NY Kendras Law Audit A Comprehensive Guide

Ny kendras law audit – NY Kendra’s Law Audit: Navigating the complexities of compliance in New York. This guide delves into the intricacies of the audit process, providing a clear and concise overview of the requirements, procedures, and potential implications for organizations operating within the state. Understanding the specific legal framework, data analysis methods, and case studies are crucial to ensuring smooth compliance and a thorough grasp of the audit process.

This comprehensive resource explores the essentials of a NY Kendra’s Law audit, covering everything from defining the law itself to outlining the necessary procedures and data analysis techniques. The guide further explores various case studies, demonstrating the practical application of the audit framework and its impact on different organizations. A thorough understanding of the audit process is crucial to successful compliance and proactive risk management.

Overview of NY Kendra’s Law Audit

New York State’s Kendra’s Law is a crucial component of the state’s approach to mental health and public safety. It aims to provide a structured and supportive framework for individuals with serious mental illness who may pose a risk to themselves or others. This law, implemented with the intention of reducing harm and promoting well-being, has significant implications for service providers and the individuals they serve.

The NY Kendra’s Law audit is a crucial process, but it’s important to consider the broader context. Recent events involving renters in Williamsburg, Brooklyn, and Kiev, Ukraine, highlight the complexities of housing issues across borders, as detailed in this article: renters williamsburg brooklyn kiev ukraine. Ultimately, a thorough NY Kendra’s Law audit needs to consider these external factors to provide a comprehensive understanding of the issues.

A thorough audit of Kendra’s Law programs is essential to ensuring the effectiveness, compliance, and ethical delivery of these services.The purpose of an audit related to NY Kendra’s Law is to evaluate the adherence to established laws, regulations, and best practices in the implementation of the program. It seeks to identify areas of strength and areas needing improvement, ultimately contributing to a more efficient, effective, and equitable system of care for individuals with serious mental illness.

An audit helps maintain accountability and promotes the ongoing development of a system that prioritizes both public safety and the well-being of individuals.

Definition of NY Kendra’s Law

Kendra’s Law in New York mandates that individuals with a history of serious mental illness and violent behavior are eligible for court-ordered community-based treatment. The law recognizes that appropriate interventions and support can prevent future harm while promoting the person’s well-being. This proactive approach differentiates it from reactive measures and seeks to prevent crises before they escalate.

Purpose and Objectives of an Audit

The primary objectives of a NY Kendra’s Law audit are to assess the effectiveness and efficiency of the program’s implementation, ensure compliance with all relevant laws and regulations, identify potential areas for improvement, and promote transparency and accountability. This systematic review aims to optimize the utilization of resources and ensure the safety of the community.

Scope of a NY Kendra’s Law Audit

A typical audit encompasses a broad range of activities, from evaluating individual case files to reviewing program policies and procedures. It scrutinizes the intake process, the assessment of risk factors, the development and implementation of treatment plans, and the ongoing monitoring of participants. This comprehensive review encompasses the entire continuum of care, from initial contact to discharge or completion of services.

My recent dive into NY Kendra’s Law audit highlighted some serious issues, but the potential ecological collapse of the Amazon rainforest, particularly the amazon rain forest tipping point , is a truly terrifying prospect. These environmental concerns make the NY Kendra’s Law audit even more crucial, as they underscore the importance of robust legal frameworks that protect vulnerable populations and ensure accountability.

We need to address these issues with urgency and dedication.

Potential Benefits of a NY Kendra’s Law Audit

Conducting a thorough audit yields several key benefits. It can identify areas where services are not being delivered effectively or where resources are not being utilized optimally. It helps to improve the quality of care for individuals under the program, enhance community safety, and build trust between stakeholders. Audits foster transparency, accountability, and continuous improvement within the system.

Types of Audits Under NY Kendra’s Law

Different types of audits may be conducted under NY Kendra’s Law, depending on the specific focus and objectives. These may include compliance audits, program effectiveness audits, financial audits, and individual case file reviews. The chosen type of audit is tailored to the particular needs and concerns identified.

Key Components of a NY Kendra’s Law Audit

The following table Artikels the crucial components of a NY Kendra’s Law audit. These components ensure a comprehensive and systematic evaluation of the program’s operation.

| Component | Description | Example | Further Considerations |

|---|---|---|---|

| Data Collection | Gathering relevant information from various sources, including participant records, program reports, and agency documentation. | Collecting data on the number of individuals enrolled, the types of services provided, and the outcomes of treatment. | Ensuring data accuracy and confidentiality throughout the collection process. |

| Reporting | Producing a comprehensive report that summarizes findings, identifies areas for improvement, and provides recommendations. | A report detailing compliance issues, suggesting policy changes, and highlighting successful practices. | Tailoring the report to be easily understood by stakeholders and decision-makers. |

| Compliance | Verifying that all program activities adhere to established laws, regulations, and best practices. | Checking if treatment plans meet mandated requirements and if staff are properly trained. | Evaluating the appropriateness of the program’s procedures for diverse populations. |

| Recommendations | Formulating actionable suggestions to enhance the program’s effectiveness, address identified weaknesses, and promote future success. | Recommending staff training on new laws or suggesting modifications to program policies. | Ensuring recommendations are practical and feasible to implement. |

Legal Framework and Requirements

Navigating the intricacies of NY Kendra’s Law audits requires a deep understanding of the legal framework underpinning the process. This framework ensures accountability and protects the rights of individuals involved, while maintaining the safety of the community. This section delves into the specific legal requirements, highlighting the roles and responsibilities of various stakeholders and the implications of non-compliance.The legal requirements for conducting audits under NY Kendra’s Law are meticulously detailed in relevant statutes, regulations, and guidelines.

I’ve been digging into NY Kendra’s law audit lately, and it’s fascinating how it intersects with the housing market. High-end properties like those in the 800000 dollar homes california market are often complex, and a thorough audit of the law is crucial to ensure fairness and transparency. The legal implications of such an audit are significant, and NY Kendra’s law is just one example of how intricate legal frameworks can impact various aspects of our lives.

These legal instruments Artikel the procedures to be followed, ensuring transparency and fairness throughout the audit process. Understanding these requirements is crucial for all stakeholders to ensure adherence to the law.

Statutory and Regulatory Basis

NY Kendra’s Law, as enshrined in specific statutes and regulations, provides the foundational framework for audits. These legal instruments dictate the scope of the audit, the information to be collected, and the procedures to be followed. The regulations often provide further clarification and practical guidance on implementing the statutory provisions.

Stakeholder Roles and Responsibilities

The audit process involves multiple stakeholders, each with defined roles and responsibilities. This includes the auditing agency, the facility subject to the audit, and potentially other relevant parties, such as individuals with experience in the area. Each stakeholder’s role is crucial for the smooth and effective conduct of the audit, ensuring all legal requirements are met.

The NY Kendra’s law audit is a crucial process, scrutinizing the implementation of the law. Interestingly, recent news about the return of Romeo Gigli to Marrakech, return of romeo gigli marrakesh , might, in some ways, highlight the importance of these audits. This return, potentially related to business interests, will undoubtedly add another layer of complexity to the ongoing NY Kendra’s law audit, particularly if it involves potential violations of the law.

- The auditing agency is responsible for conducting the audit in accordance with the prescribed procedures and guidelines.

- The facility being audited has a responsibility to cooperate with the auditing agency and provide all necessary information and documentation.

- Individuals with knowledge of the facility’s operations, including the program’s leadership, may also be involved to offer their expertise during the audit process.

Potential Legal Implications of Non-Compliance

Failure to adhere to the procedures Artikeld in NY Kendra’s Law can result in significant legal implications. Non-compliance can lead to penalties, fines, or even legal action, depending on the severity of the violation. Understanding these implications is crucial for all parties involved in the audit process to ensure compliance.

Key Legal Terms

- Kendra’s Law: This is the overarching legislation governing the voluntary commitment and care of individuals with mental health conditions. It emphasizes community-based care and the protection of individual rights.

- Voluntary commitment: An individual’s agreement to participate in a mental health treatment program.

- Facility compliance: The adherence of a mental health facility to the provisions of Kendra’s Law.

- Audit procedures: The established methods and guidelines for conducting an audit of a mental health facility.

- Subpoena: A legal order requiring the production of documents or the testimony of individuals.

Audit Procedures and Methods

A thorough NY Kendra’s Law audit is crucial for ensuring compliance and effectiveness of programs. This process involves a systematic examination of the program’s operations, adherence to legal frameworks, and the overall well-being of individuals served. A well-designed audit procedure will provide a clear roadmap for the process, allowing for a comprehensive and unbiased evaluation.A successful audit hinges on meticulous procedures, diverse data collection methods, and robust record-keeping.

This section details the essential components for conducting a comprehensive and effective NY Kendra’s Law audit.

Step-by-Step Audit Procedure

The audit process should follow a structured approach to ensure thoroughness and objectivity. This involves a series of steps designed to cover all aspects of the program, from intake to discharge. This structured approach guarantees that no critical area is overlooked.

- Initial Planning and Preparation: Define the audit scope, objectives, and timeline. Identify key personnel involved and necessary resources. This phase ensures clarity and focuses the audit.

- Document Review: Examine relevant policies, procedures, and records to understand the program’s operations. This step provides context and a baseline for comparison.

- Site Visits and Observation: Conduct on-site visits to observe program activities, interactions, and facilities. Direct observation offers valuable insights into the practical implementation of the program.

- Data Collection: Gather quantitative and qualitative data from various sources, including client records, staff interviews, and program reports. A diversified data collection strategy enhances the audit’s depth and breadth.

- Data Analysis and Evaluation: Analyze collected data to identify areas of compliance, non-compliance, and areas needing improvement. Statistical and qualitative analyses provide actionable insights.

- Reporting and Recommendations: Compile findings into a comprehensive report that clearly articulates the audit’s conclusions and recommendations. Clear and concise reporting facilitates the implementation of improvements.

- Follow-up and Monitoring: Monitor the implementation of recommendations and assess their impact. This ensures the program continues to meet its objectives.

Data Collection and Analysis Methods

Effective data collection is crucial for a comprehensive audit. Utilizing a mix of methods ensures a more holistic understanding of the program’s performance.

- Quantitative Data Collection: Use surveys, questionnaires, and data analytics to measure program outcomes and client satisfaction. Numerical data provides a quantifiable assessment of the program’s effectiveness.

- Qualitative Data Collection: Conduct interviews with clients, staff, and stakeholders to gain a deeper understanding of their experiences and perspectives. Qualitative data provides insights into the program’s impact on individuals and the nuances of its operations.

- Statistical Analysis: Apply statistical methods to analyze quantitative data, identify trends, and assess program outcomes. Statistical methods provide objectivity and patterns that would be missed with simple observation.

- Thematic Analysis: Identify recurring themes and patterns in qualitative data to gain insights into program effectiveness and client experiences. This is a method to uncover recurring patterns and sentiments in qualitative data.

Documentation and Record-Keeping

Comprehensive documentation is essential for maintaining transparency and accountability in a NY Kendra’s Law audit.

- Maintaining Detailed Records: Thorough documentation of all procedures, interactions, and decisions is crucial. This enables traceability and reproducibility.

- Accurate and Timely Reporting: All findings and recommendations should be documented in a clear and concise manner, with proper citations. This ensures accountability and clarity in the audit process.

- Secure Storage of Records: Maintain records in a secure and organized manner to protect sensitive information and ensure compliance with confidentiality standards. This is crucial for legal and ethical compliance.

Necessary Resources and Tools

Several resources and tools are essential for conducting a successful NY Kendra’s Law audit.

- Trained Personnel: Employ qualified individuals with expertise in social work, law, and auditing to conduct the audit. A team with diverse expertise guarantees a multifaceted approach.

- Software and Technology: Utilize appropriate software for data collection, analysis, and report generation. Technology can significantly improve efficiency and accuracy.

- Budget and Funding: Allocate sufficient budget to cover travel, personnel, and other necessary expenses. This is crucial for effective audit implementation.

Best Practices

Adhering to best practices enhances the audit’s effectiveness and credibility.

- Objectivity and Impartiality: Ensure that the audit process is conducted with objectivity and impartiality. A fair and balanced approach promotes credibility.

- Confidentiality and Privacy: Maintain confidentiality and protect the privacy of all individuals involved in the program. This is crucial for ethical conduct.

- Collaboration and Communication: Foster collaboration among stakeholders and maintain clear communication throughout the audit process. This ensures smooth collaboration.

Audit Methods Applicability Table

| Method | Description | Strengths | Weaknesses ||—|—|—|—|| Quantitative Analysis | Statistical analysis of numerical data | Provides objective measurements; identifies trends | May overlook qualitative factors || Qualitative Interviews | In-depth conversations with stakeholders | Uncovers perspectives, experiences, and nuances | Can be time-consuming and subjective || Document Review | Examination of policies, procedures, and records | Provides context, history, and operational details | May not capture current practices || Site Observation | Direct observation of program activities | Provides real-time insights into program operations | Can be influenced by observer bias |

Data Analysis and Reporting

Unraveling the findings of a NY Kendra’s Law audit requires a systematic approach to data analysis and a clear presentation of the results. This stage is crucial for identifying areas needing improvement, ensuring compliance, and ultimately, protecting vulnerable individuals. A robust analysis allows for the identification of patterns, trends, and potential risks within the system.Thorough data analysis and comprehensive reporting are essential for effective implementation of Kendra’s Law.

This includes not only identifying compliance issues but also highlighting areas of success and providing actionable recommendations for enhancement. The objective is to transform raw data into actionable insights that inform policy decisions and improve the overall well-being of individuals served by the program.

Data Analysis Process, Ny kendras law audit

The process of analyzing data collected during a NY Kendra’s Law audit involves several key steps. First, the collected data is meticulously reviewed and cleaned to ensure accuracy and consistency. This involves identifying and correcting any errors or inconsistencies in the data, and ensuring the data is properly formatted for analysis. Next, relevant statistical measures and techniques are applied to the cleaned data.

This step often involves identifying patterns, trends, and correlations within the data. Finally, the results are interpreted in the context of the specific requirements of Kendra’s Law. This stage often involves comparing the findings against established benchmarks and best practices.

Interpreting Audit Findings

Interpreting audit findings requires a nuanced understanding of the data and the specific context of Kendra’s Law. Qualitative analysis is crucial, combining numerical data with observations and insights gleaned from interviews, documentation reviews, and site visits. This allows for a more comprehensive understanding of the situation, revealing potential root causes of any identified issues and offering valuable insights beyond simple numerical comparisons.

Comparing the findings against established benchmarks, best practices, and previous audit results provides context and allows for a more objective evaluation.

Comprehensive Audit Report Structure

A comprehensive audit report should be structured to facilitate easy understanding and action. It should begin with an executive summary that concisely presents the key findings and recommendations. The body of the report should include a detailed description of the audit methodology, a clear presentation of the data analysis, and a discussion of the findings. The report should also include specific recommendations for improvement, based on the analysis of the collected data.

Finally, appendices containing supporting documentation, raw data, and any other relevant materials should be included.

Clear and Understandable Presentation

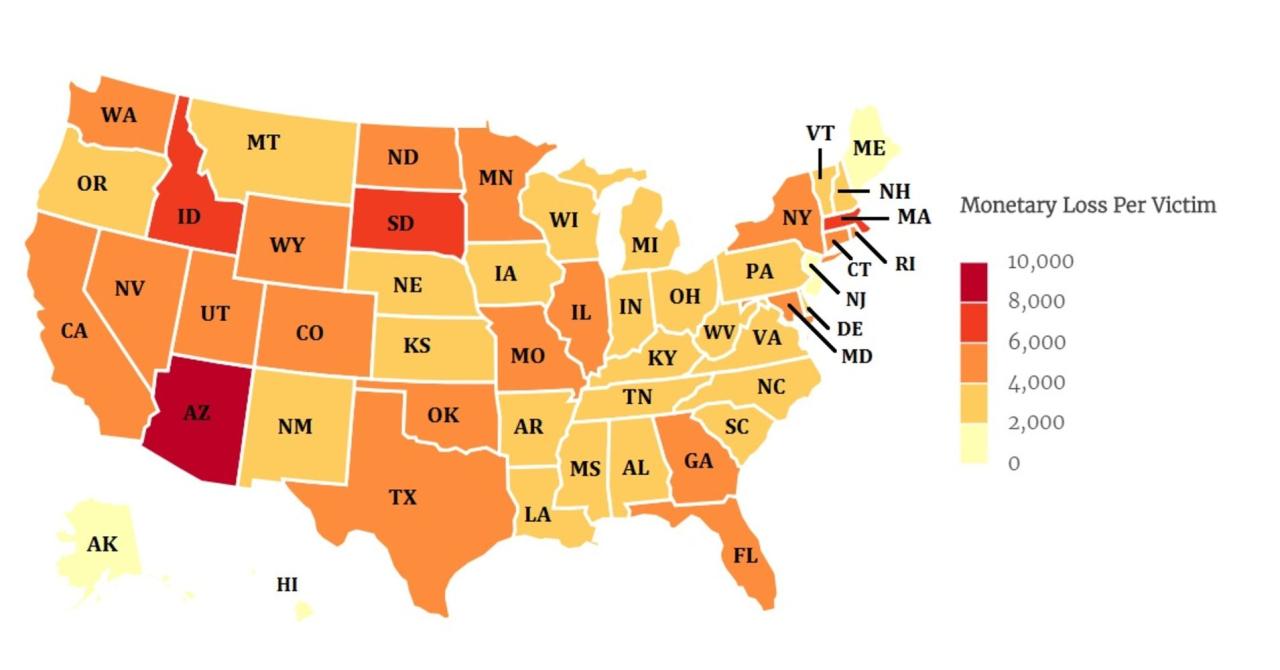

Presenting audit findings in a clear and understandable format is essential for effective communication and action. Visual aids such as charts, graphs, and tables are crucial for presenting complex data in a readily digestible manner. This allows stakeholders to quickly grasp the key findings and understand the implications of the audit results. The use of color-coded charts, bar graphs, and other effective visualizations can enhance the clarity and impact of the presentation.

Effective Visualizations

Examples of effective visualizations for presenting audit data include:

- Bar charts to compare different categories or groups.

- Line graphs to show trends over time.

- Pie charts to illustrate proportions or percentages within a dataset.

- Heatmaps to highlight correlations between variables.

These visualizations provide a concise and compelling way to communicate complex data, facilitating a more profound understanding of the findings. Consistent formatting and labeling are key to ensuring clarity and avoiding misinterpretations.

Data Analysis Techniques

This table Artikels different data analysis techniques applicable to NY Kendra’s Law audits.

| Technique | Description | Example Data | Use Case |

|---|---|---|---|

| Descriptive Statistics | Summarizing and describing the main features of the data. | Average number of clients served, percentage of compliance with reporting requirements. | Understanding the overall performance of the program. |

| Inferential Statistics | Drawing conclusions and making predictions about a population based on a sample. | Comparing the success rates of different intervention programs. | Identifying factors associated with successful outcomes. |

| Regression Analysis | Examining the relationship between two or more variables. | Relationship between client demographics and program success. | Identifying factors that influence program effectiveness. |

| Qualitative Analysis | Interpreting non-numerical data to uncover themes and patterns. | Interview transcripts, observations from site visits. | Gaining a deeper understanding of the program’s impact on individuals. |

Applying these techniques allows for a thorough understanding of the audit findings, facilitating informed recommendations for improvements and ultimately enhancing the effectiveness of NY Kendra’s Law.

Illustrative Case Studies

NY Kendra’s Law audits are crucial for ensuring compliance and effectiveness of programs designed to protect children. These audits provide valuable insights into the operational aspects of these programs, helping organizations identify areas for improvement and maintain the highest standards of child safety. A deep dive into hypothetical scenarios allows us to visualize the practical application of the audit process.Hypothetical scenarios presented in this section highlight the various facets of a Kendra’s Law audit, from initial findings to the long-term impact on an organization’s operations.

These scenarios serve as learning tools, showcasing the potential benefits of rigorous audit procedures.

Hypothetical Scenario 1: A Family Services Organization

This scenario examines a family services organization receiving a Kendra’s Law audit. The organization, while adhering to the core principles of the law, exhibited inconsistencies in record-keeping and case management procedures.

- Audit Findings: Discrepancies were found in the timely documentation of client interactions, and a lack of standardized procedures for assessing client needs. Some staff members lacked adequate training on Kendra’s Law requirements. The audit also revealed instances of insufficient communication between case managers and stakeholders.

- Recommendations: The audit recommended implementing a comprehensive training program for all staff, developing standardized case management protocols, and implementing a robust electronic record-keeping system. It also emphasized the importance of regular communication and collaboration with stakeholders, such as court personnel and community agencies.

- Impact on the Organization: The organization recognized the critical nature of the audit findings and prioritized the implementation of recommendations. Improved record-keeping significantly streamlined case management, leading to enhanced accountability and transparency. Staff training fostered a greater understanding of Kendra’s Law, boosting the organization’s ability to provide effective services. Collaboration with stakeholders increased, fostering a supportive network that enhanced the overall impact of the program.

Hypothetical Scenario 2: A Community Mental Health Center

This scenario focuses on a community mental health center that had previously undergone a Kendra’s Law audit and is now undergoing a follow-up audit.

- Audit Findings: The follow-up audit revealed that while the center had implemented many of the recommendations from the previous audit, some areas still needed improvement. A key finding was the need for stronger oversight and supervision of staff assigned to Kendra’s Law cases. While case management had improved, the center struggled to maintain consistent quality across all caseworkers.

- Recommendations: The audit suggested the implementation of a performance monitoring system for caseworkers, regular supervisory meetings, and a process for tracking and addressing concerns. The recommendations also emphasized the need for continuous training to maintain and enhance caseworker skills.

- Steps Taken to Implement Recommendations: The center established a performance monitoring system, including regular reports and metrics, to track caseworker performance. Supervisors implemented bi-weekly meetings with their caseworkers to address concerns and provide feedback. A dedicated training schedule was developed to ensure ongoing skill development. The center created a feedback loop, enabling caseworkers to report any difficulties encountered and receiving prompt support.

I’ve been digging into the NY Kendra’s Law audit lately, and it’s fascinating how it connects to broader issues like public safety. The recent shooting on the D train in NYC, as detailed in this article nyc shooting d train , highlights the need for thorough reviews of these types of laws and their effectiveness. Ultimately, a thorough NY Kendra’s Law audit needs to consider the full picture, including the impact on public safety initiatives.

Comparison of Scenarios

| Scenario 1 | Scenario 2 | Key Differences |

|---|---|---|

| Family services organization with initial compliance issues | Community mental health center undergoing a follow-up audit | Focus on initial compliance vs. ongoing improvement; differing levels of implementation from the previous audit |

| Primary concerns: record-keeping, case management, and staff training | Primary concerns: staff oversight, quality consistency, and continuous training | Reflecting on the differing audit needs for different organizations and their stages of compliance |

| Focus on implementing new systems and procedures | Focus on refining existing systems and enhancing oversight | Highlighting the importance of ongoing monitoring and evaluation within Kendra’s Law programs |

Impact and Implications: Ny Kendras Law Audit

A NY Kendra’s Law audit, while intended to ensure compliance and protect vulnerable individuals, carries significant implications for organizations and the community. Understanding these impacts is crucial for proactive planning and fostering a supportive environment for everyone involved. The audit process itself can be demanding, requiring substantial resources and expertise, potentially leading to short-term disruptions in operations.The key to navigating these impacts lies in understanding the potential benefits alongside the challenges.

A thorough audit, performed correctly, can lead to improvements in practices, increased safety, and a better overall environment. However, a poorly executed or misinterpreted audit can cause unnecessary stress and potentially damage the reputation of the organization. A balanced approach, focusing on both compliance and community well-being, is vital for long-term success.

Potential Positive Impacts on Organizations

Organizations that successfully navigate the audit process can expect several positive outcomes. Improved practices in areas like safety protocols, staff training, and communication with vulnerable populations can lead to a safer environment for everyone. The audit process can also highlight areas where procedures can be streamlined or where resources can be allocated more effectively. This proactive approach to compliance fosters a culture of accountability and responsibility within the organization.

Furthermore, a positive audit outcome can enhance the organization’s reputation and foster trust with the community and stakeholders.

Potential Negative Impacts on Organizations

Organizations may face challenges during the audit process. The time and resources needed for the audit can disrupt regular operations. Potential costs associated with implementing recommendations to address identified deficiencies could also be a concern. A negative audit outcome can lead to reputational damage and potentially affect funding or partnerships. In some cases, the complexity of the audit requirements might exceed the organization’s capacity, necessitating external assistance, which adds further costs and complexity.

Implications for Stakeholders

The implications of a NY Kendra’s Law audit extend beyond the organization itself. Stakeholders, including families, caregivers, and community members, can benefit from improved services and support systems. A successful audit can result in more responsive and proactive interventions, ensuring the safety and well-being of vulnerable individuals. Conversely, a poorly conducted audit can lead to delays in services or a lack of confidence in the organization’s ability to provide adequate support.

Importance of Continuous Improvement and Compliance

Continuous improvement and consistent compliance with NY Kendra’s Law are essential to mitigate potential negative impacts and maximize positive outcomes. A commitment to ongoing training, review of policies, and regular evaluations will help organizations maintain a high level of compliance. This proactive approach can proactively address emerging issues and prevent future problems.

Long-Term Effects of the Audit

The long-term effects of a NY Kendra’s Law audit are multifaceted. Positive outcomes can include enhanced community trust, improved operational efficiency, and a strengthened organizational reputation. Conversely, negative outcomes can result in diminished public trust, financial burdens, and even legal challenges. A sustained focus on compliance and improvement is crucial for achieving positive long-term effects.

Possible Future Trends Related to NY Kendra’s Law Audits

Future trends in NY Kendra’s Law audits may include an increased focus on data-driven approaches, utilizing technology for compliance monitoring, and incorporating community feedback to enhance the audit process. The increasing use of technology, including AI-powered tools, may streamline data collection and analysis, leading to more efficient and effective audits. Examples of this include automated reporting and real-time monitoring of compliance.

Greater collaboration between organizations and community stakeholders will also likely play a more prominent role in future audit processes.

Conclusive Thoughts

In conclusion, conducting a NY Kendra’s Law audit is not just a regulatory obligation; it’s a proactive step towards ensuring compliance, safeguarding your organization, and fostering a stronger community. This guide provides a structured approach to navigating the audit process, from understanding the legal framework to interpreting findings and implementing recommendations. By thoroughly reviewing the provided resources, organizations can confidently address the specific needs of their NY Kendra’s Law audit and maintain a high standard of compliance.

General Inquiries

What is the purpose of a NY Kendra’s Law audit?

The purpose is to ensure compliance with NY Kendra’s Law regulations, identify potential risks, and provide recommendations for improvement.

What are the common data collection methods in a NY Kendra’s Law audit?

Common methods include document reviews, interviews with staff, and data extraction from relevant systems.

What are the potential penalties for non-compliance with a NY Kendra’s Law audit?

Penalties can range from fines to legal action, depending on the severity and nature of the non-compliance.

How can organizations best prepare for a NY Kendra’s Law audit?

Thorough documentation, organized records, and a clear understanding of the legal requirements are key to effective preparation.