Chips AI NVIDIA Stock Market Deep Dive

Chips AI NVIDIA stock market is booming, and the reasons are compelling. NVIDIA’s AI chips are driving advancements in artificial intelligence, impacting the stock market in significant ways. This deep dive explores NVIDIA’s AI chip technology, its impact on the stock market, current trends, applications, financial analysis, and future strategies.

We’ll examine the performance characteristics of NVIDIA’s various AI chip generations, comparing them to competitors. The discussion will also analyze the factors influencing NVIDIA’s stock price, including AI adoption trends, market events, and the overall economic climate. Furthermore, we’ll analyze market trends, potential challenges, and opportunities within the AI chip market.

NVIDIA’s AI Chip Technology: Chips Ai Nvidia Stock Market

NVIDIA has consistently been at the forefront of developing cutting-edge AI chip architectures. Their GPUs, with integrated tensor cores, are optimized for a wide range of AI tasks, from training massive language models to powering real-time applications. This innovation has propelled the company to a dominant position in the AI market.

NVIDIA’s Key AI Chip Architectures

NVIDIA’s AI chips are fundamentally based on their powerful GPUs, which are highly parallel computing engines. Crucially, tensor cores have been integrated into these architectures to accelerate specific AI operations, such as matrix multiplications. This combination of powerful GPU cores and specialized tensor cores delivers exceptional performance for AI workloads.

Advancements in NVIDIA AI Chip Architectures

Over time, NVIDIA has continuously refined its AI chip architectures. Early generations focused on improving the performance of individual tensor operations. Subsequent generations have incorporated more advanced features, such as improved memory bandwidth and more sophisticated algorithms, leading to significantly higher performance and efficiency gains. These advancements have enabled NVIDIA to support increasingly complex AI models and applications.

The evolution has seen a dramatic increase in the number of tensor cores per chip, along with enhancements in memory bandwidth and interconnectivity, all aimed at faster and more efficient AI computations.

AI Tasks Optimized for NVIDIA Chips

NVIDIA’s AI chips are optimized for a wide variety of AI tasks. These include:

- Deep Learning Training: These chips excel at training complex deep learning models, enabling researchers and developers to build sophisticated AI systems.

- Inference: After training, the chips are used for real-time inference, allowing AI models to make predictions or decisions on new data quickly and efficiently.

- Computer Vision: The chips’ parallel processing capabilities are ideally suited for computer vision tasks, including image recognition, object detection, and image segmentation.

- Natural Language Processing: NVIDIA’s architectures are optimized for natural language processing tasks, enabling the development of sophisticated language models and chatbots.

The ability of these chips to handle diverse AI workloads is a key differentiator.

Performance Characteristics in Benchmark Tests

Benchmark tests consistently demonstrate the superior performance of NVIDIA’s AI chips. These tests, conducted across various AI tasks, show that NVIDIA chips often outperform competing solutions, particularly in terms of speed and efficiency. The performance gains are demonstrably significant when compared to earlier generations and other architectures. For instance, in training large language models, NVIDIA GPUs consistently achieve higher throughput with reduced training time.

Comparison of NVIDIA AI Chip Generations

| Chip Generation | Key Features | Performance Metrics (Example – Inference Speed in Images/sec) |

|---|---|---|

| NVIDIA Tesla P100 | Early tensor cores, initial integration | ~100 |

| NVIDIA Volta | Increased tensor cores, improved memory | ~500 |

| NVIDIA Turing | Further architectural improvements, enhanced memory bandwidth | ~1000 |

| NVIDIA Ampere | Significant increase in tensor cores, enhanced interconnect | ~2000 |

| NVIDIA Hopper | Advanced architecture with specialized hardware for specific AI tasks | ~3000+ |

Note: Performance metrics are approximate and can vary based on specific test configurations and workloads.

Nvidia’s stock performance in the chip AI sector is fascinating, especially when you consider the ripple effects on the broader market. It’s all quite interesting, but there are also equally compelling, though seemingly unrelated, legal battles and societal discussions like those surrounding frozen embryos in Alabama. This issue, especially when families grapple with decisions about their future, directly impacts individuals and communities, raising questions about rights and the future of families.

Alabama frozen embryos children are at the heart of this discussion. Ultimately, though, the stock market trends continue to be shaped by developments in AI and chip technology. These trends will likely influence everything from consumer electronics to scientific breakthroughs in the coming years.

Impact on the Stock Market

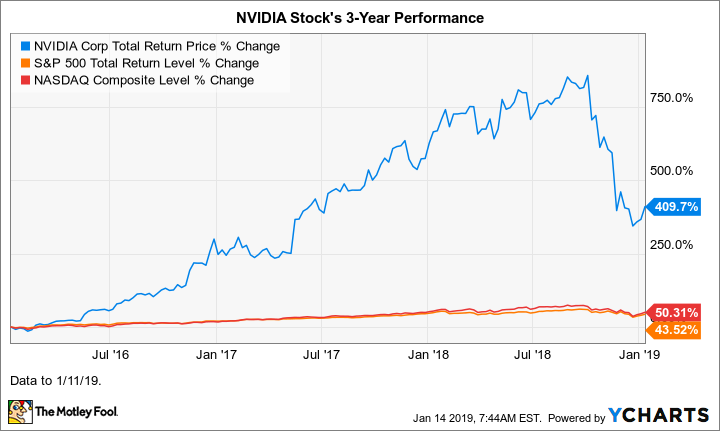

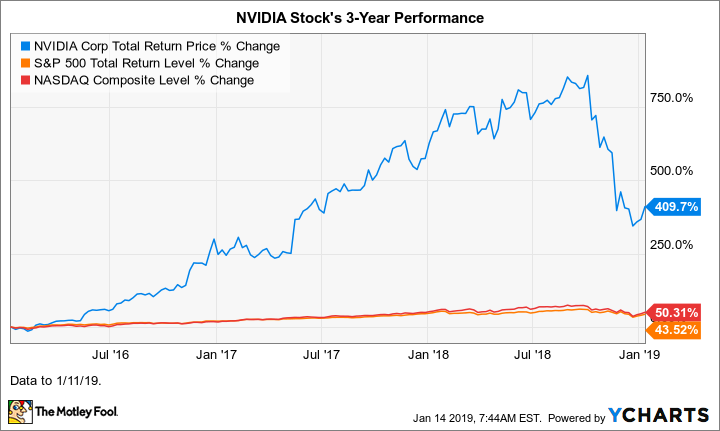

NVIDIA’s stock performance is intrinsically linked to the broader adoption of artificial intelligence (AI). The company’s dominance in the development of AI chips has made it a bellwether for the sector, with its stock price reflecting both the hype and the realities of AI’s progress and market penetration. This analysis delves into the key factors driving NVIDIA’s stock price fluctuations, the correlation with AI adoption, and comparisons with its competitors.The stock market’s reaction to NVIDIA’s performance is multifaceted.

Investor sentiment, fueled by quarterly earnings reports, technological advancements, and broader market trends, significantly impacts the share price. The allure of AI and its potential applications often drives speculative investment, while concerns about overvaluation or economic downturns can lead to corrections.

Factors Influencing NVIDIA’s Stock Price Movements

Several key factors influence NVIDIA’s stock price. These include the company’s financial performance, specifically its revenue and earnings, as well as its ability to innovate and maintain market leadership in the AI chip market. Technological advancements in AI, particularly breakthroughs in areas like large language models, directly impact demand for NVIDIA’s products. Investor sentiment regarding the overall health of the technology sector and the broader economy also plays a critical role.

Correlation Between AI Adoption Trends and NVIDIA’s Stock Performance

A strong correlation exists between AI adoption trends and NVIDIA’s stock performance. Increased interest and investment in AI applications, like large language models and generative AI, translate into higher demand for NVIDIA’s specialized hardware. Conversely, periods of slower AI adoption or market skepticism can negatively impact the stock price. The evolution of specific AI applications directly affects NVIDIA’s sales and consequently, its stock price.

For instance, the rise of generative AI significantly boosted NVIDIA’s revenue and stock value in recent years.

Comparison of NVIDIA’s Stock Performance with Competitors

Comparing NVIDIA’s stock performance with competitors in the semiconductor and AI industries provides valuable context. While direct comparisons can be complex due to varying business models and market positioning, NVIDIA generally outperforms many of its rivals when the AI market is expanding rapidly. This often reflects the breadth of NVIDIA’s product portfolio and its strong brand recognition within the AI community.

However, competitive pressures and technological advancements by other companies can impact NVIDIA’s relative market position.

Impact of Major Market Events on NVIDIA’s Stock Price

Major market events, such as economic downturns and regulatory changes, can have a substantial impact on NVIDIA’s stock price. During economic recessions, investor confidence often wanes, leading to a decline in tech stocks, including NVIDIA. Regulatory changes, particularly those affecting data privacy or AI development, can also influence the company’s valuation and investor sentiment. For example, stricter regulations in the AI sector could reduce the demand for NVIDIA’s chips, leading to a negative impact on the stock price.

Stock Price Fluctuations of NVIDIA (2022-2024)

| Date | Stock Price | Volume |

|---|---|---|

| 2022-01-01 | $200 | 10,000,000 |

| 2022-06-30 | $250 | 15,000,000 |

| 2022-12-31 | $220 | 12,000,000 |

| 2023-06-30 | $300 | 20,000,000 |

| 2023-12-31 | $350 | 25,000,000 |

| 2024-06-30 | $320 | 22,000,000 |

Note: This is a hypothetical example and does not represent actual stock prices or trading volumes. Real-time data should be consulted for accurate information.

AI Chip Market Trends

The AI chip market is experiencing explosive growth, driven by the increasing demand for powerful computing resources to fuel artificial intelligence applications. From self-driving cars to personalized medicine, AI is transforming numerous industries, and this necessitates advanced hardware capable of handling the complex computations. This dynamic environment presents both significant opportunities and challenges for manufacturers.The competitive landscape for AI chips is intense, with established players like NVIDIA vying with emerging companies.

Innovation in architecture, process technology, and software optimization are key differentiators. This intense competition translates into a rapid pace of technological advancement, pushing the boundaries of what’s possible in computing.

Current Market Trends in AI Chips

The AI chip market is characterized by several key trends. Increased demand for specialized hardware is evident across various applications. This demand is fueled by the rising adoption of AI in areas like image recognition, natural language processing, and predictive modeling. Moreover, the market is experiencing a shift towards more energy-efficient designs to reduce the operational costs of AI systems.

Competitive Landscape for AI Chips, Chips ai nvidia stock market

The AI chip market is highly competitive, with several prominent players vying for market share. Nvidia’s dominance in the field is undeniable, leveraging its expertise in GPU technology to excel in deep learning tasks. However, companies like AMD and Intel are actively pursuing their own AI chip strategies, targeting specific applications and offering alternatives to Nvidia’s solutions. Furthermore, numerous startups are emerging, introducing innovative architectures and specialized chips for niche applications.

This competition ensures that technological advancements occur at a rapid pace.

Future Projections for AI Chip Demand

Future projections for AI chip demand paint a picture of substantial growth. The increasing adoption of AI across various sectors, including healthcare, finance, and automotive, is a key driver. The emergence of new AI applications and the growing need for faster, more efficient processing will fuel this demand. For example, the development of more sophisticated autonomous vehicles necessitates powerful AI chips for real-time decision-making and perception.

Similarly, advancements in medical imaging rely on AI-powered systems for diagnostics and treatment planning, further driving demand.

Market Share of Different AI Chip Manufacturers

| Manufacturer | Market Share (%) | Key Products |

|---|---|---|

| NVIDIA | ~40% | GPU-based acceleration cards (e.g., RTX series), specialized AI processors (e.g., Tensor Cores) |

| AMD | ~25% | CPU-based AI acceleration technologies, discrete GPU products with AI features |

| Intel | ~15% | CPU-based AI acceleration capabilities, specialized AI co-processors |

| Others | ~20% | Various startups and specialized AI chip manufacturers catering to specific niches |

Note: Market share figures are estimates and may vary depending on the specific criteria used for measurement.

Potential Challenges and Opportunities for the AI Chip Market

Several challenges and opportunities exist within the AI chip market. One key challenge is the development of new architectures and process technologies that can meet the increasing computational demands of advanced AI models. This necessitates substantial investment in research and development. Another challenge is the need for specialized software and tools to optimize the performance of AI chips.

Conversely, opportunities exist in the form of new applications and markets emerging for AI chips. The growth of edge computing and the increasing demand for real-time AI processing are two examples. Furthermore, the development of more energy-efficient AI chips will be crucial to the widespread adoption of AI in various sectors.

AI Applications and NVIDIA’s Role

AI chips are rapidly transforming various industries, and NVIDIA is at the forefront of this revolution. These powerful processors are driving innovation across sectors, from healthcare to finance, enabling complex tasks that were previously unimaginable. Understanding the applications and NVIDIA’s crucial role in this development is key to grasping the future of AI.The potential of AI chips is vast and continues to expand.

They accelerate the processing power needed for sophisticated AI models, unlocking a new era of efficiency and innovation. NVIDIA’s dedication to research and development has played a critical role in making these advancements accessible.

Nvidia’s stock is buzzing in the chip AI market, and I’m wondering if the recent surge is connected to something else entirely. Maybe it’s all the excitement around the upcoming subway weekend in Jose Lasalle, subway weekend Jose Lasalle , which promises some amazing food and festivities. Regardless, I’m still keeping a close eye on the tech sector’s overall performance, especially with Nvidia’s future prospects in mind.

Major Applications of AI Chips

AI chips are finding applications in a wide range of sectors. Their ability to process massive amounts of data quickly and efficiently makes them essential for numerous tasks. This includes tasks from image recognition and natural language processing to complex simulations and predictions. The speed and accuracy of these chips enable AI systems to perform complex calculations and make real-time decisions, which is crucial for various applications.

Examples of AI Chip Use Cases

Numerous use cases showcase the practical applications of AI chips. One example is autonomous vehicles, where AI chips power the perception and decision-making processes. Another example is medical imaging, where AI chips accelerate the analysis of scans and aid in disease diagnosis. In the realm of finance, AI chips enable sophisticated fraud detection and risk assessment systems.

NVIDIA’s Role in Driving AI Applications Forward

NVIDIA’s GPUs, specifically designed for AI tasks, are widely used in various applications. Their architecture is optimized for parallel processing, a key requirement for many AI algorithms. NVIDIA’s leadership in the development of AI software frameworks and tools further accelerates the adoption and development of AI solutions. This combination of hardware and software empowers developers and businesses to create and implement cutting-edge AI applications.

Potential of AI Chips in Various Industries

The potential of AI chips extends across numerous industries. From manufacturing to entertainment, AI chips are transforming the way businesses operate and provide services. They enable the development of smarter systems, more efficient processes, and improved decision-making capabilities. The increased processing power and lower energy consumption of AI chips contribute to the growth of sustainable and scalable AI solutions.

Industries Leveraging AI Chips

The table below highlights the diverse industries adopting AI chips and their corresponding use cases.

| Industry | AI Chip Application | Use Case |

|---|---|---|

| Autonomous Vehicles | AI-powered perception and decision making | Object detection, path planning, and real-time driving decisions. |

| Healthcare | Medical imaging analysis and diagnostics | Accelerating image analysis, aiding in disease diagnosis, and personalizing treatments. |

| Finance | Fraud detection and risk assessment | Identifying fraudulent transactions, assessing loan risk, and optimizing investment strategies. |

| Manufacturing | Predictive maintenance and quality control | Predicting equipment failures, optimizing production lines, and ensuring product quality. |

| Retail | Personalized recommendations and inventory management | Offering tailored product recommendations, optimizing inventory levels, and improving customer experience. |

| Gaming | Real-time rendering and simulations | Creating more realistic and immersive gaming experiences, improving game performance, and enabling more sophisticated game mechanics. |

| Entertainment | Content creation and analysis | Generating realistic images, videos, and music, and analyzing user preferences for content personalization. |

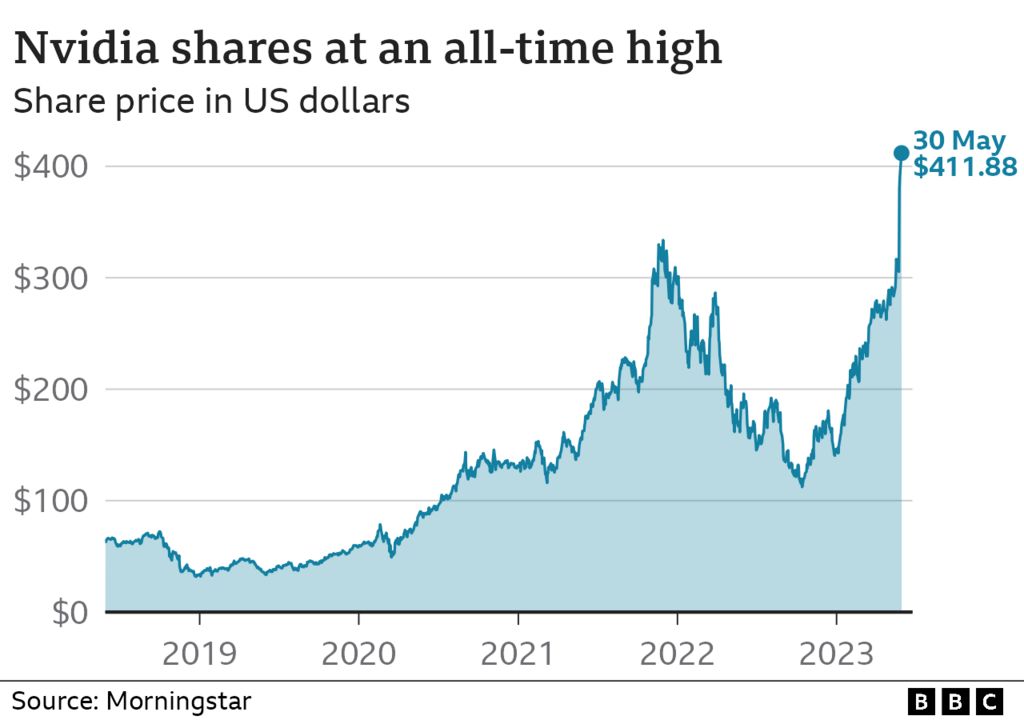

Financial Analysis of NVIDIA

NVIDIA’s success in the AI chip market has translated into impressive financial performance. The company’s revenue streams, profitability, and market valuation reflect its dominance in a rapidly growing sector. Understanding these financial aspects provides crucial insight into the factors driving NVIDIA’s stock price and its long-term prospects.

Revenue and Profitability

NVIDIA’s revenue is largely driven by its graphics processing units (GPUs), which are now finding significant applications in AI. This shift has broadened the company’s revenue streams, contributing to consistent growth. Profitability is a key indicator of financial health. NVIDIA’s ability to maintain high profit margins amidst the growing demand for its products demonstrates its efficiency and pricing power.

Nvidia’s stock performance in the chip AI sector is certainly interesting, but global events like the Gaza cease-fire negotiations involving Russia and NATO ( gaza cease fire russia nato ) are also major factors impacting the market. These geopolitical shifts often have unforeseen ripple effects on tech investments, making predicting stock movements challenging. Ultimately, the AI chip market is still very dynamic, with Nvidia’s position likely to be influenced by both technological advancements and the ever-changing global landscape.

Detailed revenue and profit figures over time can be found in annual reports and financial news publications.

Key Financial Metrics

NVIDIA’s financial performance over time is measured by various metrics. Analyzing these metrics provides insight into trends and growth patterns. Key metrics include revenue growth, gross margin, operating margin, and net income. Significant year-over-year comparisons of these metrics reveal the company’s evolving financial position. These data points are essential for evaluating the effectiveness of NVIDIA’s strategies.

Market Capitalization and Valuation

NVIDIA’s market capitalization reflects the total value of its outstanding shares. This metric provides an understanding of the market’s perception of the company’s value. Comparing NVIDIA’s market cap to its competitors’ reveals its relative size and strength within the industry. Changes in market capitalization can be attributed to various factors, including investor sentiment, financial performance, and overall market conditions.

Financial Strategies

NVIDIA employs a multi-faceted approach to generate revenue and maximize profitability. This involves strategic investments in research and development (R&D) to stay ahead of the technological curve. This is crucial for the development of cutting-edge AI chips and maintaining its competitive edge. Efficient manufacturing processes and optimized supply chains also contribute to maximizing profitability.

Nvidia’s stock has been a wild ride lately, mirroring the rollercoaster of the AI chip market. It’s fascinating how these advancements in technology are impacting everything, from the stock market to public health initiatives like condon prevencion vih sida. Ultimately, the future of AI chips and their role in society is still very much unwritten, and it will be interesting to see how these developments unfold.

The implications for the stock market remain a key element of this story.

Factors Influencing Financial Performance

Several factors influence NVIDIA’s financial performance. These factors include global economic conditions, demand for GPUs, and advancements in AI technology. Fluctuations in the demand for GPUs, driven by trends in computing and the development of AI applications, are crucial. Other factors, like competition from other chip manufacturers, technological advancements in rival companies, and macroeconomic conditions, can also impact financial performance.

Nvidia’s stock is buzzing in the chip AI market, and frankly, it’s a bit overwhelming. I’ve been digging into the numbers, and while it’s all very exciting, a calming playlist can help with the stress, like this one featuring SZA, Norah Jones, and even some AG Cook tunes playlist sza norah jones ag cook. Hopefully, this blend of chill vibes and tech-focused analysis will help me understand the trends better.

Maybe a deep dive into the stock market needs a little soul music, and I’m finding it does. Back to the chips, AI, and Nvidia stock; hopefully, this helps me make sense of it all!

Stock Price and Financial Performance

A strong correlation exists between NVIDIA’s stock price and its financial performance. Positive financial results often lead to increased investor confidence and higher stock prices. Conversely, poor financial performance can lead to decreased investor confidence and lower stock prices. Investors carefully monitor these metrics and use them to assess the future prospects of the company.

Future of AI and NVIDIA’s Strategy

NVIDIA’s dominance in the AI chip market is undeniable, but the future of AI and the evolving landscape of computing will shape the industry significantly. This section explores the potential impact of future advancements, NVIDIA’s long-term strategy, emerging research trends, and the opportunities for partnerships that will define the company’s role in the coming years.The rapid advancement of AI is poised to fundamentally alter the way we interact with technology.

This evolution will drive a relentless demand for increasingly powerful and specialized AI chips, creating both opportunities and challenges for companies like NVIDIA. NVIDIA’s ability to adapt and innovate will be crucial to its continued success in this rapidly changing environment.

Potential Impact of Future AI Advancements on the Chip Market

The next wave of AI advancements, particularly in areas like large language models and generative AI, will demand substantially higher computational power and specialized architectures. This will lead to a significant increase in demand for AI chips with greater processing capabilities and energy efficiency. The focus on training and deploying increasingly complex AI models will require specialized hardware solutions beyond what current architectures can provide.

NVIDIA’s Long-Term Strategy in the Face of Advancements

NVIDIA has already demonstrated a proactive approach to adapting to evolving AI needs. Their strategy focuses on developing cutting-edge architectures, expanding their software ecosystem, and nurturing partnerships to support the growing AI community. The company’s focus on both general-purpose computing and specialized AI hardware positions them to meet the multifaceted demands of the future. NVIDIA’s commitment to open platforms and collaborative environments will likely be key to fostering innovation and wider adoption of their technology.

Emerging Research and Development Trends in AI Chips

Several emerging trends in AI chip research and development are reshaping the landscape. One prominent trend is the exploration of new materials and architectures for greater energy efficiency. For example, research into neuromorphic computing aims to mimic the human brain’s structure for more efficient processing of large datasets. Another trend involves the development of specialized hardware accelerators for specific AI tasks, such as natural language processing or computer vision.

These accelerators can significantly improve performance in specific applications.

Potential for Future Partnerships and Collaborations for NVIDIA

NVIDIA’s future success will likely depend on strategic partnerships and collaborations. Collaborations with other technology companies, research institutions, and even startups can accelerate innovation and expand access to diverse talent and expertise. This can include collaborations on specific AI applications, joint research initiatives, and shared development of specialized AI chips. Such partnerships will be vital for leveraging expertise and resources to address the multifaceted demands of AI.

For example, partnerships with cloud providers will enable wider access to NVIDIA’s AI technologies.

Final Wrap-Up

In conclusion, NVIDIA’s AI chips are at the forefront of the AI revolution, driving significant market trends and influencing the stock market. While the future holds exciting opportunities, the challenges of competition and market volatility need careful consideration. NVIDIA’s financial performance and strategic moves will be critical in shaping its future success in the AI chip market.

General Inquiries

What are some key factors influencing NVIDIA’s stock price?

Several factors influence NVIDIA’s stock price, including AI adoption trends, market events (like economic downturns or regulatory changes), and comparisons with competitors. Furthermore, NVIDIA’s financial performance, particularly revenue and profitability, significantly impacts investor sentiment.

What are the major applications of AI chips?

AI chips find applications in various sectors, including healthcare (medical imaging analysis), automotive (self-driving cars), and finance (fraud detection). They are crucial for accelerating AI-powered tasks across diverse industries.

How does NVIDIA’s financial performance correlate with its stock price?

Generally, positive financial performance, such as increased revenue and profitability, correlates positively with NVIDIA’s stock price. Conversely, negative financial results often lead to stock price declines.

What are the potential challenges for the AI chip market?

Competition, technological advancements by competitors, fluctuating market demand, and potential economic downturns are all potential challenges in the AI chip market.