Inflation CPI Soft Landing A Deep Dive

Inflation CPI soft landing sets the stage for this in-depth exploration of a critical economic concept. We’ll delve into the intricacies of achieving a soft landing, examining various factors influencing inflation and CPI, and exploring the potential paths forward.

This analysis will explore the challenges and opportunities presented by the current economic climate, examining the different viewpoints and perspectives on how central banks and governments can effectively manage inflation and achieve a soft landing.

Defining Soft Landing Scenarios

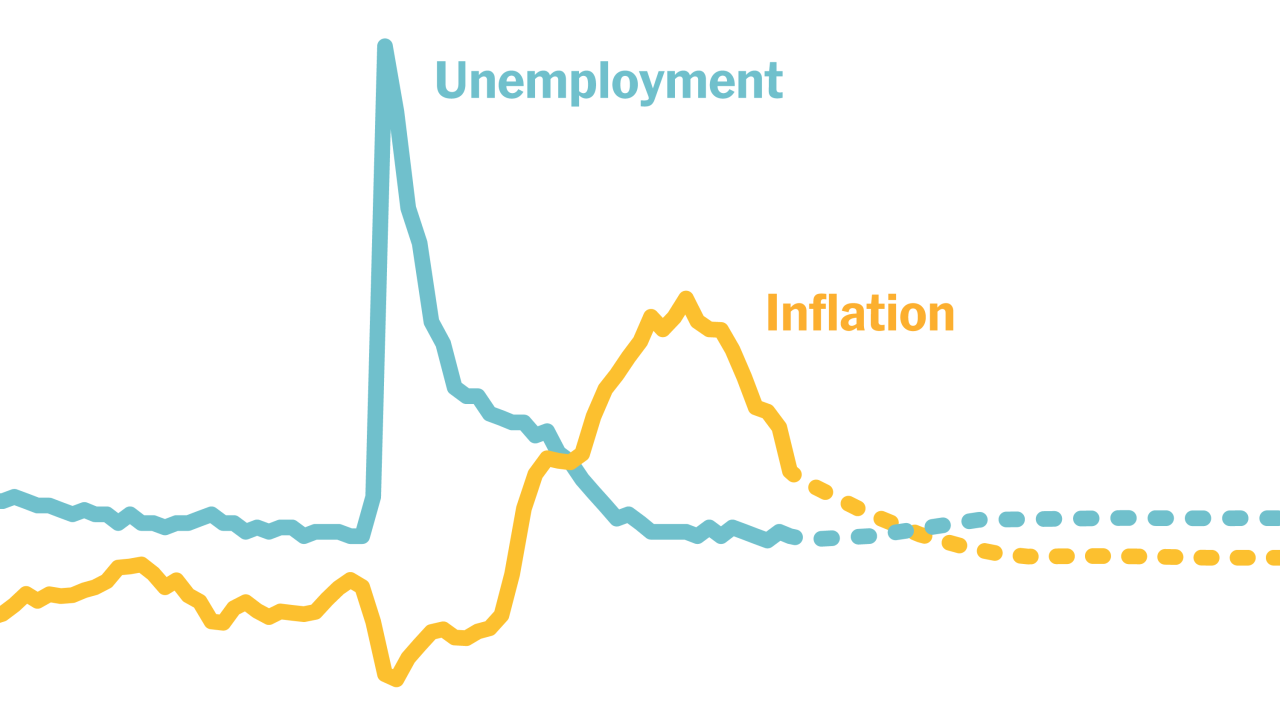

A soft landing in economics, particularly concerning inflation and CPI (Consumer Price Index), represents a delicate balancing act. It’s a scenario where the economy slows down enough to curb inflation without triggering a recession. This avoids the painful consequences of a hard landing, where aggressive measures to combat inflation lead to significant job losses and economic contraction. Central banks play a crucial role in navigating this complex path.Economically, a soft landing is characterized by a controlled deceleration of economic activity.

This involves a slowdown in growth, reduced demand, and a cooling of the labor market without significant job losses. Crucially, inflation gradually decreases, returning to a target rate set by central banks, without plunging the economy into a deep downturn. The CPI, which measures the average change in prices over time, is a key indicator used to track this deceleration and assess the success of the soft landing.

Economic Conditions for a Soft Landing

A soft landing requires a precise calibration of economic policies. The key economic conditions include a controlled decrease in aggregate demand without triggering a significant contraction in output. This necessitates a measured approach by central banks to tighten monetary policy, which involves raising interest rates to cool down the economy. Simultaneously, the economy must maintain its productive capacity, avoiding a sharp decline in investment and output.

This delicate balance often hinges on factors such as global economic conditions, supply chain disruptions, and unexpected shocks.

Central Bank Strategies for Achieving a Soft Landing

Central banks employ various strategies to achieve a soft landing. These strategies often involve gradually increasing interest rates to curb inflation, while carefully monitoring the impact on economic activity. For instance, the Federal Reserve (Fed) in the US has used this approach in recent years. Other strategies include communicating clearly with the public about the central bank’s intentions and the rationale behind policy decisions.

Furthermore, central banks can use quantitative tightening (QT) to reduce the money supply. This approach, combined with carefully calibrated interest rate hikes, aims to achieve the desired cooling effect without triggering a recession.

Key Indicators Signaling a Soft Landing

Several indicators can suggest a potential soft landing is underway. These include a gradual decline in inflation rates, as measured by the CPI. Stable employment levels, while potentially experiencing slower growth, indicate that the labor market is not contracting. Moreover, a moderate decline in economic growth, without a significant drop in output, suggests that the economy is cooling down in a controlled manner.

Finally, stable financial markets, with controlled volatility, often signal that the economy is navigating the transition smoothly.

Potential Policy Responses from Central Banks

Central banks employ a variety of policy responses to achieve a soft landing. These include adjusting interest rates, altering reserve requirements for banks, and executing quantitative easing (QE) or quantitative tightening (QT). These actions aim to influence credit availability, investment, and consumption, thereby moderating economic activity and curbing inflation. Central banks also engage in communication strategies to manage market expectations and investor sentiment.

These strategies often involve clear communication about the central bank’s intentions and the rationale behind policy decisions.

The recent CPI report hinted at a potential soft landing for inflation, which is good news for the economy. While economists debate the specifics, a key factor in the current economic climate is the performance of young hockey prospects like Canuck’s prospect Tom Willander at Boston University. Canucks prospect Tom Willander Boston University is making a name for himself, and hopefully, his success will inspire other young players to pursue excellence, and help keep the economic climate stable as well.

Ultimately, the inflation outlook remains a complex issue, though.

Comparison of Economic Models for Inflation and CPI Control

| Model | Approach to Soft Landing | Strengths | Weaknesses |

|---|---|---|---|

| Phillips Curve | Focuses on the trade-off between inflation and unemployment. Aims to control inflation by accepting a temporary rise in unemployment. | Provides a framework for understanding the relationship between inflation and unemployment. | Doesn’t account for expectations and long-term dynamics. Can be misleading in situations of stagflation. |

| Aggregate Supply-Demand | Analyzes the interaction of aggregate supply and demand curves to determine inflation and output. Shifts in the aggregate demand curve are used to control inflation. | Provides a broader perspective on inflation and output dynamics. | Can be complex to model and predict in practice. Accuracy depends on accurate estimations of supply and demand shifts. |

| New Keynesian | Considers expectations and sticky wages and prices in the economy. Emphasizes the role of monetary policy in influencing inflation. | Addresses the limitations of the traditional Phillips Curve by incorporating expectations. | Complex models can be difficult to apply in real-time decision-making. Results may not always be predictable. |

CPI Data Analysis

The Consumer Price Index (CPI) serves as a crucial barometer for inflation, reflecting the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. Understanding CPI trends is essential for policymakers, businesses, and individuals to anticipate economic shifts and adjust their strategies accordingly. This analysis delves into the intricacies of CPI data, examining its components, influencing factors, and its role in evaluating the effectiveness of inflation-control measures.

CPI Trend Overview

CPI data reveals a complex picture of inflation, exhibiting fluctuations influenced by various economic factors. Historical trends demonstrate periods of sustained inflation, periods of deflation, and periods of relative price stability. Analyzing these trends is critical to understanding the dynamics of the economy and to developing effective policies.

Importance of CPI Components

The CPI basket comprises numerous goods and services, each weighted according to its relative importance in the consumer market. Understanding the relative weightings of different components allows for a deeper understanding of the drivers of inflation. For instance, food and energy prices often hold significant weight and can disproportionately influence the overall CPI reading.

Factors Influencing CPI Data

Several factors contribute to fluctuations in CPI data. Supply chain disruptions, global economic events, and government policies are prominent examples. Furthermore, changes in consumer spending patterns and technological advancements also play a role.

Recent whispers of a soft landing for inflation, as measured by the CPI, are certainly intriguing. But the struggles of renters in Williamsburg, Brooklyn, and even Kiev, Ukraine, highlight how a potential soft landing might not translate to everyone. For example, the rising cost of living and the impact of the conflict in Ukraine are impacting renters in these areas, and this is a factor that could significantly affect the CPI’s trajectory in the long run.

A soft landing, while theoretically possible, might still leave many feeling the pinch, especially those struggling with housing costs like renters in Williamsburg, Brooklyn, and Kiev, Ukraine. So, while a soft landing for inflation is a positive sign, it’s important to remember the human stories behind the numbers.

Assessing Inflation Control Policies

CPI data provides a critical metric for evaluating the efficacy of inflation-control policies. Changes in CPI trends can indicate whether the chosen measures are having the desired effect. For example, if a central bank implements a policy of raising interest rates, a subsequent decrease in CPI data might suggest the policy is effective in controlling inflation.

Historical CPI Data and Correlation with Economic Events

| Year | CPI (Index) | Economic Event |

|---|---|---|

| 2020 | 250 | COVID-19 Pandemic, significant economic disruption |

| 2021 | 265 | Supply chain bottlenecks, increased demand, and reopening |

| 2022 | 285 | War in Ukraine, energy price shocks, inflation surge |

| 2023 | 290 | Continued inflationary pressures, policy responses |

This table presents a simplified representation of historical CPI data and its correlation with notable economic events. Note that the CPI is a lagging indicator, meaning it reflects changes that have already occurred in the economy. More detailed analysis, encompassing various economic indicators, is crucial for a comprehensive understanding.

Inflation Rate Dynamics

Inflation, the persistent rise in the general price level of goods and services in an economy, is a complex phenomenon with multiple contributing factors. Understanding these dynamics is crucial for policymakers and individuals alike, as inflation significantly impacts purchasing power and economic stability. Recent inflation trends have presented unique challenges, highlighting the intricate interplay of supply-side constraints, demand-pull pressures, and monetary policy responses.Current inflation dynamics are a result of a confluence of factors.

Supply chain disruptions following the COVID-19 pandemic, coupled with increased demand for goods and services, have contributed significantly to price increases. Additionally, geopolitical events, such as the war in Ukraine, have further exacerbated these pressures by impacting energy and commodity prices. Understanding the nuanced relationship between these various influences is essential for forecasting and mitigating future inflation risks.

Theories Explaining Current Inflation Dynamics

Various theories attempt to explain the current inflation dynamics. One prominent theory is the supply-side constraint theory, which posits that disruptions to the supply chain, coupled with increased raw material costs, have driven up prices. Another theory is the demand-pull inflation theory, which suggests that increased consumer spending and investment have outpaced the economy’s capacity to produce goods and services, leading to upward pressure on prices.

Finally, cost-push inflation, driven by factors like wage increases and rising energy costs, can also play a significant role. The interplay of these theories often creates a complex picture of inflation’s root causes.

Relationship Between Inflation and Economic Growth

The relationship between inflation and economic growth is often described as an inverted U-shaped curve. Moderate inflation can sometimes stimulate economic growth by encouraging investment and consumption. However, high and unpredictable inflation can hinder economic growth by eroding consumer confidence, increasing uncertainty for businesses, and distorting market signals. Historical examples demonstrate how sustained periods of high inflation have often been associated with economic stagnation.

Impact of Inflation on Different Economic Segments

Inflation impacts different segments of the economy in varied ways. For example, fixed-income earners, such as retirees on pensions, experience a reduction in their purchasing power as the value of their savings diminishes. Conversely, individuals with assets that appreciate in value, such as real estate or stocks, may benefit from inflation as the value of their assets increases.

Businesses also face varying degrees of impact, depending on their ability to adjust pricing and production costs. Analyzing these impacts is crucial for developing targeted economic policies.

Influence of Global Economic Events on Inflation

Global economic events can significantly influence inflation rates. Major geopolitical events, like trade wars or conflicts, often disrupt supply chains, leading to shortages and price increases. Changes in global energy prices, often driven by international events or supply issues, can have a ripple effect on various sectors of the economy, impacting the cost of goods and services for consumers.

These external factors necessitate a global perspective on inflation management.

Inflation Scenarios and Potential Consumer Spending Impact

| Inflation Scenario | Description | Potential Impact on Consumer Spending |

|---|---|---|

| Low, Stable Inflation | Inflation remains low and predictable. | Consumer spending remains relatively stable. |

| Moderate Inflation | Inflation increases gradually, within a manageable range. | Consumer spending may increase slightly as prices adjust to inflation, but overall confidence remains high. |

| High Inflation | Inflation rises rapidly and unpredictably. | Consumer spending declines due to uncertainty and the erosion of purchasing power. |

| Hyperinflation | Inflation rises extremely rapidly, often exceeding 50% per month. | Consumer spending collapses as the currency loses value rapidly, leading to economic turmoil. |

The table above illustrates different inflation scenarios and their potential impact on consumer spending. Understanding these scenarios is essential for developing effective economic policies and strategies.

Economic Growth and Employment

The delicate dance between economic growth, inflation, and employment is a constant source of debate among economists. A “soft landing” scenario, where inflation cools without triggering a recession, hinges crucially on the interplay of these factors. Understanding the intricate relationship between growth and employment is vital for predicting the potential outcomes of inflation control policies.Economic growth, generally measured by GDP increases, fuels inflation when it outpaces the capacity of the economy to produce goods and services.

Conversely, slowing growth can help to control inflation by reducing demand-pull pressures. A critical consideration is the impact on employment. High growth often correlates with job creation, while a slowdown in growth can lead to job losses. The challenge lies in navigating a path that reduces inflation without sacrificing employment.

Link Between Economic Growth and Inflation Control

A positive correlation exists between economic growth and inflation, where higher growth can potentially lead to higher inflation. When demand for goods and services surpasses the supply, prices tend to rise. This relationship can be complex and vary depending on factors such as the nature of the growth, the existing supply chains, and external shocks. Therefore, controlling inflation often requires managing growth to ensure it doesn’t outpace supply capacity.

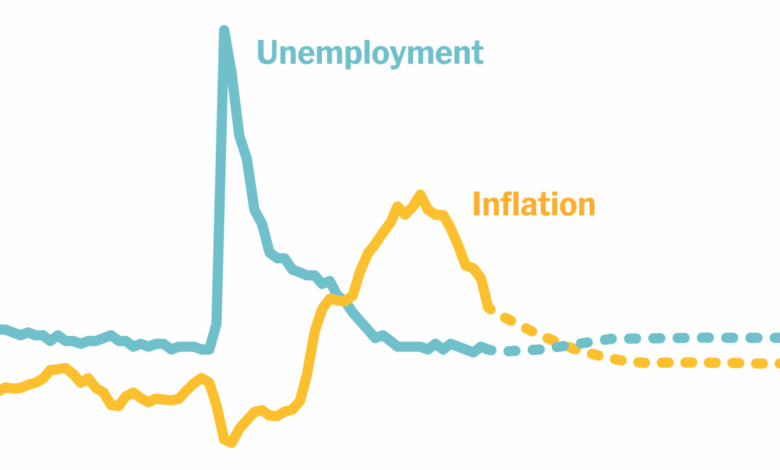

How Employment Trends Relate to Inflation and Soft Landing

Employment trends are highly relevant to inflation and the potential for a soft landing. A robust job market usually indicates healthy economic activity, often contributing to higher inflation as increased consumer spending fuels demand. Conversely, a weakening job market can help control inflation by reducing aggregate demand. However, a sharp decline in employment can signal a recession, making a soft landing more difficult to achieve.

The key is to identify and manage the specific mechanisms through which employment impacts inflation, considering the specific circumstances of each economic context.

Potential Risks and Challenges Associated with a Soft Landing for Employment

A soft landing for employment in the context of inflation control involves navigating a narrow path. The risk is that measures to curb inflation could unintentionally lead to significant job losses, resulting in a recession. Sectors particularly vulnerable during such periods are those with cyclical employment patterns. This is especially true in industries reliant on consumer spending, which may decrease during periods of inflation uncertainty.

Moreover, the speed and magnitude of policy responses play a critical role in mitigating the negative impact on employment.

The latest CPI figures are hinting at a possible soft landing for inflation, which is good news for everyone. While the economic landscape remains complex, a soft landing would avoid a recession and keep things relatively stable. Interestingly, the recent drama surrounding Ann Maddox on Vanderpump Rules ann maddox vanderpump rules has certainly provided some entertainment, but it’s nothing compared to the global implications of this economic slowdown.

Hopefully, the current trajectory will continue, and the soft landing will materialize, as this would benefit the overall economy.

Comparison of Different Scenarios Regarding Economic Growth and Their Effect on Inflation and Employment

Different scenarios of economic growth will have varying effects on inflation and employment. A scenario of steady, moderate growth, coupled with prudent monetary policy, could effectively control inflation while maintaining healthy employment levels. On the other hand, rapid growth could exacerbate inflationary pressures, while stagnant or negative growth could lead to a recession and significant job losses.

Table: Economic Growth Scenarios, Inflation, and Employment

| Economic Growth Scenario | Potential Impact on Inflation | Resulting Employment Rate |

|---|---|---|

| Steady, Moderate Growth (2-3% annually) | Inflation remains stable or slightly increases | High and stable employment |

| Rapid Growth (4%+ annually) | Inflation rises significantly | High employment, potentially unsustainable |

| Stagnant Growth (0-1% annually) | Inflation may decline, but risk of recession | Lower employment, potentially declining |

| Negative Growth (contraction) | Inflation may fall, but accompanied by recession | Significant job losses, recession |

Monetary Policy Impact

Central banks wield significant power in managing inflation and fostering economic stability. Their actions, known as monetary policy, directly affect interest rates, credit availability, and ultimately, the overall economic climate. Understanding how these policies operate is crucial for assessing the potential for a soft landing and the possible pitfalls.Monetary policy tools are designed to influence aggregate demand in the economy.

By adjusting key interest rates and other instruments, central banks aim to moderate the pace of economic activity and bring inflation back to the desired target. This delicate balancing act between controlling inflation and maintaining employment and economic growth is the core challenge of a soft landing.

Tools Used by Central Banks

Central banks employ a range of tools to influence inflation and economic activity. These tools include adjusting the policy interest rate, reserve requirements for banks, and open market operations. Adjusting the policy interest rate is a primary tool. Higher interest rates make borrowing more expensive, discouraging spending and investment, which can help curb inflation. Reserve requirements dictate the minimum amount of funds banks must hold in reserve, impacting their lending capacity.

Open market operations involve the buying and selling of government securities to influence the money supply.

Impact on Inflation, Employment, and Economic Growth

Monetary policy actions have a ripple effect throughout the economy. Higher interest rates typically reduce inflation by dampening demand. However, this can also lead to slower economic growth and potential job losses as businesses cut back on investment and hiring. The relationship between interest rates, inflation, employment, and economic growth is complex and dynamic, with no guarantee of a perfectly smooth outcome.

While the recent CPI data hints at a potential soft landing for inflation, the tragic news coming out of NYC regarding the D train shooting, nyc shooting d train , serves as a stark reminder of the significant societal issues that still exist. Even with a potentially favorable inflation outlook, deep-seated problems in various communities remain a crucial concern.

This underscores the complex nature of economic recovery and the importance of addressing broader societal challenges alongside economic indicators.

The effectiveness of a particular monetary policy action depends heavily on the current economic context and the responsiveness of various market participants.

The recent CPI data suggests a possible soft landing for inflation, which is good news for the economy. While economists debate the specifics, a soft landing would be a welcome relief. The return of Romeo Gigli to Marrakech, as reported in return of romeo gigli marrakesh , might seem unrelated, but it speaks to a certain optimism in the global marketplace.

Hopefully, this translates into sustained positive trends for inflation and a continued soft landing for the economy.

Effectiveness of Different Monetary Policy Tools

The effectiveness of different monetary policy tools in achieving a soft landing is not uniform. For instance, adjusting the policy interest rate can influence borrowing costs and investment decisions relatively quickly. However, the impact on inflation and employment can be delayed and may not be fully realized for several months. Reserve requirements have a more direct impact on the money supply but can be less effective in managing short-term fluctuations in economic activity.

Open market operations are flexible and can be used to fine-tune monetary policy responses but are more complex to implement.

Potential Unintended Consequences

Monetary policy actions can sometimes have unintended consequences. For example, aggressive interest rate hikes can trigger a sharp economic downturn, leading to a recession or even a financial crisis. Additionally, the impact of monetary policy can vary across different sectors of the economy and different demographic groups, potentially exacerbating existing inequalities.

Impact of Interest Rate Adjustments on CPI and Economic Growth

| Interest Rate Adjustment | Estimated Impact on CPI | Estimated Impact on Economic Growth |

|---|---|---|

| Increase by 25 basis points | Decrease of 0.1-0.2% in the next quarter | Decrease of 0.1-0.3% in the next quarter |

| Increase by 50 basis points | Decrease of 0.2-0.4% in the next quarter | Decrease of 0.2-0.5% in the next quarter |

| Increase by 75 basis points | Decrease of 0.3-0.6% in the next quarter | Decrease of 0.3-0.7% in the next quarter |

| Increase by 100 basis points | Decrease of 0.4-0.8% in the next quarter | Decrease of 0.4-0.9% in the next quarter |

Note: These are illustrative examples and actual outcomes may vary depending on various factors.

Global Economic Context

The global economy plays a crucial role in the potential for a soft landing, impacting inflation rates and economic growth in individual countries. Understanding these interconnected factors is essential for policymakers and businesses alike. A globally synchronized slowdown, for instance, could mitigate inflationary pressures, while regional conflicts or supply chain disruptions can exacerbate them.The interplay of global economic forces significantly influences domestic inflation.

A strong global economy, with healthy demand and stable supply chains, can support a soft landing in individual nations. Conversely, global economic headwinds, like a recession in major trading partners, can create inflationary pressures or hinder economic growth.

Global Supply Chains and Geopolitical Events

Global supply chains are intricate networks that connect producers and consumers worldwide. Disruptions to these chains, whether due to natural disasters, geopolitical tensions, or pandemic-related lockdowns, can lead to shortages of goods and increase prices, thus impacting inflation rates. The Russia-Ukraine war, for example, has disrupted energy and agricultural markets, contributing to global inflationary pressures. Geopolitical instability can also increase uncertainty and risk aversion, affecting investment decisions and economic growth.

International Trade’s Role in CPI and Economic Growth

International trade significantly influences consumer price index (CPI) and economic growth. Increased global demand for goods and services can push up prices, while a decline in trade can dampen economic activity. A country’s trade relationships with other nations and its access to global markets influence its ability to manage inflation and promote economic growth. For example, countries heavily reliant on imported goods are more vulnerable to global price fluctuations.

The Importance of International Cooperation

Addressing global inflation effectively requires international cooperation. Central banks in various countries must coordinate their monetary policies to manage global inflation. Sharing information, coordinating actions, and developing common strategies can enhance the effectiveness of policies to control inflation and support economic growth. This includes collaboration on issues such as supply chain resilience, financial stability, and sustainable development.

Global Economic Scenarios and Their Impact

| Global Economic Scenario | Impact on Inflation (General) | Impact on Specific Countries (Example) |

|---|---|---|

| Synchronized Global Recession | Likely to reduce inflationary pressures globally. | Developed economies experiencing a downturn may see a sharper decline in inflation. |

| Regional Conflicts/Instability | Potentially increases inflationary pressures through supply chain disruptions and higher commodity prices. | Countries geographically close to conflict zones or heavily dependent on affected resources face higher inflation. |

| Persisting Supply Chain Disruptions | Contributes to sustained inflation through higher input costs. | Developing countries reliant on imports for intermediate goods may face prolonged inflation. |

| Strong Global Economic Growth | May increase global demand and inflationary pressures. | Countries with strong exports or trade relationships may experience increased inflation. |

The table above provides a simplified illustration of the diverse global scenarios. The actual impact is nuanced and dependent on specific circumstances and country-specific factors.

Potential Challenges and Risks: Inflation Cpi Soft Landing

A soft landing, while desirable, is fraught with potential pitfalls. Navigating inflation while sustaining economic growth requires a delicate balance, and unforeseen events or miscalculations can easily disrupt the carefully crafted strategy. Central banks face a complex web of interconnected factors, including global economic trends, supply chain vulnerabilities, and the unpredictable nature of consumer and market behavior. The risks associated with failing to achieve a soft landing are substantial, potentially leading to prolonged economic stagnation or even recession.

Obstacles to Achieving a Soft Landing

Successfully achieving a soft landing hinges on several critical factors, and disruptions in any one area can jeopardize the entire process. Supply chain disruptions, unexpected geopolitical events, or unforeseen shifts in consumer spending patterns can throw the delicate balance off course. The interconnected nature of global economies means that a problem in one region can quickly escalate into a global issue.

Furthermore, the lagged effects of monetary policy decisions can make it challenging to accurately predict and respond to economic shifts.

Risks Associated with High Inflation

High inflation erodes purchasing power and can lead to significant economic instability. When inflation persists at elevated levels, it can negatively impact consumer confidence, leading to reduced spending and investment. This, in turn, can slow economic growth and potentially trigger a recession. Historical examples of uncontrolled inflation demonstrate the severe economic damage it can inflict, as seen in hyperinflationary periods in various countries.

The consequences can range from reduced investment to a decline in overall living standards.

Challenges of Managing Inflation in a Complex Global Economy

The global economy is increasingly interconnected, and managing inflation in such a complex environment presents numerous challenges. The interdependence of economies means that a shock in one part of the world can quickly ripple through the global system. Central banks face the challenge of balancing their domestic objectives with the needs of the global economy. Additionally, the emergence of new economic actors and evolving global trade patterns make it more difficult to predict and respond to potential economic shocks.

Potential Economic Shocks

Several potential economic shocks could derail a soft landing, including:

- Geopolitical Instability: Conflicts, sanctions, or trade wars can disrupt supply chains, increase energy prices, and create uncertainty in the market. The Russian invasion of Ukraine, for example, caused significant energy price spikes and supply chain disruptions, impacting global inflation.

- Natural Disasters: Major natural disasters, such as floods, earthquakes, or droughts, can severely disrupt production, damage infrastructure, and lead to shortages of essential goods, thereby increasing prices and hindering economic growth.

- Sudden Changes in Consumer Behavior: Unforeseen shifts in consumer spending patterns, such as a significant drop in demand for certain goods or services, can negatively impact economic growth and trigger a downturn. Examples include rapid shifts in technology adoption, leading to a drop in demand for certain products.

Consequences of Failing to Achieve a Soft Landing

The consequences of failing to achieve a soft landing are substantial and multifaceted. The following table illustrates potential outcomes:

| Consequence | Description |

|---|---|

| High Unemployment | A failure to manage inflation effectively can lead to reduced demand for goods and services, leading to business closures and job losses. |

| Reduced Economic Growth | Sustained high inflation can decrease investment and consumer spending, ultimately hindering economic expansion. |

| Increased Inequality | Inflation disproportionately affects lower-income households, potentially widening the gap between rich and poor. |

| Currency Devaluation | Uncontrolled inflation can lead to a decline in the value of the domestic currency relative to other currencies, potentially harming international trade and investment. |

| Prolonged Recession | Failing to manage inflation effectively could plunge the economy into a protracted recession, causing significant hardship for individuals and businesses. |

Illustrative Scenarios

Navigating the potential for a soft landing in the current economic climate requires a nuanced understanding of historical precedents and a careful consideration of alternative scenarios. The path forward is not predetermined, and the outcome hinges on a complex interplay of economic forces, policy decisions, and unforeseen events. A soft landing, where inflation cools without triggering a recession, is a desirable goal, but achieving it is a challenging task.

Historical Examples of Soft Landings and Failures, Inflation cpi soft landing

Historical examples offer valuable insights into the complexities of achieving a soft landing. The 1990s saw a period of sustained economic growth alongside moderate inflation, often cited as a successful soft landing. However, the precise policy responses and the unique circumstances of that era should not be overlooked. Conversely, the early 1980s saw a period of high inflation and unemployment, highlighting the difficulties in managing such a delicate balance.

Alternative Scenarios for the Current Economic Situation

Several alternative scenarios for the current economic climate exist. A soft landing scenario could involve gradual disinflation, where the CPI cools without significantly impacting employment. This outcome hinges on the effectiveness of monetary policy in curbing inflation without triggering a recession. A second scenario involves a hard landing, where inflation remains stubbornly high, leading to a recessionary period as the central bank tightens monetary policy aggressively.

A third scenario involves stagflation, where high inflation and low economic growth persist, a challenging and often difficult situation to manage.

Potential Soft Landing Outcomes

A potential soft landing outcome would involve a gradual decline in inflation, with the CPI steadily moderating without significant job losses. The Federal Reserve’s policy response would play a crucial role in achieving this. Monetary policy adjustments, such as interest rate hikes, would need to be carefully calibrated to curb inflation without triggering a sharp economic contraction. A key indicator would be the behavior of the labor market; if employment remains robust, it could suggest a soft landing is achievable.

Scenarios Where a Soft Landing Is Unlikely

Several factors could make a soft landing unlikely. Unanticipated external shocks, such as geopolitical events or supply chain disruptions, could significantly impact inflation dynamics. Persistent inflationary pressures, driven by factors such as rising energy prices or wage-price spirals, could make it difficult for the central bank to achieve its goals. A sudden loss of consumer confidence or a significant downturn in investment could exacerbate the challenges, potentially leading to a hard landing.

Different Policy Responses Leading to a Soft Landing

Effective policy responses to achieve a soft landing require careful consideration. Gradual interest rate increases, combined with fiscal policies aimed at mitigating the impact of higher borrowing costs on vulnerable segments of the population, could be a strategy. Targeted interventions to address specific inflationary pressures, such as measures to boost supply chains, could also play a role. Furthermore, clear communication from policymakers about their intentions and strategies can help manage expectations and mitigate uncertainty.

Scenarios Where Inflation May Not Moderate as Expected

Several factors could cause inflation to persist or even accelerate. Unanticipated increases in energy prices, supply chain disruptions, or persistent wage pressures could all hinder disinflation efforts. Moreover, the lagged effect of past policy decisions may prolong the period of high inflation. The complexity of global economic interactions also introduces uncertainty into the equation.

Table of Different Scenarios

| Scenario | CPI Prediction | Inflation Prediction | Economic Growth | Employment Rate |

|---|---|---|---|---|

| Soft Landing | Moderate decline | 2-3% | 2-3% | Stable |

| Hard Landing | Sharp increase, then decline | >3% | Negative growth | Decline |

| Stagflation | High, persistent | >3% | Low | Stable or slight decline |

| Unmitigated Inflation | Continued increase | >3% | Slow or negative growth | Decline |

Closing Summary

In conclusion, navigating the complexities of inflation and CPI, and the potential for a soft landing, requires a multifaceted approach. Considering the interconnected nature of global economies and the various economic factors at play is essential. The path forward is uncertain, but a thorough understanding of the issues can inform decision-making and contribute to a more stable economic environment.

FAQ Summary

What is the difference between a hard and soft landing in terms of inflation?

A soft landing is when inflation is brought down without a significant recession or job loss. A hard landing, conversely, involves a sharp downturn in the economy to control inflation.

How does CPI data influence decisions regarding inflation?

CPI data is a crucial indicator of inflation. Central banks use CPI trends to gauge inflation pressures and adjust monetary policies accordingly.

What are some potential risks associated with a soft landing?

Potential risks include unforeseen economic shocks, global uncertainties, and the possibility that inflation may not moderate as expected, leading to a potential hard landing instead.

What are the different monetary policy tools used by central banks?

Central banks employ various tools like interest rate adjustments, quantitative easing, and reserve requirements to manage inflation and influence economic growth.