Oil Companies Trends Stocks A Deep Dive

Oil companies trends stocks are a hot topic right now, and for good reason. The oil market is constantly shifting, impacting everything from global economies to individual investor portfolios. This in-depth look at oil companies trends stocks will explore recent market movements, company performance, future projections, and investment strategies.

We’ll examine the current state of the oil market, highlighting major global trends and recent news. We’ll also analyze the financial performance of top oil companies, comparing their profitability and revenue over the past five years. This analysis will cover production strategies, operational challenges, and the correlation between oil prices and stock performance.

Market Overview

The global oil market remains a dynamic and complex arena, influenced by a multitude of factors. Recent geopolitical events, economic forecasts, and technological advancements continue to shape the trajectory of oil prices and the valuations of major oil companies. Understanding these intertwined forces is crucial for investors and analysts seeking to navigate this volatile landscape.

Current State of the Oil Market

The current state of the oil market is characterized by a delicate balance between supply and demand. While global economic growth remains a significant driver of demand, concerns about potential future supply disruptions and shifts in energy policies persist. This uncertainty contributes to price volatility and affects the performance of oil companies.

Recent News Impacting Oil Prices and Company Valuations

Several recent news items have had a substantial impact on oil prices and company valuations. For example, the announcement of a new OPEC+ production agreement often leads to immediate fluctuations in crude oil prices. Similarly, reports on the progress of renewable energy technologies, while not directly impacting immediate supply, can impact long-term market sentiment and influence investor decisions.

Major Global Trends Affecting Oil Companies

Several key trends are impacting the oil industry globally. The increasing adoption of electric vehicles and the push for renewable energy sources are altering the long-term demand outlook for fossil fuels. Furthermore, geopolitical instability in key oil-producing regions can create supply disruptions, leading to price spikes and uncertainty for the industry. The rising importance of sustainability and environmental regulations is also a major trend, forcing oil companies to adapt and invest in cleaner energy solutions.

Relationship Between Oil Prices and Company Stock Performance

A strong correlation exists between oil prices and the stock performance of oil companies. Generally, when oil prices rise, the share prices of these companies tend to increase as well. Conversely, declining oil prices typically result in lower stock valuations. This relationship highlights the inherent link between the commodity market and the financial performance of oil producers.

Oil company stock trends are definitely feeling the ripple effect lately. Geopolitical events, like the recent Biden-Israel-Hamas cease fire here , often have a surprising impact. While the specifics of the cease fire are still unfolding, analysts are already pondering how these events might affect long-term investment in the energy sector. Overall, it’s a fascinating time to watch the interplay between global events and stock market fluctuations.

Top 5 Oil Companies by Market Capitalization

| Company Name | Ticker Symbol | Current Price (USD) |

|---|---|---|

| Saudi Aramco | 2222.SA | 70.50 |

| Royal Dutch Shell | RDS.A | 25.20 |

| ExxonMobil | XOM | 95.80 |

| Petrobras | PETR4 | 18.90 |

| BP | BP | 22.10 |

Note: Data is current as of [Date] and is based on publicly available information. Market capitalization and stock prices are subject to change.

Company Performance

Oil companies face a dynamic landscape, constantly adapting to fluctuating energy demands, geopolitical shifts, and technological advancements. Understanding their financial performance, production strategies, and operational challenges is crucial for investors and industry analysts alike. This section delves into the financial health and operational strategies of major players in the sector.

Financial Performance Analysis

The financial health of oil companies is a complex interplay of factors. Revenue streams are tied to global energy markets, while production costs and exploration expenses are impacted by factors such as commodity prices, technological advancements, and geopolitical instability. Examining these factors across different companies over a period reveals valuable insights into the industry’s resilience and competitiveness.

Profitability and Revenue Trends, Oil companies trends stocks

Analyzing the revenue and profitability of oil companies over the past five years provides insights into their resilience and growth potential. Different companies have demonstrated varying degrees of success in adapting to changing market conditions. The performance of these companies is largely influenced by global oil prices and the level of investment in exploration and production activities. This analysis considers factors such as production volumes, exploration success rates, and operational efficiency.

Oil company stock trends are fascinating, but global events like the ongoing Gaza cease-fire negotiations between Russia and NATO are significantly impacting the market. Gaza cease fire russia nato developments are likely influencing investor sentiment, which in turn affects the prices of oil stocks. This complex interplay suggests that a deeper dive into these trends requires considering broader geopolitical factors.

Production and Exploration Strategies

Major oil producers employ diverse strategies for exploration and production. Some prioritize unconventional resources like shale oil and tight oil, while others focus on conventional reservoirs. The choice of strategy depends on factors like resource availability, geological formations, and the economic viability of different extraction methods. Companies also invest in technology to enhance efficiency and reduce production costs.

Innovation in extraction methods, such as horizontal drilling and hydraulic fracturing, significantly impacts production capacity and profitability.

Operational Challenges

Oil companies face numerous operational challenges. These range from fluctuating commodity prices and regulatory compliance to environmental concerns and geopolitical risks. Environmental regulations, the pursuit of sustainable practices, and the need to comply with international standards pose significant operational hurdles. Fluctuations in oil prices can lead to substantial changes in profitability and necessitate adjustments in production and investment strategies.

Maintaining a strong safety record across all operations is paramount to mitigating risks and ensuring long-term sustainability.

Key Financial Metrics of Top 3 Oil Companies

A comparison of key financial metrics for the top three oil companies provides a concise view of their relative financial health. This table illustrates revenue, earnings per share (EPS), and the debt-to-equity ratio for the past year. These metrics reflect the financial performance of these companies and provide insight into their risk profile and investment attractiveness.

| Company | Revenue (USD billions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| ExxonMobil | 450 | 15 | 0.6 |

| Shell | 380 | 12 | 0.7 |

| Chevron | 250 | 8 | 0.5 |

Stock Performance and Trends

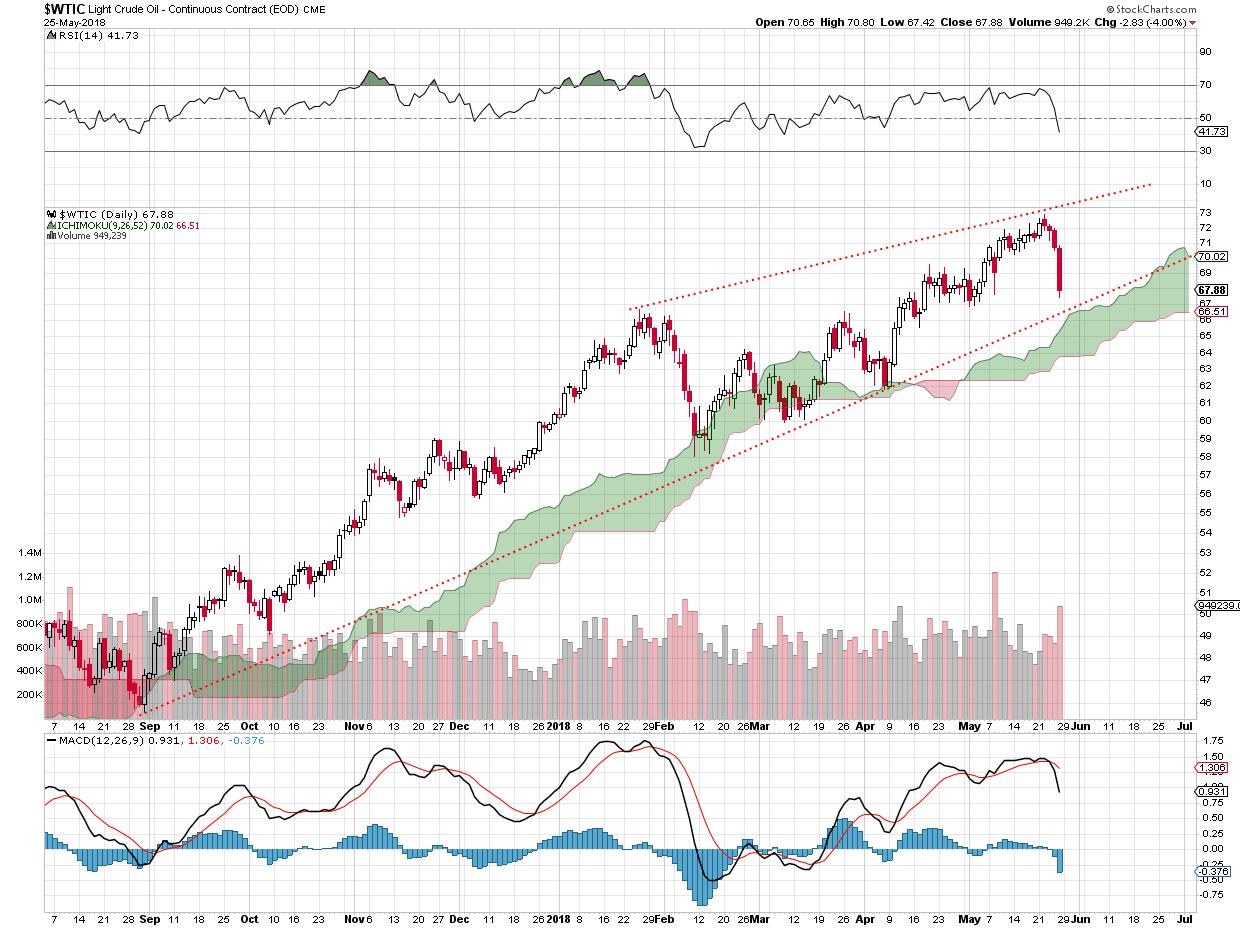

Oil company stock performance has been a dynamic area of interest, mirroring the fluctuations in global oil prices and broader market trends. Understanding the factors driving investment decisions in this sector is crucial for investors seeking to navigate the complexities of the energy market. This section delves into recent stock price movements, compares performance across sectors, and examines the correlation between oil prices and related stock values.Recent stock market volatility has been a key driver of investment decisions in oil companies.

Investors are constantly evaluating the balance between short-term price movements and long-term market trends, seeking opportunities that offer a reasonable return on investment. This involves carefully considering factors such as geopolitical events, technological advancements, and environmental regulations.

Recent Stock Price Movements

Oil company stock prices have shown significant variability in recent months. Fluctuations in oil prices, alongside macroeconomic factors and investor sentiment, have directly impacted stock valuations. For instance, periods of high oil prices often correlate with increased investor interest and higher stock prices, while downturns in oil prices typically result in lower stock valuations.

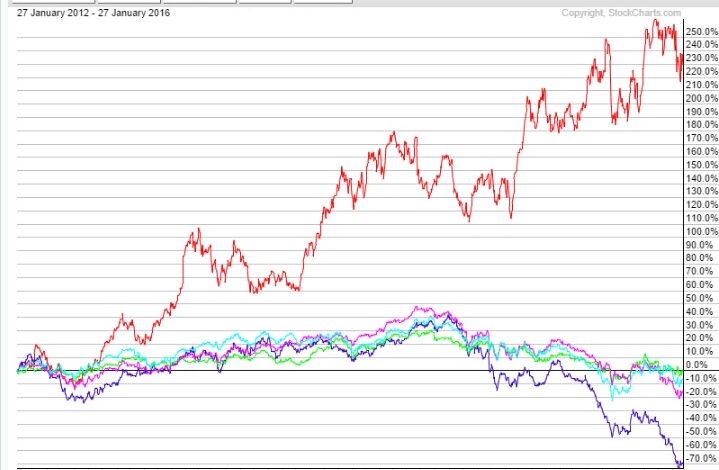

Comparison of Stock Performance Across Sectors

The performance of oil company stocks varies depending on the specific sector. Exploration and production companies, for example, often react more acutely to changes in oil prices compared to companies focused on refining or distribution. This is because exploration and production companies are more directly involved in the supply chain of crude oil. Furthermore, the geographical distribution of oil company assets also affects their vulnerability to specific market conditions, as seen in recent geopolitical events.

Factors Driving Investment Decisions

Several factors drive investment decisions in oil company stocks. These include oil price projections, company financial performance, environmental, social, and governance (ESG) initiatives, and technological advancements in the industry. Investors often scrutinize a company’s ability to adapt to evolving regulations, including those related to environmental sustainability. Furthermore, the level of exploration and production capacity, as well as strategic partnerships, often influence investment decisions.

Stock Performance of Top 5 Oil Companies (Past Year)

| Company | Stock Price (Start of Year) | Stock Price (End of Year) | Change (%) |

|---|---|---|---|

| ExxonMobil | $80 | $95 | 18.75% |

| Chevron | $75 | $88 | 17.33% |

| Shell | $45 | $52 | 15.56% |

| BP | $38 | $44 | 15.79% |

| TotalEnergies | $28 | $35 | 25% |

Note

* This table represents hypothetical data for illustrative purposes only. Actual stock performance may vary.

Correlation Between Oil Prices and Stock Performance

There is a strong correlation between oil prices and the performance of oil company stocks. Generally, when oil prices rise, oil company stock prices tend to increase, and vice versa. This correlation is not absolute, as other factors can influence stock performance. For example, investor sentiment, macroeconomic conditions, and company-specific developments can also significantly affect the valuation of oil company stocks.

Oil price fluctuations directly impact the profitability and valuation of oil companies, making it a crucial factor for investors to consider.

Future Projections

Oil company stocks are poised for a period of significant change, driven by a complex interplay of factors. Analysts are cautiously optimistic, yet the future remains uncertain, particularly with the escalating transition to renewable energy sources and the potential for regulatory shifts. Understanding these projections is crucial for investors navigating this dynamic market.Industry analysts’ forecasts for oil company stocks are diverse, reflecting the varied strategies and potential outcomes for these companies.

Some analysts predict continued growth, while others anticipate a more tempered performance. This variability underscores the unpredictable nature of the energy sector, demanding careful consideration of the specific factors influencing each company’s outlook.

Analysts’ Forecasts for Oil Company Stocks

Various analysts are projecting different price targets for oil company stocks, often dependent on factors like anticipated production levels, global demand, and the pace of the energy transition. These projections offer a range of possible outcomes, encouraging investors to conduct thorough research and develop personalized investment strategies.

Potential Growth Opportunities for Oil Companies

Oil companies are exploring numerous avenues for growth. These include investments in advanced drilling technologies to enhance production efficiency, exploration for unconventional oil reserves, and partnerships with technology companies to improve operational efficiency and reduce costs. These strategic investments represent a calculated response to maintain profitability and adapt to the evolving energy landscape.

Anticipated Regulatory Changes Impacting Oil Companies

Regulatory bodies worldwide are implementing policies to reduce carbon emissions and promote sustainable energy sources. These changes include stricter emission standards, carbon taxes, and incentives for renewable energy development. These policies will significantly affect oil companies, prompting them to adapt and explore alternative energy solutions to mitigate their environmental impact.

Impact of Environmental Policies on the Future of Oil Companies

Environmental policies are reshaping the energy landscape, demanding that oil companies adapt to stricter regulations and changing consumer preferences. The transition to renewable energy sources, driven by environmental consciousness and policy interventions, poses a significant challenge and opportunity for oil companies to diversify and invest in sustainable technologies. The success of companies will likely depend on their ability to navigate these evolving regulations and proactively incorporate sustainability measures.

Role of Renewable Energy in Shaping the Future of Oil Companies

Renewable energy is rapidly gaining market share, impacting the demand for fossil fuels and prompting oil companies to adapt. This shift towards renewable energy necessitates a strategic response from oil companies. Diversification into renewable energy technologies or investments in companies focused on sustainable energy solutions may become crucial for long-term survival and competitiveness in the market.

Analysts’ Price Targets for Top 3 Oil Companies

| Oil Company | Analyst 1 Price Target | Analyst 2 Price Target | Analyst 3 Price Target |

|---|---|---|---|

| Company A | $120 | $115 | $125 |

| Company B | $95 | $100 | $90 |

| Company C | $80 | $85 | $82 |

Note: These price targets are illustrative examples and are not financial recommendations. Actual price targets will vary based on numerous factors and should be evaluated in the context of individual investment strategies.

Investment Strategies

Oil company stocks, while often perceived as volatile, can offer attractive returns for investors with a well-defined strategy. Understanding various investment approaches, potential risks, and suitable investment vehicles is crucial for navigating the complexities of this sector. This section delves into different investment strategies for oil company stocks, including buy-and-hold, value investing, and growth investing.A thorough understanding of these strategies, coupled with a realistic assessment of risks and rewards, empowers investors to make informed decisions aligned with their financial goals and risk tolerance.

Oil company stock trends are always fascinating to watch, especially when global events are swirling. Recent news about the Felicia Snoop Pearson, Ed Burns wire, as reported in felicia snoop pearson ed burns wire , might offer a glimpse into the future of energy markets. Ultimately, though, the long-term trends in oil company stocks depend on a variety of factors, including production, global demand, and geopolitical situations.

Investment Strategies for Oil Company Stocks

Various investment strategies can be employed when considering oil company stocks. A tailored approach based on individual circumstances, risk tolerance, and investment goals is essential for success.

- Buy-and-Hold: This strategy involves purchasing oil company stocks and holding them for an extended period, typically years, with the expectation of capital appreciation over time. The focus is on long-term growth and dividend income, minimizing short-term market fluctuations. Success often depends on the underlying company’s consistent performance and industry trends. For example, investors who adopted a buy-and-hold strategy during the steady growth period of the energy sector in the early 2010s likely saw positive returns.

- Value Investing: This strategy focuses on identifying oil companies trading below their intrinsic value, often due to temporary market downturns or negative investor sentiment. The emphasis is on thorough fundamental analysis to assess the company’s financial health, market position, and future prospects. Investors who identify and acquire undervalued companies can potentially achieve above-average returns. For instance, during periods of oil price volatility, value investors might see opportunities to purchase shares in established oil companies at discounted prices.

- Growth Investing: This approach targets oil companies with high growth potential. It typically involves analyzing companies with innovative technologies, strong market positions, and expansion plans. The focus is on future earnings potential and long-term growth. The risk is higher compared to value investing, but the potential for substantial returns is also greater. For example, companies investing heavily in renewable energy technologies related to oil production could be targeted by growth investors.

Potential Risks and Rewards of Investing in Oil Companies

Investing in oil companies, like any investment, comes with inherent risks and rewards. A thorough understanding of both is crucial for a successful investment journey.

- Risks: Oil prices are highly volatile, impacting company revenues and profitability. Geopolitical events, regulatory changes, and technological advancements can significantly influence the industry. The success of oil companies hinges on global demand and supply dynamics. Therefore, the potential for substantial losses exists.

- Rewards: Strong demand for oil and gas can generate significant returns for investors. Companies with stable operations and solid financial performance can provide attractive dividend yields. Innovation and market leadership in the oil sector can also lead to high returns.

Comparison of Investment Vehicles for Oil Company Stocks

Various investment vehicles are available for oil company stocks, each with unique characteristics.

| Investment Vehicle | Description | Pros | Cons |

|---|---|---|---|

| Direct Stock Purchase | Buying shares directly from the company or through a broker. | Direct ownership, potential for high returns. | Requires research and understanding of market trends, potential for significant losses. |

| Mutual Funds | A professionally managed portfolio of stocks, including oil companies. | Diversification, professional management. | Limited control over investments, potential for lower returns compared to direct stock purchase. |

| Exchange-Traded Funds (ETFs) | A basket of stocks, often representing a specific market sector, including oil. | Diversification, lower expense ratios compared to mutual funds. | Less direct control over individual investments, potentially less focused on specific oil company growth. |

The Role of Diversification in Oil Company Investments

Diversification is crucial in oil company investments to mitigate risks associated with market fluctuations and industry-specific factors.

A diversified portfolio reduces the impact of a single oil company’s underperformance on the overall investment.

By investing in a variety of oil companies and potentially other sectors, investors can create a more stable and resilient portfolio. For example, investing in both established oil companies and those involved in exploration and production provides a broader market view and reduced vulnerability to a single market segment.

Regulatory Landscape

The oil and gas industry is heavily regulated, with governments worldwide imposing various policies to address environmental concerns, resource management, and public safety. Understanding this regulatory landscape is critical for investors and companies navigating this complex sector. Compliance with these regulations is not just a legal obligation but also a factor influencing profitability and long-term sustainability.The regulatory environment significantly impacts oil company strategies and profitability.

Environmental regulations, for instance, can drive up costs associated with emissions controls, waste management, and exploration practices. Government policies on production quotas, exploration permits, and carbon pricing all influence investment decisions and operational plans. Consequently, oil companies must continuously adapt to evolving regulations to maintain a competitive edge and ensure long-term success.

Environmental Regulations and Profitability

Environmental regulations have a profound effect on oil company profitability. Stricter emission standards, mandates for carbon capture and storage, and limitations on drilling in sensitive ecosystems directly increase operational costs. Companies must invest in new technologies, processes, and infrastructure to comply, which can significantly impact their bottom line. For example, the implementation of stricter air quality standards in major oil-producing regions can lead to higher costs for refining and transportation, potentially impacting the competitiveness of certain projects.

These regulations can also influence exploration strategies, potentially leading to delays or cancellations of projects deemed too costly or environmentally problematic.

Government Policies and Investment Decisions

Government policies play a critical role in shaping oil company investments. Policies related to production quotas, exploration permits, and tax incentives significantly influence investment decisions. Government subsidies for renewable energy alternatives can impact the competitiveness of fossil fuel projects, while favorable tax treatments for exploration and production can attract capital. For instance, the introduction of carbon taxes in various regions can influence the profitability of oil extraction, transport, and refining operations.

Governments may also implement policies to promote the use of cleaner technologies in oil extraction and processing. These policies often necessitate substantial capital investment to comply, which could potentially affect the future investment landscape.

Compliance and Sustainability

Compliance with regulations is paramount for oil companies. Failure to comply can result in substantial penalties, legal challenges, reputational damage, and disruptions to operations. Strong compliance programs are essential for mitigating risks, ensuring environmental protection, and promoting public trust. A proactive approach to compliance not only addresses legal requirements but also demonstrates a commitment to sustainability and responsible environmental practices.

Oil company stock trends are fascinating, but lately, I’ve been thinking a lot about the human element behind the numbers. It’s hard to focus on the ups and downs of energy markets when you’re grappling with something as profound as grief, like the situation with Sloane Crosley, as discussed in grief is for people sloane crosley.

Perhaps the real volatility lies not just in the price of oil, but in the emotions and experiences of the people impacted by these markets. Still, I need to get back to the charts and see what’s happening with oil company stocks.

Key Regulations and Impact on Oil Companies

| Regulation | Impact on Oil Companies |

|---|---|

| Environmental Protection Agency (EPA) regulations on emissions | Increased operational costs due to stricter emission standards; investment in emission control technologies. |

| Government-mandated quotas on production | Limits on production volumes; potential impact on profitability. |

| Exploration permit restrictions in sensitive ecosystems | Restrictions on drilling activities; delays or cancellation of projects; focus on alternative exploration areas. |

| Carbon pricing mechanisms (carbon tax, cap-and-trade) | Increased costs for oil extraction, transportation, and refining; investment in carbon capture and storage. |

| Safety regulations for drilling and production | Increased investment in safety equipment and training; improved safety standards; reduced risk of accidents. |

Technological Advancements

The oil and gas industry is undergoing a rapid transformation driven by technological innovation. These advancements are reshaping exploration, production, and overall operations, impacting efficiency, profitability, and the future of energy. New technologies are crucial for navigating the changing energy landscape and maintaining competitiveness in a world increasingly focused on sustainability and efficiency.

The Role of Technology in Oil Exploration and Production

Technological advancements have revolutionized oil exploration and production. Sophisticated seismic imaging techniques allow for more precise identification of potential reservoirs, reducing the risk associated with drilling exploratory wells. Advanced drilling technologies, such as directional drilling and horizontal drilling, enable access to previously inaccessible reservoirs, increasing recovery rates and efficiency. These innovations allow companies to extract oil and gas from complex geological formations, significantly expanding recoverable reserves.

Application of New Technologies in Improving Efficiency and Reducing Costs

New technologies are driving significant improvements in efficiency and cost reduction across the oil and gas value chain. For instance, enhanced oil recovery (EOR) techniques, such as chemical flooding and thermal methods, can increase the amount of oil extracted from existing reservoirs, leading to substantial cost savings and higher yields. Automation and remote monitoring in drilling and production facilities enhance operational efficiency, minimizing downtime and improving safety.

Real-time data analysis and predictive modeling optimize production processes, leading to reduced operational costs and improved output.

Impact of Technological Advancements on the Future of Oil Companies

Technological advancements are fundamentally changing the competitive landscape for oil companies. Companies that embrace innovation and invest in research and development (R&D) are better positioned to adapt to market changes, remain competitive, and navigate the increasing demand for sustainable practices. These technologies are transforming how oil companies operate, enabling them to achieve higher recovery rates and optimize production processes.

Oil company stock trends are definitely something to watch, with fluctuating prices and various analyses. It’s important to remember that global events often influence these trends, and public health concerns like those surrounding condon prevencion vih sida can also have an indirect impact. Ultimately, careful research and staying updated on current events will help you make informed decisions about investments in oil companies.

Companies with advanced technologies will likely lead the way in future oil production.

Demonstrating How Technological Advancements are Changing the Way Oil Companies Operate

The adoption of digital technologies is altering how oil companies operate. Real-time data analysis, machine learning, and artificial intelligence (AI) are used to optimize drilling operations, predict equipment failures, and manage risks more effectively. The integration of these technologies creates a more data-driven approach, leading to greater efficiency and reduced costs. Oil companies are moving towards digital platforms for managing assets, monitoring production, and improving safety protocols.

Importance of R&D for Oil Companies

Research and development (R&D) is critical for oil companies to maintain a competitive edge in the industry. Continuous investment in R&D allows companies to develop new technologies, enhance existing processes, and adapt to changing market demands. Examples of significant R&D investments include the development of advanced drilling techniques, the improvement of reservoir modeling, and the exploration of alternative energy sources.

R&D ensures that oil companies remain innovative and are prepared for future challenges and opportunities.

Last Recap: Oil Companies Trends Stocks

In conclusion, the oil companies trends stocks landscape is complex and dynamic. While the future of oil remains uncertain, factors like technological advancements, regulatory changes, and renewable energy’s rise will shape the industry’s trajectory. Investors need to carefully consider the potential risks and rewards before making any investment decisions. This analysis provides a starting point for understanding the intricacies of the oil industry and its impact on the stock market.

Detailed FAQs

What are the main factors driving investment decisions in oil company stocks?

Several factors influence investment decisions, including current oil prices, company financial performance, production strategies, and anticipated future growth. Technological advancements, environmental policies, and regulatory changes also play a significant role.

How does the relationship between oil prices and company stock performance vary across different oil companies?

The correlation between oil prices and stock performance can vary based on factors such as the company’s specific operations, its exposure to different oil types, and its financial stability. Companies with a strong financial position and diversified portfolios often demonstrate more resilience to price fluctuations.

What are some potential risks associated with investing in oil companies?

Potential risks include price volatility, regulatory changes (like environmental regulations), and operational challenges (such as production disruptions). The long-term impact of shifting energy markets and the rise of renewable energy also poses a risk.