Fed Rates Impact on Mortgages, Loans, & Credit Cards

Fed rates mortgages loans credit cards are intertwined, with changes in the federal funds rate significantly impacting borrowing costs for mortgages, loans, and credit cards. This article explores how these adjustments ripple through the financial landscape, affecting everything from housing market activity to personal finance strategies.

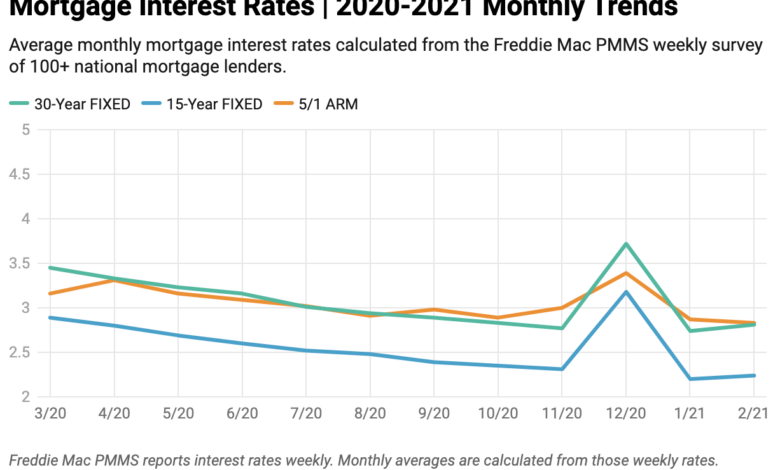

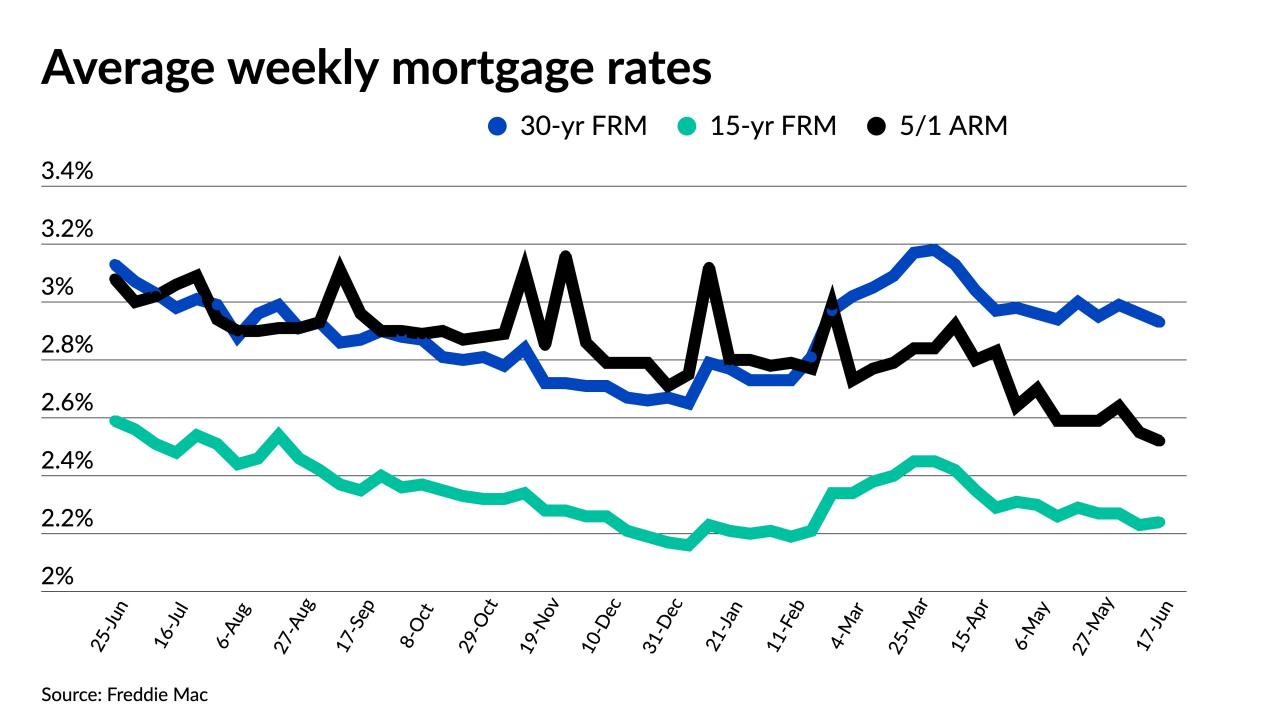

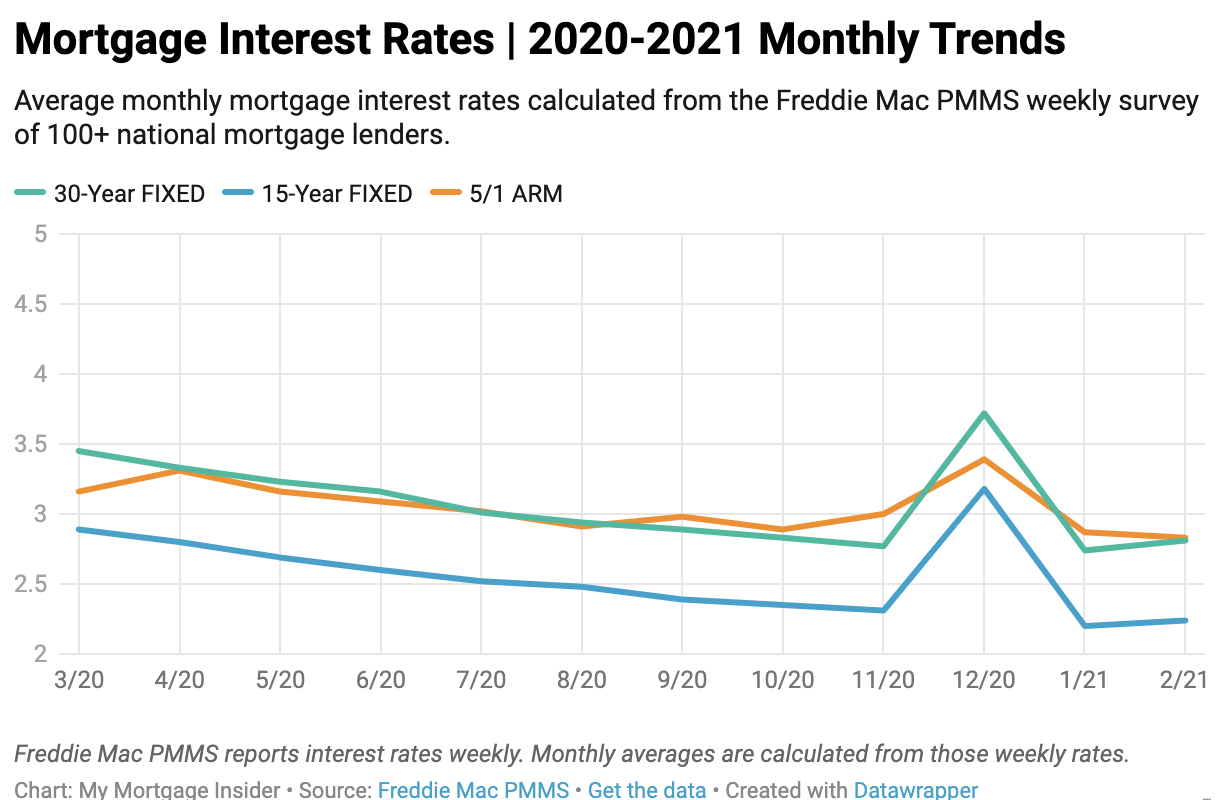

Understanding the correlation between fed rates and different loan types, like adjustable-rate mortgages (ARMs), is crucial. The time lag between Fed rate changes and consumer loan rate adjustments varies, but it’s important to know how these rates interact. This analysis provides a table comparing the impact of rate hikes on various mortgage types, including 30-year fixed, 15-year fixed, and ARMs.

We’ll also delve into the factors influencing the pass-through of these changes to consumer loan rates.

Federal Reserve Interest Rate Impacts

The Federal Reserve’s (Fed) influence on interest rates ripples through the financial system, significantly impacting everything from mortgages to credit cards. Understanding these impacts is crucial for consumers and investors alike. This exploration delves into the intricate relationship between the Fed’s actions and the rates you pay on various loans.The Fed adjusts the federal funds rate, which is the target rate at which banks lend money to each other overnight.

Changes in this rate often trigger a domino effect on other interest rates, including those for mortgages and consumer loans. The Fed’s goal is to maintain price stability and maximum employment, and interest rate adjustments are a key tool in achieving these objectives.

How Federal Funds Rate Changes Influence Mortgage Rates

Changes in the federal funds rate directly affect the cost of borrowing for banks. When the Fed raises the federal funds rate, banks must pay more to borrow money, which, in turn, increases the cost of funds for lending activities. This increased cost is then passed on to consumers in the form of higher mortgage rates. Conversely, lower federal funds rates typically lead to lower mortgage rates.

The relationship is not a direct one-to-one correspondence, as other factors influence mortgage rates.

Correlation Between Fed Rates and Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) are directly tied to the federal funds rate and other market benchmarks. When the federal funds rate rises, ARM rates typically follow suit, adjusting upward to reflect the current market conditions. This makes ARMs more sensitive to changes in the federal funds rate compared to fixed-rate mortgages. It’s essential for ARM borrowers to understand this correlation and plan accordingly for potential rate fluctuations.

Time Lag Between Fed Rate Adjustments and Consumer Loan Rate Changes

There’s often a time lag between the Fed’s interest rate adjustments and the subsequent changes in consumer loan rates. This lag is due to various factors, including the time it takes for banks to adjust their lending policies and the complexities of the financial markets. The precise duration of the lag can vary, sometimes taking weeks or even months for the full impact to be felt by consumers.

Impact of Fed Rate Hikes on Different Loan Types

| Loan Type | Impact of Fed Rate Hikes |

|---|---|

| 30-Year Fixed Mortgage | Typically experiences a rise in rates, although the impact might be somewhat less significant compared to ARMs. |

| 15-Year Fixed Mortgage | Similar to 30-year fixed mortgages, though the impact might be more pronounced due to the shorter term. |

| Adjustable-Rate Mortgage (ARM) | Directly reflects changes in the federal funds rate, often leading to a more immediate and substantial increase in rates. |

Factors Influencing Pass-Through of Fed Rate Changes to Consumer Loan Rates

Several factors can influence the degree to which changes in the federal funds rate are passed through to consumer loan rates. These factors include:

- Market Conditions: Overall economic conditions and market sentiment play a crucial role. A strong economy, for instance, might lead to a more rapid pass-through of rate changes. High demand for loans can also drive rates up more quickly.

- Bank Profit Margins: Banks aim to maintain healthy profit margins. They consider the cost of funds, the demand for loans, and other factors when adjusting loan rates.

- Competition Among Lenders: A competitive lending environment often results in more moderate rate adjustments. Banks are incentivized to remain competitive to attract customers.

- Loan Characteristics: The specific terms and conditions of the loan, such as the loan term and type of loan, can influence the extent of the pass-through. The risk profile of the borrower is also a key factor.

Mortgage Rates and Consumer Behavior

Rising interest rates, particularly those impacting mortgages, are a significant factor influencing the housing market and consumer decisions. The interplay between mortgage rates and consumer behavior is complex, affecting affordability, market activity, and ultimately, the overall health of the economy. Understanding these dynamics is crucial for investors, policymakers, and individuals navigating the current financial landscape.Fluctuating mortgage rates have a direct and measurable effect on the housing market.

Fed rates are impacting mortgages, loans, and credit cards in a big way right now. It’s all a bit unsettling, isn’t it? While the financial world grapples with these changes, it’s interesting to consider how seemingly unrelated events, like the future of snow polo in St. Moritz, are affected by climate change. Snow polo in St.

Moritz, a sport deeply rooted in tradition , is facing an uncertain future due to warming temperatures. Ultimately, these global shifts, from sporting events to financial markets, all connect in ways we’re only beginning to understand, making these high interest rates even more challenging for everyone.

Higher rates increase the cost of borrowing for homebuyers, potentially reducing demand and slowing down the pace of home purchases. Conversely, lower rates stimulate the market, encouraging more people to enter the housing market and leading to increased activity.

Impact on Housing Market Activity

Higher mortgage rates typically lead to a decrease in housing market activity. This is because the cost of borrowing becomes more expensive, making homeownership less affordable for many potential buyers. As a result, fewer people will be able to qualify for a mortgage, and the overall demand for homes will decrease. This can result in a slowdown in sales, reduced prices, and potentially a decline in housing starts.

Reduced activity can affect related industries like real estate agents, construction, and home improvement businesses.

Impact on Homebuyers’ Purchasing Decisions

Mortgage rates directly impact a homebuyer’s purchasing power. Higher rates translate into higher monthly payments, reducing the amount a buyer can afford to borrow. This often leads to a shift in purchasing decisions. Potential homebuyers may postpone their purchase plans, choose smaller or less expensive homes, or opt for renting instead of buying. The availability of financing plays a critical role in their decision-making process.

Relationship Between Mortgage Rates and Housing Affordability

The relationship between mortgage rates and housing affordability is inverse. Higher mortgage rates reduce affordability, making it harder for individuals to meet the financial obligations of a mortgage. This is especially true for first-time homebuyers, who often have limited savings and lower incomes. A higher interest rate on a mortgage loan translates into a higher monthly payment, impacting the overall affordability of the home.

Comparison of Effects on Different Demographics

The impact of mortgage rate increases varies across different demographics. First-time homebuyers are often the most vulnerable to rising rates, as they typically have smaller down payments and less established financial history. Seasoned homeowners, on the other hand, may have more financial resources and established credit histories, potentially mitigating the impact of rising rates. However, even seasoned homeowners may experience reduced purchasing power for investment or upgrading properties.

Historical Trends in Mortgage Rates and Housing Starts

| Year | Average Mortgage Rate (30-year fixed) | Housing Starts (Thousands) |

|---|---|---|

| 2020 | 3.1% | 1,500 |

| 2021 | 3.2% | 1,600 |

| 2022 | 5.5% | 1,200 |

| 2023 | 7.0% | 1,000 |

This table provides a simplified representation of historical trends. The data showcases a clear correlation between mortgage rates and housing starts. Higher rates generally correspond to a decline in housing starts. More comprehensive datasets, considering economic indicators and other market factors, are available from government agencies and financial institutions.

Fed rates are impacting mortgages, loans, and credit cards in ways we’re all feeling. It’s a complex situation, and while the financial implications are significant, they pale in comparison to the unimaginable horrors faced by lovers in Auschwitz, like Keren Blankfeld and József Debreczeni, in the cold crematorium. Their story, detailed in this heartbreaking account here , reminds us of the devastating human cost of indifference.

Ultimately, though, understanding the current financial climate, especially regarding mortgages, loans, and credit cards, remains crucial for managing personal finances.

Credit Cards and Interest Rates

Credit cards are an integral part of the modern financial landscape, offering convenience and flexibility. However, the interest rates associated with these cards are directly influenced by broader economic factors, particularly the Federal Reserve’s actions. Understanding this connection is crucial for anyone carrying credit card debt.Credit card interest rates are not static; they fluctuate in response to changes in the Federal Funds Rate, the benchmark interest rate set by the Federal Reserve.

This dynamic relationship has a significant impact on consumers’ borrowing costs.

The Connection Between Fed Rates and Credit Card Interest Rates

The Federal Reserve’s control over the federal funds rate directly impacts credit card interest rates. When the Fed raises interest rates, credit card issuers often follow suit to maintain their profitability. This is because the cost of borrowing money for the issuers increases, and they pass on these increased costs to cardholders. Conversely, when the Fed lowers interest rates, credit card issuers might also reduce their rates, although this isn’t always a direct or immediate correlation.

How Credit Card APRs are Influenced by Changes in the Fed Funds Rate

Credit card APRs (Annual Percentage Rates) are directly affected by the Fed Funds Rate. A rise in the Fed Funds Rate typically leads to a corresponding increase in credit card APRs. This is because the cost of funds for credit card companies increases. To compensate for this, they often raise their APRs to maintain their profitability. Conversely, a decrease in the Fed Funds Rate can potentially lead to a decrease in credit card APRs.

Strategies Employed by Credit Card Issuers to Adjust Their Rates

Credit card issuers employ various strategies to adjust their rates in response to changes in the Fed Funds Rate. These strategies can include:

- Market-Based Adjustments: Issuers often observe market trends and competitor actions to adjust their rates accordingly. If other issuers increase their rates, a company may be compelled to follow suit to remain competitive.

- Profitability Considerations: Credit card issuers carefully evaluate the cost of funds and their desired profit margins. Adjustments to rates are frequently linked to their overall profitability objectives.

- Economic Forecasts: Credit card issuers often take into account economic forecasts and market conditions. Predictions about future interest rates and economic growth are factored into their rate adjustment strategies.

Examples of Credit Card Interest Rate Responses to Periods of High or Low Fed Rates

During periods of high Fed Funds Rates, credit card interest rates tend to increase. This was observed during the 2022-2023 period, where several credit card companies raised their APRs. In contrast, when Fed Funds Rates were low, as seen in the 2020-2021 period, some credit card companies lowered their APRs, although this wasn’t universal.

Relationship Between Fed Rates and Average Credit Card Interest Rates

The following table illustrates the general relationship between Fed Funds Rate and average credit card interest rates over time. This is a simplified representation and doesn’t capture every nuance of the relationship. A more detailed analysis would require access to extensive historical data.

| Year | Fed Funds Rate (Approximate) | Average Credit Card APR (Approximate) |

|---|---|---|

| 2020 | 0-0.25% | 15-18% |

| 2021 | 0.25-0.50% | 16-19% |

| 2022 | 0.50-4.00% | 18-22% |

| 2023 | 4-5% | 20-24% |

Loan Types and Interest Rate Sensitivity

Interest rates play a crucial role in shaping the landscape of personal finance, particularly for loans. Understanding how different loan types react to changes in Federal Reserve (Fed) interest rates is vital for borrowers and lenders alike. This analysis delves into the sensitivity of various loan types, including auto, student, and personal loans, to Fed rate fluctuations.The Fed’s adjustments to interest rates ripple through the financial system, impacting borrowing costs and lending practices.

These changes often have a direct correlation with the interest rates charged on different types of loans. This correlation varies depending on the specific loan type and the underlying factors influencing the market.

Auto Loan Interest Rate Sensitivity

Auto loans are typically highly sensitive to changes in Fed interest rates. When the Fed raises rates, auto lenders often increase their borrowing costs to maintain profitability. This is because auto loans are often tied to benchmark rates, such as the prime rate, which is influenced by the Fed’s actions. As a result, a rise in Fed rates usually translates into higher monthly payments and increased borrowing costs for consumers.

Conversely, a decrease in Fed rates tends to lower auto loan interest rates, making vehicles more affordable. For instance, during periods of historically low Fed rates, auto loan interest rates have reached record lows, encouraging car purchases.

Student Loan Interest Rate Influence

Student loans, particularly federal ones, often have interest rates that are linked to the 10-year Treasury yield or other benchmarks. Changes in Fed rates can, therefore, impact student loan interest rates. While the direct link isn’t always immediate or uniform, the overall trend shows a correlation. If the Fed raises rates, student loan interest rates might also rise, increasing the total cost of education.

So, fed rates are impacting mortgages, loans, and credit cards in a big way right now. It’s a complex issue, and figuring out how it all affects you personally can be tricky. Knowing how these interest rate changes affect your finances is key, especially when you consider the joy of welcoming a new addition to the family and the importance of choosing the right last name for your child, which is something you can research more about on this page discussing apellido bebe madre padre.

Ultimately, understanding the current fed rate environment and its influence on your financial decisions is crucial for staying on top of your personal finances.

Conversely, a decrease in Fed rates might lead to lower student loan interest rates. Historically, fluctuations in Fed rates have influenced the overall cost of higher education.

Personal Loan Interest Rate Impact

Personal loans, often used for various purposes like consolidating debt or home improvements, are generally sensitive to Fed rate changes. These loans frequently have variable interest rates, which are directly or indirectly tied to the prime rate or other benchmark rates influenced by the Fed. When the Fed raises rates, lenders usually adjust personal loan rates, making borrowing more expensive.

This can affect the availability and cost of personal loans, with higher rates often leading to reduced loan applications and approvals. Conversely, a decrease in Fed rates usually makes personal loans more accessible and affordable. The specific impact can vary depending on the lender and the loan terms.

Comparison of Loan Type Sensitivities

| Loan Type | Sensitivity to Fed Rate Changes | Impact of Fed Rate Increases | Impact of Fed Rate Decreases |

|---|---|---|---|

| Auto Loans | High | Higher monthly payments, increased borrowing costs | Lower monthly payments, reduced borrowing costs |

| Student Loans (Federal) | Moderate to High | Potentially higher interest rates, increased total loan cost | Potentially lower interest rates, reduced total loan cost |

| Personal Loans | Moderate to High | Higher interest rates, reduced loan availability | Lower interest rates, increased loan availability |

The table above provides a general overview of the varying sensitivities of different loan types to changes in Fed rates. It’s crucial to remember that individual loan terms and lender practices can influence the exact impact.

Market Trends and Economic Conditions

The Federal Reserve’s decisions regarding interest rates are deeply intertwined with the overall economic climate. Understanding the interplay between inflation, unemployment, and economic forecasts is crucial to grasping how these decisions impact loans, mortgages, and consumer behavior. This section will delve into the factors that shape economic conditions and how they influence the Fed’s actions, ultimately affecting the availability and cost of credit.The Federal Reserve (Fed) constantly monitors economic indicators to gauge the health of the economy.

These indicators, including inflation rates, unemployment figures, and GDP growth, inform the Fed’s decisions on interest rate adjustments. The Fed’s goal is to maintain a stable economy with low inflation and maximum employment.

Inflation and Unemployment Dynamics

Inflation and unemployment are key economic indicators that significantly influence Fed rate decisions. A high inflation rate often necessitates higher interest rates to curb spending and cool down the economy. Conversely, low inflation might signal the need for lower rates to stimulate economic activity. Unemployment rates are also crucial. High unemployment often warrants lower rates to encourage hiring and investment.The Fed strives to strike a balance between these two crucial indicators.

For instance, during periods of high inflation and low unemployment, the Fed might raise interest rates to control price increases while maintaining employment levels.

Economic Forecasts and Market Expectations, Fed rates mortgages loans credit cards

Economic forecasts, produced by various institutions and economists, significantly impact market expectations regarding future Fed rate changes. These forecasts analyze economic data and predict future inflation, unemployment, and GDP growth. When economists anticipate a rise in inflation, the market anticipates higher interest rates, influencing borrowing costs.For example, if an economic forecast projects a surge in inflation, the market may anticipate a corresponding increase in the federal funds rate, leading to higher mortgage rates and loan interest rates.

This, in turn, impacts consumer borrowing decisions.

Impact on Credit Card and Loan Availability

Economic indicators directly impact the availability and terms of credit cards and loans. During periods of economic uncertainty or high inflation, lenders might be more cautious about issuing new loans, especially if they predict rising defaults. This caution often leads to stricter lending criteria and higher interest rates.Conversely, in periods of economic growth and low inflation, lenders may be more willing to extend credit at favorable terms, leading to increased loan availability and lower interest rates.

Predicting Fed Funds Rate Changes

Economists employ various models and techniques to predict changes in the Fed funds rate. These methods incorporate numerous factors, including historical data, current economic conditions, and expert opinions.

Fed rates are impacting mortgages, loans, and credit cards in a big way right now. It’s a tough time for many, but the recent news about Adrian Beltre being inducted into the Hall of Fame for the Texas Rangers adrian beltre hall of fame texas rangers reminds us that even in challenging economic times, there’s still reason for celebration.

Hopefully, the recent positive financial news will help stabilize the market and make these financial products more accessible to everyone again soon.

One crucial method involves analyzing the relationship between inflation, unemployment, and interest rates.

Fed rates are impacting mortgages, loans, and credit cards in significant ways right now. Understanding the current political climate, like the upcoming Nevada caucus primary, is crucial for navigating these financial waters. A good explainer on the Nevada caucus primary explainer will help you contextualize the broader economic picture and its potential effect on these financial products.

Ultimately, staying informed about these interconnected factors is key for making smart financial decisions.

Economic models often project future interest rate adjustments based on anticipated changes in inflation and unemployment. For example, a model might predict a rate increase if inflation is expected to rise significantly. Real-world examples of this are seen in periods of rapid inflation, where the Fed has consistently raised interest rates to curb rising prices.

Consumer Implications: Fed Rates Mortgages Loans Credit Cards

Interest rate adjustments by the Federal Reserve ripple through the economy, impacting consumers in significant ways. Understanding these impacts is crucial for making informed financial decisions. Consumers need to be aware of how changes in borrowing costs affect their ability to secure mortgages, loans, and credit cards, and how these shifts impact their overall financial well-being.

Mortgage Implications

Federal Reserve interest rate hikes often translate to higher mortgage rates. This makes homeownership more expensive, potentially impacting affordability for prospective buyers. Conversely, rate cuts can make mortgages more accessible, stimulating the housing market. A 0.25% increase in the Fed funds rate can translate to a noticeable rise in mortgage interest rates, affecting the monthly payments for existing homeowners and potential homebuyers.

For example, a $200,000 mortgage with a 30-year term could see monthly payments increase by several hundred dollars if the interest rate rises by a few percentage points.

Loan Implications

Similar to mortgages, personal loans, auto loans, and other types of loans are sensitive to changes in Federal Reserve rates. Higher rates increase the cost of borrowing, making loans more expensive for consumers. This can impact consumers’ ability to make large purchases, such as a new car or consolidate debts. The impact on loan availability can also be substantial, as lenders may tighten lending criteria in response to higher rates.

A good example of this is the impact of 2022-2023 Fed rate hikes on auto loans, which resulted in more stringent approval criteria, limiting access to financing.

Credit Card Implications

Credit card interest rates often track changes in the Fed funds rate. A rise in the Fed rate frequently leads to higher credit card interest rates, increasing the cost of carrying a balance. Conversely, a decrease in the Fed rate typically results in lower credit card rates, offering consumers a more favorable borrowing environment. For instance, during periods of high inflation and rising interest rates, consumers might see their credit card interest rates increase by a significant margin, leading to a higher debt burden.

Financial Planning Strategies

Effective financial planning is crucial during periods of fluctuating interest rates. Consumers should assess their current financial situation, including their debt levels, income, and savings. Develop a budget to track spending and identify areas where expenses can be reduced. Building an emergency fund is vital for unexpected expenses, as it reduces reliance on high-interest debt during times of economic uncertainty.

Review and adjust borrowing strategies to account for the changing interest rate landscape. A thorough understanding of available financial tools, like balance transfers or debt consolidation, is important.

Real-World Examples

In 2022, the Federal Reserve significantly increased interest rates to combat inflation. This led to higher mortgage rates, making homeownership less affordable for some. Conversely, consumers who had variable rate credit cards experienced higher interest charges. This illustrates how a change in the Fed rate can significantly impact different aspects of the consumer economy.

Navigating Fluctuating Rates

Consumers can navigate fluctuating interest rates by monitoring market trends and economic conditions. Staying informed about the Fed’s policies and how they impact various financial products is essential. Comparing interest rates from different lenders is crucial for securing the best possible terms. A contingency plan is crucial, such as having a savings buffer to cover unexpected expenses, and actively managing debt.

Flowchart for Managing Finances

This flowchart Artikels steps consumers can take to manage their finances in response to Fed rate changes:

[Start] --> Assess Current Financial Situation --> Monitor Fed Policy & Market Trends --> Compare Interest Rates --> Develop a Budget --> Build an Emergency Fund --> Review & Adjust Borrowing Strategies --> [End]

Final Thoughts

In conclusion, fed rates mortgages loans credit cards are intrinsically linked, and understanding their intricate relationship is key to navigating fluctuating interest rates. From the impact on homebuyers to strategies for managing personal finances, the insights shared here provide a comprehensive overview.

The tables presented offer concrete examples of how rate changes affect different loan types and the overall market. Armed with this knowledge, consumers can make more informed decisions about borrowing and financial planning.

Questions and Answers

How do changes in the fed funds rate affect credit card interest rates?

Credit card APRs typically rise or fall in tandem with changes in the federal funds rate. Issuers adjust their rates to reflect market conditions and maintain profitability.

What is the typical time lag between fed rate adjustments and changes in consumer loan rates?

There’s often a delay between the Federal Reserve’s interest rate adjustments and the changes seen in consumer loan rates. The precise time frame varies depending on the specific loan type and market conditions.

How do rising mortgage rates affect housing market activity?

Higher mortgage rates typically cool down the housing market. Fewer people can afford to buy homes, leading to a potential decrease in home sales and housing starts.

How can consumers navigate fluctuating interest rates?

Consumers should stay informed about market trends and consider factors like their credit score and financial goals when making borrowing decisions. A well-defined financial plan and flexible budgeting are key.