Inflation, Federal Reserve, and the Economy

Inflation federal reserve economy – Inflation, Federal Reserve, and the economy are intricately linked. Understanding how the Federal Reserve’s monetary policy actions impact inflation and, in turn, affect various sectors of the economy is crucial. This exploration dives into the complex interplay between these forces, examining historical responses, potential consequences, and the multifaceted effects on individuals and businesses.

From the impact of inflation on consumer behavior to the long-term consequences of persistent inflation, this discussion unpacks the vital relationship between inflation, the Federal Reserve, and the overall economic landscape. We’ll examine key indicators, global factors, and the intricate trade-offs involved in managing inflation while fostering economic growth.

Federal Reserve’s Monetary Policy Actions: Inflation Federal Reserve Economy

The Federal Reserve (Fed) plays a crucial role in managing the U.S. economy, particularly in controlling inflation. Its monetary policy tools are designed to influence the money supply and credit conditions to achieve its dual mandate of maximum employment and stable prices. Understanding these tools, their historical application, and potential consequences is vital for comprehending the Fed’s impact on the economy.The Federal Reserve employs a variety of instruments to manipulate the money supply and credit conditions.

These tools, while often subtle in their application, have profound effects on economic activity and inflation. By adjusting these tools, the Fed aims to balance economic growth with price stability.

Key Monetary Policy Tools

The Fed utilizes several key tools to achieve its goals. These tools work by influencing interest rates, the availability of credit, and the overall money supply.

- Federal Funds Rate: This is the target rate that the Federal Reserve influences by conducting open market operations. It’s the interest rate at which commercial banks lend money to each other overnight. Changes in this rate directly impact borrowing costs for businesses and consumers, affecting investment and spending. For example, a higher federal funds rate makes borrowing more expensive, potentially curbing inflation but also potentially slowing economic growth.

- Discount Rate: This is the interest rate at which commercial banks can borrow money directly from the Federal Reserve. Changes in the discount rate influence the cost of borrowing for banks, indirectly affecting lending rates to consumers and businesses. A higher discount rate discourages banks from borrowing from the Fed, potentially reducing the money supply and inflation. Historically, changes in the discount rate are often correlated with changes in the federal funds rate.

- Reserve Requirements: These are the fraction of deposits that banks are required to hold in reserve. Lowering reserve requirements increases the amount of money banks can lend, potentially stimulating economic activity. Conversely, increasing reserve requirements reduces the amount of money banks can lend, potentially curbing inflation.

- Open Market Operations: This involves the buying and selling of U.S. Treasury securities by the Federal Reserve. Buying securities injects money into the banking system, increasing the money supply and potentially lowering interest rates. Selling securities removes money from the system, reducing the money supply and potentially raising interest rates. This is a powerful tool for managing short-term interest rates and the overall money supply.

Historical Responses to Inflation

The Fed’s response to inflation throughout history has varied significantly. Sometimes, the Fed has been quick to act, while other times its response has been slower or less decisive. This variation is often due to differing economic conditions and political pressures. For example, during periods of high inflation, the Fed may raise interest rates to curb spending and cool down the economy.

This can result in a temporary economic slowdown.

Potential Consequences of Monetary Policy Decisions

Monetary policy decisions have significant consequences for the entire economy. Raising interest rates, for instance, can slow economic growth by increasing borrowing costs for businesses and consumers. Conversely, lowering interest rates can stimulate economic growth but potentially lead to increased inflation.

Trade-offs Between Inflation Control and Economic Growth

The Fed constantly faces a trade-off between controlling inflation and supporting economic growth. Policies aimed at curbing inflation may inadvertently slow economic growth, and policies that promote growth may inadvertently fuel inflation. Finding the optimal balance between these competing objectives is a complex challenge.

Table of Monetary Policy Tools

| Tool Name | Description | Potential Impact on Inflation | Potential Impact on Economic Growth |

|---|---|---|---|

| Federal Funds Rate | Target rate for overnight lending between banks | Can reduce inflation by increasing borrowing costs | Can slow growth by increasing borrowing costs |

| Discount Rate | Interest rate for banks borrowing directly from the Fed | Can reduce inflation by affecting lending rates | Can slow growth by affecting lending rates |

| Reserve Requirements | Fraction of deposits banks must hold in reserve | Can reduce inflation by reducing lending capacity | Can slow growth by reducing lending capacity |

| Open Market Operations | Buying and selling U.S. Treasury securities | Can reduce inflation by influencing the money supply | Can influence growth by influencing the money supply |

Inflation’s Impact on the Economy

Inflation, a persistent rise in the general price level of goods and services, significantly impacts various segments of the economy. Its effects ripple through different sectors, influencing consumer spending, investment decisions, and overall economic activity. Understanding these effects is crucial for policymakers and individuals alike.The impact of inflation isn’t uniform across all groups. Different segments of the population experience varying consequences, depending on their income, savings, and debt levels.

The Federal Reserve’s attempts to combat inflation are definitely impacting the economy, but recent events like the tragic armorer Alec Baldwin Rust shooting highlight the complex interplay of factors beyond just monetary policy. While inflation remains a significant concern, these unforeseen events can also create ripples throughout the market, adding another layer of uncertainty to the overall economic picture.

It’s a complicated situation with no easy answers, and the Fed’s decisions will continue to be closely watched.

Some groups benefit from inflation while others are negatively affected.

Effects on Different Population Segments

Inflation’s effects on individuals are diverse. Workers, savers, and borrowers are all impacted in varying ways. Workers may see increased wages, but the purchasing power of their income may still decline if wages don’t keep pace with inflation. Savers face a reduction in the real value of their savings as the purchasing power of their money erodes.

Conversely, borrowers may find that their debt burden decreases in real terms, if the interest rate on the debt is fixed and does not adjust with inflation. For example, if a person borrowed money at a fixed interest rate of 5% and inflation rose to 8%, the real interest rate would be negative. This means the borrower is effectively getting money from the lender as inflation reduces the real value of the debt.

Impact of Different Inflation Rates on Economic Activity

Different inflation rates have varying impacts on economic activity. Low and stable inflation is generally considered favorable for economic growth. Moderate inflation can incentivize spending and investment, encouraging economic activity. However, high and unpredictable inflation creates uncertainty, discourages investment, and can lead to economic instability. For example, during periods of high inflation, businesses may postpone investments in new equipment or expansion projects, impacting job creation and economic growth.

Factors Contributing to Inflation

Inflation is a complex phenomenon with various contributing factors. Supply chain disruptions, characterized by bottlenecks and delays in the movement of goods, can lead to higher production costs and increased prices. Demand-pull pressures, where aggregate demand exceeds the economy’s productive capacity, can also drive up prices. Other factors include government policies, such as increased money supply, and external factors, like global events and commodity price fluctuations.

Relationship Between Inflation and Unemployment

The relationship between inflation and unemployment is often complex and debated. The Phillips Curve, a theoretical model, suggests an inverse relationship between inflation and unemployment, implying that lower unemployment rates may be associated with higher inflation. However, this relationship is not always consistent and can be influenced by various factors. For example, supply shocks, such as an oil crisis, can simultaneously increase inflation and unemployment.

Economic Sector Vulnerability to Inflation

| Economic Sector | Potential Vulnerability to Inflation |

|---|---|

| Agriculture | Vulnerable to supply chain disruptions and commodity price fluctuations. |

| Manufacturing | Vulnerable to supply chain disruptions and increased input costs. |

| Services | Varying vulnerability depending on the specific service and ability to adjust prices. |

| Technology | Generally less vulnerable to inflation in the short run, but can be affected by supply chain issues. |

| Real Estate | Potentially vulnerable to rising interest rates and construction costs. |

Economic Indicators and Inflation

Inflation, a persistent rise in the general price level of goods and services, is a crucial economic phenomenon. Understanding how inflation is measured and its impact on the economy is paramount for policymakers and individuals alike. Key economic indicators provide insights into the current inflationary pressures and help anticipate future trends.Economic indicators, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), are crucial tools for monitoring inflation and understanding its implications for the economy.

These indicators provide a snapshot of the price changes across various sectors, informing policy decisions and influencing market expectations.

Key Economic Indicators for Measuring Inflation

Various economic indicators are used to measure inflation. These indicators reflect price changes in different parts of the economy. The most common are the Consumer Price Index (CPI) and the Producer Price Index (PPI).

- Consumer Price Index (CPI) measures the weighted average of prices of a basket of consumer goods and services purchased by households. It’s a crucial indicator for assessing the cost of living for the average consumer. CPI tracks the price changes of items such as food, housing, transportation, and medical care. The weight given to each item reflects its importance in the typical consumer’s budget.

- Producer Price Index (PPI) measures the average change over time in the selling prices received by domestic producers for their output. PPI tracks the price changes of goods and services at the wholesale level, before they reach the consumer. This indicator is important because it can anticipate future price changes for consumers and signal potential inflationary pressures.

Calculation and Interpretation of Economic Indicators

These indicators are calculated by gathering price data from a representative sample of goods and services. For instance, the CPI collects price information from a variety of retailers and service providers. These prices are then weighted according to their relative importance in the consumer basket.

The Federal Reserve’s moves to combat inflation are definitely impacting the economy, and it’s fascinating to consider how these economic forces can mirror artistic expressions. For instance, the soaring prices of goods and services can feel almost as dramatic as the thrilling musical numbers in a Broadway cast album, like broadway cast albums sweeney todd. Ultimately, understanding these economic shifts requires a nuanced perspective, similar to appreciating the intricate storytelling behind a masterpiece like Sweeney Todd.

CPI = [(Cost of basket in current period / Cost of basket in base period)] – 100

The calculation results in a percentage change, reflecting the rate of inflation. A higher percentage indicates a faster rate of price increase. The interpretation of these indicators is critical. A sustained increase in the CPI or PPI over time suggests inflationary pressures are building. Conversely, a decrease or stable values indicate a cooling inflation environment.

The Federal Reserve’s actions regarding inflation are impacting the economy in ways we’re only beginning to understand. It’s a complex dance, and frankly, feels a bit like navigating a minefield. This economic uncertainty, combined with the personal struggles of people dealing with loss, like those highlighted in the recent article “Grief is for people sloane crosley” grief is for people sloane crosley , underscores just how interconnected these seemingly disparate issues are.

Ultimately, the Federal Reserve’s decisions have far-reaching consequences that ripple through individual lives and the overall economy.

Relationship with Federal Reserve Policy Decisions

The Federal Reserve closely monitors economic indicators like CPI and PPI when making monetary policy decisions. These indicators provide valuable data points to assess the current state of the economy and its potential future trajectory. Elevated inflation rates often lead to concerns about economic overheating and the Fed may respond with interest rate increases to curb demand and cool down the economy.

Conversely, if inflation is low or declining, the Fed might consider lowering interest rates to stimulate economic activity.

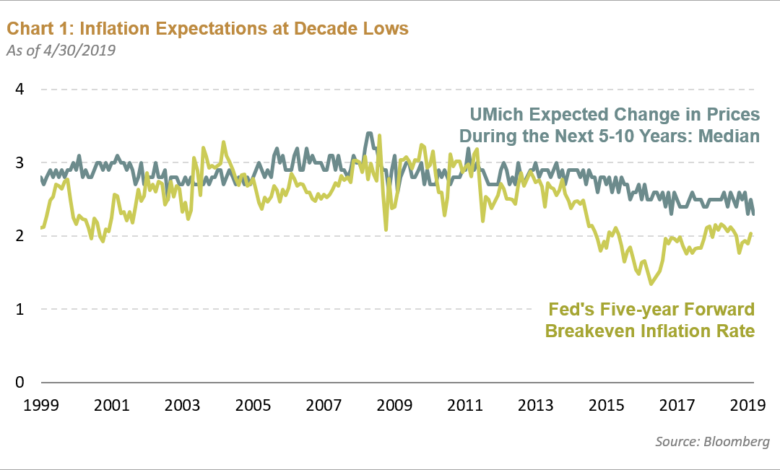

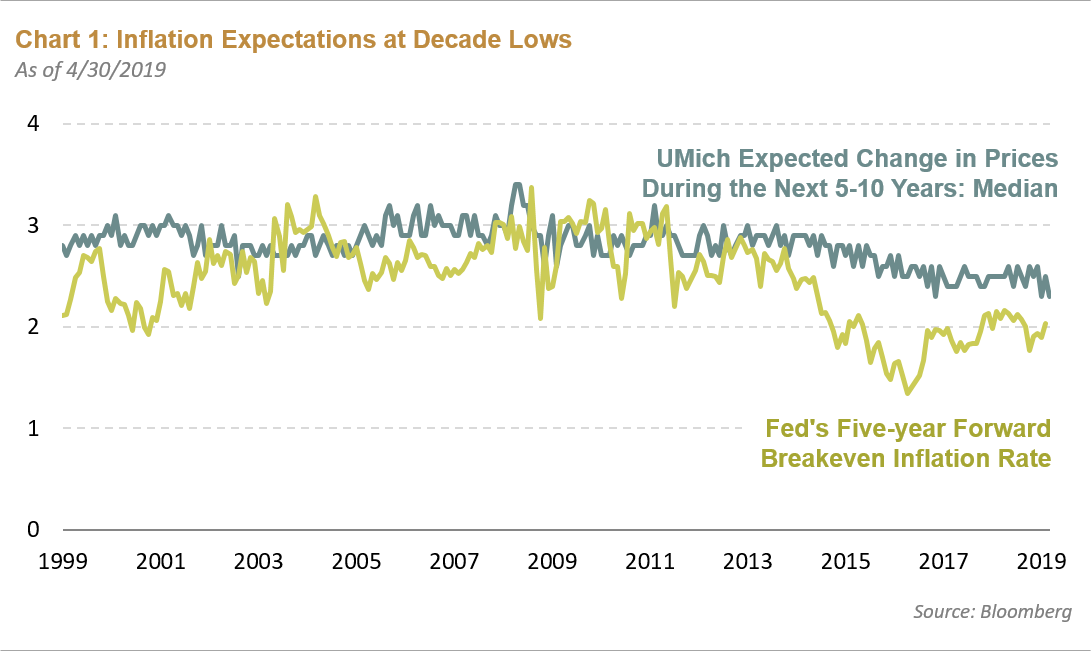

Impact of Inflation Expectations

Inflation expectations play a significant role in shaping economic outcomes. If consumers and businesses anticipate higher inflation in the future, they may adjust their spending and investment decisions accordingly. This anticipatory behavior can contribute to the actual realization of higher inflation, creating a self-fulfilling prophecy.

Economic Indicators Table

| Indicator | Definition | Use in Assessing Inflation |

|---|---|---|

| Consumer Price Index (CPI) | Weighted average of prices of a basket of consumer goods and services. | Measures the cost of living for consumers; a key indicator of inflation. |

| Producer Price Index (PPI) | Average change in selling prices received by domestic producers. | Signals potential future inflation; tracks price changes at the wholesale level. |

Global Economic Context and Inflation

The global economy is a complex web of interconnected relationships. Fluctuations in one region can ripple across the globe, impacting inflation rates and economic growth in various countries. Understanding these global factors is crucial to comprehending the dynamics of inflation in the United States and how it interacts with the rest of the world.The current global economic landscape is marked by various intertwined factors.

The Federal Reserve’s moves to combat inflation are definitely impacting the economy, and it’s fascinating to see how that ripples through different sectors. For example, the housing market near NYC housing market near nyc is experiencing some interesting shifts. These changes, in turn, are likely influencing broader economic trends and adding another layer to the complex puzzle of inflation and the Federal Reserve’s response.

These include supply chain disruptions, geopolitical tensions, and shifts in consumer demand. These forces have a direct influence on the cost of goods and services, which, in turn, affects inflation rates in the United States and other major economies. Analyzing these influences is essential for comprehending the current inflationary pressures and the potential for future changes.

Global Factors Influencing US Inflation

Various global factors contribute to inflationary pressures in the United States. These factors include shifts in global supply chains, fluctuations in commodity prices, and international conflicts. The interconnected nature of global economies means that events in one country can quickly affect others.

Impact of International Events on Domestic Inflation Rates

International events, such as conflicts, trade wars, and natural disasters, can significantly affect domestic inflation rates. These events often disrupt supply chains, increase costs for imported goods, and alter consumer behavior, leading to price increases. For example, the ongoing conflict in Ukraine has disrupted the global supply of energy and certain commodities, contributing to rising energy prices and inflation globally, including the US.

Comparison of Inflation Trends in the US and Other Major Economies, Inflation federal reserve economy

Comparing inflation trends across major economies provides insights into the global economic context. Countries experience different inflation rates due to various factors, including varying economic policies, consumer demand, and supply chain vulnerabilities. While the US has experienced significant inflation in recent periods, other economies, such as the Eurozone, have also faced similar challenges, albeit with differing degrees of severity.

Interconnectedness of Global Economies in Terms of Inflation

Global economies are deeply interconnected, making it difficult to isolate domestic inflation pressures from external influences. Changes in one economy often trigger reactions in others, creating a complex web of interactions. For instance, a sudden surge in demand for raw materials in one country can lead to price increases that spread across the globe, impacting inflation in multiple countries.

Table Comparing Inflation Rates and Economic Growth Rates in Different Countries

This table provides a snapshot of inflation and growth rates in selected countries, illustrating the interconnectedness of global economies. Note that data is current as of [Date] and may vary depending on the source and methodology used.

| Country | Inflation Rate (%) | Economic Growth Rate (%) |

|---|---|---|

| United States | [US Inflation Rate] | [US Growth Rate] |

| Eurozone | [Eurozone Inflation Rate] | [Eurozone Growth Rate] |

| China | [China Inflation Rate] | [China Growth Rate] |

| Japan | [Japan Inflation Rate] | [Japan Growth Rate] |

| India | [India Inflation Rate] | [India Growth Rate] |

Inflation and Consumer Behavior

Inflation’s relentless march significantly impacts consumer behavior, reshaping spending habits, eroding confidence, and affecting the overall economic landscape. Understanding these intricate relationships is crucial for navigating the complexities of a fluctuating economy. From the psychological toll of rising prices to the practical adjustments in budgeting, inflation’s influence is pervasive.Inflation disrupts the delicate balance between spending and saving, prompting consumers to make difficult choices.

Consumers often adjust their spending patterns, prioritizing essential goods and services while cutting back on discretionary purchases. This shift in priorities is driven by the diminishing purchasing power of money. As prices climb, the same amount of money buys less, forcing consumers to make choices about what to forgo.

Impact on Consumer Spending and Saving Habits

Inflation compels consumers to reassess their spending and saving strategies. With the erosion of purchasing power, consumers often shift spending towards essential goods and services, postponing or eliminating discretionary purchases like entertainment, dining out, or non-essential items. Saving becomes more crucial, as the real value of savings diminishes with rising inflation. This adaptation to changing economic realities is a key aspect of consumer response to inflation.

Impact on Consumer Confidence

Inflation’s impact on consumer confidence is substantial and multifaceted. As prices rise, consumers often feel a decline in their financial security and purchasing power. This eroded confidence directly affects consumer spending, as individuals become more cautious about making large purchases. The uncertainty associated with inflation leads to a reluctance to commit to future expenses, hindering economic growth.

The confidence in the future of the economy can be negatively affected by inflation, leading to decreased spending.

Psychological Effects of Inflation on Individuals

The psychological effects of inflation can be profound, ranging from feelings of anxiety and insecurity to a sense of helplessness. Facing escalating prices, individuals may experience stress and financial anxiety. The constant awareness of diminishing purchasing power can lead to a feeling of loss and a diminished sense of control over their financial well-being. Individuals may experience heightened stress and a sense of being overwhelmed by the rising cost of living.

Relationship Between Inflation and Household Debt

Inflation’s relationship with household debt is complex and often negative. As prices increase, the real value of debt declines, but the nominal amount remains the same. This can lead to a feeling of being further burdened by debt. The ability to repay debt can be significantly impacted by rising inflation. Individuals with substantial debt may find it challenging to meet their financial obligations as the cost of living increases.

This can have a cascading effect on financial stability.

Table Illustrating Inflation’s Impact on Consumer Choices

| Inflation Rate (%) | Consumer Choices | Purchasing Power Impact |

|---|---|---|

| 0-2 | Relatively stable spending patterns; discretionary purchases maintained. | Minor adjustments; savings are maintained at their real value. |

| 3-5 | Consumers shift spending to necessities; some reduction in discretionary spending. | Moderate decline in purchasing power; savings lose value. |

| 6-8 | Significant reduction in discretionary spending; consumers prioritize essentials. | Significant decline in purchasing power; savings eroded substantially. |

| 9+ | Consumers prioritize essential goods and services; drastic reduction in discretionary spending. | Severe decline in purchasing power; savings may be significantly devalued. |

Long-Term Economic Effects of Inflation

Persistent inflation, while sometimes a symptom of a healthy economy, can have devastating long-term consequences if left unchecked. The erosion of purchasing power, unpredictable market fluctuations, and potential for destabilizing economic conditions all contribute to a challenging environment for individuals and businesses. Understanding these effects is crucial for policymakers and individuals alike to mitigate potential risks and maintain long-term economic stability.

Consequences of Unchecked Inflation

The cumulative effect of sustained high inflation erodes the real value of savings and fixed-income investments. This is particularly problematic for retirees and those reliant on fixed incomes, as the value of their savings diminishes over time. Additionally, businesses face difficulties in planning for the future, making long-term investments risky, and consumers may adjust their spending habits, potentially impacting economic growth.

The Federal Reserve’s actions to combat inflation are definitely a hot topic right now, but the ongoing geopolitical tensions, like the recent Biden-brokered cease-fire in the Israel-Hamas conflict here , are also playing a significant role in the global economic climate. These factors are undeniably intertwined, and while the cease-fire is a positive development, its long-term economic impact remains to be seen.

The Federal Reserve’s approach to inflation will undoubtedly be influenced by these complex global events.

Risks and Challenges Associated with High Inflation

High inflation creates uncertainty in the marketplace. Businesses struggle to accurately forecast costs and revenues, hindering their ability to make sound investment decisions. Consumers may reduce their spending, further impacting economic activity. Furthermore, high inflation can lead to a loss of confidence in the currency, potentially triggering a wider economic crisis. For example, the hyperinflation experienced in Zimbabwe in the early 2000s severely disrupted the economy, leading to widespread poverty and instability.

Importance of Price Stability for Long-Term Prosperity

Maintaining price stability is fundamental to long-term economic prosperity. A stable price environment encourages investment, stimulates economic growth, and fosters confidence in the economy. When prices are predictable, individuals and businesses can make informed decisions about saving, investing, and spending, leading to greater economic efficiency.

Impact of Inflation on Asset Values

Inflation’s impact on asset values is complex and multifaceted. While stocks may increase in nominal value, their real value (adjusted for inflation) may not keep pace with the rate of inflation. Bonds, particularly those with fixed interest rates, suffer a significant loss in purchasing power. Real estate values can be affected, but the relationship is not always direct, depending on factors such as local market conditions and interest rate adjustments.

Potential Long-Term Impacts of Different Inflation Scenarios

| Inflation Scenario | Impact on Economic Productivity |

|---|---|

| Low and Stable Inflation (2-3%) | Encourages investment, fosters confidence, promotes economic growth. |

| Moderate Inflation (3-5%) | Potential for increased economic activity, but requires careful management to avoid destabilizing effects. Businesses may need to adjust pricing strategies. |

| High Inflation (5-10%) | Significant reduction in purchasing power, reduced investment, potential for economic stagnation or recession. Businesses face difficulty in forecasting and planning. |

| Hyperinflation (>10%) | Complete disruption of economic activity, widespread poverty, loss of confidence in the currency, and severe social and political instability. |

Examples of hyperinflation include Weimar Germany (1920s) and Zimbabwe (2000s), demonstrating the devastating long-term consequences of unchecked inflation.

Summary

In conclusion, the relationship between inflation, the Federal Reserve, and the economy is dynamic and multifaceted. The Federal Reserve’s actions, global factors, and consumer behavior all play a role in shaping inflation trends. Understanding these intricate connections is crucial for navigating the complexities of the modern economic environment.

FAQ

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a key economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It’s a crucial tool for understanding inflation trends.

How does the Federal Reserve’s interest rate policy affect inflation?

Higher interest rates tend to curb inflation by reducing borrowing and spending, which cools down the economy. Conversely, lower rates stimulate economic activity, potentially leading to higher inflation.

What is the Phillips Curve?

The Phillips Curve describes the inverse relationship between inflation and unemployment. Generally, lower unemployment can be associated with higher inflation, and vice-versa. However, this relationship is not always consistent and can be influenced by other factors.

How do supply chain disruptions affect inflation?

Supply chain disruptions increase the cost of goods and services, contributing to inflationary pressures. This is because scarcity and logistical problems can lead to price increases for consumers.