NVIDIA Valuation Stock AI A Deep Dive

NVIDIA valuation stock AI is a crucial area of analysis for investors. This in-depth look examines NVIDIA’s financial performance, stock valuation metrics, and the significant impact of AI integration on its future prospects. We’ll explore market trends, analyst predictions, and potential investment opportunities within the context of the rapidly evolving AI landscape. The analysis provides a comprehensive understanding of NVIDIA’s position in the competitive semiconductor and AI industries.

This analysis delves into NVIDIA’s financial performance, scrutinizing its recent earnings reports, revenue streams, and profitability metrics. We compare its performance against competitors and analyze the key factors driving its success or potential challenges. This exploration also touches on the pivotal role of AI in shaping NVIDIA’s future, from product innovation to market leadership.

NVIDIA’s Financial Performance

NVIDIA’s financial performance has consistently been impressive, driven by strong demand for its graphics processing units (GPUs) and related products. The company’s recent reports demonstrate continued growth, highlighting its strategic position in the burgeoning artificial intelligence and high-performance computing markets. However, external factors like macroeconomic conditions and competition remain significant considerations for future projections.

Recent Financial Reports Summary

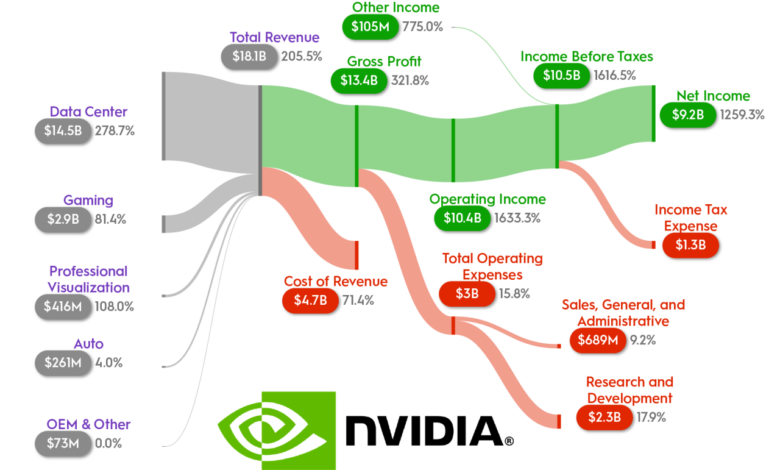

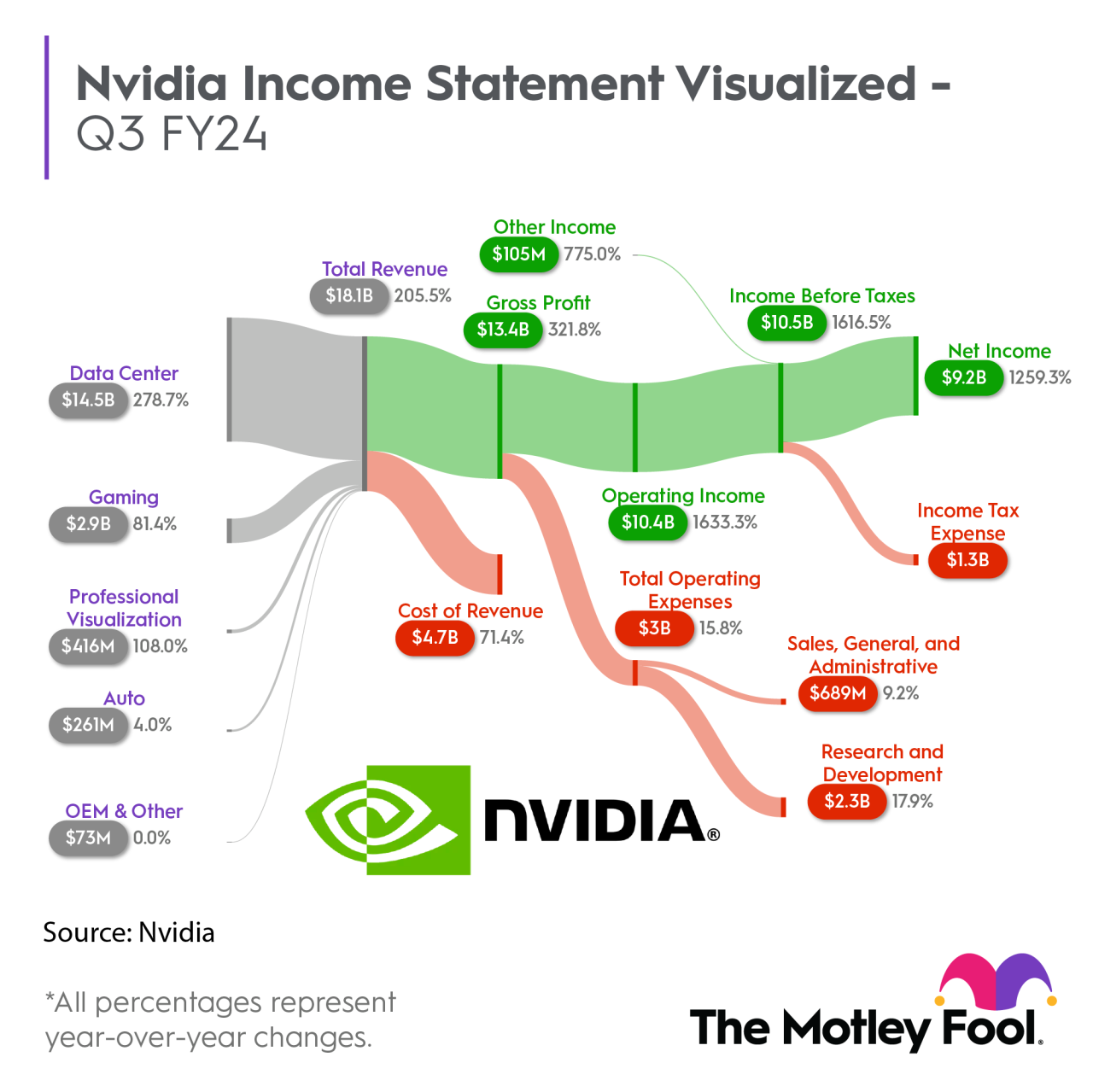

NVIDIA’s recent financial reports consistently showcase robust revenue growth, fueled by strong demand for its GPUs across various sectors. Key revenue streams include data center, gaming, and professional visualization. Profitability metrics, such as gross margins and operating income, also reflect the company’s operational efficiency and market dominance.

Earnings Trends (Past 3-5 Years)

NVIDIA’s earnings have exhibited a remarkable upward trend over the past three to five years. The company has consistently surpassed market expectations, driven by product innovation and expanding market adoption. Growth has been fueled by several successful product launches, effectively positioning the company as a leader in the GPU market. The consistent year-over-year increases in revenue and profitability demonstrate the company’s resilience and adaptability.

Comparison to Competitors

Compared to its competitors in the semiconductor industry, NVIDIA stands out due to its strong market position and innovative product offerings. While other companies like AMD and Intel have also seen growth, NVIDIA’s specific focus on AI-related applications has provided a significant competitive advantage. This specialization has translated into substantial market share and strong financial returns.

Factors Driving Financial Performance

Several factors have contributed to NVIDIA’s financial success. The increasing demand for high-performance computing, particularly in AI and data centers, has created a strong market for NVIDIA’s GPU technology. Successful product launches, such as the new RTX series GPUs, have generated substantial revenue and market excitement. Strategic partnerships and collaborations with leading technology companies further enhance NVIDIA’s market reach.

Potential Risks and Challenges

Despite its strong performance, NVIDIA faces several potential risks. Fluctuations in the global economy and macroeconomic conditions can impact demand for its products. Intensifying competition from established and emerging companies poses a challenge to maintaining market share. The complexity of the AI and high-performance computing markets presents evolving challenges to navigate. Moreover, regulatory scrutiny and potential supply chain disruptions also contribute to the uncertainty surrounding the company’s financial future.

Stock Valuation Metrics

Analyzing a company’s stock valuation is crucial for investors seeking to understand its intrinsic worth. This involves evaluating various metrics that provide insights into the company’s profitability, growth potential, and overall financial health. Different valuation metrics offer unique perspectives, and combining them provides a more comprehensive picture. Understanding these metrics and their trends helps in forming informed investment decisions.

Valuation Metrics Comparison

Several key valuation metrics are used to assess NVIDIA’s stock. These metrics compare the stock price to different aspects of the company’s financial performance, such as earnings, sales, and book value. Comparing these metrics against industry benchmarks and historical trends reveals valuable insights into the stock’s relative attractiveness.

| Metric | Formula | Interpretation | Significance |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | Price per share / Earnings per share | Indicates how much investors are willing to pay for each dollar of earnings. | A higher P/E ratio suggests higher growth expectations or higher risk. |

| Price-to-Sales (P/S) Ratio | Price per share / Sales per share | Reflects the price paid for each dollar of revenue. | Useful for companies with low or no earnings, providing insights into market sentiment. |

| Price-to-Book (P/B) Ratio | Price per share / Book value per share | Compares the market value of a company to its net asset value. | Helpful in evaluating companies with significant assets, such as hardware manufacturers. |

Calculation and Significance of Metrics

Each metric provides a specific perspective on NVIDIA’s valuation. The P/E ratio, for instance, indicates the multiple investors are willing to pay for each dollar of earnings. A high P/E can suggest that investors expect significant future earnings growth, while a low P/E might signal lower expectations or potentially undervaluation.

P/E Ratio = Price per Share / Earnings per Share

The P/S ratio, on the other hand, assesses the price paid for each dollar of sales. This is particularly useful for companies that haven’t yet generated significant profits. A high P/S ratio could indicate high growth expectations or speculation.

P/S Ratio = Price per Share / Sales per Share

The P/B ratio compares the market value to the book value (assets minus liabilities). This is especially relevant for companies with substantial assets. A high P/B suggests the market values the company’s assets more than their net book value.

P/B Ratio = Price per Share / Book Value per Share

NVIDIA’s Valuation Metrics vs. Industry and Competitors

Comparing NVIDIA’s valuation metrics to its peers in the semiconductor industry and broader tech sector provides context. This analysis helps understand whether NVIDIA is relatively overvalued or undervalued compared to its competitors. For example, a higher P/E ratio compared to the industry average might suggest that investors have greater confidence in NVIDIA’s future earnings growth.

Historical Trend of Metrics

Tracking the historical trend of these metrics over time provides insight into market sentiment and the company’s performance. A consistent upward trend in the P/E ratio, for instance, might indicate increasing investor confidence and growth expectations.

Nvidia stock valuations are all anyone seems to be talking about these days, especially with AI taking center stage. It’s fascinating to see how the market reacts, but sometimes it feels like we’re all just trying to make sense of something bigger than ourselves. Perhaps that’s why the recent piece on grief, “Grief is for people sloane crosley” grief is for people sloane crosley , resonates so deeply.

Ultimately, understanding these market fluctuations and personal struggles are both part of the human experience, and I’m sure the Nvidia valuation will eventually find its place in that bigger picture.

Factors Influencing NVIDIA’s Valuation

Several factors influence NVIDIA’s stock valuation. Strong financial performance, innovative product launches, and positive industry trends contribute to a higher valuation. Conversely, regulatory hurdles, supply chain disruptions, or market downturns can negatively impact the valuation.

AI Integration and Impact

NVIDIA’s strategic focus on artificial intelligence (AI) has positioned the company as a key driver of advancements in the field. Their cutting-edge graphics processing units (GPUs) are essential components in training and running complex AI models, making them indispensable for numerous applications. This strategic investment in AI technology is expected to significantly impact NVIDIA’s future performance and profitability.NVIDIA’s role in accelerating AI development is multifaceted.

From powering the training of large language models to enabling real-time image recognition in autonomous vehicles, NVIDIA’s technology is at the heart of many AI breakthroughs. The company’s innovative approach to AI has fostered a ripple effect, spurring further innovation and growth within the broader tech industry.

NVIDIA’s Role in AI Advancements

NVIDIA’s GPUs are highly optimized for parallel processing, a crucial aspect of AI algorithms. Their architecture allows for efficient training of deep learning models, enabling advancements in various fields, including image recognition, natural language processing, and robotics. The increasing demand for powerful computing resources in the AI sector directly benefits NVIDIA’s bottom line.

Enabling AI Advancements Through Products and Services

NVIDIA’s portfolio of products and services is meticulously tailored to support diverse AI applications. Their CUDA platform, a parallel computing platform and programming model, provides developers with the tools needed to build and deploy AI applications on NVIDIA hardware. The company also offers specialized AI software and tools, accelerating the development process for researchers and businesses alike. This comprehensive approach to AI support is a significant competitive advantage.

Projected Impact on Future Revenue and Profitability

The increasing adoption of AI across industries is projected to drive substantial growth in NVIDIA’s revenue and profitability. The demand for high-performance computing infrastructure, powered by NVIDIA GPUs, is expected to rise alongside the expanding AI market. Specific applications like autonomous driving, where NVIDIA’s GPUs are critical for perception and decision-making, provide a compelling example of this growth potential.

Real-world deployments of AI-powered systems in healthcare, finance, and manufacturing are further bolstering the expected increase in demand.

Comparison with Competitors, Nvidia valuation stock ai

NVIDIA’s competitors in the GPU market face significant challenges in matching NVIDIA’s comprehensive AI strategy. While other companies offer specialized AI solutions, NVIDIA’s integrated approach, encompassing hardware, software, and platforms, provides a distinct edge. The seamless integration of their products allows for a faster development cycle and better performance, ultimately offering a more compelling value proposition for customers.

Potential for Future Innovation

AI has the potential to drive substantial innovation in NVIDIA’s products. The development of new AI algorithms and architectures will likely lead to further optimization of NVIDIA’s GPUs and other AI-related technologies. Advanced features like specialized hardware for specific AI tasks could potentially be developed and incorporated into future product lines, creating new avenues for growth and differentiation in the market.

The company’s commitment to research and development in AI will be instrumental in realizing this potential.

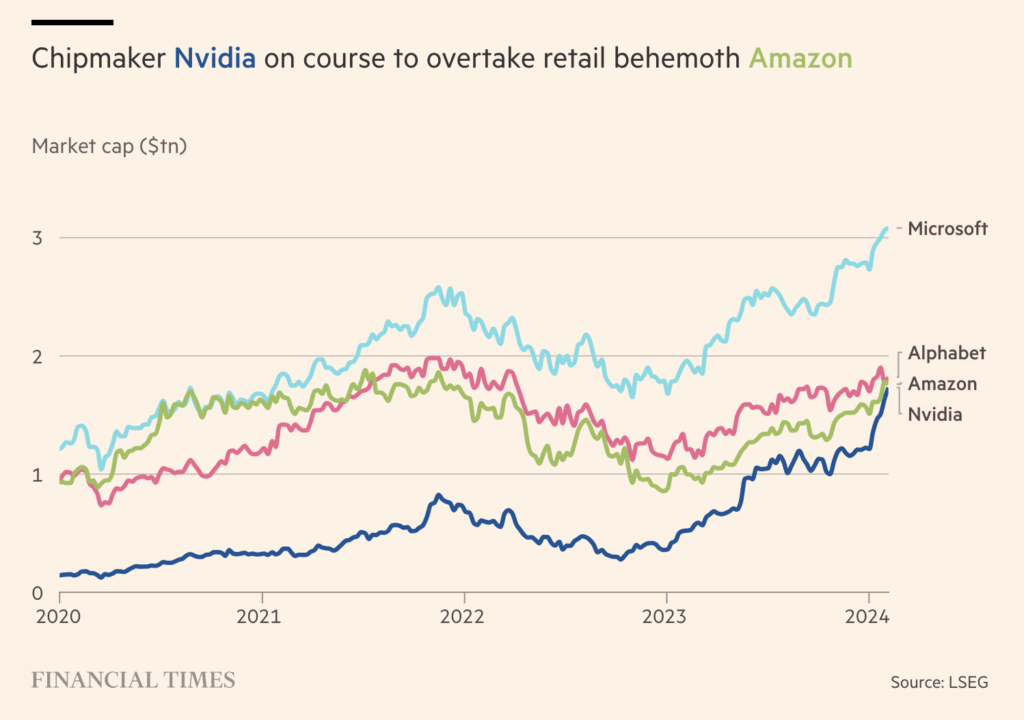

Market Trends and Analysis

NVIDIA’s success hinges on the ever-evolving landscape of artificial intelligence, GPUs, and the broader semiconductor industry. Understanding these trends is crucial for assessing the company’s future performance and stock valuation. This section delves into the current market forces, competitive pressures, and potential regulatory hurdles that could impact NVIDIA’s trajectory.The AI revolution is driving unprecedented demand for powerful computing, and NVIDIA, with its specialized GPUs, is at the forefront.

This surge in demand translates to significant revenue growth potential, but it also brings with it the challenges of maintaining competitive advantage and navigating the complex regulatory environment.

Current Market Trends in AI and GPUs

The AI market is experiencing explosive growth, fueled by advancements in machine learning algorithms and the increasing availability of large datasets. This trend is driving a substantial demand for GPUs, as they are essential for training and deploying AI models. The demand for high-performance computing (HPC) solutions is also rising, further bolstering the market for GPUs. Cloud computing services are integrating AI capabilities, leading to further demand for processing power.

Potential Impact on NVIDIA’s Stock Valuation

The strong demand for AI-related hardware and software is a major positive factor for NVIDIA’s stock valuation. Increased adoption of AI across various industries, from healthcare to finance, directly translates to higher demand for NVIDIA’s products. Successful market penetration and consistent innovation in GPU technology will likely maintain or increase the company’s stock valuation. However, fluctuations in market sentiment, economic downturns, or unexpected technological disruptions could negatively affect the stock’s performance.

Competitive Landscape Analysis

NVIDIA faces significant competition from other semiconductor companies, including AMD and Intel. AMD has been aggressively developing its own GPU offerings, particularly for high-end gaming, while Intel is making strides in the server market. The competition necessitates continued innovation and strategic positioning to maintain NVIDIA’s leading market share. Furthermore, smaller, specialized AI chip companies are emerging, posing a challenge for NVIDIA’s dominance in the field.

Regulatory Implications for NVIDIA’s AI Business

The increasing use of AI raises potential regulatory concerns, particularly regarding data privacy, algorithmic bias, and the potential for misuse. The development of robust ethical guidelines and regulations for AI development and deployment is likely to impact the industry. NVIDIA will need to demonstrate compliance with these regulations and address any potential risks associated with AI bias or security vulnerabilities.

Emerging Technologies Affecting NVIDIA’s Position

Emerging technologies such as quantum computing and neuromorphic computing hold the potential to disrupt the current computing paradigm. These technologies could create new demands for specialized hardware, either competing with or complementing NVIDIA’s existing offerings. The company will need to proactively explore these emerging areas to adapt and remain relevant in the future. Staying ahead of the curve through research and development is crucial for maintaining market leadership.

The integration of these technologies into existing infrastructures will determine the degree of impact on NVIDIA.

Analyst Ratings and Predictions

A crucial aspect of evaluating any stock is understanding the perspective of industry analysts. Their insights, based on in-depth research and financial modeling, provide valuable context for investors. This section delves into the consensus view of analysts regarding NVIDIA’s future performance, examining the reasoning behind their ratings and predictions.

Summary of Analyst Ratings

Analysts’ ratings offer a snapshot of the perceived value and potential of a company’s stock. These ratings, often expressed as buy, hold, or sell recommendations, reflect a professional judgment on the stock’s trajectory. Different financial institutions employ various methodologies for their analyses, leading to potentially varied perspectives on NVIDIA.

Analyst Consensus View

The collective opinion of analysts, often expressed as a consensus rating, provides a general direction for the stock’s potential future performance. This consensus view, derived from aggregated ratings from multiple institutions, can serve as a valuable indicator for investors. For NVIDIA, a consensus buy or hold rating, along with projected growth rates, signifies a generally positive outlook on the company’s future.

Comparison of Ratings from Different Institutions

Different financial institutions employ various methodologies for their analyses, leading to potentially varied perspectives on NVIDIA. Some institutions may focus on the company’s short-term performance, while others might emphasize long-term growth potential and technological advancements. For instance, a firm focused on short-term profitability might prioritize recent earnings reports and quarterly projections. In contrast, a firm with a long-term focus may place greater emphasis on NVIDIA’s role in the evolving AI landscape and potential market share gains.

These varied perspectives can lead to different buy/sell recommendations.

Reasoning Behind Analyst Ratings

Analyst ratings are typically based on a combination of factors, including financial performance, industry trends, and competitive analysis. For NVIDIA, analysts may consider recent earnings reports, revenue growth, profitability, and the company’s market position in the rapidly evolving AI sector. Furthermore, the impact of key products and technological advancements like AI chips, gaming GPUs, and data centers are factored into the valuation and predictions.

Table Summarizing Analyst Ratings and Predictions

This table provides a snapshot of the analyst ratings and predictions for NVIDIA stock, offering a comparative overview of the various financial institutions’ viewpoints.

Nvidia’s stock valuation in the AI boom is certainly interesting, but have you considered the musical theatre side of things? Listening to a Broadway cast album, like the haunting melodies of Sweeney Todd, can be a surprisingly effective way to decompress after hours of poring over complex AI market analyses. Finding the perfect balance between the technical nuances of a company like Nvidia and the emotional resonance of broadway cast albums sweeney todd is key.

Ultimately, it’s all about finding that perfect balance. This helps in appreciating the nuanced valuation of Nvidia’s stock in a broader context.

| Financial Institution | Rating | Price Target | Reasoning |

|---|---|---|---|

| Morgan Stanley | Overweight | $350 | Strong growth potential in the AI market. |

| Goldman Sachs | Buy | $325 | Significant market share gains and strong product pipeline. |

| J.P. Morgan | Neutral | $280 | Concerns about potential competition in the GPU market. |

| Barclays | Buy | $310 | Continued dominance in the AI and gaming segments. |

Potential Investment Opportunities in NVIDIA Stock

NVIDIA’s dominance in the burgeoning AI sector presents compelling investment prospects, but careful consideration of various factors is crucial for navigating potential risks. Investors need a nuanced understanding of short-term and long-term strategies, alongside the diverse risks inherent in the tech market, to make informed decisions.

Nvidia’s stock valuation and AI advancements are fascinating, but global events like the recent Biden-Israel-Hamas cease fire efforts here can significantly impact investor sentiment. These geopolitical developments, while seemingly unrelated, often ripple through the market, affecting tech valuations and investor confidence in companies like Nvidia. Ultimately, the long-term trajectory of Nvidia’s stock price will depend on continued innovation in AI, alongside a stable global economic environment.

Investment Strategies for NVIDIA Stock

Understanding the different time horizons and approaches is key to successful investment. Short-term strategies often focus on exploiting short-term price fluctuations, while long-term strategies prioritize sustained growth and consistent returns. Different approaches offer varying levels of risk and potential reward.

- Short-Term Trading Strategies: These strategies often involve technical analysis to identify short-term price patterns and capitalize on momentum. Examples include day trading, swing trading, and scalping. The rapid changes in the technology sector and market volatility increase the risk associated with short-term strategies. Successfully implementing short-term strategies necessitates a deep understanding of market dynamics and technical indicators.

- Long-Term Growth Investing: This approach aims to benefit from the long-term growth potential of NVIDIA’s business and its position within the AI market. Investors holding shares for extended periods, often years, seek to capture the compound returns of a company with a proven track record and strong growth potential. The success of long-term strategies depends on the company’s ability to innovate and adapt to evolving market conditions.

- Value Investing: This strategy seeks to identify undervalued companies with solid fundamentals. Investors employing this approach look beyond short-term market fluctuations to assess the intrinsic value of NVIDIA’s business, considering factors such as its revenue streams, profitability, and competitive advantages. However, accurately assessing intrinsic value can be challenging, especially in a rapidly changing technological landscape.

Risk Factors Associated with NVIDIA Stock

Several risk factors need careful consideration when evaluating NVIDIA’s investment potential. These factors can significantly impact the company’s performance and investor returns.

- Technological Disruption: The rapid pace of technological advancements presents a significant risk. New innovations could render NVIDIA’s existing technologies obsolete, impacting its market share and profitability. The ever-evolving landscape of AI and computing hardware requires continuous adaptation and innovation.

- Competition: The highly competitive nature of the semiconductor industry means that other companies are vying for market share. Aggressive competition can put pressure on NVIDIA’s pricing and profitability. The intense competition from established players and emerging competitors poses a significant risk.

- Economic Downturn: Economic downturns can impact consumer spending, reducing demand for NVIDIA’s products and services. Economic instability can have a cascading effect on investment returns and potentially impact demand for NVIDIA’s products and services.

Investment Approaches for Investors

Different investors may choose diverse approaches depending on their risk tolerance and investment goals. A well-defined investment strategy is essential for navigating the complexities of the market.

- Diversification: Diversifying investments across different asset classes and sectors can mitigate risk. Investors can spread their portfolio to reduce reliance on a single company or sector.

- Risk Management: Establishing clear risk tolerance levels and implementing appropriate risk management strategies is crucial. This includes setting stop-loss orders to limit potential losses. Risk management is a vital aspect of mitigating potential downsides.

- Due Diligence: Thorough research and analysis of NVIDIA’s financial performance, market position, and competitive landscape are vital for informed investment decisions. Comprehensive due diligence can help assess the potential for long-term value creation.

Factors Influencing Risk Assessment

Several factors influence the risk assessment for NVIDIA stock, including but not limited to its market position, financial performance, and competitive landscape. A holistic view is essential.

- Market Trends: Understanding the current and projected market trends for AI and related technologies is essential. Factors such as demand for AI solutions and technological advancements influence the risk assessment.

- Financial Performance: NVIDIA’s financial performance, including profitability, revenue growth, and debt levels, directly impacts the risk assessment. The financial health of the company significantly affects the assessment.

- Competitive Landscape: The competitive landscape within the semiconductor industry significantly influences the risk assessment. Assessing the competitive positioning and actions of competitors is a critical factor.

Comparing Potential Investment Strategies

The following table provides a concise comparison of potential investment strategies for NVIDIA stock, highlighting key aspects.

Nvidia’s stock valuation in the AI sector is definitely a hot topic right now, but it’s also important to remember that things like the recent disappearance of a couple on a boat in Grenada, couple missing boat grenada , highlight the unpredictable nature of life and the human element. While investors are analyzing the potential of AI, there are still plenty of real-world events that can impact the overall market and the company’s future.

So, even with all the exciting AI developments, a careful eye on the market is key to a balanced investment strategy.

| Investment Strategy | Time Horizon | Risk Tolerance | Potential Return | Key Considerations |

|---|---|---|---|---|

| Short-Term Trading | Days to weeks | High | High | Market volatility, technical analysis |

| Long-Term Growth Investing | Years | Moderate to High | Moderate to High | Company growth, market trends |

| Value Investing | Years | Moderate | Moderate | Intrinsic value, financial health |

Historical Data and Trends

NVIDIA’s stock performance has been significantly influenced by its innovative advancements in graphics processing units (GPUs) and their expanding applications in artificial intelligence. The company’s journey reflects a dynamic interplay between technological breakthroughs, market shifts, and investor sentiment. Understanding the historical data provides crucial context for assessing the current valuation and future prospects.

Summary of Historical Stock Performance

NVIDIA’s stock price has exhibited considerable volatility throughout its history. Initial fluctuations were largely driven by the evolving adoption of GPUs in gaming and professional applications. Subsequent surges and dips correlated with the rise and fall of specific market trends, such as the increasing demand for high-end graphics cards and the growing popularity of artificial intelligence. Early investors who recognized the potential of NVIDIA’s technology experienced substantial returns.

More recent periods have seen substantial price fluctuations related to broader economic conditions and the emergence of new competitors.

Key Historical Events Influencing Stock Price

Several pivotal events significantly impacted NVIDIA’s stock price. The launch of the GeForce series of graphics cards, and the adoption of GPUs for tasks beyond gaming, like scientific computing, marked important milestones. The emergence of artificial intelligence as a disruptive technology and NVIDIA’s strategic positioning in this field resulted in substantial price increases. The COVID-19 pandemic, along with the increased demand for remote work and online entertainment, spurred GPU demand and elevated the stock price.

The emergence of new competitors in the AI hardware market, coupled with broader economic downturns, has also resulted in stock fluctuations.

Nvidia’s stock valuation, driven by AI advancements, is definitely grabbing headlines. However, global events like the ongoing Gaza cease-fire negotiations involving Russia and NATO ( gaza cease fire russia nato ) are also impacting investor sentiment. Ultimately, these external factors could significantly influence the future trajectory of Nvidia’s stock performance.

Correlation Between Market Events and Stock Performance

NVIDIA’s stock price often mirrors market trends and broader economic conditions. A robust global economy, combined with high demand for high-tech solutions, usually results in higher stock prices. Conversely, economic downturns, geopolitical instability, or shifts in consumer preferences can negatively impact the stock price. Technological advancements, particularly in artificial intelligence and related fields, also strongly influence the company’s valuation and, consequently, its stock price.

Visual Representation of Stock Price Trend

A graph showcasing NVIDIA’s stock price over time would visually depict the fluctuations mentioned above. The graph would illustrate the upward trend associated with the rise of AI and the volatility during periods of economic uncertainty. A significant increase in the stock price would be visible around periods of significant product launches or technological advancements. Such a graph would be highly informative in identifying key trends and patterns.

Reasons Behind Fluctuations in Stock Price

Several factors contribute to fluctuations in NVIDIA’s stock price. Changes in demand for GPUs for various applications (gaming, professional graphics, AI) impact investor confidence. New product launches, or significant technological breakthroughs, can lead to substantial price increases. Market sentiment, influenced by factors such as economic conditions, geopolitical events, and competitor actions, significantly impacts the stock price. Speculation and investor psychology can also lead to short-term volatility.

Overall, the factors influencing the stock price are multifaceted and intertwined.

End of Discussion: Nvidia Valuation Stock Ai

In conclusion, NVIDIA’s stock valuation is a complex interplay of financial performance, AI integration, and market trends. While the company enjoys a strong position within the AI sector and exhibits healthy financial growth, risks and challenges are present. Investors must carefully weigh these factors alongside their own risk tolerance and investment goals. This analysis aims to equip investors with the knowledge to make informed decisions about NVIDIA’s stock.

Top FAQs

What is NVIDIA’s historical stock performance like?

NVIDIA’s stock performance has been highly volatile, with periods of significant growth and fluctuations. Key events like major product launches or shifts in market trends have often correlated with changes in the stock price.

How does NVIDIA compare to its competitors in terms of valuation?

Comparing NVIDIA’s valuation metrics (like P/E ratio) to competitors provides context. Differences often reflect factors like market share, product innovation, and perceived growth potential.

What are the key risks associated with investing in NVIDIA stock?

Risks include market fluctuations, competition from other chipmakers, and regulatory changes affecting the AI industry. Investors should thoroughly research these risks before making any investment decisions.

What are the most important AI advancements that NVIDIA is supporting?

NVIDIA is actively involved in various AI advancements, including breakthroughs in deep learning, computer vision, and natural language processing. Their GPUs are central to these advancements, driving innovation across various sectors.