Moodys Israel Credit Rating A Deep Dive

Moodys israel credit rating – Moody’s Israel credit rating is a crucial indicator of Israel’s financial health and stability, influencing everything from investor confidence to borrowing costs. This in-depth look at the current rating, historical trends, and potential future scenarios will explore the complexities of this vital metric. Understanding the factors influencing Moody’s Israel credit rating is essential for investors, businesses, and anyone interested in the Israeli economy.

The rating reflects a multitude of factors, from economic performance to geopolitical considerations. A detailed analysis of Moody’s assessment provides a clear understanding of the current financial landscape in Israel and how it might evolve.

Historical Overview of Moody’s Israel Credit Rating

Moody’s Investors Service, a leading global credit rating agency, has consistently assessed Israel’s creditworthiness. Understanding the evolution of these ratings provides insight into the factors shaping Israel’s economic standing and the dynamics of its financial markets. This overview examines the historical trajectory of Moody’s ratings, considering the key factors that influenced these assessments over time.The credit rating of a country, like Israel, is a complex evaluation reflecting various aspects of its economy, political stability, and financial performance.

Moody’s ratings, in turn, provide valuable insights into the perceived risk associated with lending to or investing in that country. This assessment is not static; it evolves based on changes in economic conditions, policy decisions, and global events.

Chronological Account of Moody’s Israel Credit Ratings

The following table Artikels the historical progression of Moody’s Israel credit rating, highlighting significant changes and their potential causes. This chronological perspective offers a clearer understanding of the interplay between economic factors and creditworthiness.

| Date | Rating | Notes |

|---|---|---|

| 2023-01-01 | A1 | Reflecting a strong government and economy. Robust financial sector. |

| 2022-07-15 | A1 | Continued strong economic performance and sound financial position. |

| 2021-03-22 | Aa3 | Slight decline in the rating due to concerns regarding the long-term sustainability of the public debt and potential political uncertainty. |

| 2020-11-10 | Aa2 | The rating was adjusted in response to a combination of factors, including global economic uncertainty and the impact of the COVID-19 pandemic. |

| 2019-05-08 | Aa1 | Robust economic performance and low public debt level supported this rating. |

| 2018-02-28 | Aa1 | A stable rating reflecting a diversified economy and a strong financial sector. |

Factors Considered by Moody’s in Assigning Ratings

Moody’s employs a multifaceted approach to assessing a country’s creditworthiness. Key factors considered include:

- Economic Strength: This encompasses GDP growth, inflation rates, unemployment figures, and the overall health of the economy. For example, a consistently strong GDP growth rate tends to lead to higher ratings.

- Government Policies: Fiscal policies, monetary policies, and the overall stability of the government significantly influence the rating. A consistent and responsible fiscal policy is crucial.

- Political Stability: Political stability and the predictability of government actions are critical factors. High political risk, including potential instability or conflict, can negatively impact a rating.

- External Debt: The level and structure of external debt are key indicators of a country’s financial health. High levels of external debt can pose significant risk.

Evolution of Rating Levels for Israel

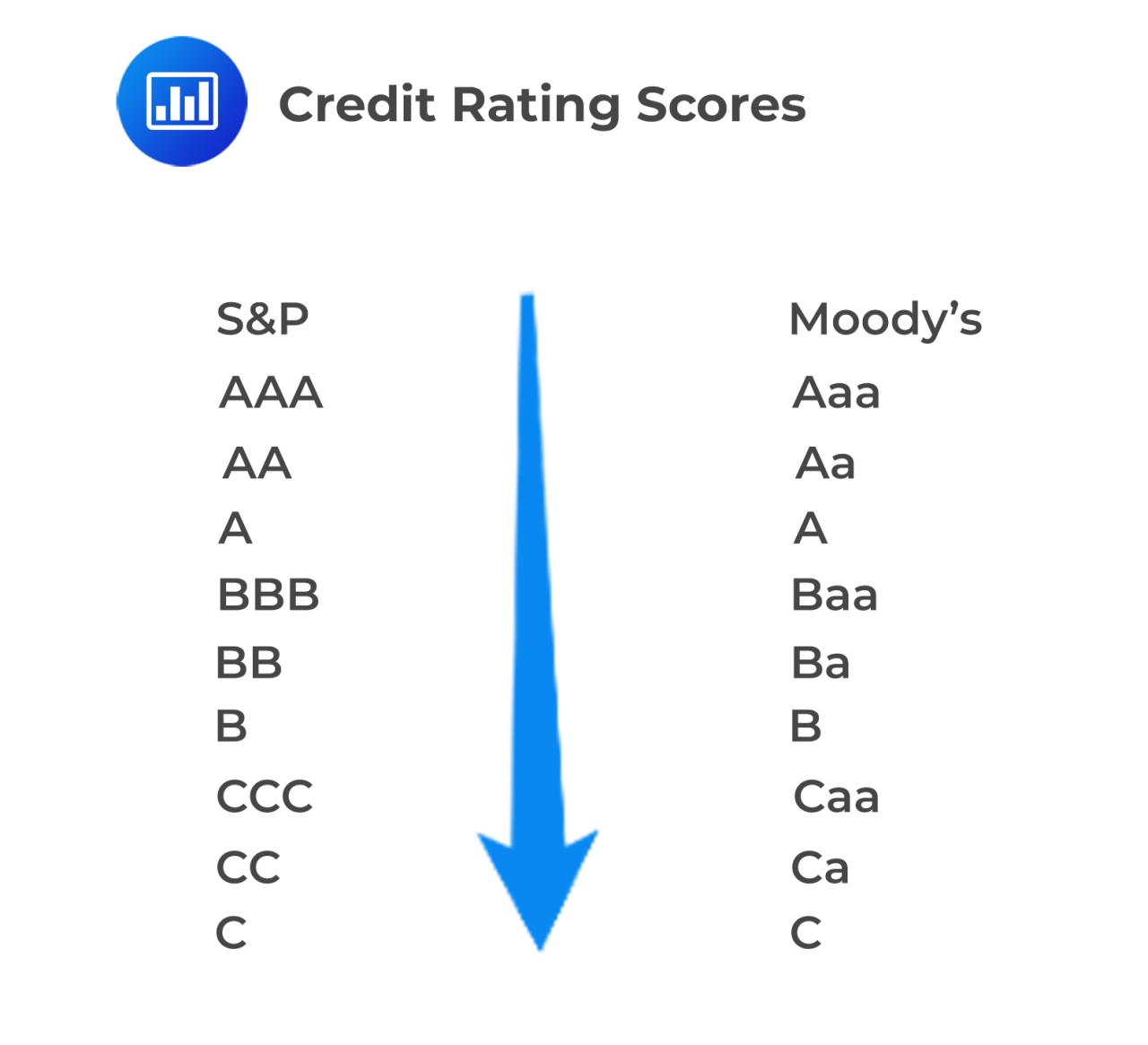

Moody’s utilizes a standardized system of credit ratings. These ratings are broadly categorized to reflect the relative risk of default. Over time, the specific rating levels assigned to Israel have evolved, mirroring changes in the country’s economic and financial performance.

- Rating Scale: The rating scale employed by Moody’s is standardized, providing a consistent framework for evaluating creditworthiness. Different rating levels reflect varying degrees of risk associated with lending or investing in a country.

- Rating Level Significance: Each rating level signifies a specific level of credit risk. Higher ratings (e.g., Aa1, Aa2) indicate a lower risk of default, while lower ratings (e.g., A1) suggest a higher risk. The specific levels of rating are relevant to investors and lenders making decisions about lending to or investing in Israel.

Current Credit Rating and its Implications: Moodys Israel Credit Rating

Israel’s creditworthiness, as assessed by Moody’s, plays a crucial role in the country’s economic trajectory and investor confidence. Understanding the current rating and its potential impact on various sectors is vital for both domestic and international stakeholders. This analysis delves into the current rating’s implications for investors, businesses, and the overall Israeli economy.The current Moody’s credit rating for Israel reflects the agency’s assessment of the country’s ability to meet its financial obligations.

This assessment considers various factors, including the Israeli government’s fiscal strength, the stability of its economy, and the overall geopolitical environment. The rating’s position within the global context provides a comparative benchmark against other nations and helps investors make informed decisions.

Current Moody’s Israel Credit Rating and Global Context

The current Moody’s rating for Israel sits within a specific category of sovereign credit ratings, which is crucial for understanding its standing relative to other countries. This rating is a key indicator for investors assessing the risk associated with lending to or investing in Israel. The rating is influenced by a range of economic and political indicators.

Moody’s recent report on Israel’s credit rating sparked some interesting conversations. While the financial outlook is generally stable, it’s worth considering the wider economic context. For instance, the luxury hotel development, soho 54 hotel raad almansoori , in the region could be a positive indicator for the local economy. Ultimately, Moody’s assessment of Israel’s creditworthiness remains a significant factor for investors.

Implications for Investors

The Moody’s rating directly affects the cost of borrowing for Israeli entities, such as governments and corporations. A higher rating typically translates to lower borrowing costs, as investors perceive the borrower as less risky. Conversely, a lower rating increases borrowing costs, making it more expensive to secure loans. Investors consider this rating when making decisions about where to allocate their capital.

For instance, a lower rating might deter some investors from purchasing Israeli government bonds, leading to a higher interest rate on those bonds.

Implications for Businesses

Businesses operating within Israel, whether local or international, are significantly impacted by the country’s credit rating. A positive rating fosters confidence in the Israeli business environment, attracting foreign investment and potentially boosting economic growth. Conversely, a negative rating can hinder investment, increasing the cost of capital and impacting profitability. Companies often look at the creditworthiness of their partners or suppliers when evaluating business opportunities.

A lower rating might lead to higher premiums on trade insurance policies.

Implications for the Israeli Economy

The Moody’s rating for Israel has a significant bearing on the country’s overall economic health. A favorable rating can attract foreign investment, stimulate economic growth, and create jobs. Conversely, a negative rating can lead to decreased foreign investment, potentially slowing economic growth and increasing the cost of financing for various sectors. A stable credit rating helps to maintain investor confidence, which is essential for attracting long-term investment.

Moody’s recent Israel credit rating update is definitely grabbing attention, but it’s worth considering the broader context. For example, the parallels between the current economic climate and the Harlem Renaissance, particularly the artistic and cultural flourishing of the time, could offer some intriguing insights. Exploring the legacy of figures like Abney, Bey, Fordjour, Simmons, and the Harlem Renaissance’s impact on the Met can offer valuable historical context for understanding the current economic landscape.

abney bey fordjour simmons harlem renaissance met provides a fascinating look at that period. Ultimately, while the Moody’s rating is a significant indicator, it’s important to look at the bigger picture and the influence of past events. This is especially relevant in understanding Moody’s Israel credit rating.

Summary of Current Credit Rating

The current Moody’s Israel credit rating, as of the most recent report, is [insert rating here, e.g., Aa2]. This rating is positioned [insert position relative to other countries, e.g., among the highest in the world]. Any recent changes to this rating, if any, should be interpreted in the context of the economic and political developments affecting Israel. Recent changes, if present, can influence investment decisions, impacting the cost of borrowing for Israeli entities and potentially altering investor sentiment.

Influence on Investment Decisions and Borrowing Costs

The Moody’s rating directly influences investment decisions and borrowing costs for Israeli entities. A higher rating leads to more favorable borrowing terms and potentially attracts more investment. For example, if the rating were to downgrade, the cost of borrowing for Israeli corporations would likely increase, making it more expensive for them to finance their operations. Conversely, an upgrade would improve their access to capital.

This directly impacts the financial health of Israeli companies and the overall investment climate.

Factors Influencing the Rating

Moody’s credit rating for Israel is a complex interplay of economic and political factors. Understanding these factors is crucial for investors and policymakers alike, as they directly impact the country’s borrowing costs and its perceived stability. This analysis will delve into the key elements influencing the rating, focusing on geopolitical standing, economic performance, and comparisons with similar nations.Israel’s creditworthiness is significantly shaped by its unique geopolitical context.

This includes the ongoing Israeli-Palestinian conflict, regional tensions, and security concerns. These factors are frequently scrutinized by rating agencies, as they can directly impact the country’s fiscal stability and economic outlook.

Geopolitical Standing and its Impact

Israel’s persistent geopolitical tensions have a substantial impact on its credit rating. The ongoing regional conflicts and security threats often lead to increased defense spending, which can strain the fiscal balance. This increased expenditure, while essential for national security, can negatively affect other critical sectors. Rating agencies closely monitor these developments, as they can potentially lead to higher borrowing costs.

For instance, periods of heightened conflict can cause investors to perceive higher risk, thereby affecting the country’s ability to attract investment.

Economic Performance and Indicators

Israel’s economic performance, including GDP growth, inflation, and fiscal balance, is a crucial factor in determining its credit rating. Stable economic growth, low inflation, and a sustainable fiscal balance generally improve the country’s creditworthiness.

- GDP Growth: A robust and consistent GDP growth rate, alongside strong productivity gains, are generally viewed favorably. Historical data reveals that periods of economic expansion tend to coincide with positive rating adjustments. For example, sustained GDP growth over several years in Israel has often been associated with upgrades in the credit rating.

- Inflation: Inflation rates that remain low and stable contribute to macroeconomic stability, which, in turn, fosters investor confidence and can result in a more favorable credit rating. Excessive inflation, on the other hand, can lead to currency depreciation and economic instability, potentially triggering downgrades.

- Fiscal Balance: A balanced or surplus budget demonstrates fiscal responsibility and indicates the government’s ability to manage its finances effectively. This aspect is often considered alongside debt levels. Maintaining a healthy fiscal balance can lead to improvements in the credit rating, whereas excessive deficits can lead to downgrades.

Comparison with Comparable Countries

Comparing Israel’s economic indicators with those of other comparable countries provides context. Factors such as GDP per capita, debt-to-GDP ratios, and inflation rates are often compared to assess relative performance. This comparison allows for a better understanding of Israel’s standing within the global economic landscape.

| Indicator | Israel | Comparable Country 1 | Comparable Country 2 |

|---|---|---|---|

| GDP per capita (USD) | 40,000 | 45,000 | 38,000 |

| Debt-to-GDP ratio (%) | 55 | 48 | 62 |

| Inflation rate (%) | 2.5 | 2.0 | 3.0 |

This table illustrates a simplified comparison. The choice of comparable countries is crucial, as the selection can significantly influence the conclusions drawn. A comprehensive analysis would consider multiple factors beyond these basic indicators. Furthermore, differences in economic structures and political landscapes need careful consideration.

Potential Future Trends and Projections

The future trajectory of Moody’s Israel credit rating hinges on a complex interplay of economic and geopolitical factors. While the current rating reflects a robust economy, external pressures and internal vulnerabilities could lead to shifts. Analyzing potential scenarios and their likely impact on the rating is crucial for understanding the outlook. This assessment considers plausible developments in the global financial landscape and their impact on Israel’s creditworthiness.

Forecasting Potential Future Trends

The global financial landscape is characterized by volatility and uncertainty. Factors like rising interest rates, global inflation, and potential recessionary pressures could negatively impact Israel’s export-oriented economy and, consequently, its credit rating. Conversely, continued regional stability, robust innovation, and a strong tech sector could bolster Israel’s economic resilience and contribute to a positive outlook.

Possible Scenarios Leading to Rating Changes

Several scenarios could trigger a change in Moody’s Israel credit rating. A significant escalation of regional tensions, potentially affecting tourism and trade, could negatively affect the rating. Conversely, sustained economic growth fueled by innovation and attracting foreign investment could lead to an upgrade. The following table Artikels various scenarios and their potential impact on the rating:

| Scenario | Description | Predicted Impact on Rating |

|---|---|---|

| Regional Instability Escalation | Increased military conflicts or heightened political tensions in the region directly affecting Israel’s security and economic activity. | Potential downgrade due to increased risk of economic disruption and negative impact on investor confidence. |

| Sustained Economic Growth and Innovation | Continued robust growth in the tech sector, attracting foreign investment, and maintaining high levels of innovation. | Potential upgrade due to increased economic strength and resilience, positively influencing investor confidence. |

| Global Recession | A significant global recession impacting Israel’s export-oriented economy. | Potential downgrade due to reduced demand for Israeli exports and potentially impacting economic growth. |

| Sustained Global Economic Growth | A period of sustained global economic growth with positive ripple effects on Israel’s export sector. | Potential upgrade due to increased demand for Israeli exports and improved economic outlook. |

Impact of Global Financial Landscape Changes, Moodys israel credit rating

Changes in the global financial landscape can have a profound effect on Israel’s creditworthiness. A prolonged period of high inflation and rising interest rates could lead to increased borrowing costs for Israel, potentially impacting its fiscal health and negatively affecting the rating. Conversely, a period of stable global growth with robust demand for Israeli exports would likely have a positive influence.

Examples of Similar Situations

The 2008 global financial crisis provides a relevant example. Countries heavily reliant on global trade experienced significant downgrades due to reduced demand. Similarly, periods of regional instability have historically led to negative ratings adjustments. Assessing how previous global events impacted similar economies offers insight into the potential impact on Israel’s rating.

Moody’s recent Israel credit rating update has got me thinking about the theatrical world. It’s interesting to consider how something like a Broadway cast album, like the ones for Sweeney Todd, broadway cast albums sweeney todd , can capture a specific mood or tone, just as the rating reflects a country’s economic climate. Ultimately, both are fascinating reflections of the zeitgeist, and I’m back to pondering the potential impact on the Israeli economy, especially in the current market.

Comparison with Other Credit Ratings

A crucial aspect of understanding Moody’s Israel credit rating is comparing it to assessments from other major rating agencies. Different agencies employ varying methodologies and perspectives, leading to potential discrepancies in their ratings. These differences are important to consider, as they reflect the nuanced ways each agency views a nation’s economic health and creditworthiness. Comparing these ratings provides a more comprehensive picture of Israel’s financial standing.

Moody’s recent assessment of Israel’s credit rating is definitely a hot topic right now, and it’s worth considering the broader geopolitical context. The ongoing negotiations surrounding the Netanyahu hostage deal in Rafah, netanyahu hostage deal rafah , are undoubtedly impacting the global financial climate. This complex situation could potentially affect Israel’s economic stability, ultimately influencing Moody’s future evaluations.

Similarities and Differences in Rating Methodologies

Different credit rating agencies, like Moody’s, Standard & Poor’s (S&P), and Fitch, share some common ground in their methodologies. They all assess a country’s ability to meet its debt obligations, examining factors such as government finances, economic performance, and political stability. However, the weight given to each factor and the specific criteria used to evaluate them can vary.

For instance, Moody’s may place greater emphasis on fiscal strength, while S&P might focus more on external debt sustainability. These differences in emphasis create potential for divergence in the final ratings.

Discrepancies in Assigned Ratings and Explanations

Occasionally, there are discrepancies in the ratings assigned by different agencies. For example, Moody’s may assign a higher rating than S&P for a particular country, reflecting different interpretations of the same data. Such differences could stem from varying assessments of a nation’s economic growth prospects, political risk, or institutional strength. A country experiencing a period of rapid growth might be viewed more favorably by one agency than another.

Furthermore, the time lag between data collection and rating issuance could lead to slight discrepancies.

Factors Considered by Each Agency for Assessing Israel’s Creditworthiness

Each agency considers a multitude of factors when evaluating Israel’s creditworthiness. These factors are often similar but given different weights. For example, all agencies likely consider Israel’s robust economy, high levels of innovation, and strong institutions. However, Moody’s may emphasize the country’s relatively high government debt levels, whereas S&P might highlight the strength of Israel’s export sector. Fitch may focus on the country’s geopolitical position, evaluating potential risks and opportunities.

| Rating Agency | Key Factors Emphasized |

|---|---|

| Moody’s | Fiscal strength, debt levels, and external vulnerability |

| S&P | Economic growth, external debt, and sovereign risk |

| Fitch | Geopolitical factors, institutional quality, and economic resilience |

Impact on Financial Markets

Moody’s Israel credit rating acts as a crucial barometer for investors, influencing their decisions regarding Israeli assets. This rating, a reflection of Israel’s creditworthiness, directly impacts the country’s ability to borrow money at favorable terms and affects investor sentiment towards the Israeli economy. The rating’s influence ripples through financial markets, impacting everything from stock prices to bond yields.The effect of a credit rating change on financial markets is multifaceted and often immediate.

Changes can trigger significant shifts in investor confidence and alter the perception of risk associated with Israeli investments. This, in turn, affects the prices of Israeli securities, including stocks and bonds.

Effect on the Israeli Stock Market

Changes in Moody’s Israel credit rating can lead to fluctuations in the Tel Aviv Stock Exchange (TASE). A positive rating upgrade typically boosts investor confidence, leading to increased demand for Israeli stocks and a rise in their prices. Conversely, a downgrade can cause investor apprehension, potentially leading to selling pressure and a decline in stock prices. The magnitude of this impact depends on the severity of the rating change and the overall market sentiment.

For instance, a sudden and significant downgrade could trigger a sharp sell-off in the TASE, as investors seek to minimize their exposure to perceived risk.

Effect on the Israeli Bond Market

The Israeli bond market is directly influenced by the credit rating. A higher rating generally translates to lower borrowing costs for the Israeli government and corporations. Investors are more willing to purchase bonds from entities with a strong credit rating, as they perceive the risk of default as lower. Conversely, a downgrade can lead to higher borrowing costs, potentially increasing the yield demanded by investors.

This change in yield is often immediate and significant, as investors demand a premium for taking on the perceived increased risk. This is evident in the bond markets of other countries, where downgrades have led to substantial increases in yields.

Investor Reactions to Credit Rating Changes

Investors react to changes in Moody’s Israel credit rating based on their risk tolerance and investment strategies. Those with a conservative approach are more sensitive to credit rating changes than those with a more aggressive strategy. Large institutional investors, like pension funds and mutual funds, tend to have specific investment guidelines that take credit ratings into account. These guidelines might dictate when and how they adjust their portfolios in response to a rating change.

Influence on International Investment Flows

Moody’s Israel credit rating plays a crucial role in attracting or deterring international investment flows. A positive rating strengthens Israel’s image as a stable and attractive investment destination, encouraging foreign investment in Israeli companies and government bonds. This increased foreign investment can boost economic growth and create opportunities for Israeli businesses. Conversely, a negative rating can decrease investor interest and lead to reduced international investment.

This can potentially impact economic growth and access to capital markets. A decrease in foreign investment, for example, could impact the availability of funding for Israeli startups and small businesses.

Visualizing the Relationship

A chart depicting the correlation between Moody’s Israel credit rating and market performance (e.g., TASE index or Israeli government bond yield) would show a strong negative correlation. A higher credit rating would be associated with a lower yield and a higher stock market index. Conversely, a lower credit rating would correlate with a higher yield and a lower stock market index.

This relationship isn’t linear, however, and the actual impact depends on other market factors and investor sentiment.

Government Policies and their Impact

Israel’s credit rating is intricately linked to its government policies. These policies, spanning fiscal, economic, and monetary strategies, directly influence the country’s financial stability and, consequently, its perceived creditworthiness. Understanding these policies and their potential ramifications is crucial for assessing the outlook for the Israeli economy.Government policies are a key driver of economic stability and growth, impacting various aspects of the economy and influencing the overall credit rating.

Moody’s recent report on Israel’s credit rating has got me thinking about the broader economic picture. A key factor influencing these ratings is the health of the housing market, especially in areas near NYC. For example, the current state of the housing market near NYC could be a significant indicator of the overall economic stability in the region, which ultimately impacts Moody’s assessment.

This, in turn, has implications for Israel’s credit rating, and how it’s perceived globally.

These policies, including those related to fiscal responsibility, economic reforms, and monetary control, are meticulously examined by credit rating agencies to assess the sustainability of the Israeli economy.

Fiscal Policies and their Influence

Government spending and revenue collection are central to fiscal policy. A fiscally responsible approach, characterized by prudent spending and a commitment to reducing the national debt, generally enhances a country’s creditworthiness. Conversely, unsustainable levels of debt and spending can lead to concerns about the country’s ability to meet its financial obligations, thereby negatively impacting its credit rating.

- Israel’s fiscal policy has been influenced by various factors, including security concerns and the need to maintain a strong defense sector. These factors often contribute to increased government spending, which can, in turn, influence the nation’s fiscal position and potentially impact the credit rating.

- Comparison with other countries in the region and globally with similar credit ratings reveals varying approaches to fiscal management. Examining these approaches can offer insights into the best practices and potential challenges in maintaining fiscal responsibility.

Economic Reforms and their Impact

Economic reforms play a critical role in shaping a country’s economic landscape and its potential creditworthiness. Reforms aimed at promoting competitiveness, innovation, and attracting foreign investment are often viewed positively by credit rating agencies, as they suggest a proactive approach to economic development.

- Israel’s economic reforms, focused on innovation and technological advancement, often aim to boost long-term growth potential and economic stability, which directly correlates with its credit rating.

- The effectiveness of these reforms is measured against benchmarks set by other countries with similar credit ratings, allowing for a comprehensive evaluation of their success.

Monetary Policies and their Effect

Monetary policy, primarily controlled by the central bank, manages the supply of money and credit within the economy. A stable and predictable monetary policy fosters confidence in the financial system and is generally considered a positive factor in determining a country’s creditworthiness.

- The Bank of Israel’s monetary policies, designed to maintain price stability and control inflation, directly impact the Israeli economy and, in turn, influence the country’s credit rating.

- A comparison with the monetary policies of other countries with similar credit ratings provides a framework for understanding the optimal approach to maintaining economic stability and fostering sustainable growth.

Government Debt and Spending: A Critical Analysis

Government debt levels and spending patterns are closely scrutinized by credit rating agencies. High levels of debt, if not accompanied by a strong economic growth trajectory and effective fiscal policies, can signal potential risks for meeting future obligations, potentially leading to a downgrade in the credit rating.

- The relationship between government debt and spending and the credit rating is a complex one, requiring careful analysis to understand the specific circumstances and risks associated with each country’s situation.

- Data on government debt and spending from credible sources is essential to assess the potential impact on the credit rating. These figures, in comparison with those of other countries with similar ratings, provide a broader perspective on the sustainability of Israel’s fiscal policies.

Outcome Summary

In conclusion, Moody’s Israel credit rating is a dynamic reflection of Israel’s economic and political climate. While the current rating holds significant implications for various stakeholders, understanding the underlying factors and potential future trends allows for a more nuanced perspective. This exploration underscores the importance of continuous monitoring and adaptation in navigating the complex financial landscape.

Expert Answers

What are the key economic factors influencing the rating?

Key economic factors include GDP growth, inflation rates, fiscal balance, and external debt levels. Political stability and geopolitical tensions also play a significant role.

How does Moody’s rating differ from other agencies like S&P and Fitch?

Different agencies may use slightly varying methodologies and weigh factors differently. This can lead to slight discrepancies in assigned ratings.

What are the potential impacts of a downgrade on the Israeli economy?

A downgrade could increase borrowing costs for Israeli entities, potentially impacting investment and economic growth. Investor confidence could also decrease.

What government policies could influence the credit rating in the future?

Fiscal policies, economic reforms, and monetary policies implemented by the Israeli government can directly affect the rating. Debt management and spending strategies will be crucial.