Congress Election Year Tax Deal A Deep Dive

Congress election year tax deal promises a complex interplay of political maneuvering and economic realities. This analysis delves into the historical context of such deals, exploring past successes and failures. We’ll examine the current political landscape, potential provisions, economic impacts, public opinion, challenges, and illustrative scenarios.

Understanding the intricate dynamics surrounding tax legislation during election years is crucial. The motivations, compromises, and potential consequences will be carefully dissected to offer a comprehensive perspective.

Historical Context of Election-Year Tax Deals

Election years often see tax deals emerge in the US Congress. These deals, often politically motivated, aim to address economic concerns and garner public support. The history reveals a complex interplay of economic factors, political strategies, and the lasting impact on the American economy.

Political Motivations Behind Election-Year Tax Deals

Political parties frequently use tax deals as tools to win voter favor. Candidates may propose tax cuts to stimulate the economy, appealing to the desire for lower taxes. Conversely, tax increases might be justified as necessary for addressing the budget deficit or social programs, playing to voters’ concerns about government spending. The specific motivations often vary depending on the political climate and the specific economic challenges facing the country.

Tax Policy Approaches Across Presidential Administrations

Presidential administrations have employed varied approaches to tax policy in election years. Some administrations have prioritized tax cuts for businesses and high-income earners, arguing that it stimulates investment and economic growth. Other administrations have emphasized tax increases on corporations or wealthy individuals, aiming to fund social programs or reduce the national debt. These differences highlight the contrasting economic philosophies and priorities of different administrations.

Historical Overview of Election-Year Tax Deals

| Year | President | Key Provisions | Impact |

|---|---|---|---|

| 1981 | Ronald Reagan | Substantial tax cuts for individuals and corporations. | Increased national debt, but also stimulated economic growth in the short term. Long-term impact remains debated. |

| 1990 | George H.W. Bush | Tax increases to address the growing national debt. | Initially met with public resistance, but helped reduce the deficit over time. |

| 2001 | George W. Bush | Significant tax cuts for individuals and corporations, with emphasis on reducing the marginal tax rates. | Reduced government revenue, contributing to the rise in the national debt. |

| 2017 | Donald Trump | Substantial tax cuts for corporations and high-income earners, reducing corporate tax rates. | Led to a decrease in government revenue and an increase in the national debt. Long-term effects on economic growth are still being assessed. |

Long-Term Economic Impacts of Election-Year Tax Deals

The long-term economic impacts of election-year tax deals are complex and often debated. Some deals have stimulated economic growth in the short term, but others have resulted in increased national debt and budget deficits. The effectiveness of these deals often depends on the overall economic conditions and the specific provisions of the legislation.

Examples of Successful and Unsuccessful Tax Deals

Several examples demonstrate the varying outcomes of election-year tax deals. The 1981 Reagan tax cuts, while initially stimulating economic growth, also contributed to a significant increase in the national debt. The 1990 tax increases, while contributing to deficit reduction, faced initial political opposition. The outcomes depend on a complex interplay of economic factors, public support, and the effectiveness of the policy in addressing underlying economic issues.

Current Political Landscape

The 2024 election year looms large over any potential tax deal. Political maneuvering, fueled by party platforms and the desire to gain electoral advantage, will undoubtedly shape the debate. The current political climate is highly polarized, impacting the likelihood of bipartisan agreement on a complex issue like taxation.The current political climate significantly influences the potential for a tax deal.

Negotiations will likely be highly contested, with each party pushing for policies that benefit their base. The current president’s agenda and the opposing party’s counter-proposals will dictate the path of these negotiations. Public opinion will play a crucial role in swaying political positions.

Key Political Players and Their Stances

Political parties hold distinct views on taxation. The Democratic Party often advocates for progressive taxation, where higher earners pay a larger percentage of their income in taxes. This approach aims to fund social programs and reduce income inequality. The Republican Party typically favors lower taxes across the board, believing this stimulates economic growth. This approach often leads to debates on tax cuts for corporations and high-income individuals.

- The current president and their party will likely prioritize policies that resonate with their base. This could involve tax cuts for specific sectors or investments in infrastructure projects, aiming to garner support from voters.

- The opposing party will likely focus on contrasting proposals, highlighting potential drawbacks of the president’s plan. This may involve emphasizing the potential inflationary impact of tax cuts or the need to address budget deficits.

Influence of Public Opinion

Public opinion plays a significant role in shaping the political landscape surrounding tax policy. Public support for tax cuts or increases can influence politicians’ willingness to negotiate and compromise. Polls and surveys can provide insight into the public’s views on tax fairness and economic impacts. However, the public’s understanding of complex tax policies can be limited, impacting their ability to fully engage with the debate.

Economic Conditions and Their Relevance

Current economic conditions are paramount in the tax deal debate. Inflation, unemployment rates, and GDP growth significantly influence the need for, and design of, tax adjustments. A robust economy might allow for more expansive tax cuts, while an economic downturn might necessitate tax increases to fund social safety nets.

State of the US Budget

The US budget is a complex document outlining projected revenues and expenditures. The current budget reflects the country’s financial standing, including debt levels and spending priorities. A balanced budget is often a goal, but deficits and surpluses can fluctuate based on economic conditions and government spending decisions. Understanding the budget’s current state is crucial to assess the potential impact of a tax deal.

| Political Party | Stance on Taxation |

|---|---|

| Democratic Party | Progressive taxation; higher earners pay a larger percentage; funding for social programs; reduced income inequality. |

| Republican Party | Lower taxes across the board; stimulate economic growth; tax cuts for corporations and high-income individuals. |

| Independent/Third Parties | Varying stances, some advocating for specific targeted tax reforms. |

Potential Provisions

A potential tax deal in an election year often involves carefully crafted compromises to appeal to diverse interests. This delicate balancing act necessitates a deep understanding of the current economic climate and the political landscape, as well as a consideration of the long-term implications of any proposed changes. These considerations are crucial for shaping a tax deal that can garner bipartisan support and foster economic stability.This framework explores potential provisions for different income brackets, contrasting various tax reform approaches and examining their impact on various segments of the population, small businesses, investment, and savings.

It is vital to acknowledge that the specifics of any actual deal will depend on the political realities of the moment.

Congress’s election-year tax deal is always a hot topic, with everyone wondering what it will entail. It’s fascinating how the culinary world can inspire similar discussions, like Gordon Ramsay’s relentless pursuit of excellence in his cooking shows. Gordon Ramsay’s next level chef approach reminds me of the intense pressure and strategic maneuvering in crafting a successful tax deal.

Ultimately, both aim for a high standard of achievement, and we’ll see how this year’s deal plays out.

Potential Tax Rates and Brackets

Understanding how different tax rates affect various income levels is essential to evaluating the potential impact of a tax deal. The current tax system employs a progressive structure, meaning higher earners typically pay a higher percentage of their income in taxes. A potential deal might adjust these rates, potentially altering the overall burden on different segments of the population.

The congress election year tax deal is always a hot topic, especially when you consider its potential impact on everyday life. For example, how might this deal affect the escalating housing market, particularly in places like California, where 2 million dollar homes california are becoming increasingly common? Ultimately, the tax deal’s success hinges on its ability to stimulate the economy without disproportionately impacting lower and middle-income families.

| Income Bracket | Current Tax Rate | Potential New Tax Rate |

|---|---|---|

| $0-$25,000 | 10%

|

10%

|

| $25,001-$50,000 | 12%

|

15%

|

| $50,001-$100,000 | 22%

|

25%

|

| $100,001-$250,000 | 24%

|

30%

|

| Over $250,000 | 35%

|

38%

|

Note: These are illustrative examples and do not represent specific proposals. Actual rates and brackets would depend on the specifics of the proposed deal.

Progressive, Regressive, and Flat Taxes

Different tax systems have varying effects on income distribution. A progressive tax system, where higher earners pay a larger percentage of their income, aims to reduce income inequality. A regressive tax system, on the other hand, places a heavier burden on lower earners. A flat tax system applies the same rate to all income levels. The choice of system influences the distribution of the tax burden and its effect on different segments of society.

The upcoming congress election year tax deal is shaping up to be interesting. While the details are still fuzzy, it’s clear that the focus is on economic stimulus. This is especially relevant to the booming EV sector in China, like the HeFei city economy, which is rapidly evolving into a major player in electric vehicle manufacturing and development.

china hefei ev city economy is a great example of this. Ultimately, the tax deal will likely influence both domestic and international markets, potentially impacting this trend.

Impacts on Different Income Segments

A tax deal’s provisions will affect various segments of the population differently. Lower-income individuals might experience relief from tax increases, while higher-income individuals could face higher tax rates. The specific impact on each group will depend on the provisions of the deal, such as deductions, credits, and exemptions. The effects will likely differ based on factors like the specific provisions and how the tax burdens are redistributed.

Impact on Small Businesses and Entrepreneurs

Small businesses and entrepreneurs are often sensitive to changes in tax laws. A tax deal could impact their profitability and investment decisions. Potential provisions, such as deductions for business expenses or tax credits for startup costs, can incentivize or disincentivize business formation and growth.

Impact on Investment and Savings

Investment and savings decisions are heavily influenced by tax laws. A tax deal could alter the incentives for individuals to invest in stocks, bonds, or real estate. The specific provisions, such as tax deductions for retirement savings or capital gains rates, will directly influence these choices. A decrease in capital gains tax rates, for instance, could incentivize more investment in the stock market, leading to potentially higher returns.

Impact of Proposed Tax Changes on Various Segments of the Population

The effects of tax changes can vary greatly across different demographics. For instance, families with children might experience varying impacts depending on the availability of tax credits or deductions. The potential impact on specific groups should be thoroughly assessed to ensure fairness and equity in the tax system.

Economic Impact Analysis

A potential tax deal in an election year carries significant economic implications, impacting various sectors, job creation, income distribution, government finances, and international relations. Understanding these effects is crucial for informed public discourse and policymaking. The interplay between tax policies and economic indicators is complex, with outcomes often contingent on specific provisions and the broader economic climate.

Potential Impact on Different Sectors

The effects of a tax deal will vary across sectors. Industries with high capital investment might see increased investment if tax incentives are offered. Small businesses, often the backbone of many economies, could benefit from reduced tax burdens, potentially leading to expansion and job creation. Conversely, some sectors might face reduced demand or investment if the deal disproportionately benefits other areas.

For instance, a tax break for large corporations could lead to reduced investment in smaller, local businesses.

Job Creation and Income Inequality

A well-structured tax deal can potentially foster job creation. Incentives for businesses to expand or invest might translate into new employment opportunities. However, the effect on income inequality is a crucial consideration. If the deal favors high-income earners or corporations, the gap between the rich and the poor could widen. Tax policies that target specific sectors or provide targeted support for lower-income workers can help mitigate these effects.

For example, tax credits for childcare or education could improve employment opportunities for lower-income families.

Impact on Government Revenue and Spending

A tax deal’s effect on government revenue and spending is intrinsically linked. Reduced tax rates can lead to lower government revenue. However, this is often balanced by increased economic activity and employment, which in turn can lead to higher tax revenue. To understand the true impact, one must consider the overall economic effect of the deal and its influence on other economic factors like inflation and GDP.

A crucial aspect of this analysis is evaluating whether the potential revenue loss from tax cuts is offset by increased economic activity. Historical data on similar deals can offer insights into these relationships.

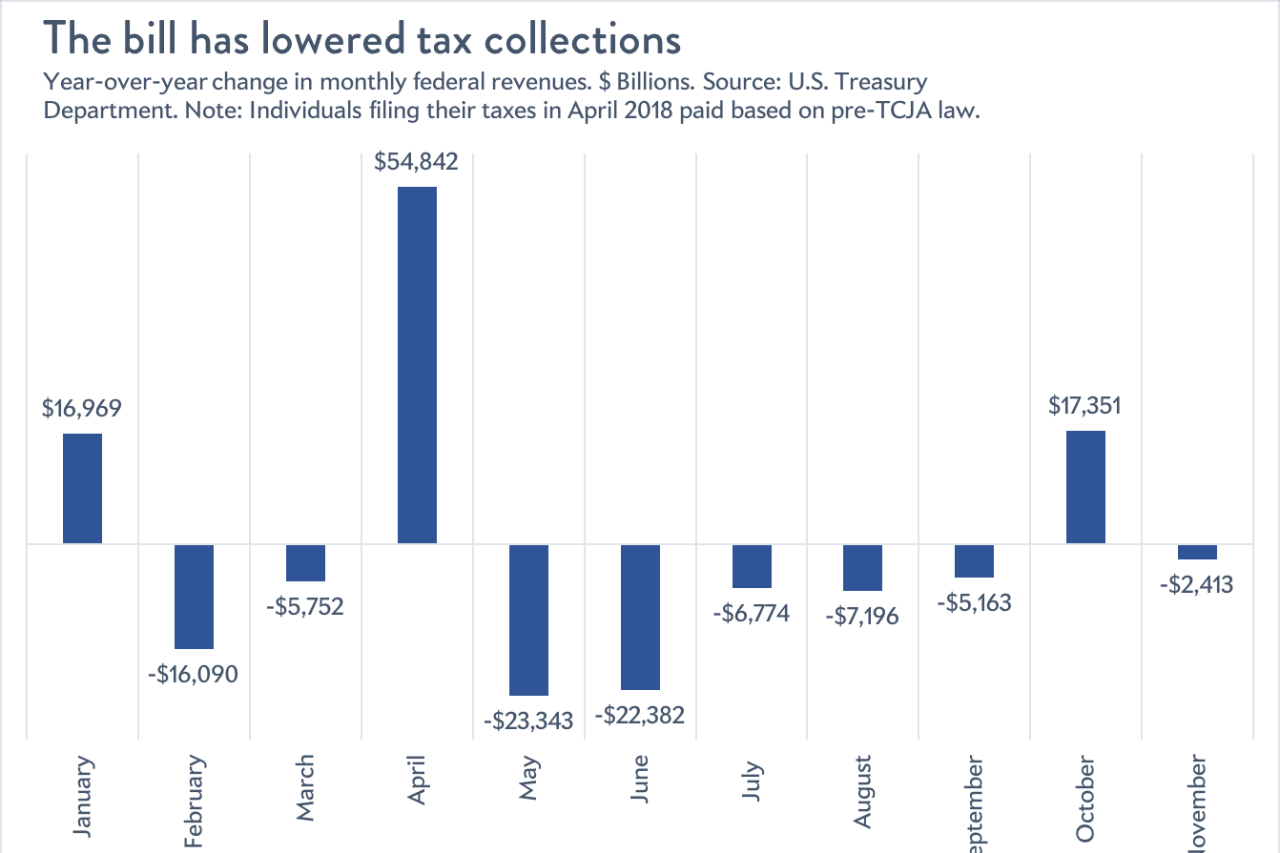

Economic Effects of Previous Tax Deals

Studying the economic consequences of past tax cuts provides valuable context. For example, the 2017 Tax Cuts and Jobs Act in the US showed varied effects. While some sectors experienced growth, others saw limited change. Detailed analysis of the economic data before, during, and after the tax cuts provides valuable insights into the potential consequences of a current deal.

Data from independent research institutions on the effects of past deals can provide useful information to anticipate potential results.

Potential Impact on International Trade and Investment

A tax deal can influence international trade and investment. Changes in domestic tax rates might make a country’s products or services more or less attractive to foreign buyers or investors. A competitive tax environment might attract foreign investment, but it could also lead to a loss of domestic investment opportunities. The deal’s impact on the international market depends on the specific provisions and the reactions of other countries.

Inflationary or Deflationary Pressures

The inflationary or deflationary pressures from a tax deal depend on several factors. A deal that stimulates economic activity might increase demand, potentially leading to inflation. Conversely, a deal that focuses on deficit reduction could lead to reduced demand and deflation. The overall effect hinges on the magnitude of the deal’s impact on aggregate demand and supply.

The interplay between tax rates, interest rates, and overall economic conditions is crucial in determining the pressure.

The upcoming congress election year tax deal is shaping up to be interesting. While details are still emerging, it’s clear that various factors will influence the final outcome, including the potential impact on the public’s pocketbooks. Recent headlines about stars like Harley Johnston, Oettinger, and Benn, all of whom have been in the news recently , might even subtly influence the final shape of the tax bill.

Overall, the deal’s potential impact on the election and the economy remains a significant concern for many.

Projected Economic Impact Scenarios

| Scenario | Projected GDP Growth (%) | Unemployment Rate (%) | Inflation Rate (%) |

|---|---|---|---|

| Scenario 1: Stimulatory Deal | 2.5 | 3.5 | 2.0 |

| Scenario 2: Neutral Deal | 1.8 | 4.0 | 1.5 |

| Scenario 3: Contractionary Deal | 0.5 | 4.5 | 0.8 |

The table above illustrates projected economic impacts under different hypothetical scenarios. These projections are based on various factors, including the magnitude of the tax cuts, the specific industries targeted, and the broader economic environment. The outcomes are estimations, and actual results may vary. A thorough economic impact assessment is crucial for policymaking.

Public Opinion and Debate

The upcoming election-year tax deal will undoubtedly spark a lively public debate. Public perception of the deal will be crucial in shaping its ultimate success or failure in Congress. Different interest groups will have varying perspectives on its potential benefits and drawbacks, and the media will play a critical role in framing the discussion. Understanding these dynamics is essential to anticipating the likely public response.The public’s reaction to any tax deal is complex, influenced by a multitude of factors including economic anxieties, political leanings, and personal financial situations.

Public opinion polls will provide insights into the general sentiment, but understanding the nuances of public concerns is critical to understanding the overall impact.

Likely Public Concerns

The public will likely be concerned about the fairness and equity of the proposed tax changes. Will the deal disproportionately benefit certain income groups or specific industries? Concerns about inflation and the impact on the national debt are also likely to be prominent. The public will scrutinize the long-term economic consequences, considering potential job creation or loss, and whether the deal addresses critical economic needs.

Arguments For and Against the Deal

Different interest groups will articulate diverse arguments for and against the deal. Labor unions might argue that the deal does not adequately address worker compensation or job security. Small business owners may fear that the deal increases their tax burden. Advocates for lower taxes will likely argue that the deal stimulates economic growth, while progressives might express concern about increased inequality.

Media Coverage of Past Tax Deals

Past tax deals have frequently been the subject of intense media scrutiny. The media’s framing of the debate often influenced public opinion. For example, during the 2017 tax cuts and jobs act, the media highlighted differing viewpoints on the deal’s economic impact. Coverage focused on the potential for job growth versus concerns about increased national debt. The debate often centered on fairness and equity, with discussions about the benefits accruing to various income groups.

Role of Lobbying Groups

Lobbying groups will play a significant role in shaping public opinion. Groups with vested interests in the tax code will likely exert considerable influence on the debate. They will likely fund advertisements, organize rallies, and engage in public relations campaigns to promote their viewpoints.

Potential for Public Protests or Rallies

Public protests or rallies are a possible outcome of the debate surrounding the tax deal. If the public perceives the deal as unfair or harmful, there is a potential for organized protests or demonstrations to voice dissent. The magnitude of these actions will depend on the perceived impact of the deal on different segments of the population.

Range of Public Opinions and Groups

| Public Opinion | Groups Holding Opinion |

|---|---|

| Favorable | Taxpayers who anticipate benefits from the deal; business owners anticipating reduced costs; and certain political parties or coalitions. |

| Unfavorable | Groups facing increased tax burdens; workers concerned about job security; environmental groups concerned about environmental impacts; and certain political parties or coalitions. |

| Neutral | Individuals who are uncertain about the deal’s impact; and those who are not directly affected by the changes. |

“Public opinion is a powerful force in shaping policy outcomes. A strong and informed public voice can influence the direction of a tax deal, ensuring its fairness and efficacy.”

Potential Challenges and Obstacles: Congress Election Year Tax Deal

Navigating the political landscape during an election year often complicates the path toward bipartisan agreements, particularly on complex issues like tax reform. The inherent pressures of campaigning and the need to appeal to diverse constituencies can create significant hurdles in achieving consensus. This year’s tax deal, if one is reached, will be tested by competing priorities and the need to balance economic concerns with political realities.

Party Polarization and Ideological Differences

Significant partisan divisions in Congress often hinder progress on tax legislation. Different political parties frequently hold vastly divergent views on the appropriate role of government in the economy, and these contrasting ideologies can translate into intractable disagreements on tax policy. For example, Republicans generally favor lower taxes and reduced government spending, while Democrats often advocate for higher taxes on corporations and wealthy individuals to fund social programs.

These fundamental differences make reaching a bipartisan agreement challenging.

Political Maneuvering and Strategic Considerations

Political maneuvering plays a crucial role in shaping the negotiation process. Members of Congress might prioritize their own political standing or the interests of their constituents over the pursuit of a comprehensive tax deal. For example, a politician might strategically oppose a provision to gain favor with a particular interest group. Successful negotiation often requires deft political maneuvering to navigate these complexities.

Legislative Gridlock and the Role of Political Parties

Legislative gridlock can emerge when one party refuses to compromise or when the legislative process is dominated by procedural hurdles. A party might use procedural tactics to stall or block legislation that they oppose. The threat of a filibuster or other procedural maneuvers can create considerable uncertainty and delay the progress of a tax deal. This situation often leads to political gridlock, effectively preventing the passage of any meaningful legislation.

For example, the inability to pass a budget in recent years exemplifies the challenges of navigating such situations.

Influence of Interest Groups, Congress election year tax deal

Interest groups, including business organizations, labor unions, and advocacy groups, often exert significant influence on the legislative process. These groups can lobby members of Congress and support or oppose particular provisions in a tax deal based on their own agendas. For example, a particular business group might lobby for lower corporate tax rates, while a labor union might advocate for tax credits for working families.

The influence of these groups can complicate the process of reaching a bipartisan consensus.

“A tax deal in an election year is inherently vulnerable to political opportunism. Focusing on short-term political gains rather than long-term economic prosperity will likely lead to a fractured outcome.”

Potential for Unforeseen Challenges

Unforeseen economic downturns, unexpected shifts in public opinion, or significant events could further complicate the negotiation and passage of a tax deal. These events can create unpredictable situations, forcing policymakers to adapt their strategies and priorities. For example, a sudden rise in inflation could make certain provisions of a tax deal politically untenable, or a major international event could shift the political climate and necessitate a re-evaluation of the proposed deal.

These unforeseen challenges often require flexibility and adaptability from the negotiating parties.

Illustrative Scenarios

Navigating the political labyrinth of election-year tax deals requires careful consideration of potential outcomes. Factors like public opinion, economic forecasts, and the political climate all play significant roles in shaping the ultimate fate of such legislation. Understanding these diverse scenarios allows for a more nuanced evaluation of the potential impact.

Scenarios of Passage

A successful tax deal hinges on a delicate balance of political will and public support. When broad consensus emerges, the path to passage is smoother. Conversely, significant opposition can create substantial obstacles, necessitating compromises and potentially leading to legislative gridlock.

The upcoming congress election year tax deal is shaping up to be a fascinating political battle. While the details are still emerging, it’s likely to be a complex negotiation. Interestingly, the media’s coverage of the deal often highlights celebrity endorsements or other news cycles, like, for example, Chita Rivera’s key moments in her career , but ultimately, the focus should remain on the financial impact on everyday Americans.

The election year dynamic will certainly make this tax deal a very interesting one to follow.

- Broad Support Scenario: A tax deal enjoys widespread support across the political spectrum, with bipartisan backing from both the House and the Senate. Public opinion polls indicate substantial public backing, and the deal addresses key economic concerns for various segments of the population. The deal likely passes with a comfortable margin in both chambers, with swift and efficient legislative procedures.

This scenario is often characterized by a unified front, allowing for focused negotiations and swift passage. An example of this could be a deal addressing a significant economic downturn or widespread unemployment, where the benefits are clear to most citizens and political parties.

- High Opposition Scenario: The tax deal faces significant opposition from key interest groups and political factions. Public opinion polls reveal a stark divide, and the deal fails to address pressing concerns for significant segments of the population. The deal might encounter procedural roadblocks, amendments that fundamentally alter its nature, or potential filibusters in the Senate. This scenario highlights the need for extensive negotiations and potential compromises, with a likelihood of a protracted legislative process.

This could happen if the deal is perceived as heavily favoring one segment of the population, potentially exacerbating existing political divisions.

Detailed Description of Easy Passage

A tax deal passes easily when it satisfies a broad spectrum of interests. A deal that includes provisions for targeted tax relief for middle-class families, coupled with measures to stimulate job creation and economic growth, often enjoys bipartisan support. A well-defined, clear, and concise presentation of the deal’s provisions is crucial to gain understanding and support. The deal’s economic impact analysis, clearly demonstrating the benefits for all segments of the population, would further bolster its chances.

For example, a deal that addresses a clear economic crisis or widespread unemployment could enjoy substantial support, as the potential benefits are evident.

Detailed Description of Significant Opposition

Significant opposition emerges when the tax deal disproportionately benefits a specific group, creating resentment among others. This could manifest as a perception of unfairness or a lack of transparency in the negotiation process. Political events, like a sudden economic downturn or a significant policy shift, can exacerbate opposition, leading to prolonged debates and possible amendments that alter the original intent of the deal.

For instance, a tax deal that heavily favors large corporations might face intense opposition from labor unions and small business owners. This scenario demonstrates the importance of addressing concerns and concerns proactively during the negotiation phase.

Impact of Political Events

Political events, such as major economic indicators, election cycles, or shifts in public opinion, can significantly impact the passage of a tax deal. A positive economic report, for example, might increase support for a deal, while an unexpected economic downturn could hinder its progress. The timing of the deal in relation to elections is critical, with the likelihood of passage potentially influenced by political motivations and priorities.

Consider the impact of recent inflation, the political narrative surrounding it, and the potential effects of the deal on inflation itself.

Scenarios Affecting the National Debt

The passage of a tax deal can significantly impact the national debt.

- Scenario 1: A tax deal that stimulates economic growth, leading to increased tax revenues, potentially reduces the national debt. Increased economic activity translates to higher tax collections, thus offsetting the tax cuts.

- Scenario 2: A tax deal that includes significant tax cuts, without corresponding spending reductions, likely increases the national debt.

- Scenario 3: A tax deal that includes both tax cuts and spending reductions, but the spending reductions are insufficient to offset the tax cuts, would likely lead to a modest increase in the national debt.

Impact Table

| Scenario | Tax Cuts | Spending Reductions | National Debt Impact |

|---|---|---|---|

| Scenario 1 | Moderate | Significant | Decrease |

| Scenario 2 | Significant | Minimal | Increase |

| Scenario 3 | Moderate | Moderate | Slight Increase |

Final Conclusion

In conclusion, a congress election year tax deal presents a multifaceted challenge for policymakers. The potential for both positive and negative economic impacts is significant, demanding careful consideration of various scenarios. Navigating the political and economic complexities will be crucial for success.

FAQ

What are the typical political motivations behind election-year tax deals?

Often, these deals serve as political tools to gain favor with voters. They can be used to attract support from specific demographics or to appeal to broader economic interests. Sometimes, they represent attempts to address economic concerns or create a positive image for the administration.

How do past tax deals impact the current political climate?

Historical outcomes and public reactions to past deals significantly influence the current political climate. Successes can encourage similar approaches, while failures can deter certain strategies.

What are some common concerns regarding election-year tax deals?

Public concerns often revolve around fairness, economic stability, and the potential for unintended consequences. Concerns regarding the impact on various income brackets and the national debt are frequently raised.

What is the role of interest groups in shaping public opinion regarding tax deals?

Interest groups play a significant role in shaping public opinion through lobbying efforts, media campaigns, and public advocacy. Their influence can vary based on the group’s resources and political connections.