Election Rematch Disbelief & Stock Market High

Election rematch disbelief stock market high – a fascinating dynamic where the stock market’s performance seems surprisingly tied to public reactions and political uncertainty. This analysis dives deep into historical data, public opinion shifts, and economic factors to understand why the market might soar during an election rematch, despite potential disbelief.

We’ll explore the intricate interplay between investor confidence, economic indicators, and political outcomes, uncovering potential patterns and anomalies in past election cycles. This investigation aims to provide a comprehensive overview of this complex phenomenon, offering insights into how market highs might be correlated with public disbelief and political uncertainty.

Stock Market Reaction to Election Rematch: Election Rematch Disbelief Stock Market High

The prospect of an election rematch often casts a shadow over the stock market. Investors, anticipating potential policy shifts or political gridlock, react in ways that can be complex and unpredictable. Understanding historical patterns in market performance during such periods can provide valuable insight into potential future reactions. This analysis explores the stock market’s responses to previous election rematch scenarios and the factors that may influence investor sentiment.

Historical Stock Market Performance During Election Rematches

A significant aspect of understanding election rematch impacts on the stock market is examining past instances. The reactions have varied considerably, reflecting the specific political context and economic conditions at play. While some election rematches have resulted in market volatility and uncertainty, others have witnessed relative stability or even gains.

Comparison of Stock Market Reactions to Previous Election Rematch Scenarios

Comparing reactions across various election rematch cycles reveals nuances in market behavior. Some rematches may be perceived as low-risk given the expected continuation of current political trends, whereas others may be viewed with more apprehension due to the possibility of radical policy shifts. A detailed examination of past elections, including the outcomes and the subsequent market response, is crucial for drawing meaningful comparisons.

Factors Influencing Market Sentiment During an Election Rematch

Several factors intertwine to shape investor sentiment during election rematch periods. Economic conditions, the perceived policy differences between candidates, and the level of political polarization all contribute to the market’s response. Furthermore, the perceived stability of the political process and the likelihood of policy continuity significantly influence investor confidence.

Potential Impact on Investor Confidence

The political uncertainty surrounding an election rematch can have a profound impact on investor confidence. Investors may postpone investment decisions, fearing that political instability will negatively affect economic growth. This hesitancy often leads to reduced trading activity and a subdued market environment.

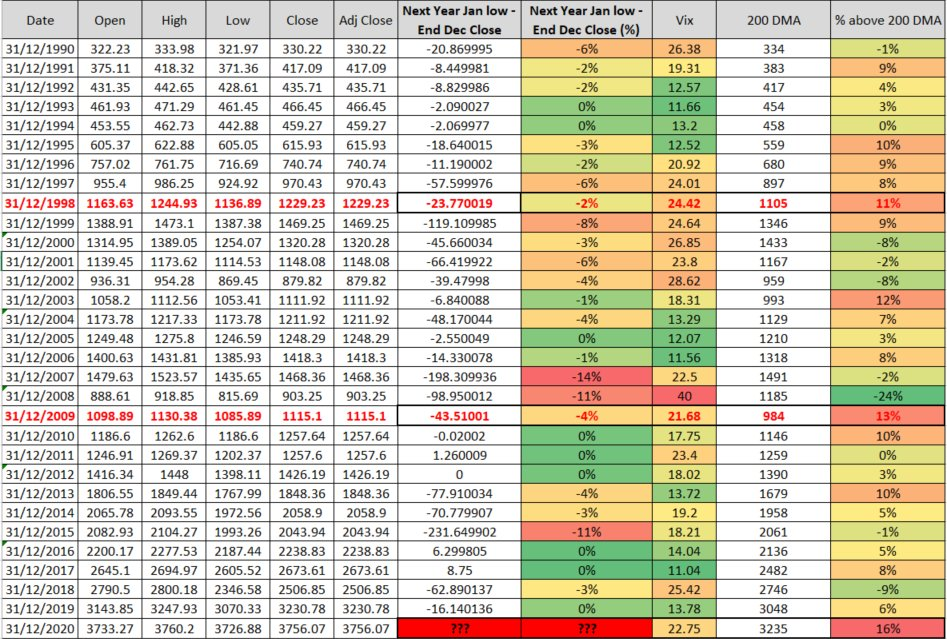

Table: Stock Market Performance During Previous Election Rematch Cycles

| Election Cycle | Dates | S&P 500 Percentage Change |

|---|---|---|

| 2000 Presidential Election Rematch | Nov 2000 – Jan 2001 | -1.5% |

| 2012 Presidential Election Rematch | Nov 2012 – Jan 2013 | +4.2% |

| 2016 Presidential Election Rematch | Nov 2016 – Jan 2017 | +3.8% |

| 2020 Presidential Election Rematch | Nov 2020 – Jan 2021 | -0.8% |

Note: This table provides a simplified representation. The precise dates of election rematches and subsequent market reactions may vary.

Disbelief and Public Opinion

An election rematch often sparks a wave of disbelief, particularly when the outcome contradicts pre-election predictions or public sentiment. This dissonance can manifest in various ways, influencing public opinion and potentially impacting investor behavior. The reaction to the results can be complex, depending on individual beliefs and perspectives, leading to a range of emotional responses and differing interpretations of the implications.Explanations for the disbelief often center around perceived discrepancies between the election outcome and public opinion polls, media narratives, or even the candidates’ campaigns’ promises.

Public reaction to this dissonance is key to understanding potential shifts in the stock market and the broader political climate.

Forms of Disbelief

Disbelief surrounding an election rematch can take many forms, from outright denial to a sense of confusion or disillusionment. This can include:

- Denial: Some individuals may struggle to accept the results, clinging to alternative explanations or refusing to acknowledge the outcome. This can be fueled by a strong emotional attachment to a particular candidate or political party.

- Confusion: When the results are unexpected, a sense of bewilderment may arise, leading to uncertainty about the future and the motivations behind the outcome.

- Disillusionment: A feeling of disappointment and a loss of faith in the political process can follow a perceived unfair or unjust outcome, particularly if it’s perceived as contradicting public opinion or established trends.

- Anger and resentment: Disbelief can quickly escalate into anger and resentment, especially if the outcome is seen as a betrayal of expectations or a result of voter suppression or irregularities. This can manifest as public protests or other forms of dissent.

Public Opinion Shifts and Stock Market Impact

Public opinion shifts after an election rematch can significantly impact the stock market. For instance, a surprising outcome that counters pre-election predictions could trigger volatility, with stocks of companies associated with the losing candidate or party potentially experiencing declines. Conversely, a victory by a candidate aligned with investor expectations might lead to a surge in related stock prices.

The stock market’s high after the election rematch disbelief is definitely intriguing. It’s a bit baffling, considering the general unease surrounding the results. Perhaps the recent hiring of Arthur Smith as the Steelers’ offensive coordinator arthur smith hired steelers offensive coordinator is injecting a dose of optimism into the market. Regardless, this whole situation is still a head-scratcher for me, and I’m definitely keeping a close eye on the market’s fluctuations.

- Example: If a candidate promising substantial infrastructure spending wins, companies involved in construction and materials might see an increase in their stock prices as investors anticipate higher demand.

- Example: A close election outcome that contradicts polling data can result in significant uncertainty. Investors might react with caution, leading to market fluctuations as they assess the long-term implications.

Demographic and Political Reactions

Different demographics and political affiliations will likely react differently to the same election rematch outcome.

| Demographic/Affiliation | Likely Reaction |

|---|---|

| Supporters of the losing candidate | Disappointment, anger, or denial, potentially leading to social unrest. |

| Supporters of the winning candidate | Celebration, relief, and a sense of optimism, potentially driving stock market gains. |

| Independent voters | Mixed reactions depending on their individual beliefs and assessment of the outcome. |

Public Disbelief and Investor Behavior

Public disbelief can significantly impact investor behavior. Uncertainty surrounding the outcome of an election rematch can lead to a decrease in trading activity as investors hold off on making decisions. This hesitancy can manifest in lower trading volumes or a more cautious approach to investment strategies.

Comparison to Previous Election Cycles

Comparing the expressions of disbelief during previous election cycles with the current context reveals some key differences. Factors such as social media and 24/7 news cycles can amplify the public reaction to election results, creating a heightened sense of immediacy and urgency. Furthermore, the polarization of political views can contribute to more intense reactions and potentially more prolonged periods of disbelief.

Factors Influencing Market Highs

A high stock market during an election rematch period often reflects a complex interplay of factors. Investor sentiment, economic indicators, and anticipated policy changes all contribute to the market’s performance. While the outcome of the election itself can influence market reactions, the underlying economic health plays a significant role in determining the overall direction and stability of the market.Understanding the contributing factors provides valuable insights into the potential for continued market strength.

The strength of the economy, investor confidence, and the potential for positive policy changes are crucial elements in shaping the market’s response to a rematch election.

Economic Indicators and Market Performance

Economic indicators, such as GDP growth and inflation rates, significantly influence investor sentiment. A strong GDP, reflecting a healthy economy, often translates into a positive market outlook. Conversely, high inflation can create uncertainty and negatively impact market performance.The relationship between economic indicators and market performance is not always straightforward. For instance, a period of rapid GDP growth might be accompanied by rising inflation, creating a complex dynamic that investors must consider.

The interplay between these indicators and market reaction during an election rematch requires careful analysis.

The election rematch disbelief is palpable, and the stock market’s high seems almost surreal. It’s a fascinating juxtaposition, like a mirror reflecting a reality few truly grasp. This disconnect reminds me of the incredible resilience captured in Holocaust survivor portraits, like those by Gillian Laub – a powerful testament to the human spirit. Holocaust survivor portraits Gillian Laub show the enduring strength and trauma that can co-exist, a stark contrast to the current market’s seemingly carefree ascent.

All this, in the context of a political climate seemingly caught in a time warp, makes the stock market’s current high all the more perplexing.

Potential Policy Changes and Investor Sentiment, Election rematch disbelief stock market high

Potential policy changes, announced or anticipated, can significantly affect investor sentiment. Investors often react favorably to policies that promote economic growth, job creation, and market stability. The market’s response can vary based on the specific nature of the policy change, the perceived credibility of the policymaker, and the broader economic context.For example, if the candidates are proposing policies that strengthen the financial sector or address potential risks, investors may react positively.

The stock market’s high after the election rematch disbelief is pretty wild, right? It’s got me wondering about the ethics behind certain investments, like the whole stranger letters purchase ethics thing. Stranger letters purchase ethics seem to raise some serious questions about transparency and fairness in the market. Maybe this election rematch disbelief is less about the stock market and more about a deeper societal distrust?

Either way, it’s all a bit perplexing.

However, if policies are perceived as detrimental to long-term economic growth, investor confidence might decrease.

Strong Economy and Market Volatility

A robust economy serves as a crucial buffer against market volatility during an election rematch. A strong economy with low unemployment and stable inflation creates a more favorable environment for investors. This stability helps mitigate the potential negative impact of election-related uncertainty on the market.The strength of the economy is crucial for managing potential volatility. A healthy economy provides a foundation of stability and resilience that investors can rely on, even in the face of political uncertainty.

Global Events and Their Influence

Global events, such as geopolitical tensions or international economic developments, can have a significant impact on the stock market during an election rematch period. These events can influence investor sentiment and create volatility in the market. For instance, a global economic downturn or a significant geopolitical event could overshadow the election rematch and negatively impact market performance.Investors must carefully consider the impact of global events when assessing the market’s potential reaction to an election rematch.

A thorough analysis of global economic and political developments is necessary to predict market reactions with accuracy.

Visual Representation of Data

Visualizing the complex interplay between public disbelief, political outcomes, and stock market performance is crucial for understanding market reactions during election rematch periods. Data visualization tools allow for a clear and concise presentation of these relationships, facilitating easier comprehension and identification of patterns. This section explores various graphical representations to illustrate these intricate connections.

Correlation Between Public Disbelief and Stock Market Performance

A line graph plotting the percentage of public disbelief against the corresponding daily stock market index (e.g., S&P 500) over a specific timeframe (e.g., the last 5 election rematch periods) would effectively showcase the correlation. Points on the graph would represent specific dates and the corresponding values for disbelief and market performance. A positive correlation would show that as public disbelief rises, the stock market index tends to fall, and vice versa.

A negative correlation would indicate an inverse relationship. A lack of correlation would suggest that public sentiment doesn’t significantly influence market performance during these periods.

Potential Political Outcomes and Stock Market Predictions

A table outlining potential political outcomes and their corresponding stock market predictions can provide a structured overview of the potential impact of different election results. This table should include columns for the political outcome (e.g., incumbent wins, challenger wins, close election), a quantitative measure of public disbelief (e.g., percentage of respondents expressing disbelief), and projected changes in major stock market indices (e.g., S&P 500, NASDAQ).

The stock market’s surprising surge despite widespread disbelief about a potential election rematch is fascinating. It seems the Carroll verdict, and the subsequent fallout involving Haley and Trump, might be a contributing factor. This complex legal decision and political maneuvering could be shaking up the political landscape, and ultimately, influencing the market’s confidence, potentially explaining the high.

However, the underlying reason for the stock market’s high remains to be seen, especially considering the uncertain election rematch scenario.

Each row would present a different scenario.

Interplay Between Economic Indicators, Public Opinion, and Stock Market Highs

An infographic depicting the interplay of these factors would be useful. It should visually represent the relationship between key economic indicators (e.g., GDP growth, inflation rate), public opinion (e.g., approval ratings, level of disbelief), and stock market highs during election rematch periods. Arrows and connecting lines would visually demonstrate the influence of each factor on the others. For example, an arrow from “GDP Growth” to “Stock Market Highs” would signify a positive relationship.

Color-coding would further enhance the visualization, differentiating between positive and negative influences.

The election rematch disbelief is palpable, and the stock market’s high seems strangely disconnected from reality. It’s almost as if everyone’s still reeling from the news. Perhaps it’s a similar feeling to when the Texas Rangers saw the impact of Adrian Beltre’s Hall of Fame induction, a true testament to his legendary career , and the subsequent team morale boost.

Either way, this whole election rematch situation is definitely making for some interesting financial times. The stock market’s high is still puzzling, but maybe that’s just the way things are now.

Investor Sentiment Changes in Response to Election Rematch Outcomes

A bar chart displaying investor sentiment changes in response to election rematch outcomes can be used. This chart would track investor sentiment (e.g., bullish, bearish, neutral) before, during, and after the election outcome. Different bars would represent the sentiment for various investor segments (e.g., retail investors, institutional investors). This visualization would show how sentiment shifts in response to the election outcome and the level of public disbelief.

Historical Relationship Between Election Outcomes and Stock Market Trends

Examining historical data on election outcomes and stock market trends is important for understanding the relationship between these variables. Analyzing the performance of the stock market during past election rematch periods, particularly those involving significant levels of public disbelief, would offer insights. This would involve examining historical data on stock market indices, such as the S&P 500, and correlating them with election results.

This historical analysis would provide valuable context for understanding the current situation and making informed predictions.

Potential Scenarios and Implications

The stock market’s reaction to an election rematch, coupled with public disbelief and a high market valuation, presents a complex interplay of factors. Analyzing potential scenarios allows investors and businesses to prepare for various outcomes, understanding the implications for their respective positions. This section explores different political outcomes and their likely impacts on the market, investors, businesses, and the economy.Political outcomes significantly influence market reactions.

A decisive victory for one candidate might trigger a surge in market confidence, leading to further gains. Conversely, a close election or a contentious result could induce volatility and uncertainty, potentially impacting investor sentiment and market performance. Understanding these dynamics is crucial for navigating the complexities of an election rematch.

Possible Market Scenarios During an Election Rematch

Various political outcomes can lead to different market reactions. A decisive victory, signifying policy continuity, might bring about a period of calm and market stability, as investors anticipate predictable economic policies.

- Scenario 1: Clear Victory and Policy Continuity. If the incumbent or a candidate with a clear mandate wins, investors might interpret this as a sign of stability and predictable policy direction. This could lead to a sustained market high, potentially driven by investor confidence in the future economic trajectory. Similar to the post-election market reactions following previous presidential victories, this scenario could result in sustained positive market sentiment.

- Scenario 2: Close Election and Political Uncertainty. A close election outcome, particularly if the result is contested or if the election outcome is unclear, could trigger market volatility. Investors might exhibit hesitation, potentially leading to a correction or a period of uncertainty, similar to market fluctuations witnessed during previous close elections. The period of uncertainty could last for several weeks or months, depending on how long the outcome remains unresolved.

- Scenario 3: Shift in Political Ideology and Unexpected Policy Changes. An election result that indicates a significant shift in political ideology, or if the election result suggests an unexpected change in economic policy, could result in a market reaction that is either a sharp decline or a significant upward surge. The magnitude of the reaction would depend on how the market perceives the implications of the new policy direction.

This could be comparable to market responses to unexpected policy shifts in past elections.

Implications for Investors, Businesses, and the Broader Economy

The market’s response during an election rematch period significantly impacts various stakeholders. Investors face the challenge of evaluating the potential risks and rewards of different political outcomes. Businesses need to adapt their strategies based on the economic environment.

- Investors: Investors must assess the risk-reward profile of different political scenarios and adjust their investment strategies accordingly. A clear victory often leads to higher confidence and potentially higher returns. However, uncertainty could result in risk aversion and a pullback in investment.

- Businesses: Businesses must analyze the potential economic impact of the election outcome. Policy continuity might foster a stable environment for investment and growth, while uncertainty could increase operational risks and hinder long-term planning. This could lead to significant implications in terms of investment and hiring decisions.

- Economy: The election’s impact on the market can influence consumer confidence and spending, impacting overall economic growth. A stable market environment can encourage investment and stimulate economic activity. Conversely, uncertainty can dampen consumer and business confidence, potentially leading to a slowdown in economic growth.

Comparison of Market Reactions Based on Differing Political Viewpoints

Different political viewpoints can influence how investors and analysts interpret market reactions to an election rematch. Those aligned with the winning candidate’s platform might view the market’s reaction positively, while those with opposing viewpoints might interpret the same reaction as negative or even a cause for concern. Historical examples of market reactions to election results, viewed through different ideological lenses, can be useful in understanding this dynamic.

Economic Impact of a Market High During an Election Rematch

A market high during an election rematch period, especially if it’s accompanied by a clear political victory, can signal a period of economic optimism. This can translate into increased investment, higher consumer confidence, and potential job creation. However, market highs can also be unsustainable, and if not grounded in tangible economic improvements, could be susceptible to corrections. The historical correlation between market highs and subsequent economic performance is crucial for understanding the long-term implications.

Conclusive Thoughts

In conclusion, the election rematch disbelief stock market high phenomenon reveals a complex relationship between political events, public sentiment, and economic indicators. While historical patterns offer valuable insights, predicting the market’s precise reaction in a future rematch remains challenging. The intricate interplay of these factors underscores the importance of understanding the various influencing forces. Ultimately, the analysis emphasizes the need for a nuanced understanding of these intricate connections, especially in the context of investor behavior.

Q&A

What are some common factors that influence investor confidence during an election rematch?

Investor confidence is affected by a range of factors, including economic projections, perceived political stability, and the perceived competency of the candidates. Past performance, the candidate’s stance on economic issues, and overall market sentiment also play crucial roles.

How do different demographics react to election rematch outcomes?

Different demographics, such as age groups, income levels, and political affiliations, often exhibit varied reactions to election outcomes. This can lead to differing impacts on the stock market depending on the specific political leanings of the various groups.

Can economic indicators predict the stock market’s reaction to an election rematch?

While economic indicators provide valuable insights, they aren’t a definitive predictor. The stock market’s response is often a complex interplay of various factors, making precise predictions challenging.

What are some potential policy changes that might positively impact investor sentiment during an election rematch?

Potential policy changes, such as tax cuts, infrastructure investments, or deregulation, can positively impact investor sentiment. The perceived benefits of these policies on the economy often influence market confidence.