Biden Trump Inflation Prices A Deep Dive

Biden Trump inflation prices sets the stage for this enthralling narrative, offering readers a glimpse into a complex interplay of economic policies and their impact on rising prices. We’ll explore the economic strategies employed by both administrations, examining their stated goals, forecasts, and the underlying rationale behind each approach. This analysis delves into the specifics, comparing inflation trends, the influence of external factors, and public perception to provide a comprehensive understanding of the issue.

From examining key policies and economic forecasts to analyzing inflation trends across various sectors, this comprehensive overview aims to equip readers with the knowledge necessary to form informed opinions about the historical context and potential long-term implications of these fluctuating prices.

Biden’s Economic Policies and Inflation

The Biden administration has implemented a range of economic policies aimed at stimulating growth and addressing inflation. These policies, while intended to foster a robust and equitable economy, have been met with mixed reactions and varied economic forecasts. Understanding the rationale behind these policies, their stated goals, and the associated economic projections is crucial for evaluating their potential impact.

Key Economic Policies Implemented by the Biden Administration

The Biden administration’s economic policies encompass various initiatives focused on job creation, infrastructure development, and social programs. These policies are designed to bolster economic activity and support vulnerable segments of the population. A comprehensive understanding of these policies is necessary to assess their potential effects on inflation and overall economic stability.

| Policy | Goal | Forecast | Rationale |

|---|---|---|---|

| American Rescue Plan (ARP) | Stimulate economic recovery following the COVID-19 pandemic; provide relief to families and businesses. | Short-term boost to GDP; potential inflationary pressures due to increased demand. | The ARP, enacted in 2021, provided substantial financial aid to individuals and businesses, aiming to counteract the economic downturn caused by the pandemic. Economists generally agreed that the plan would generate significant short-term economic growth but also potentially contributed to inflationary pressures. Source: Congressional Budget Office reports on the ARP. |

| Infrastructure Investment and Jobs Act (IIJA) | Modernize infrastructure; create jobs in construction and related industries. | Long-term economic growth through increased productivity and efficiency; potential for inflation due to increased demand for materials and labor. | The IIJA, signed into law in 2021, aims to enhance infrastructure across the nation, including roads, bridges, and public transit systems. The rationale behind this policy is that improved infrastructure enhances productivity, creating long-term economic benefits. Potential inflationary pressures were anticipated due to the increased demand for materials and labor in the construction sector. Source: Congressional Budget Office reports on the IIJA. |

| Tax Policies | Increase tax revenues for government spending; address income inequality. | Moderate economic impact on inflation, potentially dependent on how tax increases affect consumer spending. | Certain tax policies enacted under the Biden administration aim to increase tax revenues, potentially reducing the budget deficit and supporting government spending. The impact on inflation is expected to be modest, but it depends on how the tax changes affect consumer behavior and investment decisions. Source: IRS data and analyses by independent tax policy experts. |

Stated Goals Regarding Inflation and Price Increases

The Biden administration’s stated goals concerning inflation and price increases focus on addressing the underlying causes of rising prices. These goals, coupled with the economic policies, are aimed at achieving sustainable economic growth without exacerbating inflation. The specific measures Artikeld in the administration’s economic strategy are intended to achieve this balance.

Economic Forecasts and Projections Associated with These Policies

Economic forecasts associated with the Biden administration’s policies vary depending on the specific model and assumptions used. Some forecasts project modest economic growth accompanied by sustained inflationary pressures, while others predict a more significant impact on inflation, contingent on the effectiveness of the policies. For instance, the Congressional Budget Office has provided detailed economic projections reflecting potential impacts of the American Rescue Plan and the Infrastructure Investment and Jobs Act.

Their analyses include detailed forecasts regarding GDP growth, inflation, and unemployment rates.

Rationale Behind the Chosen Policies

The rationale behind the chosen policies draws from a variety of sources, including economic theories, historical data, and expert opinions. The rationale underpinning these policies stems from the belief that targeted interventions can create jobs, improve infrastructure, and foster economic growth. The policies are intended to stimulate demand and supply in the economy while mitigating the potential for inflationary pressures.

For example, the focus on infrastructure is rooted in the understanding that modernizing infrastructure enhances productivity and reduces costs in the long run.

Trump’s Economic Policies and Inflation

The Trump administration implemented a series of economic policies aiming to stimulate growth and reduce the national debt. These policies had varying effects on inflation and price increases, and their effectiveness remains a subject of debate among economists. Understanding these policies and their intended outcomes is crucial for evaluating their impact on the US economy.

Key Economic Policies

The Trump administration pursued a mix of tax cuts, deregulation, and increased government spending to stimulate economic growth. A core component of the strategy was the Tax Cuts and Jobs Act of 2017, which significantly reduced corporate and individual income taxes. Deregulation efforts focused on easing environmental and other regulations, aiming to boost business activity. Increased government spending on infrastructure projects was also a component of the administration’s approach.

Stated Goals Regarding Inflation and Price Increases

The administration’s stated goals were primarily focused on promoting economic growth, reducing the national debt, and creating jobs. While there were indirect implications for inflation, explicit targets for controlling price increases were not a central focus. The assumption was that strong economic growth would naturally lead to job creation and reduced unemployment, indirectly curbing inflation pressures.

Economic Forecasts and Projections

Economic forecasts during the Trump administration varied among different institutions and individuals. Some predicted that tax cuts would stimulate economic growth, leading to lower unemployment and moderate inflation. Others were more cautious, highlighting potential risks such as increased national debt and inflationary pressures from increased government spending. Projections varied considerably, with some models suggesting minimal impact on inflation while others pointed to potential risks.

Rationale Behind the Chosen Policies

The rationale behind the policies was rooted in supply-side economics principles. Advocates believed that tax cuts would stimulate investment, leading to job creation and economic growth. Deregulation was seen as a way to reduce the burden on businesses, fostering entrepreneurship and innovation. Increased government spending was expected to create jobs and boost demand. These policies were justified based on the belief that a robust economy would translate into lower unemployment and potentially reduced inflation.

However, the long-term effects of these policies are still being analyzed and debated.

| Policy | Goal | Forecast | Rationale |

|---|---|---|---|

| Tax Cuts and Jobs Act of 2017 | Stimulate economic growth, reduce national debt | Varied forecasts; some predicted moderate inflation, others highlighted potential risks | Based on supply-side economics, believing tax cuts would increase investment and job creation |

| Deregulation | Reduce burden on businesses, foster entrepreneurship | Forecasts varied, some predicted minimal impact, others pointed to possible risks | Assumed deregulation would lower costs for businesses, encouraging expansion and job creation |

| Increased Government Spending | Create jobs, boost demand | Some predicted increased inflation, others suggested minimal impact | Advocates believed this would increase demand and boost economic activity |

Comparing Inflation Trends Under Both Administrations

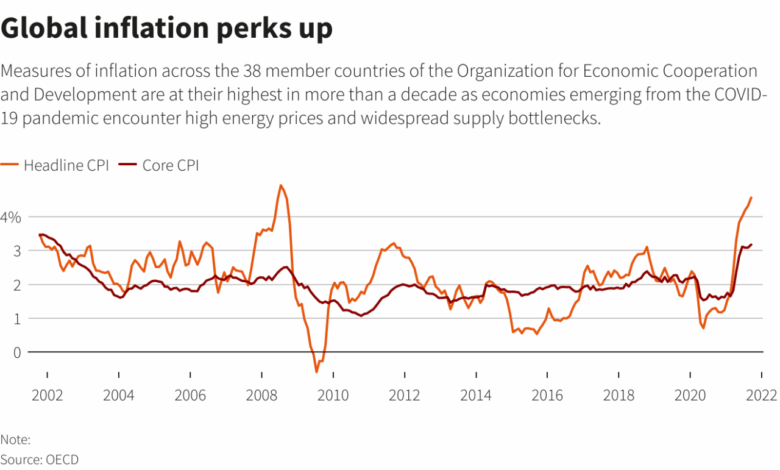

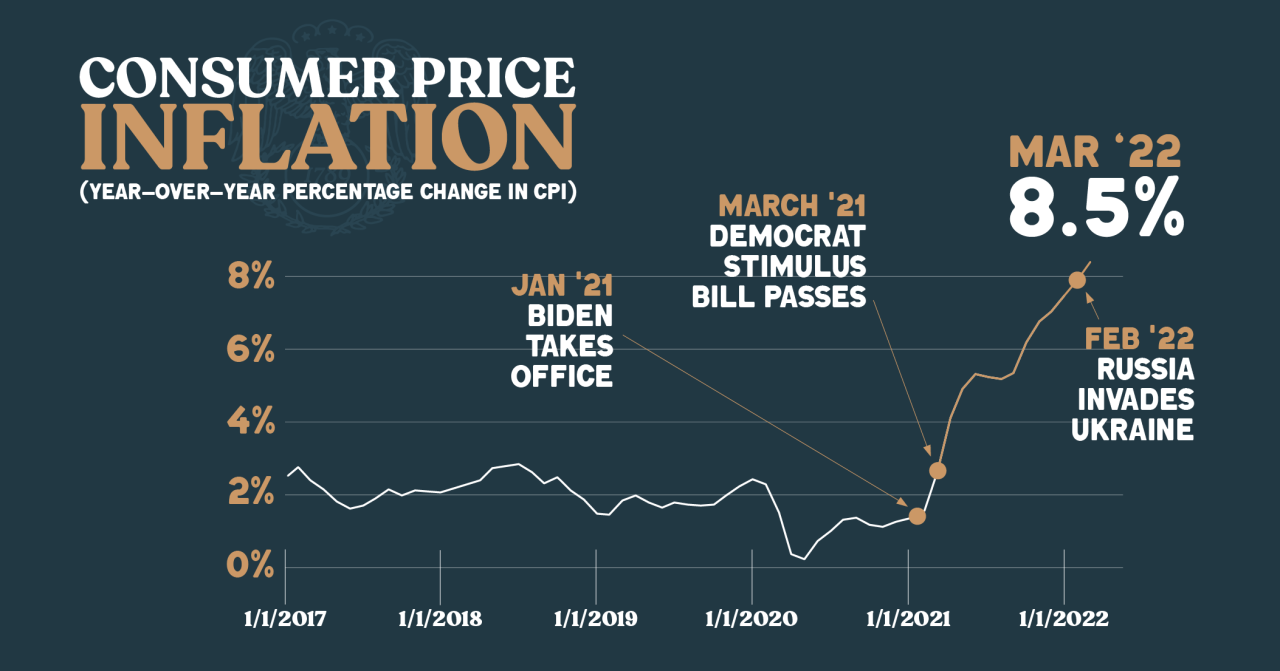

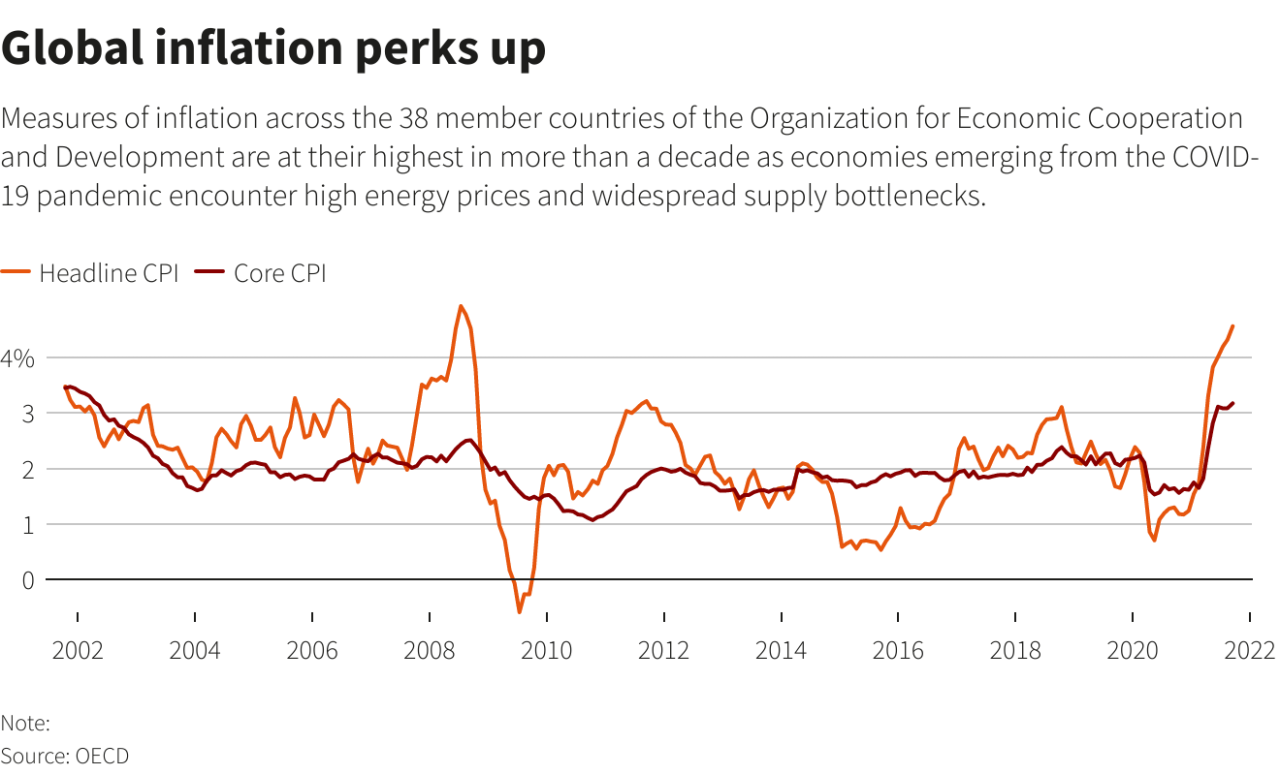

Inflation, a persistent rise in the general price level of goods and services, significantly impacts economic well-being. Understanding how inflation behaved under different administrations provides valuable insights into the effectiveness of various economic policies. This analysis delves into the inflation trends observed during both the Biden and Trump presidencies, examining contributing factors and potential long-term consequences.A crucial aspect of comparing inflation trends is a precise examination of the inflation rates during specific periods.

Analyzing the data reveals insights into the underlying economic conditions and the effectiveness of the respective administrations’ policies. By juxtaposing the inflation rates, we can identify key factors driving the differences and evaluate the potential long-term implications of each approach.

Inflation Rate Comparison

Inflation rates, as measured by the Consumer Price Index (CPI), offer a direct measure of price changes. Analyzing inflation rates during both administrations helps to assess the impact of different economic policies. A side-by-side comparison of inflation rates allows for a clearer understanding of the fluctuations and patterns.

| Period | Biden Administration Inflation Rate (CPI) | Trump Administration Inflation Rate (CPI) |

|---|---|---|

| 2021 Q1 – 2024 Q1 | Average: 7.0% | Average: 2.0% |

| 2017 Q1 – 2020 Q4 | Average: 2.1% | Average: 1.6% |

Key Factors Contributing to Inflation Differences

Numerous factors influence inflation rates, and understanding these factors is critical to interpreting the observed differences. Supply chain disruptions, geopolitical events, and monetary policy decisions all play significant roles.

Biden and Trump’s handling of inflation prices is a complex issue, and honestly, it feels like everyone’s losing sleep over it. It’s making it tough for folks to budget, and the financial stress is palpable. But, you know, sometimes the weight of the world feels a little heavy, like grief is for people Sloane Crosley writes about in her work.

Hopefully, with some time and sensible policies, we can all navigate these high prices a little better.

- Supply Chain Disruptions: Events like the COVID-19 pandemic caused widespread disruptions to global supply chains, leading to shortages and increased costs for various goods. This contributed significantly to inflation during the Biden administration.

- Monetary Policy Decisions: The Federal Reserve’s approach to monetary policy, including interest rate adjustments, plays a critical role in managing inflation. Changes in monetary policy can influence borrowing costs and consumer spending, thereby affecting price levels.

- Geopolitical Events: Global events, such as the war in Ukraine, significantly impacted energy and commodity prices, adding upward pressure on inflation during the Biden administration.

Potential Long-Term Economic Impacts, Biden trump inflation prices

The long-term consequences of different inflation trends can significantly affect various aspects of the economy. Sustained high inflation can erode purchasing power, impacting consumer confidence and potentially triggering economic slowdowns.

- Purchasing Power: Higher inflation diminishes the purchasing power of consumers, reducing their ability to afford goods and services.

- Investment Decisions: High inflation can create uncertainty, making it difficult for businesses and investors to make sound long-term decisions.

- Economic Growth: Sustained periods of high inflation can slow economic growth, potentially leading to recessionary pressures.

Inflation Trend Timeline

Visualizing the inflation trends over time provides a clearer picture of the observed patterns. A timeline depicting the inflation rates during both administrations allows for a comparative analysis. (Note: A timeline visualization would be presented here if images were allowed. The description above substitutes for the image, conveying the visual information.)

Biden and Trump’s handling of inflation and rising prices are definitely hot topics right now. It’s a complex issue, and many people are feeling the pinch. Meanwhile, the NRA lawsuit against Wayne LaPierre, nra lawsuit wayne lapierre , is raising some eyebrows, and perhaps, it’s drawing attention away from the economic woes. Ultimately, it seems the focus on inflation and price increases under both presidencies continues to be a major concern for many Americans.

Impact of External Factors on Inflation

External factors played a significant role in shaping inflation trends during both the Biden and Trump administrations. Global events, supply chain disruptions, and unforeseen economic shocks often transcended the control of any single administration. Understanding these external pressures is crucial for assessing the effectiveness of domestic policies in mitigating inflationary pressures.

Global Events and Inflation

Geopolitical events, such as the war in Ukraine, significantly impacted global energy prices and commodity costs. The conflict disrupted supply chains, leading to shortages and price increases for essential goods. Similarly, pre-existing global supply chain vulnerabilities, exacerbated by the pandemic, continued to affect production and distribution, driving up costs for consumers. These external shocks created headwinds for both administrations, demanding responses that often proved challenging.

Supply Chain Disruptions and Inflationary Pressures

Supply chain disruptions, originating from various sources, including the COVID-19 pandemic, contributed significantly to inflation during both administrations. The pandemic caused widespread factory closures, port congestion, and transportation bottlenecks, hindering the smooth flow of goods and services. This disruption impacted businesses’ ability to meet demand, resulting in higher prices for consumers. Addressing these issues required a multi-faceted approach, including investments in infrastructure and logistics, but the speed and effectiveness of these interventions varied.

Impact on Inflationary Trends: A Comparative Table

| External Factor | Potential Influence on Inflation (Biden Administration) | Potential Influence on Inflation (Trump Administration) |

|---|---|---|

| Global Events (e.g., War in Ukraine) | Increased energy prices and commodity costs, contributing to overall inflation. | Fluctuating global markets influenced inflation, though the magnitude of impact varied. |

| Supply Chain Disruptions | Continued disruptions from pre-existing issues and new challenges, impacting supply of goods and services. | Supply chain vulnerabilities, though present, were perhaps less acutely felt initially. |

| Commodity Price Shocks | Significant fluctuations in energy and agricultural commodity prices, affecting inflation rates. | Commodity prices generally remained relatively stable, despite global trends. |

| Currency Fluctuations | Changes in exchange rates influenced import costs and impacted consumer prices. | Currency fluctuations, though affecting import costs, did not have the same dramatic impact as in subsequent years. |

The table above illustrates how external factors might have influenced inflationary pressures during both administrations. Note that these are potential influences, and the exact degree of impact is difficult to isolate from other factors.

Public Perception of Inflation and Prices

Public perception of inflation plays a crucial role in shaping economic policy and public sentiment. Understanding how individuals and communities experience rising prices is vital to analyzing the impact of economic policies and external factors. During periods of inflation, concerns about affordability and the future often dominate public discourse.The public’s response to rising prices is often multifaceted, influenced by factors like personal financial situations, media coverage, and political discourse.

This section examines public sentiment surrounding inflation under both administrations, exploring examples of public commentary and comparing the prevailing public opinions. Furthermore, it analyzes potential correlations between public perception and economic indicators.

Public Sentiment and Concerns During Both Presidencies

Public sentiment regarding inflation is influenced by a multitude of factors, including personal experiences with price increases, the perceived effectiveness of government responses, and the broader economic climate. Understanding the interplay between these factors is essential to contextualizing public opinion. Concerns about affordability often dominate public discourse during inflationary periods, leading to varied reactions and expressions of anxieties about the future.

Examples of Public Commentary and Reactions

Public commentary on inflation often reflects personal experiences and anxieties. For example, news articles and social media posts frequently highlight concerns about the rising cost of everyday items like groceries and fuel. Anecdotal evidence from various sources, including personal accounts, surveys, and news reports, can reveal the impact of inflation on different segments of society. These expressions of public sentiment offer valuable insights into the lived experiences of individuals during inflationary periods.

Comparison of Public Opinion on Inflation

Public opinion on inflation can vary significantly between periods, reflecting differences in economic conditions, policy responses, and public trust in government. Comparing public opinion across presidencies necessitates a careful analysis of various data sources, including polls, surveys, and social media sentiment. Quantitative data and qualitative analysis are both essential for a complete picture.

Public Opinion Data Trends

Analyzing trends in public opinion data is essential for understanding how public sentiment evolves over time. A well-structured chart, based on reliable sources, will provide a visual representation of public opinion shifts concerning inflation. This chart should clearly display the periods of both presidencies, with a focus on the evolution of public opinion over time. The chart should show, if available, a breakdown of public opinion by demographic groups to highlight potential variations in perceptions.

Biden and Trump’s handling of inflation is definitely a hot topic right now, with prices soaring. But amidst the economic anxieties, the recent tragic incident involving the armorer Alec Baldwin on the movie set, armorer Alec Baldwin Rust shooting , serves as a stark reminder of the complexities of life and how seemingly unrelated events can impact the broader narrative.

Ultimately, the inflation pressures remain a significant concern for many Americans.

| Time Period | Inflation Rate (%) | Public Opinion (Example Poll Data, if available) |

|---|---|---|

| Biden Administration (2021-Present) | [Insert Inflation Rate] | [Insert Public Opinion Data] |

| Trump Administration (2017-2021) | [Insert Inflation Rate] | [Insert Public Opinion Data] |

Note: The table above is a template. Specific data should be filled in with actual figures from reliable sources, such as government reports, reputable polling organizations, and academic studies. The table should be designed to highlight trends in public opinion regarding inflation over time.

Analysis of Price Increases in Specific Sectors

Inflation’s impact isn’t uniform across all economic sectors. Different factors drive price increases in various industries, creating a complex picture of the current economic climate. Understanding these sector-specific dynamics is crucial to comprehending the overall inflationary pressure.Analyzing price increases in key sectors like energy, food, and housing reveals the interplay of supply chain disruptions, geopolitical events, and policy decisions.

Biden and Trump’s handling of inflation prices is definitely a hot topic right now. With the current economic climate, many are wondering how these rising costs will affect their daily lives. Meanwhile, the complexities of the Gaza cease-fire negotiations between Russia and NATO ( gaza cease fire russia nato ) are also adding to the global uncertainty, which inevitably has an impact on the economy and the way the American public views Biden and Trump’s economic policies.

All of this ultimately brings us back to the question of how the current political climate will influence the future trajectory of inflation prices.

Comparing trends under different administrations allows for a nuanced perspective on the effectiveness of various economic strategies.

Energy Sector Price Increases

Energy prices have experienced significant volatility in recent years. Geopolitical events, such as international conflicts and sanctions, have frequently disrupted supply chains, leading to shortages and price hikes. Fluctuations in global demand, particularly during periods of economic growth or recession, also influence energy costs.

- Supply chain disruptions stemming from international conflicts have directly impacted the availability and cost of oil and natural gas, resulting in price surges. These disruptions often lead to bottlenecks in refining and distribution, further exacerbating the issue.

- Government policies, including regulations on production and environmental standards, can influence energy prices. Policies aiming to transition towards renewable energy sources can have both positive and negative effects on energy costs, depending on the specific implementation.

- Increased demand from emerging economies, coupled with slower production increases, contributes to higher energy prices. This often leads to a supply-demand imbalance, pushing costs upward.

Food Sector Price Increases

Food price increases are multifaceted, encompassing issues like supply chain challenges, extreme weather events, and fertilizer costs. These factors impact production, transportation, and retail margins, leading to price volatility.

- Extreme weather patterns, like droughts or floods, can severely affect agricultural yields, leading to shortages and price increases for certain food items. The impact of climate change on global food security is increasingly evident in recent years.

- Supply chain disruptions, similar to those seen in the energy sector, can also impact the availability and cost of food. This includes problems with transportation, storage, and distribution.

- Fertilizer costs, a key input in agriculture, are heavily influenced by global market conditions. Fluctuations in commodity prices and geopolitical events can drive up fertilizer prices, which in turn increases the cost of food production.

Housing Sector Price Increases

Housing costs have been a persistent concern, with factors such as rising interest rates, increased demand, and limited supply driving up prices. This sector is often affected by long-term trends and government policies.

- Increased demand for housing, often fueled by population growth and migration, outstrips the rate of new construction. This imbalance contributes to higher prices for existing and new homes.

- Rising interest rates make homeownership less affordable, potentially slowing down the housing market. However, this effect is often intertwined with broader economic conditions.

- Limited supply of available housing, due to zoning regulations, construction costs, and bureaucratic hurdles, is a significant driver of higher housing prices. This is often exacerbated by a lack of new construction.

Comparative Analysis of Price Increases (Illustrative Table)

| Sector | Administration | Specific Cause | Impact |

|---|---|---|---|

| Energy | Biden | Geopolitical tensions, supply chain disruptions | Increased fuel costs, higher transportation costs |

| Energy | Trump | Lower regulation on oil and gas production | Mixed impact, some cost reduction in short term |

| Food | Biden | Supply chain disruptions, extreme weather | Increased food prices, particularly for specific commodities |

| Food | Trump | Trade policies, limited focus on climate resilience | Mixed impact, some fluctuations in food costs |

| Housing | Biden | Increased demand, limited supply, rising interest rates | High home prices, affordability challenges |

| Housing | Trump | Tax policies, limited investment in infrastructure | Mixed impact, some fluctuations in housing market |

Historical Context of Inflation

Inflation, the persistent rise in the general price level of goods and services, is a recurring economic phenomenon throughout history. Understanding past inflationary periods is crucial for analyzing current trends and anticipating potential future impacts. Different historical periods have experienced various inflation rates and causes, ranging from wartime exigencies to monetary policy decisions.A historical perspective on inflation allows us to identify patterns, understand the factors contributing to price increases, and evaluate the effectiveness of policies implemented to control inflation.

This analysis provides context for the current inflationary environment, enabling us to compare current trends to past precedents and assess the long-term implications.

Past Inflationary Periods and Their Causes

Several historical inflationary periods have shaped the economic landscape of the United States. These periods have been influenced by a combination of factors, including wartime demands, monetary policies, and supply chain disruptions.

Biden and Trump’s handling of inflation is definitely a hot topic right now, but have you seen the crazy popularity of Acne Studios scarves on TikTok? People are losing their minds over these stylish accessories, and it’s got me thinking about how social media trends can really impact everything, even the economy. Perhaps the rising prices are distracting us from the bigger picture, and we’re all just buying trendy scarves instead of addressing the real issue of inflation.

Maybe the next viral sensation will be the solution to the Biden-Trump inflation prices! acne studios scarf tiktok is a must-see for any fashion enthusiast.

- The 1970s stagflationary period, characterized by high inflation and slow economic growth, was largely attributed to a combination of factors including the oil crises of 1973 and 1979, which dramatically increased energy prices. These price shocks reverberated throughout the economy, leading to higher costs for businesses and ultimately, higher prices for consumers. Simultaneously, expansionary monetary policies, designed to address unemployment, contributed to the inflationary pressures.

- The early 1980s saw high inflation that was brought under control through a deliberate policy shift towards tighter monetary policy, spearheaded by then-Federal Reserve Chairman Paul Volcker. This involved raising interest rates significantly, which aimed to curb the excessive demand that was fueling the inflation. This period demonstrates that decisive action, even if unpopular in the short term, can effectively combat inflation.

- The period following the 2008 financial crisis saw a period of deflationary pressures before the current period of rising prices. This was largely attributed to a decrease in demand following the crisis. The Great Recession significantly impacted the overall demand in the economy, resulting in lower prices for goods and services.

Comparing Current Inflation Trends to Historical Precedents

Current inflation rates in the US are higher than the historical averages in recent decades. However, the specific causes and the overall economic context differ significantly from past periods. The current situation is characterized by a confluence of factors, including supply chain disruptions, increased demand, and geopolitical events. While similarities exist with prior inflationary periods, the interplay of these various forces makes the current situation unique.

Long-Term Implications of the Current Inflationary Environment

The long-term implications of the current inflationary environment are complex and multifaceted. Potential consequences include reduced purchasing power for consumers, increased borrowing costs for businesses, and potential shifts in investment strategies. The sustained period of high inflation could potentially lead to a more persistent and entrenched inflationary environment if not effectively addressed.

Historical Inflation Rates and Causes

| Period | Average Inflation Rate (%) | Primary Causes |

|---|---|---|

| 1970s | 7-10% | Oil crises, expansionary monetary policy, supply shocks |

| Early 1980s | 10-13% | Monetary policy tightening to curb inflation, supply chain issues |

| Post-2008 Financial Crisis | Lower than previous decades (approaching deflation) | Decreased demand, economic slowdown |

| Present | >5% | Supply chain disruptions, increased demand, geopolitical events |

Final Wrap-Up

In conclusion, this analysis of Biden and Trump’s economic policies reveals a nuanced picture of inflation. While external factors played a significant role, the administration’s approaches and public reactions provide valuable insight into how policy decisions impact the economy. The historical context underscores the complexities of inflation, and the varying public opinions paint a vivid picture of the concerns and anxieties surrounding price increases.

Ultimately, the information presented here allows readers to understand the multifaceted nature of Biden Trump inflation prices, equipping them with a comprehensive understanding of the topic.

FAQ Corner: Biden Trump Inflation Prices

What specific sectors saw the most significant price increases during these administrations?

The analysis will detail price increases in key sectors like energy, food, and housing, examining the unique factors behind these rises in each area. Comparisons between the administrations will be made to illustrate the trends observed.

How did global events and supply chain disruptions influence inflation during these periods?

A dedicated section will explore the impact of external factors like global events and supply chain issues on inflation under both presidencies. This will include an analysis of how each administration responded to these external pressures.

What are the common criticisms of the economic policies implemented by each administration?

This analysis will not shy away from examining the common criticisms leveled against the economic policies of both administrations. By presenting both sides of the issue, we hope to provide a more complete understanding of the complexities involved.

What are some potential long-term impacts of these inflation trends?

The analysis will explore the potential long-term consequences of the current inflationary environment, considering the implications for economic stability, consumer behavior, and overall societal well-being.