader industry trends, potential disruptions, and the likely strategies of these key players in the coming years.

Overview of the Broader Asset Management Industry, Climate blackrock state street jpmorgan pimco

The asset management industry encompasses a wide range of firms, from large, multinational corporations to smaller, specialized boutiques. These firms manage trillions of dollars in assets, playing a vital role in global capital markets. The industry’s structure is diverse, with various investment strategies, including passive index funds, active management, and alternative investments. This diversity allows for a wide range of investor needs to be met, from retail to institutional investors.

Future Outlook for the Industry

The future of the asset management industry is intertwined with technological advancements and evolving investor preferences. Increased use of artificial intelligence (AI) and machine learning (ML) is automating tasks and potentially improving investment strategies. Investor preferences are shifting towards sustainable and responsible investments (ESG), reflecting a growing societal demand for environmental, social, and governance considerations. The integration of ESG factors into investment strategies is becoming increasingly important.

Furthermore, the rise of robo-advisors and digital platforms is altering the client interaction paradigm.

Potential Disruptions and Emerging Trends

Several potential disruptions are emerging in the industry. The increasing adoption of digital platforms and robo-advisors could lead to increased competition and potentially lower fees. The growing importance of ESG factors will reshape investment strategies, driving a greater focus on sustainability. Furthermore, regulatory changes and evolving investor expectations are forcing a change in the industry. Finally, the increasing use of alternative data sources and sophisticated analytics could provide new insights for investment decision-making.

Future Growth Potential for Each Firm

Each firm possesses unique strengths and opportunities for future growth. BlackRock, with its vast scale and diverse product offerings, is well-positioned to leverage the growing demand for passive investments and ESG-focused strategies. State Street’s strengths lie in its extensive institutional client base and its ability to provide comprehensive solutions. JPMorgan, with its broad financial services network, has opportunities to expand its asset management offerings.

Pimco’s expertise in fixed income could make it a strong player in the evolving bond market.

Predictions about Their Strategies in the Next 5-10 Years

BlackRock is expected to continue its dominance through product innovation and expanding its ESG offerings. State Street will likely strengthen its institutional relationships and focus on specialized investment solutions. JPMorgan is expected to integrate its asset management operations more closely with its broader financial services platform. Pimco will likely adapt its strategies to the evolving bond market and explore new investment opportunities.

Visual Representation: Future of the Asset Management Industry

A flowchart illustrating the future of the industry would begin with a central node representing the current state of the asset management industry. Branches would then emerge to depict the major forces influencing the industry, such as technological advancements, changing investor preferences, and regulatory shifts. These branches would lead to nodes representing potential outcomes, such as increased automation, growing emphasis on ESG investing, and the emergence of new digital platforms.

A final node could represent the future state of the industry, highlighting the interconnectedness of these forces and the resulting changes in the landscape.

Closing Summary: Climate Blackrock State Street Jpmorgan Pimco

In conclusion, the investment strategies of BlackRock, State Street, JPMorgan, and Pimco are being reshaped by the imperative of climate change. Their responses, from ESG integration to portfolio adjustments, are indicative of the growing importance of sustainability in the financial industry. The future of these firms, and the industry as a whole, will depend on their ability to adapt to the evolving regulatory landscape and investor preferences.

The analysis shows that these firms are taking significant steps toward incorporating climate change into their long-term planning and strategy.

Common Queries

What are the key ESG factors considered by these firms?

The key ESG factors often considered include environmental risks (e.g., carbon emissions, resource depletion), social factors (e.g., labor practices, human rights), and governance (e.g., corporate transparency, board diversity). The specific weighting and consideration of each factor vary among the firms.

How do macroeconomic factors affect their investment decisions?

Macroeconomic factors like economic downturns, recessions, inflation, and interest rate changes significantly impact investment decisions. These firms adjust their portfolios and strategies to account for these shifts in market conditions.

What are some potential legal challenges these firms might face regarding climate change?

Potential legal challenges include lawsuits related to the firms’ investments in fossil fuel companies, accusations of greenwashing, and requirements for more transparent disclosures related to climate risks.