Budget Deal US Government Debt Analysis

Budget deal US government debt looms large over the nation’s financial future. This comprehensive analysis delves into the implications of the recent agreement, exploring its impact on the national debt, potential economic consequences, and international ramifications.

The US government’s financial health is a complex issue, with historical trends, various components, and stakeholders all playing a crucial role. This analysis will explore the intricacies of the budget deal, considering the debt ceiling, negotiations, and potential solutions.

Overview of the US Government Debt

The United States government’s national debt represents the cumulative total of borrowed funds over time, exceeding trillions of dollars. Understanding this debt is crucial to grasping the nation’s fiscal health and the impact on its citizens. It’s not simply a number; it reflects economic policies, spending priorities, and the overall trajectory of the nation.This overview delves into the historical context, different components, and the various types of debt that comprise the US national debt.

Analyzing these elements provides a more complete picture of this significant economic phenomenon.

Historical Trends of US Government Debt, Budget deal us government debt

The US national debt has fluctuated significantly throughout history, often correlating with major economic events and wars. Initially, the debt was relatively low compared to the nation’s economic output. However, World War II and subsequent periods of significant spending, such as the Korean War, the Vietnam War, and more recently, the economic crises of 2008 and the COVID-19 pandemic, led to substantial increases.

These increases reflect both the need to fund essential programs and the challenges of maintaining fiscal stability during times of economic instability.

Components of the US National Debt

The US national debt encompasses various categories of borrowing. These categories include debt held by the public, which represents the amount owed to individuals, corporations, and foreign governments. Another component is intragovernmental holdings, where one part of the government owes money to another. This typically arises from the government borrowing money from its own trust funds or special accounts.

Types of US Government Debt

Understanding the different types of government debt provides a more nuanced perspective on the overall picture. The following table categorizes and summarizes the various types of US government debt:

| Debt Type | Description | Amount (approximate) |

|---|---|---|

| Debt held by the public | This comprises Treasury securities held by individuals, corporations, and foreign governments. | $28 trillion |

| Intragovernmental holdings | This category includes debt held by one part of the federal government (like Social Security Trust Funds) owing to another. | $8 trillion |

| Treasury Bills | Short-term debt instruments with maturities of less than one year. | Variable, depending on issuance |

| Treasury Notes | Debt instruments with maturities ranging from two to ten years. | Variable, depending on issuance |

| Treasury Bonds | Long-term debt instruments with maturities exceeding ten years. | Variable, depending on issuance |

Understanding these different types of debt provides a complete picture of the national debt’s composition.

Budget Deal Implications

The recent budget deal, a crucial agreement for the US government, has significant implications for the national debt and the overall financial health of the nation. Understanding these implications requires a nuanced approach, examining both immediate and long-term effects, and considering the diverse stakeholders impacted. The deal, while aiming to address immediate fiscal challenges, potentially introduces complexities for the future.The budget deal’s impact on the US national debt is multifaceted.

While the agreement may temporarily reduce the deficit, it also sets the stage for future fiscal responsibilities. The specific provisions and their projected effects on the debt ceiling and overall national debt are key to understanding the deal’s long-term implications.

Impact on the National Debt

The budget deal, through its provisions, will likely influence the national debt in both the short and long term. This is because the deal’s components, including spending caps and revenue adjustments, directly affect the government’s ability to borrow money and manage its financial obligations. The precise amount of the debt reduction is contingent on the deal’s implementation and its subsequent impact on government spending and revenue collection.

Short-Term Effects

The immediate effects of the budget deal will depend on how swiftly Congress enacts the provisions and how quickly the economic conditions respond. These immediate impacts include potential changes in government spending and tax collection, which might lead to short-term economic volatility. Increased government spending on certain programs might stimulate the economy, but simultaneously increase the national debt, depending on the program and the economic climate.

The US government’s budget deal is looking pretty tricky right now, with a lot of debate swirling around the national debt. This delicate situation is further complicated by the ongoing tensions in the Middle East, particularly the conflicts involving Iran, iran conflictos medio oriente. These external pressures undoubtedly add another layer of complexity to the already challenging task of negotiating a responsible budget deal.

Tax adjustments could have similar economic consequences.

The US government’s budget deal is a hot topic right now, and it’s definitely causing some ripples. It’s all about finding a balance, and that’s always tricky. Meanwhile, the recent Carroll verdict involving Haley and Trump is also making headlines, highlighting the complex interplay of legal and political narratives. This verdict, as reported in carroll verdict haley trump , adds another layer to the discussion, which is undoubtedly impacting the overall political climate.

Ultimately, the budget deal will likely face scrutiny and adjustments as the political landscape continues to evolve.

Comparison with Previous Budget Deals

Comparing the recent budget deal with past agreements highlights the ongoing tension between short-term fiscal needs and long-term financial sustainability. Previous deals often exhibited similar challenges in balancing immediate needs with future obligations. Examining the historical trends and outcomes of these previous agreements provides valuable insights into the potential trajectory of the current deal. Analyzing the historical success rates of debt reduction strategies implemented in past deals can shed light on the feasibility of the current plan and its potential consequences.

Long-Term Financial Consequences

The long-term financial consequences of the budget deal are complex and depend on various factors, including economic growth, inflation, and unforeseen circumstances. Failure to address long-term fiscal challenges could result in unsustainable debt levels, potentially impacting future economic growth and creating uncertainty for investors. This can lead to higher borrowing costs, which in turn might negatively impact businesses and consumers.

Stakeholders Affected

The budget deal’s impact extends to a variety of stakeholders. Taxpayers, as primary contributors to government revenue, will be affected by changes in tax policies. Businesses, which often invest and operate within the economic environment, will feel the consequences of economic shifts caused by the deal. The government itself, through its various agencies and departments, will experience changes in funding and operational capacity.

Ultimately, the long-term success of the deal depends on its ability to foster a balanced approach that addresses the needs of all stakeholders.

Debt Ceiling and Negotiations: Budget Deal Us Government Debt

The US government’s ability to borrow money is constrained by a statutory limit known as the debt ceiling. When the government hits this limit, it can’t issue new debt to cover its obligations, potentially leading to a default on its financial commitments. Negotiations to raise the debt ceiling are often fraught with political tension, as disagreements between the political parties can delay or even threaten the process.

This complex issue demands a clear understanding of the process, historical context, and potential consequences.The process of raising the debt ceiling involves Congressional action. The Treasury Department signals when the debt ceiling is about to be reached, giving Congress time to act. Legislation is then introduced to raise the limit, often incorporating amendments and compromises related to broader policy debates.

The passage of this legislation is crucial to avoid a default.

The Debt Ceiling Raising Process

The US Treasury Department issues debt to finance government spending. This debt is reflected in the national debt, which is the total amount of money the government owes. The debt ceiling is a legal limit on the amount of debt the government can accumulate. When the debt reaches this limit, the Treasury is unable to borrow further money.

The only way to avoid a default is for Congress to raise the debt ceiling. This involves passing legislation that increases the limit, usually in the form of a bill. Once approved, the legislation is signed into law by the President, and the Treasury Department can continue borrowing.

Historical Context of Debt Ceiling Negotiations

Debt ceiling negotiations have a long history of political clashes. Disagreements over spending levels, tax policies, and other economic priorities often become intertwined with the debt ceiling process. These disagreements have frequently led to protracted negotiations and sometimes, even brinkmanship, with the potential for a default hanging over the nation. Previous instances have highlighted the economic vulnerability associated with such a default.

Potential Consequences of Failing to Raise the Debt Ceiling

A failure to raise the debt ceiling would have severe consequences. The US government would be unable to meet its financial obligations, including paying its bills, such as salaries, social security payments, and interest on the national debt. This could lead to a financial crisis, impacting the economy and confidence in the US financial system. The consequences would be widespread, affecting individuals, businesses, and the global economy.

History provides ample examples of the severe disruptions caused by sovereign debt defaults.

Role of Political Parties in Debt Ceiling Negotiations

Political parties often have differing views on government spending and fiscal policy. These differing perspectives significantly influence the negotiations surrounding the debt ceiling. One party might advocate for spending cuts, while the other party may favor increased spending or tax policies. These opposing viewpoints can create significant roadblocks in reaching a compromise. These political pressures often dominate the debate, leading to contentious negotiations.

Examples of Previous Debt Ceiling Crises

Several instances of debt ceiling crises have occurred in the past. These events have highlighted the potential economic instability that can arise when the government approaches or hits the debt ceiling. Each crisis reveals the importance of timely and effective negotiation to avoid a default. These previous crises underscore the need for a responsible and predictable approach to managing the national debt.

The 2011 debt ceiling crisis is a prime example of the potential economic damage from political gridlock.

Economic Impact of Debt

The recent budget deal, while crucial for averting a government shutdown, raises significant questions about the long-term economic health of the United States. Understanding the potential ripple effects of increased national debt on interest rates, inflation, and various sectors is paramount to assessing the deal’s true impact. Navigating this complex landscape requires a clear understanding of the interplay between fiscal policy, economic growth, and public perception.

Interest Rate Implications

The national debt directly influences interest rates. A substantial increase in the debt, as often happens with budget deals, can lead to higher borrowing costs for the government. This, in turn, can push up interest rates for consumers and businesses. For example, if the government needs to borrow more, it may increase the demand for loanable funds, thus increasing the cost of borrowing for individuals and corporations.

This is a classic supply-and-demand principle in action. Higher interest rates can stifle economic growth, making it more expensive for businesses to invest and consumers to finance purchases.

Impact on Inflation

Increased government spending, a common feature of budget deals, can potentially fuel inflation. If the government borrows heavily, the increased money supply can push up prices, as more money chases the same goods and services. Historically, significant increases in government spending have been correlated with periods of inflation. This is a critical consideration for policymakers, as inflation erodes purchasing power and can negatively impact economic stability.

Effects on Economic Sectors

The budget deal’s impact will likely vary across economic sectors. For example, industries heavily reliant on government contracts or subsidies might experience a boost. Conversely, sectors that are sensitive to interest rate fluctuations, like housing or automotive, could face headwinds. The deal’s specific provisions regarding spending on infrastructure or other projects will directly influence the sectors that see the most significant effects.

Inflation and Employment

The interplay between inflation and employment is complex. High inflation can erode purchasing power, impacting consumer spending. This can lead to a reduction in demand for goods and services, potentially impacting employment. Conversely, if the deal leads to economic growth, increased demand might lead to job creation. The extent of this impact is difficult to predict precisely, but it’s an important aspect to consider when evaluating the overall economic impact.

International Perspective

The US national debt, a significant global economic factor, has repercussions beyond its borders. Understanding the international implications of the recent budget deal is crucial to assessing its overall impact. The interconnectedness of global financial markets means that actions taken in one major economy, like the US, often reverberate throughout the world.The relationship between US debt and global financial markets is complex and multifaceted.

A stable US economy, underpinned by a responsible fiscal policy, fosters confidence in the dollar and in the broader global financial system. Conversely, uncertainty surrounding the US debt ceiling and potential default can create volatility and anxieties in global markets, impacting investors and economies worldwide.

Global Context of US National Debt

The US national debt, a substantial figure in the global financial landscape, influences international capital flows, exchange rates, and investor sentiment. Its size and management directly impact global economic stability. A large and seemingly intractable debt can create a ripple effect, affecting other economies through currency fluctuations and investment decisions.

Relationship Between US Debt and Global Financial Markets

The US dollar’s position as a global reserve currency is inextricably linked to the US government’s creditworthiness. Uncertainty regarding the US debt ceiling can lead to a flight to safety, where investors seek safer assets, potentially causing a decline in the value of the dollar and increased volatility in global markets. The potential for a US debt default would have a devastating impact on global financial markets.

This is evidenced by previous instances where perceived risk has triggered market corrections and economic slowdowns.

Debt Management Strategies of Other Countries

Many countries face debt challenges, employing various strategies to manage their obligations. Some nations prioritize fiscal consolidation, reducing government spending and increasing tax revenues. Others rely on foreign investment to fund their deficits, though this approach carries risks. A country’s ability to manage its debt depends on a combination of factors, including economic growth, fiscal discipline, and international support.

For example, Japan, with its substantial public debt, has navigated its challenges through various policies and international cooperation.

International Implications of the Budget Deal

The recent budget deal has implications for international trade, investment, and economic relations. The deal’s success in resolving the debt ceiling crisis can bolster investor confidence, contributing to a more stable global economic climate. Conversely, failure to resolve the issue could lead to increased uncertainty and potential disruptions in global financial markets. The deal’s success is crucial for maintaining stability in the international economy.

The US government’s budget deal is a hot topic, but it’s interesting to consider how these financial decisions connect to other issues. For example, the recent controversy surrounding midwife vaccinations and false immunization records in Nassau County, midwife vaccinations false immunization records nassau county , raises questions about public health priorities and resource allocation. Ultimately, all these issues point to a larger conversation about responsible government spending and the potential impact of such decisions on various levels of society, all connected to the budget deal.

Comparison of US Debt with Other Major Economies

The US debt-to-GDP ratio, while large, is not necessarily unique in the global context. Comparing the US situation to that of other major economies reveals a varied landscape of debt burdens and management strategies. For instance, Japan has a significantly higher debt-to-GDP ratio than the US, but its economic structure and international relations are different, potentially influencing how it handles its debt.

Analyzing the debt situations of other major economies provides a comparative perspective on the US’s position.

Future Projections

The US national debt, a complex and ever-evolving financial landscape, demands careful consideration of future projections. Understanding potential trajectories and the impact of policy choices is crucial for responsible fiscal management. This section delves into the intricate interplay of economic factors, policy decisions, and the implications for the nation’s financial future.Predicting the future of the national debt is challenging, but essential for informed decision-making.

The US government’s budget deal is a hot topic right now, and honestly, it’s a bit overwhelming to follow. While the details are complex, it’s interesting to consider how this impacts the overall economy. For example, it’s important to look at how this budget deal will affect women’s hockey, like the incredible new York PWHL team. womens hockey pwhl new york is making waves, and that’s inspiring.

Ultimately, the budget deal’s long-term effects on the economy remain to be seen, but it’s a significant event nonetheless.

A multitude of variables, from economic growth rates to interest rates, inflation, and unforeseen events, influence the trajectory of the debt. This section analyzes possible scenarios and highlights the potential risks and challenges associated with the growing debt burden. Furthermore, it explores potential solutions and strategies for managing the debt responsibly.

Projecting Future Trends of US National Debt

Forecasting the future trajectory of the US national debt requires considering various economic scenarios. Historical trends, current economic conditions, and potential future events all contribute to the complexity of this task. The Congressional Budget Office (CBO) and other reputable institutions regularly publish analyses and projections of national debt, offering valuable insights into potential future paths. Factors like GDP growth, interest rates, and government spending levels will heavily influence the debt trajectory.

Designing a Model to Predict the Impact of Different Policy Choices

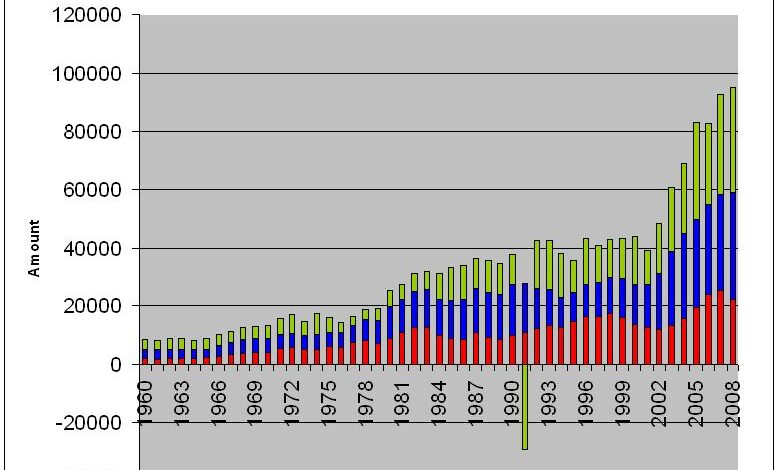

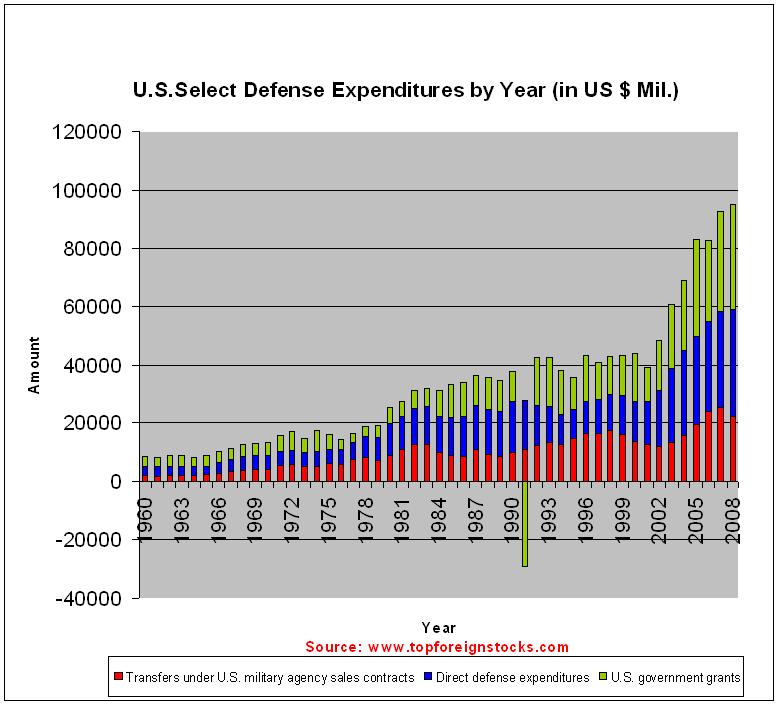

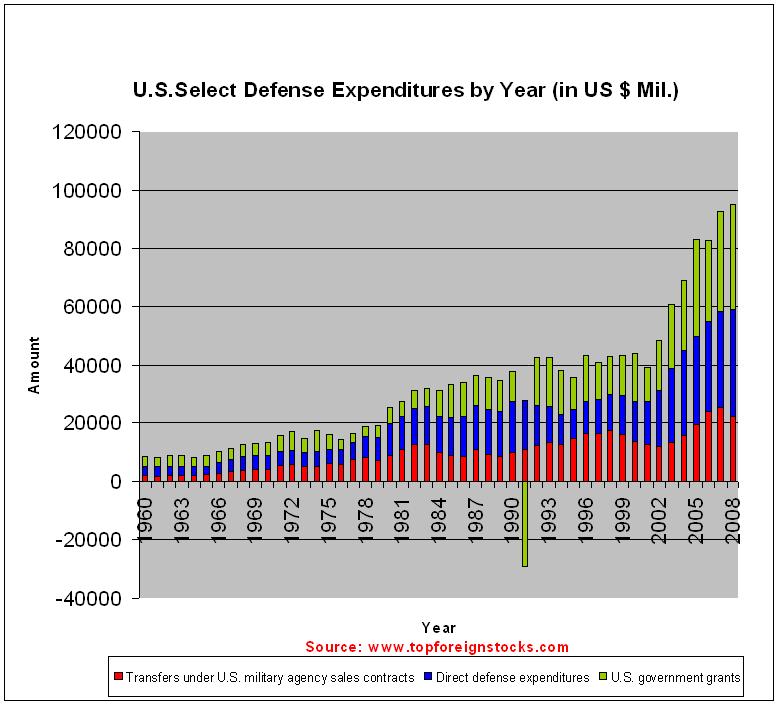

Developing a model to predict the impact of different policy choices on the national debt involves incorporating a range of variables and assumptions. A comprehensive model would need to consider government spending projections, projected revenue streams, and potential economic shocks. For example, a model predicting the effect of increased defense spending would incorporate the cost of additional military equipment and personnel, alongside the potential economic stimulation or disruption.

Similarly, changes in tax policy would require modeling the effects on revenue generation.

Potential Risks and Challenges for the Future

The rising US national debt poses significant risks and challenges for the future. One key concern is the potential for higher interest rates, which would increase the cost of servicing the debt. This could further strain the government’s budget and potentially lead to reduced investment in crucial areas like infrastructure and education. Another challenge is the risk of reduced investor confidence, which could lead to higher borrowing costs and further hinder economic growth.

The long-term impact of the debt burden on future generations also requires careful consideration.

Potential Solutions to Manage the Growing Debt

Managing the growing national debt necessitates a multifaceted approach. Strategies to reduce spending, increase revenue, and promote economic growth are crucial. A focus on efficiency in government operations, targeted investments in infrastructure and education, and sustainable revenue strategies can contribute to long-term fiscal stability. Furthermore, reforms to entitlement programs can reduce long-term costs, while also considering the impact on beneficiaries.

Projected Debt Levels Under Various Scenarios

| Scenario | Year | Debt Amount (in Trillions USD) |

|---|---|---|

| Baseline | 2030 | 40 |

| High Spending | 2030 | 45 |

| Reduced Spending | 2030 | 35 |

| Economic Recession | 2030 | 48 |

Note: These figures are illustrative examples and do not represent definitive predictions. The projected debt levels are contingent upon various economic and policy variables. Further analysis and refinement are necessary to provide precise projections.

Potential Solutions and Alternatives

The US national debt, a complex issue with far-reaching implications, requires multifaceted solutions. Simply cutting spending or increasing taxes isn’t a silver bullet. Effective strategies must consider the delicate balance between economic growth, social needs, and fiscal responsibility. Finding sustainable pathways to manage the debt is crucial for the long-term health of the nation.

Strategies for Managing the National Debt

Various strategies can be employed to manage the national debt, each with its own set of advantages and disadvantages. A comprehensive approach necessitates considering a range of options and implementing them in a coordinated manner. These strategies can be categorized into revenue generation and expenditure reduction.

Phew, the US government budget deal is finally sorted, but it’s still got me thinking about the national debt. It’s a weighty issue, no doubt, but when you see the breathtaking designs at the couture Didier Ludot 50th anniversary Paris show, it’s a welcome distraction. Still, back to the budget—how will this deal affect future generations and our national finances?

It’s a complex issue, but one that needs constant attention.

Revenue Generation Strategies

Increasing government revenue through various means is a crucial component of debt management. Raising taxes, while often unpopular, can provide significant funds to address the debt burden. Implementing new or adjusted tax policies, particularly on high-income earners and corporations, could yield substantial revenue streams.

- Tax Reform: Modernizing the tax code to close loopholes and ensure fairer distribution of tax burdens can increase revenue. For example, a reformed tax code could impose higher taxes on capital gains and dividends, and possibly include a wealth tax on the most affluent individuals.

- Increased Tax Rates: A potential solution is increasing tax rates for corporations and high-income individuals, while considering the impact on economic activity and investment.

- New Taxes: Implementing new taxes, such as a carbon tax or a financial transaction tax, could generate substantial revenue, but careful consideration must be given to the potential economic consequences and their impact on various sectors.

Expenditure Reduction Strategies

Reducing government spending is another crucial aspect of debt management. Prioritizing essential services and eliminating wasteful spending are key elements of this strategy.

- Government Efficiency Initiatives: Streamlining government operations, consolidating agencies, and improving procurement processes can lead to significant cost savings. For instance, automating administrative tasks and consolidating redundant services could free up resources for other important initiatives.

- Defense Spending Review: Regularly reviewing and adjusting defense spending levels is necessary. A thorough analysis of current needs, technological advancements, and potential threats could help optimize defense spending without compromising national security.

- Targeted Spending Cuts: Identifying and eliminating non-essential or low-impact programs could significantly reduce government expenditures. A detailed analysis of each program’s effectiveness and budgetary impact is crucial for making informed decisions.

Alternative Approaches to Debt Reduction

Alternative approaches to debt reduction go beyond traditional methods. These methods often focus on fostering economic growth and improving long-term sustainability.

- Economic Growth Initiatives: Encouraging economic growth through investments in infrastructure, education, and technological advancements can boost tax revenues and reduce the debt-to-GDP ratio over time. Investing in infrastructure projects, for example, can create jobs, stimulate economic activity, and boost long-term economic growth.

- Stimulating Investment: Policies aimed at encouraging investment in various sectors, such as renewable energy or technology, can lead to long-term economic growth and potentially reduce the burden of the national debt. Tax incentives and subsidies for these sectors can be implemented to encourage private investment.

- Debt Management Strategies: Implementing strategies to improve the efficiency and management of the existing national debt, such as using market mechanisms to lower borrowing costs, could significantly reduce the interest payments and make debt management more sustainable.

Pros and Cons of Different Debt Reduction Strategies

The following table summarizes potential solutions with their respective pros and cons:

| Solution | Pros | Cons |

|---|---|---|

| Tax Reform | Increased revenue, fairer distribution | Potential for economic slowdown, political opposition |

| Increased Tax Rates | Significant revenue generation | Economic disincentives, potential for tax avoidance |

| New Taxes | Novel revenue streams | Public resistance, negative economic impact |

| Government Efficiency | Cost savings, improved efficiency | Potential for job losses, bureaucratic resistance |

| Defense Spending Review | Cost savings, strategic realignment | Potential security risks, political opposition |

| Targeted Spending Cuts | Reduced unnecessary spending | Potential for negative social consequences, loss of critical services |

| Economic Growth Initiatives | Long-term debt reduction, improved GDP | Time-consuming, uncertain results |

| Stimulating Investment | Job creation, innovation | Ineffective policies, potential for misallocation |

| Debt Management Strategies | Lower borrowing costs, improved efficiency | Complex implementation, potential market risks |

Summary

In conclusion, the budget deal US government debt situation presents a complex web of interconnected factors. While the deal aims to address immediate concerns, long-term implications and potential solutions require careful consideration. The interplay of economic, political, and international factors shapes the future of US debt, making informed decision-making crucial.

Detailed FAQs

What are some common misconceptions about the US national debt?

Many believe the national debt is simply a sum of money owed, but it’s more nuanced. It represents accumulated borrowing over time, impacting interest rates, economic growth, and future generations. It’s not a static number.

How does the budget deal impact the debt ceiling?

The budget deal temporarily suspends the debt ceiling, allowing the government to borrow more money. However, it does not address the underlying causes of the ongoing need to raise the debt ceiling.

What are some potential alternative solutions for managing the debt?

Potential solutions range from economic growth strategies to tax reforms. The optimal approach depends on various factors and should consider the potential pros and cons of each strategy.

What is the role of international financial markets in the US debt situation?

International financial markets are heavily influenced by the US debt situation. The US’s role in the global economy and its creditworthiness affect investor confidence and interest rates worldwide.