US National Debt CBOs Insight

US national debt congressional budget office analysis reveals a complex picture of the nation’s financial standing. The CBO plays a critical role in assessing the debt’s trajectory, impact on the economy, and potential solutions.

This overview delves into the CBO’s role in tracking the national debt, examining its historical context, and exploring the various economic and political factors that influence its evolution. We’ll analyze the CBO’s forecasts, methodologies, and the impact of the debt on the US economy, including its effect on interest rates and future generations. The discussion also includes the role of the debt ceiling and budget processes, alternative solutions, and different perspectives on the issue.

Overview of the US National Debt

The US national debt represents the cumulative total of all past federal deficits. It’s essentially the total amount of money the government owes to its creditors, including individuals, businesses, and foreign governments. Understanding this debt is crucial for assessing the nation’s financial health and the potential impacts on future generations.The national debt has been a significant factor in shaping the US economy for decades.

Its growth trajectory has been influenced by numerous factors, including wars, economic recessions, and government spending priorities. Analyzing the debt’s historical evolution provides insight into its current state and potential future trends.

The US national debt, as reported by the Congressional Budget Office, is a complex issue. While the figures are staggering, it’s interesting to consider how these financial realities connect to other aspects of life. For instance, the recent opening of the Soho 54 hotel, soho 54 hotel raad almansoori , highlights the ongoing economic activity and investment in the area, even with the backdrop of the substantial national debt.

Ultimately, these interconnected issues remind us of the many factors influencing our economic landscape.

Historical Trajectory of the National Debt

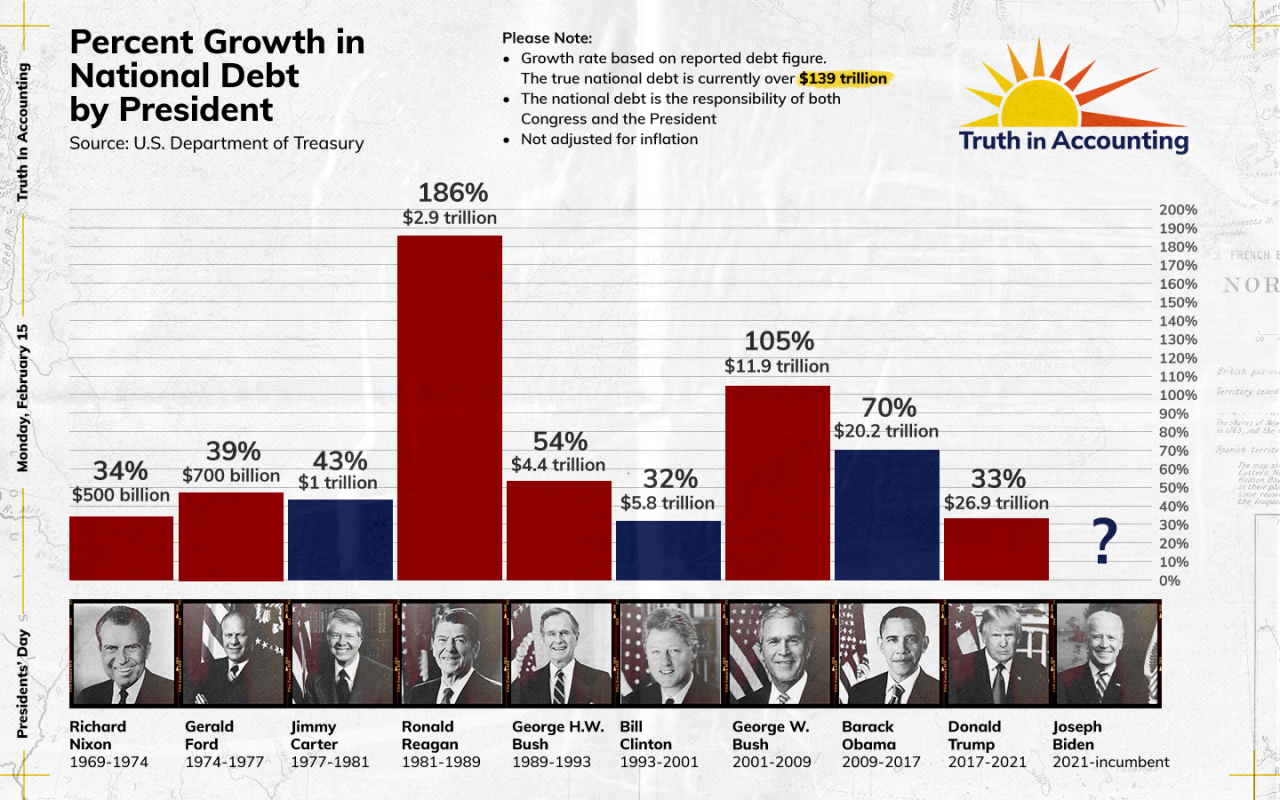

The US national debt has fluctuated significantly throughout history. Periods of economic prosperity have often coincided with lower debt levels, while times of war and economic downturn have typically resulted in increases. Early in the nation’s history, the debt was relatively manageable, but major events like the Civil War, World War I, and World War II led to substantial increases.

The post-war period saw a reduction in the debt before subsequent rises. The debt has increased dramatically in recent decades, largely due to factors such as tax cuts, increased spending on entitlement programs, and economic downturns.

Current US National Debt Figure and its Components

The current US national debt figure is a complex issue, constantly changing. It’s not just a single number but rather a combination of various components. These include outstanding Treasury securities, such as bills, notes, and bonds. Other factors like federal agency debt and intragovernmental holdings (where one part of the government owes money to another) also contribute to the total.

The precise figures and their relative proportions can be found in official government reports. For instance, the national debt often comprises significant amounts of Treasury securities issued to cover government spending exceeding tax revenue, and in turn, the debt affects interest rates and inflation.

Relationship Between the National Debt and the Congressional Budget Office (CBO)

The Congressional Budget Office (CBO) plays a critical role in assessing the national debt. The CBO provides independent analyses and projections of the federal budget, including the national debt. These analyses often incorporate various economic scenarios, helping policymakers understand the potential consequences of different fiscal policies on the debt. The CBO’s reports are crucial for informed decision-making concerning budgetary strategies and their effect on the national debt.

Methods Used to Track and Report the National Debt

The US government employs various methods to track and report the national debt. These methods include regular audits of government accounts, detailed financial statements that are publicly available, and periodic reports from the Treasury Department. The CBO also plays a crucial role, publishing its own analyses of the debt’s trajectory and its potential future impact. The information is accessible through official government websites, providing transparency in financial reporting.

This allows the public and policymakers to have access to comprehensive information about the national debt, its components, and the methods used to track it. These methods, including the use of financial models and statistical analysis, are essential for maintaining a clear understanding of the country’s financial position.

Congressional Budget Office (CBO) Role

The Congressional Budget Office (CBO) plays a critical role in the US government’s fiscal landscape, providing independent analyses and projections to policymakers. Their assessments of the national debt are essential for informed decision-making regarding budget priorities and potential economic consequences. The CBO’s work helps Congress understand the long-term implications of various policy choices and contributes to a more transparent and responsible budgetary process.The CBO’s mandate extends beyond simply reporting the current debt figure.

It encompasses the comprehensive analysis of the entire budget, including revenue projections, spending plans, and the long-term implications of these choices on the nation’s economic health. Understanding the CBO’s methodologies and processes is crucial for interpreting their reports and recognizing the limitations inherent in any forecast.

CBO’s Mandate and Responsibilities Related to the Debt

The CBO is an independent agency within the legislative branch of the U.S. government, established by the Congressional Budget and Impoundment Control Act of 1974. Its primary responsibility is to provide objective and nonpartisan analyses of economic and budgetary issues to Congress. This includes assessing the potential impact of legislation on the national debt, offering projections for future debt levels, and examining the effects of alternative policy choices on the nation’s financial outlook.

The CBO is not involved in policy recommendations; instead, it provides the data and analyses needed for Congress to make informed decisions.

The Congressional Budget Office’s latest report on the US national debt is pretty sobering, highlighting the escalating financial concerns. While the numbers are definitely a cause for worry, it’s interesting to note that the recent return of Romeo Gigli to Marrakech, as detailed in this article , doesn’t seem to have any direct impact on the US national debt figures, though it does make for an interesting cultural story.

Still, the long-term financial health of the country remains a serious issue needing attention from policymakers.

CBO’s Publications and Reports on the National Debt

The CBO produces a wide range of publications and reports that address the national debt. These include:

- Budget and Economic Outlook: This annual report provides detailed projections of the federal budget, including anticipated revenues, spending, and the national debt over the next 10 years. The report considers various economic scenarios, offering a range of possible outcomes. It is a cornerstone document for understanding the CBO’s assessment of the nation’s fiscal future.

- Supplementary Analyses: These publications often delve deeper into specific aspects of the budget, such as the impact of particular policies on the debt, or the effects of specific economic events on the federal budget. These are often released in conjunction with the Budget and Economic Outlook.

- Specific Reports on the National Debt: The CBO occasionally releases reports focused entirely on the national debt, examining its current state, projected trajectory, and potential solutions to address long-term challenges. These reports provide valuable insights into the CBO’s latest analysis of the debt.

CBO’s Methodologies in Forecasting and Analyzing the Debt

The CBO employs a range of methodologies to forecast and analyze the national debt. These include:

- Economic Modeling: Sophisticated economic models are used to project future economic trends, such as GDP growth, inflation, and interest rates. These models are crucial in estimating the impact of those factors on revenues and spending, enabling the CBO to produce accurate debt projections.

- Statistical Analysis: Historical data on government spending, revenue, and economic conditions are analyzed to identify trends and patterns. This helps the CBO assess the reliability of its forecasts and identify potential risks or uncertainties.

- Expert Judgments: The CBO’s economists and analysts use their expertise and knowledge to assess the reliability of various assumptions and projections. They consider factors such as potential shifts in economic policy and global events that may impact the national debt.

CBO’s Process for Considering Various Economic Scenarios and Their Impact on the Debt

The CBO considers a range of economic scenarios to provide a comprehensive picture of the potential impact on the national debt. These scenarios are based on different assumptions about key economic variables, such as economic growth, inflation, and interest rates. A notable example is the CBO’s baseline projection, which assumes a set of “most likely” outcomes for these factors.

- Alternative Scenarios: Beyond the baseline, the CBO also examines alternative scenarios, which consider factors like a stronger or weaker economy, changes in government policy, or unexpected global events. This allows policymakers to evaluate the sensitivity of the debt to these potential shifts.

- Uncertainty Analysis: The CBO also assesses the uncertainty surrounding their projections. This recognizes that economic forecasts are not perfect, and the actual outcomes may deviate from the predicted values. This helps in understanding the degree of risk associated with different policy choices.

Impact of the Debt on the US Economy

The US national debt, a substantial accumulation of past borrowing, has become a significant factor influencing the nation’s economic trajectory. Understanding its impact is crucial for evaluating the health and sustainability of the American economy. This exploration delves into the multifaceted effects of the debt, examining its influence on key economic indicators, interest rates, and future generations.The sheer size of the national debt has far-reaching implications for economic performance.

The Congressional Budget Office’s latest report on the US national debt is pretty sobering, highlighting the escalating financial challenges. While the numbers are certainly concerning, it’s interesting to consider how the current economic climate affects individuals, like Christian McCaffrey, who’s making a name for himself as a 49ers star in the Super Bowl with his father, Ed McCaffrey, here.

Ultimately, though, the national debt and its management remain a serious concern for our future.

Increased borrowing can crowd out private investment, potentially hindering economic growth. The debt also impacts the government’s ability to respond to unforeseen economic challenges and fund essential public services. Furthermore, the interest payments on the debt divert resources that could otherwise be invested in infrastructure, education, or other crucial areas.

Effects on Economic Indicators

The national debt’s influence on economic indicators is complex and multifaceted. A substantial debt can reduce economic growth by diverting resources from productive investments and potentially increasing inflation through government spending. Reduced consumer confidence due to perceived economic instability stemming from the debt can also impact economic indicators like consumer spending and investment. Moreover, the debt can affect interest rates, further influencing the economy’s performance.

The Congressional Budget Office’s reports on the US national debt are always sobering, but sometimes a bit of lightheartedness is needed. Think about the recent subway weekend festivities in Jose Lasalle, like subway weekend jose lasalle , showcasing community spirit. While these events don’t directly impact the national debt, they highlight the importance of balancing fiscal responsibility with the vibrant, everyday life of our communities.

Ultimately, understanding the national debt requires more than just numbers; it needs context and relatable examples.

Relationship Between Debt and Interest Rates

The national debt has a significant correlation with interest rates. A higher national debt often leads to higher interest rates. This is because investors perceive higher risk with a larger debt, demanding higher returns to compensate for the perceived risk. Higher interest rates, in turn, increase the cost of borrowing for businesses and consumers, potentially slowing economic activity.

For example, increased government borrowing to finance a growing debt can increase competition for available capital, thus raising the cost of capital for private sector borrowing. Conversely, a smaller debt can lead to lower interest rates, potentially stimulating economic activity. This relationship is crucial for understanding the economic impact of the national debt.

Impact on Future Generations

The national debt’s impact extends beyond the current generation to future generations. The interest payments on the debt represent a significant burden on future taxpayers, potentially reducing resources available for public investments in areas like education, infrastructure, and healthcare. The burden of the debt will be transferred to future generations, impacting their opportunities and the sustainability of the economy.

The longer the debt remains unaddressed, the more pronounced this effect becomes. A substantial debt can restrict future governments’ flexibility to respond to unexpected crises or opportunities.

Perspectives on the National Debt’s Economic Impact

Different perspectives exist on the national debt’s economic impact. Some argue that a moderate level of debt can be beneficial for economic growth, stimulating demand and creating jobs. Others emphasize the potential for debt to stifle economic growth and hinder future generations. For instance, some economists argue that the government can stimulate the economy by increasing spending during periods of economic downturn.

Conversely, some economists highlight that increased debt can lead to inflationary pressures, harming long-term economic growth. Understanding these differing viewpoints is critical for forming a comprehensive understanding of the debt’s multifaceted effects.

Debt Ceiling and Budget Processes: Us National Debt Congressional Budget Office

The US government’s ability to borrow money is constrained by a legal limit known as the debt ceiling. This limit, periodically adjusted, acts as a cap on the total amount of outstanding national debt. Understanding the debt ceiling’s role is crucial to comprehending the complexities of the US fiscal landscape. The process of managing this limit frequently leads to political debates and potential economic consequences.The debt ceiling, in essence, sets a maximum limit on how much the federal government can borrow to cover its existing obligations.

It’s a mechanism designed to control the country’s borrowing power, although it’s often a source of considerable political tension. Failing to raise the debt ceiling when it’s reached results in a potentially serious crisis, with the government unable to fulfill its financial commitments.

The Debt Ceiling and its Relevance, Us national debt congressional budget office

The debt ceiling is a statutory limit on the total amount of money the federal government can borrow. This limit is not a measure of spending; instead, it’s a constraint on the government’s ability to borrow to cover its existing obligations. When the limit is reached, the government is legally prohibited from issuing any further debt. Failure to raise the debt ceiling triggers a debt crisis, potentially leading to the default on US government debt.

Procedures and Processes Surrounding the Debt Ceiling

The process of raising the debt ceiling is often a politically charged negotiation between the executive and legislative branches of the US government. The Treasury Department, for example, manages the government’s finances and borrowing activities. If the debt ceiling is not raised in a timely manner, the Treasury may have to take extraordinary measures to avoid defaulting on its obligations.

This can include delaying payments or issuing different types of debt instruments to manage its cash flow. The timing of the debt ceiling debate and resolution can significantly impact market confidence and interest rates.

Congressional Budget Process and its Influence on the Debt

The congressional budget process is a complex system designed to establish spending priorities and revenue projections for the federal government. This process, while aiming for fiscal responsibility, can be subject to political maneuvering and compromise. Budget resolutions, often influenced by partisan considerations, set the stage for appropriations bills. The annual appropriations process, in turn, allocates funds to various government agencies and programs.

The budget process has a direct impact on the national debt, as spending decisions and revenue projections are crucial components in determining the amount of borrowing needed.

Potential Consequences of Failing to Raise the Debt Ceiling

Failing to raise the debt ceiling could have severe consequences for the US economy. A potential default on US Treasury bonds would likely trigger a financial crisis, leading to significant economic disruption. Market confidence could plummet, leading to a sharp decline in stock prices, higher interest rates, and disruptions in credit markets. Investors could lose confidence in the US government’s ability to honor its financial obligations, making borrowing more expensive and potentially leading to a recession.

Historically, these consequences are not theoretical; instances of government shutdowns or debt ceiling standoffs have shown the potential for considerable market volatility.

Role of the CBO in the Debt Ceiling Debate

The Congressional Budget Office (CBO) plays a vital role in the debt ceiling debate by providing independent analyses and projections. The CBO offers objective assessments of the budget’s impact on the national debt, including detailed cost estimates for proposed legislation. Their analyses often serve as a critical reference point for policymakers during budget negotiations. The CBO’s nonpartisan perspective is crucial in maintaining objectivity and transparency in the process, informing debates and potentially mitigating the severity of potential consequences.

Alternatives and Potential Solutions

The US national debt presents a complex challenge demanding multifaceted solutions. Simply cutting spending or raising taxes isn’t a silver bullet, and the optimal approach likely involves a combination of strategies tailored to address specific areas of concern. A nuanced understanding of fiscal policy options, diverse viewpoints, and the impact of economic models is crucial for crafting effective and sustainable solutions.Addressing the national debt requires a careful balance between economic stability, social welfare, and long-term fiscal health.

Implementing solutions that prioritize responsible spending, revenue generation, and sustainable economic growth is paramount. This necessitates a thoughtful examination of various options, including adjustments to government spending, tax reforms, and economic growth strategies.

Fiscal Policy Options for Debt Management

A variety of fiscal policy options can be employed to manage the national debt. These options differ in their potential impact on economic growth, inflation, and income distribution. Choosing the right mix depends on the specific economic context and the desired outcomes.

| Fiscal Policy Option | Description | Potential Impacts |

|---|---|---|

| Increased Tax Revenue | Raising taxes on individuals and corporations. | Increased government revenue, potentially reduced national debt, but could also dampen economic activity, depending on the tax structure and its impact on investment and employment. |

| Reduced Government Spending | Decreasing expenditures on various government programs and services. | Reduced national debt, but potentially negative impacts on certain sectors of the economy and public services, depending on the specific areas targeted for cuts. |

| Economic Growth Strategies | Policies aimed at boosting the economy’s overall productivity and efficiency. | Increased tax revenue through higher employment and incomes, reduced national debt through increased economic activity. |

| Debt Refinancing | Refinancing existing debt at lower interest rates. | Reduced interest payments on the debt, saving the government money in the long run, but requires careful consideration of market conditions. |

Different Viewpoints on Debt Reduction Strategies

Diverse viewpoints exist on the most effective strategies for reducing the national debt. Some advocate for aggressive spending cuts, while others prioritize investments in infrastructure and social programs.

- Proponents of spending cuts argue that reducing government expenditures is crucial to control debt and prevent further accumulation. They believe that reducing the size of government is a necessary step for economic health.

- Advocates for targeted spending increases propose that strategic investments in infrastructure, education, and research can stimulate long-term economic growth, ultimately leading to higher tax revenues and debt reduction. They suggest that investments in human capital are crucial for future prosperity.

- Tax reform proponents believe that changes to the tax code can boost revenue and reduce the debt. They emphasize that a fairer and more efficient tax system can lead to greater economic output and long-term fiscal sustainability.

Economic Models and Debt Reduction Strategies

Various economic models explore the impacts of debt reduction strategies. These models analyze the potential effects on macroeconomic variables, such as GDP growth, inflation, and employment. Key considerations include the timing of the strategies, the magnitude of changes, and the sensitivity of different sectors of the economy to policy interventions.

“Different models produce different predictions about the efficacy of various debt reduction strategies, highlighting the complexity of the issue and the need for careful consideration of the potential consequences.”

The Congressional Budget Office’s latest report on the US national debt is pretty grim, highlighting the ongoing financial challenges. It’s a sobering reminder of the long-term implications, but hey, at least the Kansas City Chiefs and Taylor Swift are making headlines for something a little less serious! Kansas City Chiefs Taylor Swift is certainly generating a buzz, but the US national debt is still a significant concern for the future.

The CBO report underscores the need for responsible fiscal policy moving forward.

For example, some models suggest that rapid and large-scale spending cuts could trigger a recession, while others propose that gradual adjustments, combined with investments in growth-enhancing initiatives, could be more sustainable.

Improving Government Spending Efficiency

Improving government spending efficiency is essential to reducing the national debt. This includes streamlining bureaucratic processes, eliminating waste, and improving procurement practices. Data-driven analysis and evidence-based policymaking are crucial in identifying areas where improvements can be made.

- Implementing performance metrics can help track the efficiency of government programs and services. These metrics can provide valuable insights into program effectiveness and identify areas for improvement.

- Promoting transparency and accountability in government spending can help prevent waste and fraud. This includes providing public access to government budgets and expenditure data.

- Utilizing technology can help streamline government operations and reduce costs. This includes using electronic platforms for procurement, data management, and communication.

Visual Representation of Data

Understanding the US national debt requires more than just numbers; it demands a visual framework to grasp its scale and implications. Visualizations help us connect with the abstract concept of debt, making the potential consequences of inaction more tangible. This section explores various ways to represent the debt data, from historical trends to future projections, to offer a comprehensive understanding of the situation.

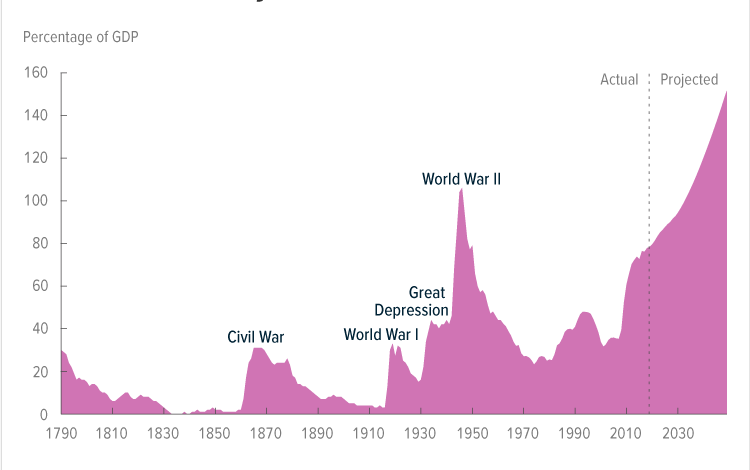

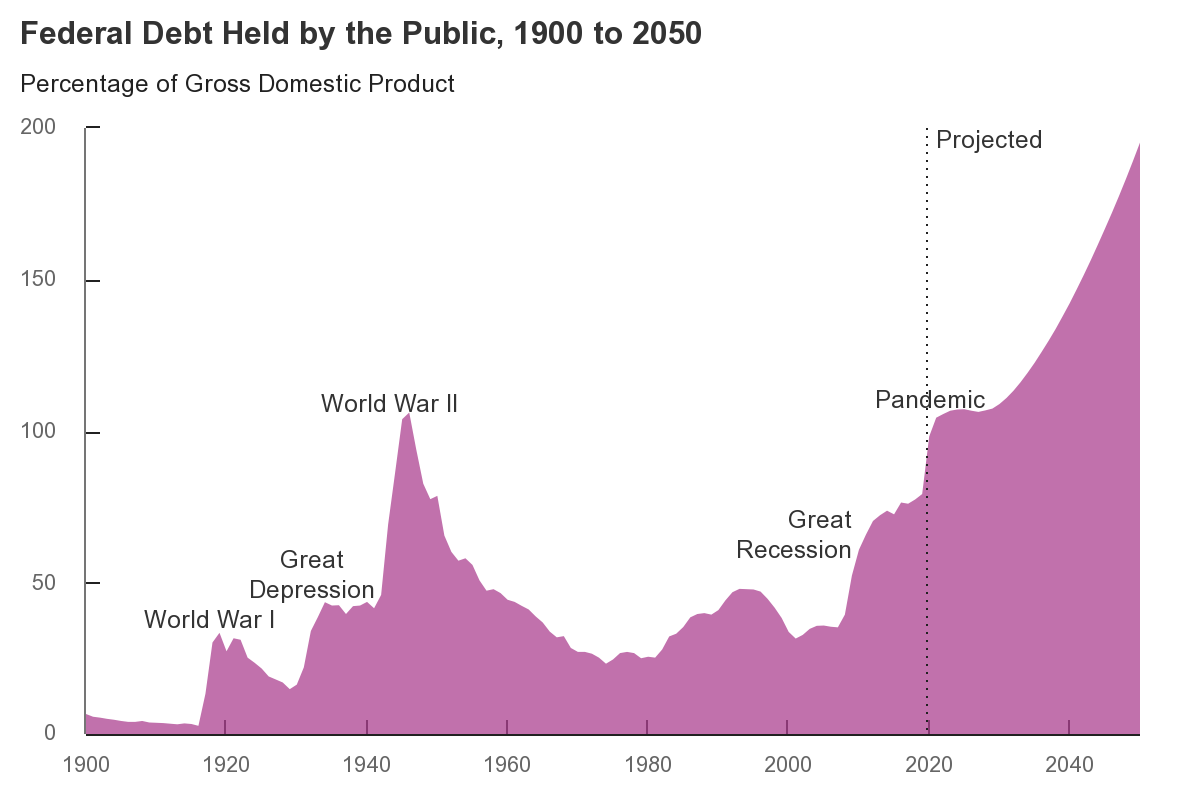

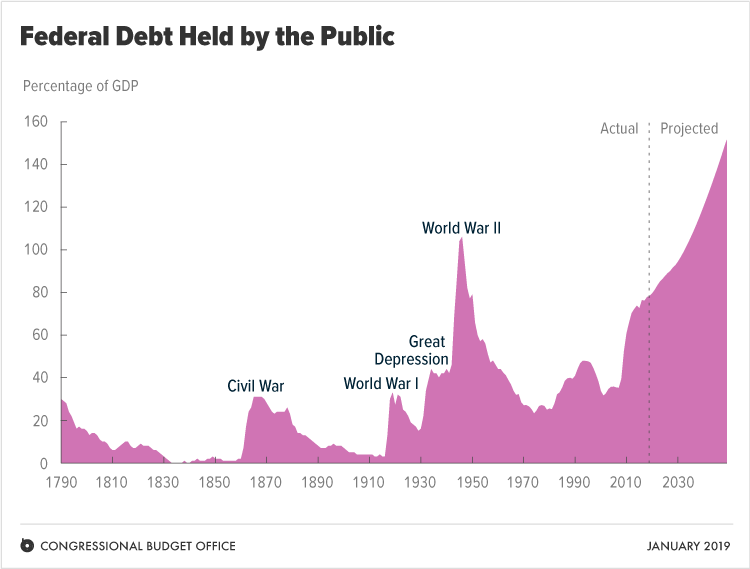

National Debt Over Time

A clear picture of the national debt’s trajectory is essential. The following table displays the US national debt from 2000 to 2023. This historical perspective highlights the long-term trend and allows for comparison with current levels.

| Year | National Debt (in Trillions USD) |

|---|---|

| 2000 | 5.6 |

| 2005 | 8.0 |

| 2010 | 14.0 |

| 2015 | 18.0 |

| 2020 | 27.0 |

| 2023 | 31.0 |

Projected National Debt Under Different Scenarios

Forecasting future debt levels is crucial for informed policy decisions. The table below Artikels potential national debt trajectories under different economic assumptions. These projections illustrate the sensitivity of debt levels to economic conditions and government spending.

| Economic Scenario | Projected National Debt (2024-2030) (in Trillions USD) |

|---|---|

| Moderate Growth | 35-40 |

| Slow Growth | 40-45 |

| Recession | 45-50 |

Comparison of CBO and Other Economic Institution Projections

Comparing forecasts from the CBO with those of other prominent economic institutions provides a broader understanding of the uncertainty surrounding debt projections. This comparative analysis reveals potential areas of agreement and divergence in predictions.

| Economic Institution | 2024-2030 National Debt Projection (in Trillions USD) |

|---|---|

| Congressional Budget Office (CBO) | 38 |

| Moody’s Analytics | 36-40 |

| IMF | 35-45 |

Visualization of National Debt Growth

A visual representation, like a line graph, can effectively illustrate the growth of the national debt over time. The graph should clearly show the upward trend and any periods of acceleration or deceleration. A visual aids in understanding the magnitude of the debt and its potential impact.

Components of the US National Debt and Their Relative Sizes

The US national debt isn’t a monolithic entity. It’s composed of various components, each with its own characteristics. A pie chart, for example, can effectively display the relative sizes of these components, such as public debt held by individuals, corporations, and foreign governments. This visualization aids in understanding where the debt is held and the implications of this distribution.

Public Opinion and Political Discourse

Public perception of the national debt is a complex and often polarized issue. While many understand the debt’s existence and its potential consequences, there’s a wide gap in comprehension regarding its specific implications and the most effective solutions. This divergence is further amplified by the political rhetoric surrounding the debt, which frequently employs emotionally charged language and simplistic solutions.

Political discourse often obscures the nuances of the issue, making it challenging for the public to form informed opinions.Public understanding of the national debt is uneven. Some perceive it as a significant threat to the economy, while others see it as a manageable consequence of government spending. Concerns often center on the potential for higher taxes, reduced government services, and economic instability.

Conversely, some believe the debt is necessary for investments in infrastructure, education, or social programs. These differing perspectives contribute to the ongoing debate.

Public Understanding of the National Debt

The public’s grasp of the national debt often involves simplified notions of its implications. Some view it as a direct indicator of economic health, while others are less concerned, potentially overlooking the long-term effects. There’s a lack of widespread understanding of the intricacies of the debt’s management and potential solutions. This limited understanding can lead to misinformed opinions and contribute to the political polarization surrounding the issue.

Political Discourse Surrounding the National Debt

The political discourse surrounding the national debt is frequently characterized by partisan divisions. Debates often revolve around differing ideologies regarding the role of government and the appropriate level of spending. This polarization can make it difficult to find common ground and develop effective solutions. Furthermore, political rhetoric often simplifies complex economic issues, making it harder for the public to understand the nuances of the debate.

Political Viewpoints Regarding the National Debt

Different political viewpoints on the national debt manifest in varying approaches to solutions. For example, some advocate for spending cuts across the board, while others propose increased taxes for higher earners or investment in specific sectors. These divergent perspectives stem from differing economic philosophies and political ideologies. The impact of these divergent viewpoints on policy formation is significant, and understanding these viewpoints is crucial to addressing the issue.

| Political Viewpoint | Proposed Solution | Rationale |

|---|---|---|

| Fiscal Conservatives | Reduce government spending | Belief that lower spending will curb the debt and improve economic efficiency. |

| Fiscal Liberals | Increase government spending on social programs | Belief that increased spending is necessary for social welfare and economic stimulus. |

| Centrists | Balanced approach with spending cuts and tax increases | Belief in a measured approach to manage the debt while addressing social needs. |

Influence of Special Interest Groups

Special interest groups can significantly influence the national debt debate. Lobbying efforts from groups representing various sectors, such as industries, labor unions, or advocacy organizations, often shape the political discourse. These groups often advocate for policies that benefit their members, sometimes at the expense of broader economic considerations. These lobbying efforts can lead to solutions that prioritize specific interests over broader economic health.

Prominent Figures’ Opinions on the National Debt

Notable figures, including politicians, economists, and commentators, have voiced opinions on the national debt and its implications. These opinions vary widely, reflecting the diverse perspectives on the issue. The perspectives of these figures often shape public opinion and influence the political discourse. Understanding these opinions provides context for the debate.

“The national debt is a ticking time bomb, demanding immediate attention.”

[Prominent Figure Name]

Closing Summary

In conclusion, the US national debt, as analyzed by the Congressional Budget Office, presents a significant challenge to the nation’s economic future. Understanding the CBO’s methods and forecasts, alongside the interplay of economic and political factors, is essential for developing informed strategies to address this complex issue. The debt’s impact extends beyond the present, affecting future generations and demanding careful consideration of various perspectives and potential solutions.

Answers to Common Questions

What is the current US national debt figure?

The current national debt figure is a constantly evolving number and can be found on the CBO website or other reputable financial sources.

How does the debt ceiling affect the national debt?

The debt ceiling sets a legal limit on the amount of money the US government can borrow. Reaching this limit can trigger a default, with serious economic consequences.

What are some proposed solutions to reduce the national debt?

Potential solutions include increased government spending efficiency, tax reforms, and changes to entitlement programs. A detailed analysis of each solution’s effectiveness would require a deeper dive into the specific proposals.

What is the CBO’s role in the debt ceiling debate?

The CBO provides independent analyses of the economic effects of various debt ceiling scenarios, helping policymakers understand the potential consequences of different approaches.